You can’t go home again

Thomas Wolfe told us that, “We can’t go back home again – to the old forms and systems of things which once seemed everlasting but which are changing all the time.”

Keep that in mind when you think about the possibility of the Fed ever truly “normalizing” their policies. Keep that in mind when you think about the chances of Big Government ever becoming smaller. We’ve crossed the Rubicon. We’re not in Kansas anymore.

This means that many Old School valuation metrics, even things as basic as a “balanced” balance sheet, have been discarded in our Brave New World of MMT government finance.

People keep voting for governments to keep spending like never before, while the central banks are underwriting “everything” with ultra-low interest rates. How could this possibly be inflationary?

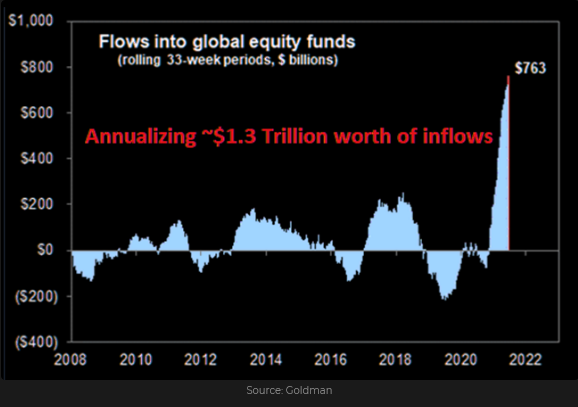

The stock market loves the Big Government/Easy Fed combo, and people love the stock market.

A “risk-off” ripple went through markets last week

Markets were positioned for last week’s Fed meeting to be a “non-event.” However, the Fed surprised markets by hinting that, maybe, a couple of years from now, they might tighten policy a bit. As a result, the USD soared, gold fell over $100, the yield curve flattened dramatically, commodities (ex. crude oil) tumbled, and the Dow dropped over 1,000 points to a 3-month low. That’s what happens when over-leveraged markets get hit with unexpected bad news.

Last week I wrote: People have been embracing/chasing “risk assets” for months. The crowd was short the USD, long commodities, long the re-opening/reflation trades, and positioned for a steeper yield curve. The Fed seemed to have green-lighted those trades, and the more they worked, the more people bought them. As a result, pro-risk market sentiment was vulnerable to a surprise.

I was short the Dow, gold and the CAD before the Fed surprise and took profits on those positions before Friday’s close. I thought the “correction” might have further to run. Still, I decided to go flat going into the weekend, hoping to see markets bounce this week and then maybe roll over – presenting a better opportunity to get short again.

Looking back at last week’s price action following the Fed surprise, it seems that the market’s reaction was driven more by “positioning re-adjustment of over-levered accounts” rather than by a fundamentally inspired reevaluation of Fed policy.

Some markets bounced more than others this week

Stocks: The major stock indices (ex. the Nasdaq) ended last week right on their lows. Typically, any market hit hard Wednesday through Friday that closes the week on the lows would open lower on Monday. However, stock index futures rallied during the Sunday overnight session, and the cash market opened higher Monday morning. The indices continued to rally throughout the week, with the S+P and the Nasdaq hitting new All-Time Highs.

Commodities: The leading commodity indices had their strongest 12-month rally in decades off last year’s lows (the Bloomberg index rallied from a 50+ year low to a 6 year high.) That spectacular rally meant that people were “substantially long” commodities ahead of the Fed meeting. Commodities bounced back from last week’s sell-off this week but not nearly as much as the stock market.

Currencies: Speculators were heavily short the USD ahead of the Fed meeting. Their short-covering late last week drove the USD sharply higher. This week the USD fell back slightly, but that dip was much less dramatic than this week’s reversals in stocks and commodities.

Interest rates: Bonds rallied as stocks fell late last week, but when stock index futures turned higher in the Sunday overnight session, the bond rally reversed from 4-month highs. I tried to get short Bonds this week but didn’t get the job done.

My short term trading

I started this week flat – happy to be on the sidelines while markets digested last week’s big moves. However, I’ve developed a bearish bias on the CAD over the past couple of months, with speculators buying it aggressively as a play on the hot commodity sector (which I thought was WAY overbought.) Last week, I covered my short CAD position and looked for an opportunity to reload this week. I sold the CAD Wednesday after it bounced 1.25 cents from last week’s lows.

The CAD bounce this week looked weak, especially in light of the new highs in the S+P and crude oil (the CAD has been strongly correlated with the S+P and crude for months.) The weak bounce in the CAD may be due to the relatively strong USD and some unwinding of the large speculative long CAD positioning.

I took profits on my short gold position last week (gold fell >$100 in 3 days), thinking that gold would probably have a good bounce after such a sharp fall, and I could re-short it this week. However, gold had a very modest bounce this week (gold shares haven’t bounced at all), considering how hard it fell last week, so I returned to the short side.

Gold’s weak rally off last week’s lows may also (like the weak rally in the CAD) be due to the relatively strong USD and some unwinding of the large speculative long positioning.

I took profits on my short Dow position last week – but I did not buy the stock indices this week. (That would have been too easy!) I’m amazed at the power of the BTD bid. It’s been a bull market for 12 years, and people love to buy things that are going up. This is a Momentum market (no kidding!), not a Value market!

Trading for a living

I posted a great piece by Peter Brandt on June 3rd about the differences between trading to make a fortune and trading to make a living. The media loves to write stories about people who made a fortune by taking a huge position in the market, holding it through great adversity, and then being gloriously proven to be “market geniuses” when it goes to the moon.

The media rarely writes about the “market geniuses” who buy a big stake in something, hold it through great adversity, and ultimately go down with the ship.

The media rarely writes about traders who are grinding it out, day after day, just trying to make a living. As Victor Sperandeo wrote in Methods of a Wall Street Master, “My career as a trader would be like a journeyman baseball player. I played in the big leagues for 20 years, but nobody knows my name.”

I’m a grinder. I have no illusions or fantasies about having genius-level market perceptions. I’ve seen too many marketing pieces over the years that tout the newest “boy wonder” who ultimately falls into the abyss or runs off with other people’s money.

It’s great to have a big winner from time to time, but, for me, the way to make money from trading is to manage risk – not to go “all in” on your latest brainwave. I understand that the “trading for excitement” crowd, the ones who approach trading from a YOLO (you only live once) perspective, disagree with my lack of style. Fine. My experience is that those folks get active, and some of them get famous, near market tops. I wish them well, but, as a group, they are a signal that market psychology is getting irrationally exuberant.

On my radar

WTI crude oil has had an amazing run since last November (up~115%.) The energy sector was the Dog of 2020; it has been the Darling of 2021. The rally the past two months was particularly outstanding given the (corrective) weakness across most of the commodity space. One energy analyst I respect has characterized the energy rally as being driven by the “Vaccine Rainbow.”

Not only has WTI been trending higher, but the nearby backwardation curve has steepened sharply (in this chart, the premium of Sept over Dec has doubled in the last month.) A steepening backwardation curve is usually a sign of strong demand for immediate delivery – relative to deferred delivery. It may also signify rising speculative demand as speculators tend to concentrate their positioning in the front months.

There has certainly been speculation about a re-opening surge in demand, but once people take that “postponed trip,” will their previous “going to work” energy consumption maintain its pre-pandemic trajectory? I suspect not. (Less commuting, less flying to meetings.) But perhaps any lessening of Developed World fossil fuel demand (don’t forget EVs) will be offset by rising demand in the Rest of the World. I don’t know.

I won’t short a market that is making new highs, but I will watch price action for signs that the “bullish narrative” runs out of steam.

Transitory supply chain issues?

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.