My best short term trading week of the year

I’ve taken a lot of small losses this year, trying to fade what I thought was irrational bullish enthusiasm – so it felt good to cash in some winning tickets this week. I’ll tell you more about that in the Short Term Trading section below, but first:

Did we just have a classic Soros Inflection Point? Did the markets over-react?

The consensus view was that the Fed meeting would be a non-event. But since that meeting, the US Dollar has had its best week since March of last year, gold is down $100, the long bond had ripped higher, the yield curve has flattened with a vengeance, and the Dow has tumbled to a 3-month low. Not exactly a non-event.

Gold and the USD continue to have a strong negative correlation. Sharply rising short-term American real interest rates also hurt gold, as did the notion that the Fed is moving against inflation.

Its all about prior conditions – prior positioning

People have been embracing/chasing “risk assets” for months. The crowd was short the USD, long commodities, long the re-opening/reflation trades, and positioned for a steeper yield curve. The Fed seemed to have green-lighted those trades, and the more they worked, the more people bought them. Pro-risk market sentiment was vulnerable to a surprise.

So, from the perspective of how far the bullish enthusiasm has taken markets the past few months, this week’s correction was NOT an over-reaction. However, from a trading perspective, I’ve taken profits on my positions that benefited from the Fed’s surprise.

Actually, some people had already started to lighten up on those pro-risk trades – I think the “max risk” point was around May 10th to 12th – and I’ll show some charts to illustrate that idea – so the real inflection point might have been back in early May, not this week.

A quick segue: Some folks like to think of the Fed as a bunch of plodding bureaucrats – but what if they are way smarter than that. I’m reminded of the old days when Central Banks would intervene in the currency markets. If they thought their currency had been driven too high by the market and they wanted to knock it down, the most effective time for them to sell their currency was when it had already started to turn lower – not to be hitting every bid as it was making new highs.

So let’s say the Fed was worried about the intense level of irrational bullish enthusiasm across markets, and they wanted to cool things out a bit. They waited until market psychology had come off the boil (post-May 10th), and then, just as the BTD crowd was getting ready to reload, the Fed gave the nod to slightly higher interest rates sometime in the distant future, and that tipped the scales.

Should we Buy The Dip?

You can if you want, but not with my money. The major stock indices ended the week down hard – with the exception of the Nasdaq – which benefited from this week’s version of rotation (FAANG stocks are long duration assets, so, I’m told, you buy’em when bonds are soaring.)

I think another consideration for the BTD crowd is what are the BIG accounts thinking now? They’ve had a wonderful run in stocks over the last few years, and by all kinds of Old School metrics, some re-balancing or “rotation” looks prudent.

May 10th – 12th: The Day The Music Died, or, It’s The Rotation, Stupid!

This week the long bond fell immediately after the Fed news (the Fed is thinking about raising interest rates – Yikes!) but rebounded sharply, especially Thursday and Friday as capital saw that the Fed was moving against inflation (the mortal enemy of bonds), and American “inflation-protected” bonds looked great compared to paper on offer in other countries. (Greek 5-year bonds are negative, the US 5-year yield is 0.90%. Which bond would you buy if you planned to hold it for a year or more?)

Yields on the long bond turned lower on May 10th. The bond market may have been the “leader of the pack” for many markets that reversed course on that date.

The DJ Transports were running hot into early May but have been the weakest index since then, down ~10% from their May 10th ATHs.

Bitcoin may have been the poster child for speculative excess earlier this year, but it made a “lower high” on May 10th and fell 50% within a couple of weeks.

Lumber was front-page news around the All-Time Highs made May 10th – its down nearly 50% since then.

Copper had a wonderfully bullish “narrative” – but it has fallen sharply since the May 10th All-Time highs.

The Homebuilder’s ETF was “smoking hot” earlier this year; May 10th was the All-Time High.

The Financial Sector (banks) ETF was also enjoying a great run earlier this year. It fell back from the May 10th highs, but rebounded into early June. It broke hard Thursday and Friday as the yield curve flattened. Banks love low short rates paired with higher long rates. A flattening yield curve is bad news.

Deere and company had a 4X run from the March 2020 lows as a hot stock that was also a play on the bullish commodity narrative. It peaked on May 10th.

WTI crude oil is the HUGE EXCEPTION to the broad weakness in the commodity sector.

My short term trading

I came into this week short the Dow and long puts on the CAD. As per the On My Radar comments last week I was looking for a good spot to re-short gold, and I did that Tuesday. I added to my short Dow trade on Wednesday, then took profits on everything Thursday. I thought better of that late Thursday and re-shorted the Dow. I took profits on that Friday and went into the weekend flat.

As usual, I never had enough on when I was right. As usual, trading is NOT a game of perfect!

Last week, I kicked out the AUD puts that I had held for three weeks. Their value had fallen 50% in a dull sideways market (time decay.) It was the right thing to do (nothing wrong with being wrong except staying wrong), but they would have been a HUGE winner if I had held them into this week!

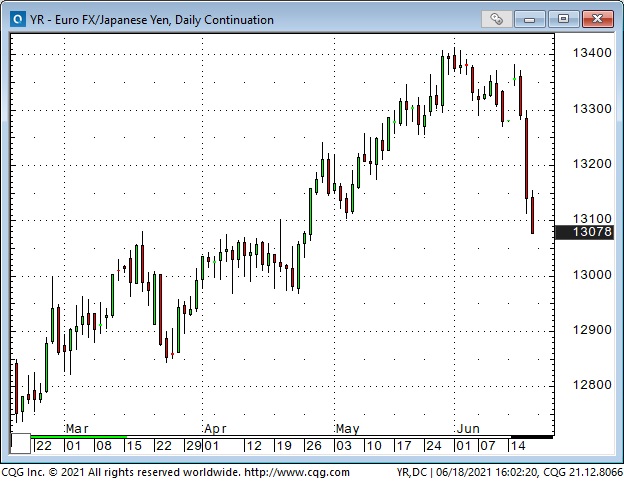

I didn’t pull the trigger on shorting Euro/Yen (I mentioned this idea in the On My Radar section of last week’s notes.) I didn’t make that trade because I was already short the Dow, CAD and gold. Adding a short EURYEN would be All The Same Trade – and I didn’t want to increase concentration ahead of the Fed meeting. Woulda, shoulda, coulda!

A couple of quick thoughts about trading

For most of the past 40+ years, as a commodity broker, I sat in front of trading screens all day – and had instant access to trading screens 24 hours a day. That was my job, and it was a hard habit to break when I retired from the brokerage business to concentrate on trading my own accounts. I’d read about many very successful traders (and talked to a few) who highly recommended staying away from your screens – so that you didn’t indulge in bad trading habits like making so-so impulsive trades just for something to do.

I’ve also thought that I like sitting in front of my screens – that’s my way of trading – that’s how I get a feel for the rhythm of the market. That’s how I notice things that alert me to a trading opportunity. I know I’ve made so-so impulsive trades just for something to do, but I call that “Keeping my hand in.”

This brings me to timing – keeping the time frame of my trading in sync with the time frame of my analysis. That is probably the most important thing in trading, yet when I review my trading, I find it is often out of sync with my analysis. For example, my analysis has been that speculative excesses in many markets have run too far, too fast. Ok, I know that’s not a timing tool but, because of that analysis (call it a bias), I’ve lost money on a lot of small bearish trades that had very short-term time horizons! If I had kept my trading time frame in sync with my analysis, I would have waited for stronger signals that markets had turned before getting short! Did I already mention that trading is not a game of perfect?

When I write about trading this way, I don’t mean to imply that this is THE way to trade. Everybody has to find their own way. I’m just “sharing a thought” that some folks may adapt to suit their own trading style.

On My Radar

I think the “corrections” across markets may have just started, but selling “in a hole” is hard, so I’ll be looking to short bounces that tire out and roll over. I may try to put on some longer-term trades (not all of my trades need to be on the same time horizon.)

Listening to Moneytalks Radio and Podcast

I started writing The Trading Desk Notes four or five years ago to prepare for my weekly interviews with Mike Campbell on the Moneytalks radio show. It is broadcast live every Saturday morning from 8:30 am to 10:00 am Pacific Coast time on AM CKNW980 in Vancouver, AM CHED630 in Edmonton, AM CHQR770 in Calgary and AM CHNL610 in Kamloops. Those stations also broadcast the show live from their websites.

I listen to the show live and often go to www.Mikesmoneytalks.ca to re-listen to the (commercial-free) podcast posted every Saturday afternoon.

Thanks for the Feedback – Forward to a Friend

A special thank you to the dozens of people who sent me comments when I asked readers how they used my blog and if they would like to see anything new on the site.

I will be doing less reporting on markets and more commenting on the how’s and why of my trading from now on. I will NOT get into recommending specific trades, nor will I ever try to pitch my readers on some wonderful undiscovered penny stock going to the moon.

Several people asked me to make it easy for them to share this blog. My webmaster has added share buttons on the left side of the page.

Please feel free to use the “Contact” page to send me a note. Anytime.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.