We’re in no rush to cut interest rates

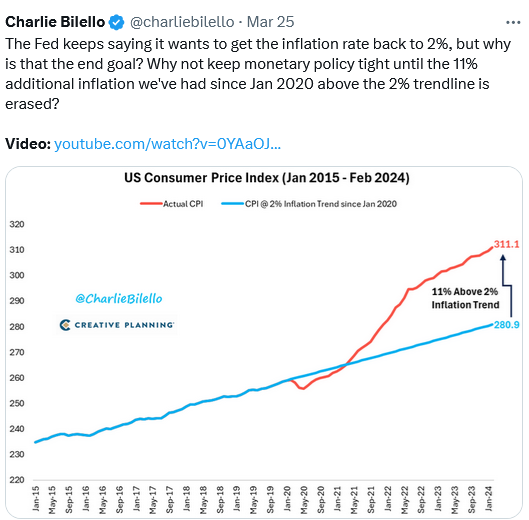

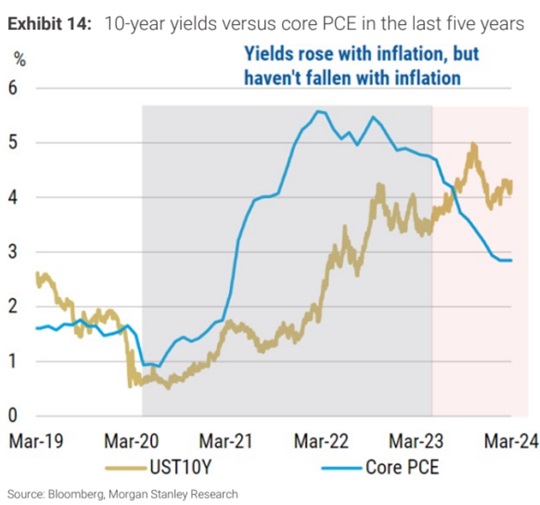

Fed Chairman Jay Powell and Fed Governor Chris Waller reminded markets this week that they are in “no rush” to cut interest rates until they see clear evidence that inflation is returning to the Fed’s 2% target.

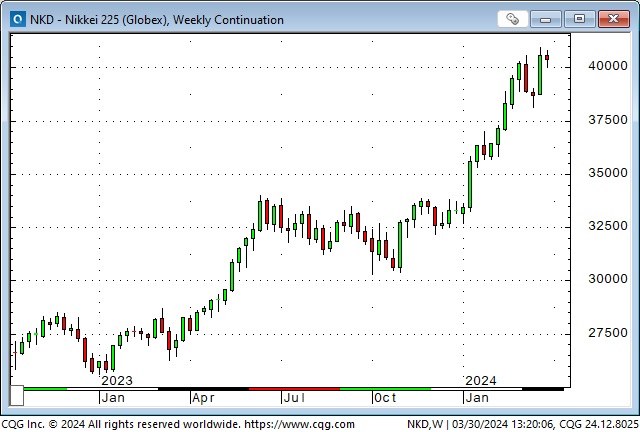

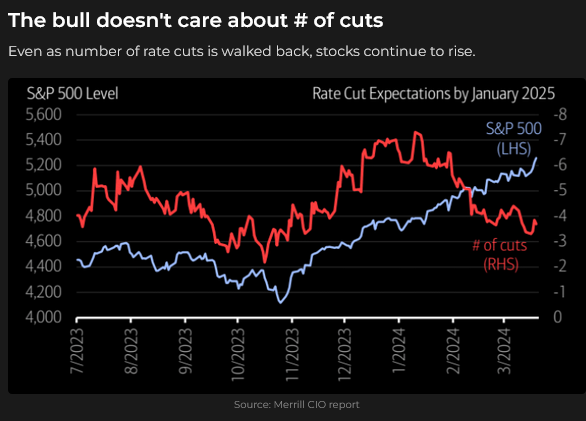

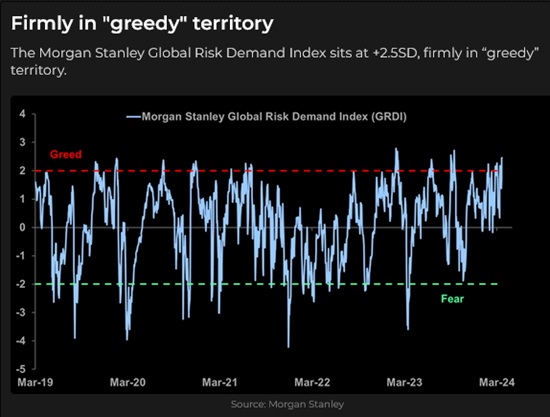

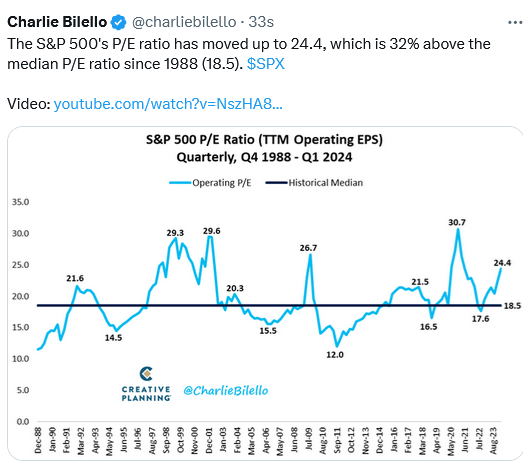

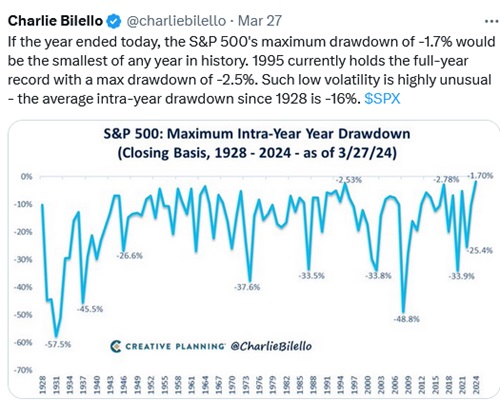

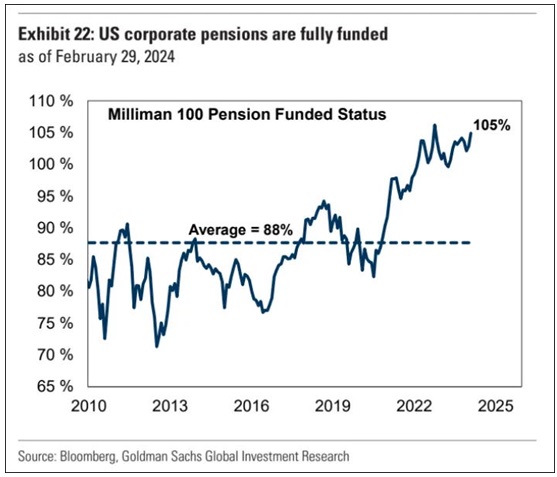

Equity markets (outside China) reflect the belief that Central Banks will not raise rates further and will start cutting within the next few months.

Leading stock indices closed this week at (or near) record highs. The MSCI Global Index rose 7.7% in Q1, its best performance in 5 years.

Are stocks an inflation hedge?

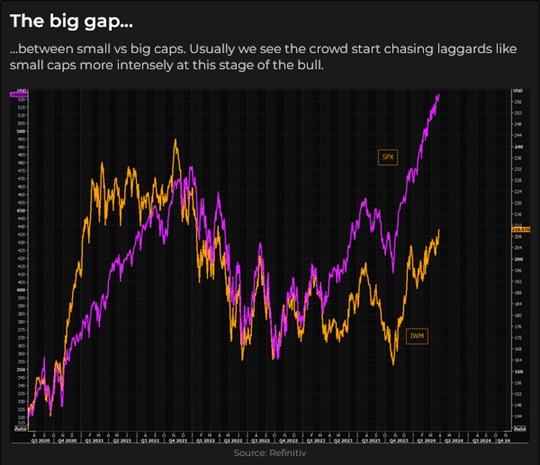

The S&P has rallied ~29% from the October lows and ~11% YTD. Big Cap Tech initially led the rally, but investors have been buying laggards lately. Sentiment and positioning are bullish. Investors may ask themselves, “Why sell rising equity markets if the Fed is preparing to cut interest rates (and perhaps tolerate higher inflation) while the economy, employment and consumer sentiment are strong?”

Short-term interest rates are at 23-year highs

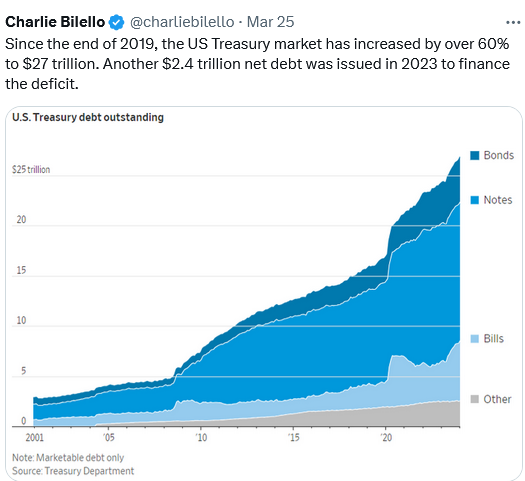

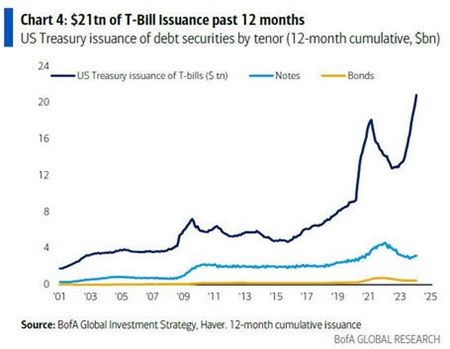

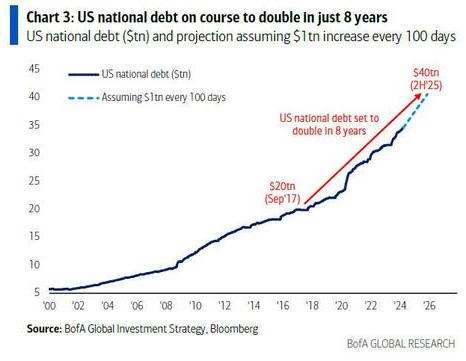

US bond auctions this week (totalling $176 Billion between 2, 5 and 7-year maturities) were well bid despite warnings from the Congressional Budget Office about the ballooning federal debt. Credit market price action was subdued ahead of the 3-day Easter weekend.

Currencies

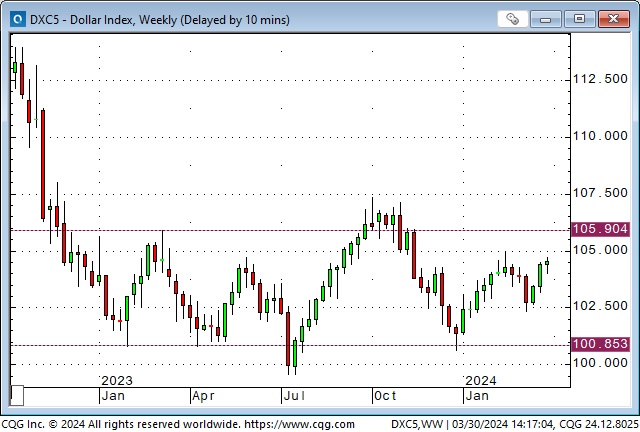

The weekly close on the US Dollar Index was the highest in five months. The USD may be gaining some support from the notion that foreign central banks (X Japan) will cut interest rates sooner and more than the US.

Implied option volatility across the currency markets is historically low, as the USDX has been in a narrow 5-cent range for the past 18 months.

The Canadian Dollar has been in a 4-cent range for 18 months.

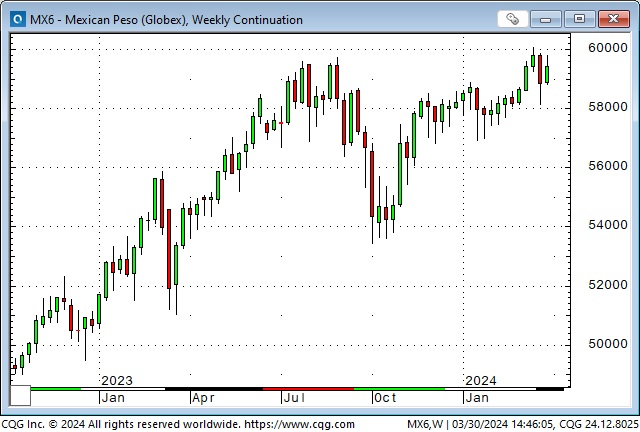

The Japanese Yen remains near 34-year lows as Japanese authorities step up verbal intervention warnings. The last official intervention was in September/October 2022; prior to that, it was in the late 1990s. Open interest was near a record high at the latest quarterly expiry, and COT data shows that net short positioning by large speculators has grown over the last three weeks to multi-year highs. We can guess that large speculators are continuing the carry trade of borrowing Yen and investing elsewhere (Mexican Pesos at 11%!) and are, in effect, challenging the Japanese authorities.

The Mexican Peso is at ~9-year highs. (Mexican short rates ~ at 11% vs. US short rates at ~5% give the Peso a lift!) COT data show large speculators with the largest net long positioning since the 2020 covid crisis.

The Swiss Franc hit 13-year highs against the USD in December (All-Time Highs against the Euro) and has fallen ~8% since. Swiss authorities want a weaker Franc now that inflation has fallen from its highs. Speculators have ramped up their net short positioning to multi-year highs.

Gold

Comex gold futures registered a daily, weekly and monthly record-high close on Thursday, with prices up ~ $400 (22%) from the October lows made before the Hamas attack on Israel. Gold is making new highs against all fiat currencies.

In last week’s Notes, I wrote, “Baring a “geopolitical” shock, this week’s spike high may remain the “high-water mark” for gold for some time.” I had seen gold spike ~$ 75 from Wednesday’s lows to Thursday’s overnight highs and then fall back ~$ 70 to Thursday’s lows (with what appeared to be a classic “running of the stops” in Thursday’s thinly traded overnight session). I was wrong!

Last Thursday’s overnight spike seemed to “come out of the blue,” as did this Thursday’s last-hour $17 rally to new all-time highs.

By “out of the blue,” I mean there was no “news” to account for the two aggressive drives to ATHs. The USD rose last week and again this week. US interest rates were steady to higher and the Fed is in “no rush” to start cutting rates.

I don’t know “why” gold rallied as it did, but it did, and sometimes you “just don’t know” what is driving prices (even if you think you do!) Whatever is driving prices higher (my first guess is Chinese retail buying), it is not showing up in the Comex. Open interest has declined since last Thursday’s spike, volume is down, and COT data (as of March 26) shows little change in speculative positioning in the previous four weeks.

I think the long-term outlook for gold is bullish (I have written many times in these Notes that I expect inflation to remain above central bank targets as Western governments embrace deficit spending and thus devalue the purchasing power of fiat currencies.) I’m surprised at the sudden short-term rally, but I know that markets often behave in “mysterious ways!”

Energy

Unlike the gold sector, where the shares of gold mining companies have woefully underperformed bullion, shares are outperforming WTI in the energy sector.

The XLE ETF closed at a 10-year high this week, while WTI closed at a 5-month high.

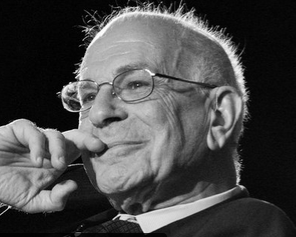

Daniel Kahneman

Daniel Kahneman, who won the Nobel Prize in Economic Science in 2002, died this week. I was, and continue to be, an admirer of his work. I recommend that readers Google him and read some of the many obituaries written about him.

He was a psychologist who “helped debunk the notion that people make rational economic decisions.” He believed that people make decisions that tend not to involve much analysis, instead preferring to choose based on instinct or bias. He wrote that people care more about losses than equally sized gains and tend to stick with the status quo.

I’ve read and highly recommend his book Thinking, Fast and Slow, and I’ve believed for years that if you want to succeed at trading, study psychology, not economics.

Another great trader-to-trader interview

I watched a fantastic video interview today between Jason Shapiro and Linda Raschke. They are both very successful veteran commodity traders. Linda was featured in Jack Schwager’s 1992 book, “The New Market Wizards,” and Jason was in Jack’s 2020 book, “Unknown Market Wizards.”

I made three pages of notes while watching the 60-minute interview. If you are interested in trading, especially if you want to make a living as a trader, I highly recommend watching this interview.

Sunday edit: The link below to the interview is “live” as of 11 am Sunday morning – Vancouver time. Check it out – it’s a terrific interview!

Readers can view the interview (free of charge) starting Sunday, March 31, by going to Jason’s substack page. (I was able to view it today because I subscribe to Jason’s COT service.)

Quote of the week

The Illusion Of Certainty, by Eric Peters, One River Asset Management

“Why do people feel that to be a good leader, they must absolutely believe in one direction over another, one path over another, one person over another?” asked the investor, an allocator. “Why do most people feel they must live in a world of absolutes?” We were discussing the illusion of certainty. “We live in a world filled with questions. And the best traders I’ve known have never been sure of anything.” The blessing and curse of this business is that it forces us to come to terms with how little we know. It is humbling and awe-inspiring that to maintain your balance; you must continually seek to define a wide range of possible outcomes and possibilities.

Go to the One River Asset Management website for the other half of this insightful quote.

My short-term trading

I started this week short of the Mexican Peso and the S&P, positions I had established late last week. I covered the MEX for a tiny loss on Monday when it rallied above 5900. I took a modest profit on the S&P on Wednesday when the market began to rally after three days of losses. My P+L was flat for the week.

I shorted the S&P on Thursday ahead of the long weekend after it failed to rally above last week’s highs and turned lower. I kept the position into the weekend.

This was a quiet week as people prepared for the markets closing for three consecutive days.

On my radar

The employment reports will be key next week.

The Barney report

Here’s a photo of our handsome boy looking a little shifty with his paws up on the kitchen island. He looks like he’s about to jump up on the island, knowing that is a major NO-NO! (He made the right decision.)

Listen to Victor talk markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed gold and stocks hitting All-Time Highs and our ideas that government deficit spending is the root cause of inflation. You can listen to the show here. My spot with Mike starts around the one-hour, one-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.