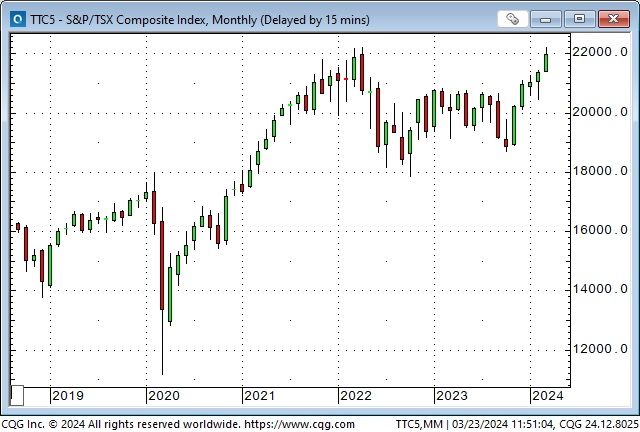

Leading stock indices rallied to new All-Time Highs as Western Central Banks signalled interest rate cuts this year

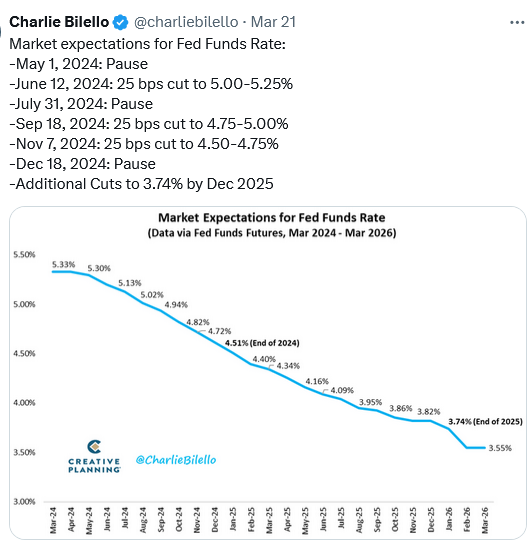

After closing lower for the past two weeks, the S&P and NAZ futures surged to new highs this week following dovish signals/cuts from the FOMC, the Swiss National Bank, the Bank of England, and the Banco de Mexico.

Even laggards like the TSE composite and the FTSE surged near previous highs.

To paraphrase the delightful Heisenberg Report, “Stocks don’t care about the timing of cuts, or how many cuts, as long as it is clear that the “worst case” scenario is current policy settings.” (In other words, buy everything if policy rates are not expected to exceed current levels.)

The consensus is that policy rates can only go down from here, but the market and the Fed have been wrong before. (As recently as mid-January, the market was pricing 6+ cuts in 2024, and the Fed will forever hang their head over “transitory.”)

Jason Shapiro argues that markets tell us that policy rates are too low, with stocks, gold and crypto surging to new highs.

What could cause Central Banks to raise rates?

Sustained higher inflation. What could cause sustained higher inflation? Continued debt-fuelled fiscal stimulus would diminish currency purchasing power, leading to rising wages and prices.

The Swiss National Bank cut interest rates

The SNB surprised the market Thursday, cutting rates by 25bps to 1.5%, their first cut in 9 years. The Swiss Franc effectively hit all-time highs against the USD and (more importantly for the Swiss) the Euro and the British Pound last December. The ultra-strong Franc had helped shield Switzerland from imported inflation but had hurt Swiss exports. The Franc weakened against the Euro YTD and fell to 8-month lows on the SNB cut. (In this chart, lower prices mean the Euro is falling Vs. the Franc.)

The Bank of Japan is trying to create inflation

The BoJ met this week and raised its policy rate from slightly below to slightly above zero. This was the first rate increase in 17 years. They also decided to stop buying Japanese ETFs to support the stock market now that the Nikkei is at All-Time Highs. They also announced a halt in their yield curve control program (now that they own ~50% of all Japanese government bonds) unless there are special circumstances. Wages are increasing at ~5% annually, the highest in ~30 years.

Japan’s finance minister, Shunichi Suzuki, said on Thursday the government is watching currency market moves with “a high sense of urgency” as the Yen has fallen to near 34-year lows. He refused to comment on possible intervention to support the Yen.

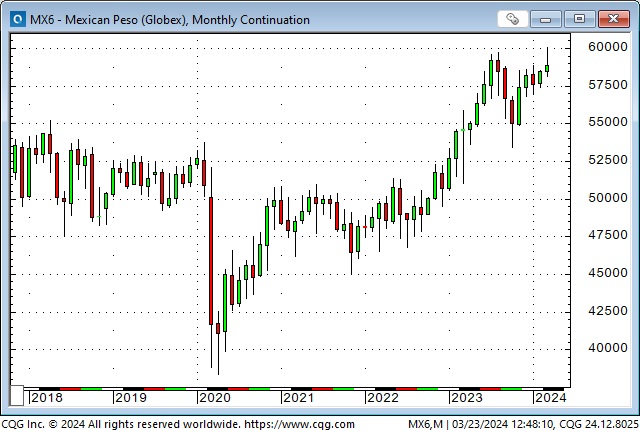

The Banco de Mexico cut interest rates

Banixco cut their policy rate 25 bps to 11%, their first cut in 3 years, with the Peso at ~9-year highs against the USD, up ~55% from the historic lows made during the 2020 covid crisis.

The Bank of England held rates steady

The BoE did not change its 5.25% policy rate but signalled future cuts. The Guardian newspaper quoted Bank of England governor Andrew Baily as saying that interest rate cuts are “in play” at forthcoming policy meetings amid progress in sharply reducing the UK’s headline inflation rate over the past year.

The Pound rallied against the USD on Wednesday (FOMC day) but fell sharply on Thursday and Friday.

The US Dollar had its highest weekly close in 4-months

The USD fell against nearly all currencies following the “dovish” FOMC meeting on Wednesday but roared back on Thursday and Friday. Are currency traders sensing that foreign Central Banks will cut rates sooner and more than the Fed?

The Chinese Offshore RMB

The Chinese currency fell sharply on Friday to close the week at a 4-month low. (In this chart, a rising price means it takes more RMB to buy a USD.) This weakness may have been in sympathy with many other currencies falling against the USD. Still, there have been market whispers about a possible RMB devaluation given their economic conditions and the mercantile competition from the Japanese Yen near a 30-year low.

The Indian Rupee falling to historic lows against the USD this week may have contributed to RMB weakness, again considering mercantile competition.

Gold

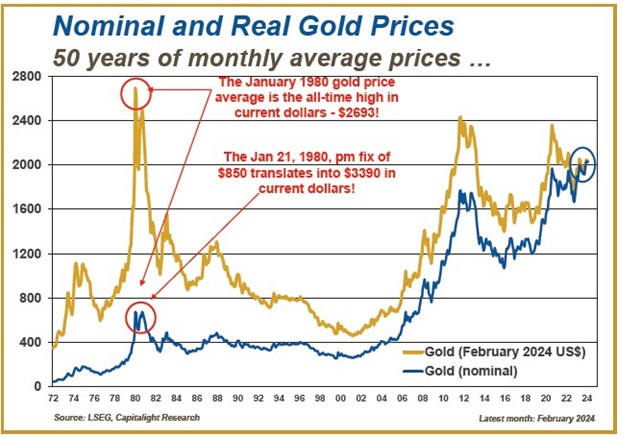

April Comex gold futures rallied ~$30 to ~$2,190 within two hours of the FOMC news, as interest rates and the USD fell and stocks rose (the blue ellipse in the chart). In the opening minutes of the (thinly traded) Comex overnight session, gold spiked another ~$ $35 to an ATH of ~$ $2,225 (the pink ellipse).

My guess is that sophisticated traders could see buy-stop orders above the previous high of ~$2,203 and aggressively bid the market higher in thin overnight conditions, “running the stops” up to ~$2,225. My “guess” is based on my inability to find any plausible “news” that would justify the spike in gold while other markets remained relatively somnolent. (Running stops in thin market conditions has a long and profitable history in the futures markets.)

My “guess” is further supported by the fact that April Comex gold traded ~$50 below the spike high during the Thursday day session and closed the week at pre-FOMC levels. Comex’s gold volume of ~528,000 contracts on Thursday was the largest daily volume since the SVB crisis in March 2023. Baring a “geopolitical” shock, this week’s spike high may remain the “high-water mark” for gold for some time.

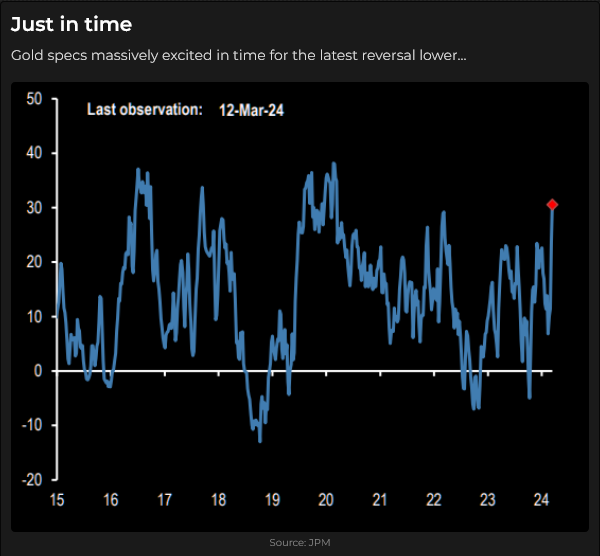

This week, capital flows into gold ETFs were the largest since the Russian invasion of Ukraine in 2022. Net long speculative positioning in the gold futures market (as of March 19 – before the FOMC and the spike to new ATH) was on par with Russian invasion levels. Speculators are buying gold heavily at All-Time Highs.

This chart, showing that gold in current dollars would have to trade above $3,390 to make new ATH in real terms, is from Martin Murembeeld.

The chart also provides perspective on how huge and violent the rally was in 1979/80 when prices went from ~$300 to ~$850 in five months – and may explain why that rally is seared forever into the memories of Boomer traders!

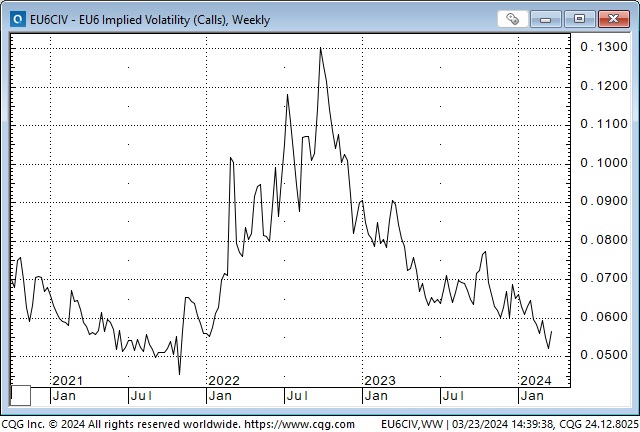

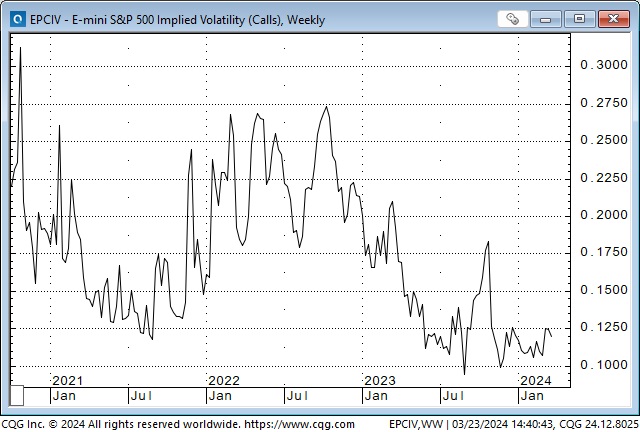

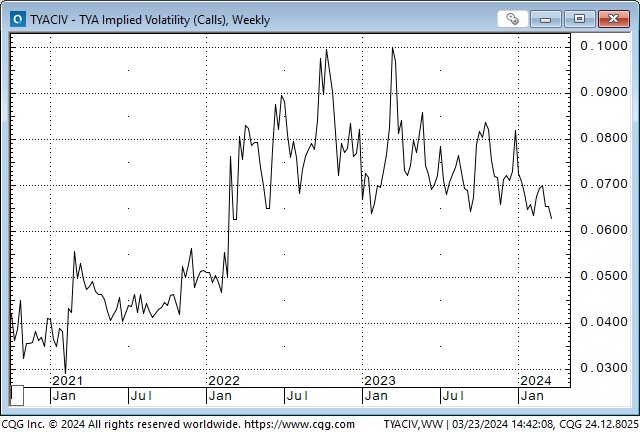

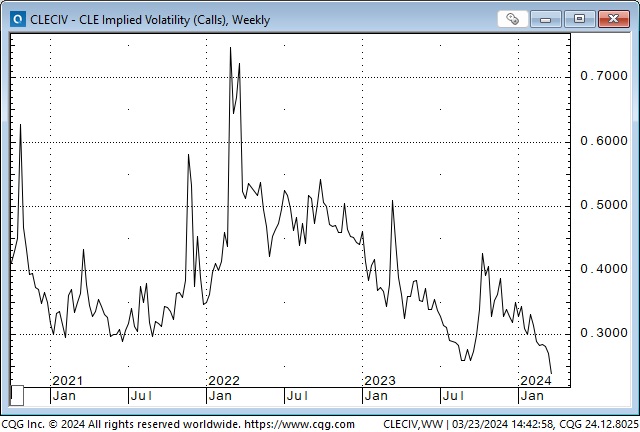

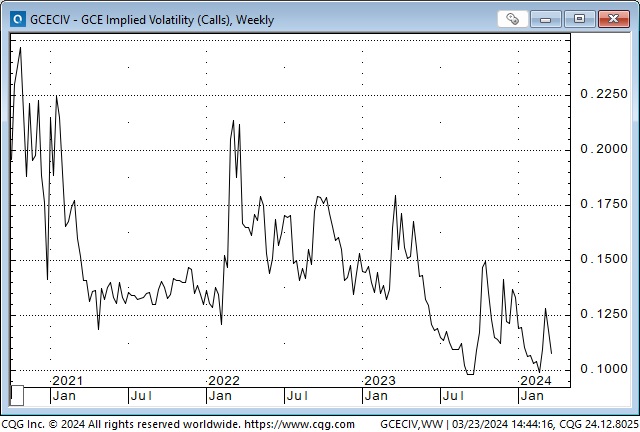

Option volatility is near recent lows across markets

Low implied VOL across asset classes likely reflects complacency with current “conditions” and may also reflect a prevalence of “yield enhancing” option writing programs. Any sudden shifts in market expectations would likely result in a jump in VOL, which might exacerbate market price changes.

Euro VOL

S&P VOL

10-Year Note VOL

WTI VOL

Gold VOL

My short-term trading

I started this week with four positions: Short CAD, Short the S&P, short gold and long calls on the Yen.

I covered the short CAD Tuesday, ahead of the FOMC, for a decent profit.

I covered the short S&P for a slight loss on the Sunday overnight session.

I was stopped on the short gold for a slight loss immediately after the FOMC on Wednesday. (Using a tight stop on my short gold position kept me from getting whacked on the sharp Thursday overnight gold rally.)

I kept the Yen calls overnight Wednesday, thinking the Yen might rally along with other FX after the FOMC. It didn’t, and I closed it for a slight loss. (The net result of my bullish Yen call spread was a small gain.)

Net, net my realized P&L was a small gain on the week.

On Thursday, I established new short positions in the MEX and the S&P (with tight stops) and held them into the weekend with modest unrealized gains.

Trades I nearly made – but didn’t

When I couldn’t find any “news” to support the spike in gold in the Thursday after-hours market, while other markets were “dead in the water,” I “knew” the spike was a run-the-stops play and that gold was short. I didn’t take the trade because gold was at all-time highs, and I believed I would have to risk $20 to $30 oz. on my stop.

I had covered my short CAD for ~70 points on Tuesday before the FOMC on Wednesday, and when it rallied about a full cent from Tuesday’s lows in the Wednesday overnight market, I wanted to get short again, but I was too slow.

Trading is not a game of perfection. If you are a perfectionist and like things neat and easy to understand, don’t be a trader!

On my radar

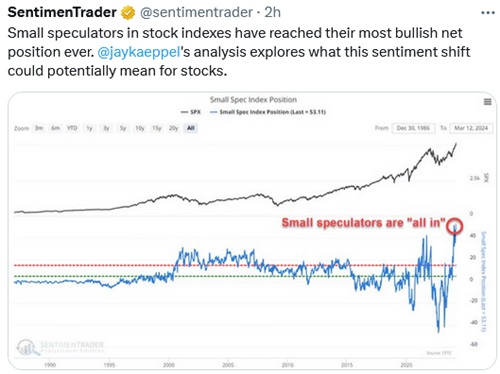

I continue to think that stock indices are overdue for a correction, but I respect the power of the rally and pick my spots to get short. The consensus is that the Fed’s next move will be to cut rates sometime soon—like June. There is no “allowance” in sentiment, positioning, or price for the Fed not cutting rates.

This is not a “value investors” market.

The COT report shows specs holding their largest net long Mexican Peso position in 4 years – since the MEX hit historic lows during the covid crisis. Specs have recently sharply increased their net short AUD position to the largest in 5+ years. Specs have also sharply increased their net short Swiss position since mid-January to the largest in 4 years. Positioning in these currencies is set up for a fade if there is a price-action trigger.

I had a brainwave and spent a couple of hours trying to find a stock or stock index trading below last October’s price levels. It was hard to find one. Almost everything is up.

I knew Newmont was below last October’s lows, but most other gold stocks were higher. TSLA is lower, but I didn’t find any other (significant) tech stocks that were lower. Even Boeing is above last October’s lows. I found a few lower commercial real estate stocks, but the “buy everything” rally has lifted almost all boats!

Thoughts on trading

I had a dream last night where I met an old friend who had been an aggressive and successful trader for years. He was in bad shape, having suffered massive losses. He had built a huge long position in one market, and it had fallen relentlessly for weeks. I asked him why he was still long. He said he knew the market would rally, and if he covered his position, he would miss the rally and be unable to recover his losses.

I asked for his number one trading rule. He said, “Never take a big loss on anything.” When I didn’t reply, he said, “But you gotta know when to break your rules.”

I reminded him of how floor traders sometimes got so badly wrong in the pits that they had to give their deck to a friend to close out their positions – they could not do it themselves.

I told him if he didn’t cover his position right now, take the loss and get flat, that he was finished as a trader because if he “got away” with breaking his number one rule this time, he would do it again and again until he busted out for good.

I woke up and reflected on the dream. I remembered a friend who had survived on the Merc floor for years but got caught long when the S&P plummeted in September/October 2008. He was trading money for friends as well as for himself, and he took his own life.

There is nothing wrong with being wrong except staying wrong.

Quote of the week

The Barney report

I take Barney out for his first walk of the day around sunrise. We go out again around noon—usually for at least an hour of off-leash running—and then again after dinner. On days like today, when I’m at my desk for hours, he bumps me with his head, usually with a ball or a rubber stick in his mouth. “Hey Papa, I’ve got a good idea. Let’s play catch.”

Today, he had a new idea. Bump Papa with two sticks in his mouth – look at me – let’s play catch! It was such a good idea that I couldn’t turn him down.

Listen to Victor talk markets with Mike Campbell

On the Moneytalks show this morning, Mike and I discussed Central Banks, stock indices and gold reaching new highs, and currencies rallying on the FOMC news, only to reverse sharply on Thursday and Friday. You can listen to the entire show here. My spot with Mike starts around the one-hour, three-minute mark.

On March 16, I did my monthly 30-minute interview with Jim Goddard on the “This Week In Money” show. We discussed my macro view on markets and drilled down on stocks, interest rates, currencies, and gold. You can listen to the interview here. My session with Jim starts around the 9.38-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.