Stocks soar to New All-Time Highs

The worries that caused the major stock indices to slump ~6% in September have been forgotten – bullish sentiment has returned BIG TIME, and the indices have surged to All-Time Highs with the DJIA and the S+P rising for the past five consecutive weeks. Since early October, the DJIA is up ~8%, the S+P ~10%, the Russell ~12% and the Naz100 ~14%.

Global Central Banks (Ex. European) starting to tighten

Short-term interest rates are firming, but bond yields are falling – which results in real (after inflation) long rates becoming more deeply negative while the yield curve flattens.

The US Dollar Index touches a 14-month high

Inter-day price action on the USDX has been choppy the past three weeks (up one day, down the next), but it rallied to a 14-month high Friday following the stronger-than-expected US employment report – but couldn’t sustain the gains. The USDX has rallied ~6% after touching a 3-year low in January.

This year, the Yen has been the weakest primary currency against the USD, down ~10% since early January.

The Euro has fallen ~5.5% against the Swiss Franc over the past eight months and is near a 6-year low. Weakness in the Euro/Swiss spread is often a sign of bearish Eurozone political sentiment.

Thanks to a vibrant commodity (especially crude oil) market, the Canadian Dollar is one of the few actively traded world currencies that has risen Vs. the USD this year. The CAD popped higher last week when the BoC was a little more-hawkish-than-expected but drifted lower recently as commodities have weakened and the USD has been strong.

Gold bounced $60 from mid-week lows to a 2-month high

Gold has been out of favour (relative to stocks and crypto) since it had that spectacular $800 rally to new All-Time Highs from 2018 to July 2020.

I’ve frequently discussed how gold ETF capital flows are an excellent barometer of gold market sentiment. In 2019 and 2020, the global gold ETF market “took” ~1,100 tonnes of gold, but the market turned sellers late in 2020, and so far this year, the ETF market has “sold” ~280 tonnes.

A breakout above $1840 could bring new attention to the gold market – especially if some currently popular markets fall out of favour.

I’ve traded gold for nearly 50 years and highly recommend the Gold Monitor, written by my good friend Dr. Martin Murenbeeld, as an excellent source of fundamental analysis. I’ve read his letter every week for thirty years.

I’d also recommend Crescat Capital for readers interested in gold – they have some nifty charts in their slide presentation decks.

WTI crude oil touched a 7-year high last week – but fell 8% to this week’s lows

WTI crude oil surged >35% from mid-August to October on perceptions of short-term (and longer-term) supply/demand deficits. (The spike in European NatGas to All-Time Highs may have been the “poster-child” for such concerns.)

My short term trading

In keeping with the “on my radar” section of last week’s Notes, I started this week flat but looking for opportunities to sell “irrational exuberance” in stocks and commodities.

The S+P closed last week at ATH and gapped higher in the Sunday (October 31) overnight session. Those overnight levels didn’t hold when the Monday “floor session” started, so I shorted the S+P with a tight stop. The trade held up throughout the Monday day and overnight sessions, but I was stopped for a tiny loss as the Tuesday “floor” session began.

Our new 2-month old puppy arrived Tuesday night and single-handedly sidelined me for the next couple of days (no sleep!)

I missed getting short crude oil (blame the puppy), but the wild price swings would probably have stopped me out with a loss (thank God for the puppy!)

I re-shorted the S+P on Friday about a dozen ticks below ATH after it lurched higher following the employment report but then rolled over and dropped through the “floor session” opening range. I remain short, with a stop just below ATH.

I bought the Yen on Friday in anticipation of it breaking out of the sideways range it has been in for the past three weeks. As noted above, the Yen has been weak against the USD all year, and as a result, speculators in the currency futures market have built a massive net short position in the Yen – they might turn buyers if the Yen was to rally. (If “something” happened and market psychology was to turn risk-off, the Yen would probably catch a “haven” bid.)

My realized P+L was down tiny for the week. My unrealized P+L is up 0.25%.

On my radar

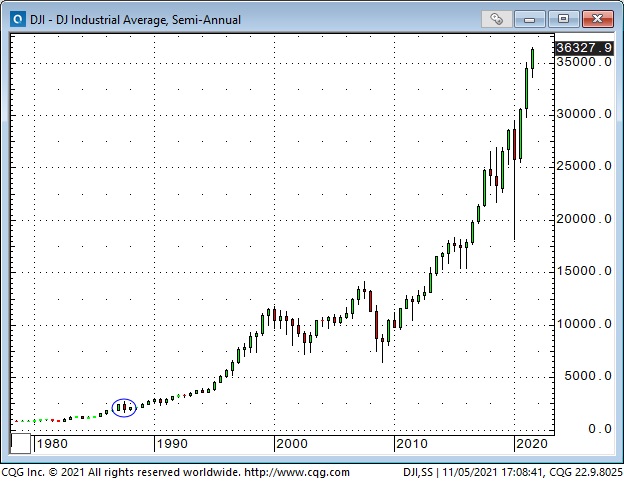

I’ve lived through many wild market swings since I began trading fifty years ago. I remember being a speaker at a significant financial conference in Toronto when the Dow Jones tumbled ~25% on October 19, 1987. There were ~1,000 financial professionals at that conference, and everybody was in shock. I cancelled a trip to Chicago and flew straight home, worried that the world as I knew it would never be the same again.

These days, that crash in 1987 barely registers as a blip on the long-term chart.

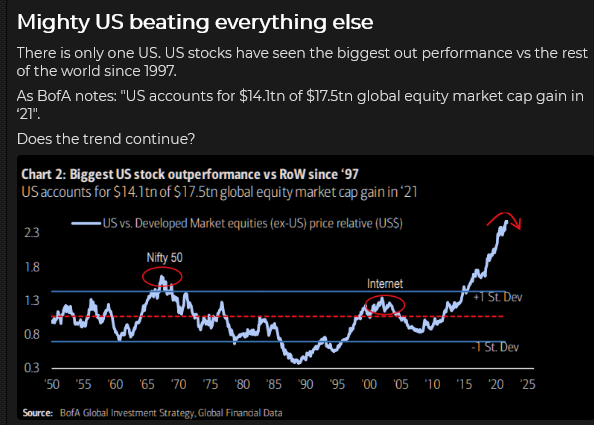

I mostly write about my short-term trading (I think of it as my “day job“), but I also pay attention to long-term trends. (See the Quotes From The Notebook section below.) from that perspective, I’m worried about the bizarre valuations we see in many markets, particularly equities.

I know ultra-low interest rates “justify” high equity prices. I know Central Banks have flooded the world with liquidity, and share prices must rise as the purchasing power of currencies is degraded. I know “There Is No Alternative.”

I know my Old School metrics are useless for understanding today’s “valuations” and “rate of change.” Please forgive me, I’m not trying to lecture anybody, but I’m saying that we’ve seen this movie before. I remember people buying penny mining stocks on the Vancouver stock exchange fifty years ago because somebody told them that XYZ was going up. The companies had no tangible assets and were flying on a wing and a prayer, but, as my long-time friend Bob Hoye loves to say, “People will believe the most preposterous stories – as long as the price keeps going up.”

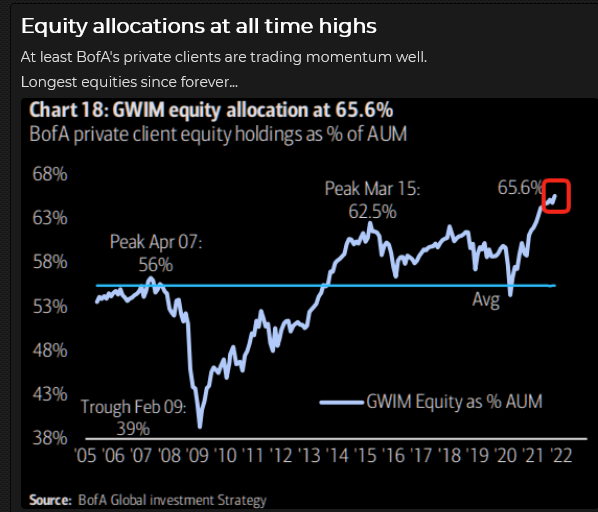

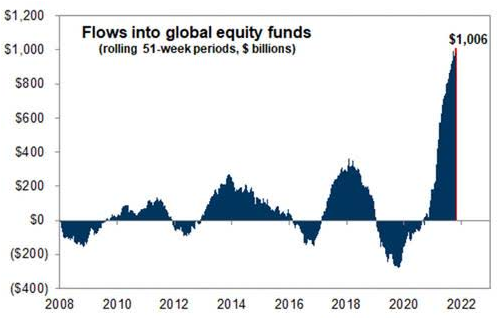

I’m not saying that the stock market will crash tomorrow – I honestly would not be surprised to see it go higher – but I think it has been going up because people believe (and have been told) that it will keep going up. Those people are putting money into the stock market like never before.

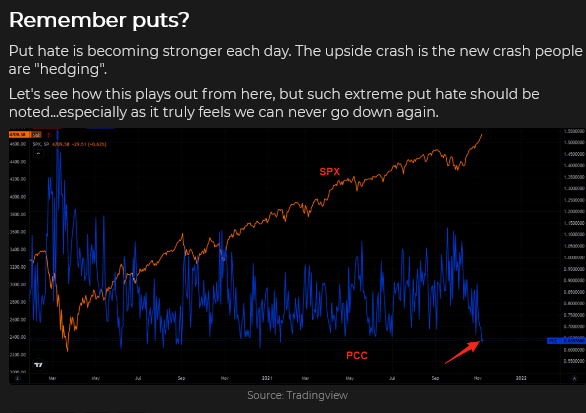

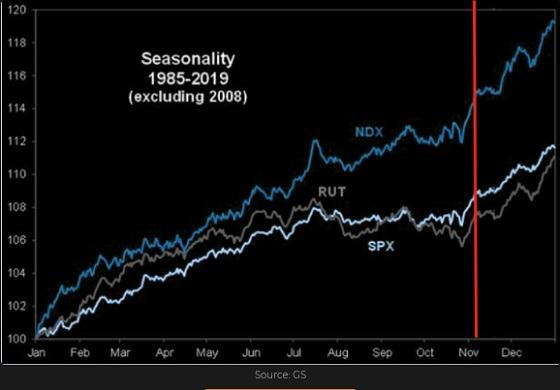

The major indices fell ~6% in September – the most prominent “tumble” we’ve seen since September 2020 – and then came roaring back the last five weeks to make new All-Time Highs. The Buy-The-Dip crowd is in an “I-Told-You-So” frame of mind – and who can blame them – you only need to look at the “seasonal trends” chart to see the roadmap to higher prices.

If markets reverse the trend of the last five weeks and take out the September lows (I know that seems impossible – but it was only five weeks ago), that would be the first time we’ve seen an interim low broken since the Covid Crash in March 2020. I think such a break would rattle the market and, perhaps, trigger some severe selling.

Thoughts on Trading – Why I read so much research, listen to podcasts, watch videos

In the gold section above, I mentioned that I’ve read Martin Murenbeeld’s weekly Gold Monitor for 30 years. Martin doesn’t offer a “buy this, sell that” service, and that’s not what I’m looking for when I read his letter. (I think letters that offer “buy this, sell that” advice are often “marketing” letters, not research letters.)

When I read a research piece, I want to be open to new ways of “seeing” things – especially if the ideas in the piece challenge some of the ideas I currently believe to be true. For instance, I got the idea that the gold ETF market was probably an excellent psychological barometer of the overall gold market while reading Martin’s letters. The next step was – if that’s the case, where’s the trade?

Another example: I recently watched a video prepared by Goehring and Rozencwajg (The Most Important 2000 Years Of Energy History) that challenged “conventional wisdom” concerning the importance of solar and wind-generated power as the world tries to transition away from fossil fuels. As I read their research, I was thinking, “If their ideas are correct, then a TON of capital is mal-invested in the energy markets – where’s the trade?”

Quotes from the Notebook

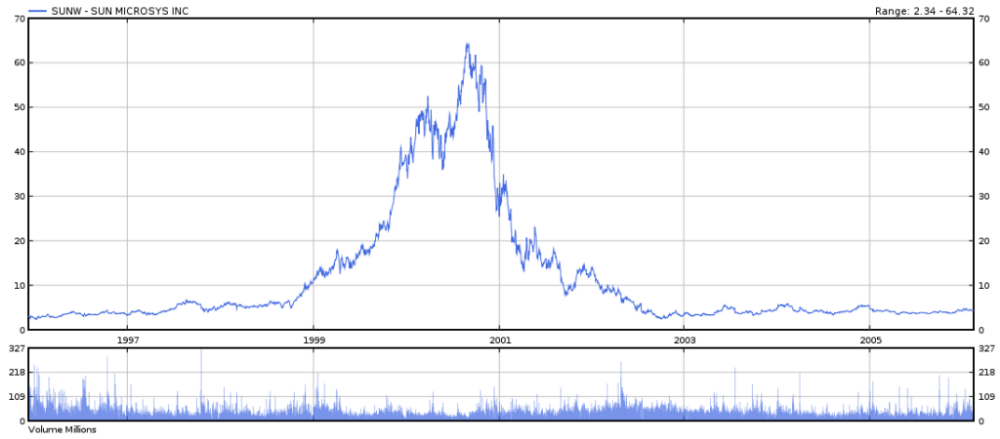

What were you thinking? Scott McNealy, founder and CEO of Sun Microsystems, from an address to an investor gathering in 2002. In 2000 shares of Sun Microsystems had been trading at $64 – which was ten times the firm’s annual revenue. Sun Microsystems was one of the HOT stocks during the dot-com boom.

At ten times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for ten straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero costs of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realise how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?“

My comment: Scott McNealy’s speech has become famous within the value investing community. What, indeed, were people thinking when they paid $64 a share (10X Sun’s annual revenue per share?) The value investing community would argue that people “weren’t thinking” when they did that – they were buying something because they believed (or had been told) that the share price was going to keep going higher.

Tesla may be the modern-day version of Sun Microsystems. If we assume annual revenues are ~$40 per share, then, with the stock trading at ~$1,200 per share, the market is pricing Tesla at ~30X revenue. Can you imagine Elon Musk, two years from now, asking, “What were you thinking?

People will believe the most preposterous stories – so long as the price keeps going up. Bob Hoye many years ago

My comment: Nobody ever said it better. Thank you, Bob.

This is Barney. He’s a 2-month old Golden Retriever / Border Collie.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.