The “too far, too fast” moves have stalled

In several of my Notes over the past few months, I’ve made the point that traders have been hunting “Peak Fed Hawkishness” – because they believe that will the best time to “Buy The Dip.” I’ve also made the point that they’ve been hunting for that “magic moment” without success – because Jay Powell keeps saying, in effect, “don’t make the mistake of thinking we’re done.”

But the Pavlovian responses created by two decades of ultra-low inflation and ultra-easy monetary policy, have spurred a FOMO anxiety – traders don’t want to miss the “magic moment”, but if they believe they have, they will “chase” the market higher, and their “chasing” creates more “chasing” and prices surge higher. I think this is exactly what has happened over the last six weeks.

The major stock indices fell to nearly 2-year lows immediately after the October 13 CPI report and then began to rally (this must be inflation’s peak!) That rally hit its zenith after the October 28 employment report (not as strong as feared) but then prices fell back ahead of the November 2 Fed meeting (Powell, the curmudgeon, might spoil the party.)

The November 2 FOMC press release ignited bullish enthusiasm with a reference to “lags” (slow or pause rate increases) but Powell’s remarks (don’t make the mistake…) during his press conference stunned traders and the Dow fell ~900 points in just over an hour.

The November 10 CPI report (lower than expected) reignited bullish enthusiasm and the Dow futures soared ~1,000 points within ten minutes!

This week the Dow hit its best levels since August, up ~5,300 points (18%) from the October 13 lows – recovering ~63% of the decline from the January All-Time Highs to the October 13 lows.

(Other indices have not done as well as the Dow. The S+P and the VTI have rallied ~16% from their October lows, and have recovered ~40% of their decline from ATH to the October 13 lows. The Russell Small Cap and the Nasdaq both had ATH in November 2021 and have recovered ~31% and ~23% respectively of their declines from ATH.)

The rally off the October 13 lows stalled this week in all of the indices. They may be in the process of rolling over as they did in August, or they may be “catching their breath” before of a Thanksgiving to Christmas rally.

I think traders have been “too eager” to find a “buying opportunity” that a “less hawkish” Fed would present. I’m currently positioned for a “rollover,” but I will abandon that position quickly if the rally resumes.

Currencies

The US Dollar index hit a 20-year high in September, up ~28% from the 3-year lows it made in early 2021. Over 2/3 of those gains came as markets realized that the Fed was aggressively shifting from its “transitory” view of inflation – so now that markets anticipate a dovish turn in Fed policy the USD has fallen ~8% from the September highs to this week’s lows.

I think the drop in the USD since November 3 has gone too far, too fast, and I’m positioned for a rebound, but I will abandon that position if the decline resumes. If markets begin to embrace the “recession is coming” idea, I think that is USD bullish because a recession will hit other countries harder than the USA.

Interest rates

Yield curves continue to become more inverted, with short rates rising relative to long rates – or long yields falling faster than short. Many analysts believe that inversions foreshadow a coming recession, and they note that a recession starts once the inversions begin to reverse.

The Eurodollar forward strip is currently pricing higher s/t rates until a June 2023 inflection point – after that short rates are expected to fall.

I’ve been a buyer of 10-year TNotes futures and calls over the past several weeks, but I’ve taken profits on those trades. If markets begin to embrace the “recession is coming” idea I think bonds will outperform stocks, so I continue to have a bullish bias.

Commodities

Gold made a triple-bottom low around $1625 in September and October and then bounced ~$170 as future interest rate expectations and the USD declined on market assumptions that “Peak Fed Hawkishness” had come and gone.

Gold briefly traded to ATH (~$2,080) on the Russian invasion but then fell ~$460 to recent lows as interest rates (especially real rates) and the USD rallied. I’ve previously noted that gold bullion ETFs have seen net selling since the Russian invasion, and that CFTC COT data showed declining net speculative long positions as traders and investors lost interest in owning gold.

(Charts courtesy of Martin Murenbeeld at Capitalightresearch.com)

I think the gold rally from the November 3 FOMC lows is overdone, but I’m not short because of concentration risk – I’m short Euro (as a bullish USD play) and adding a short gold position would be effectively doubling the risk on my bullish USD idea. I made a choice of shorting gold or the Euro, and I’d rather be short the Euro.

Copper, Crude and commodity indices have weakened this week. That may be a result of weaker-than-expected Chinese demand and/or foreshadowing a recession.

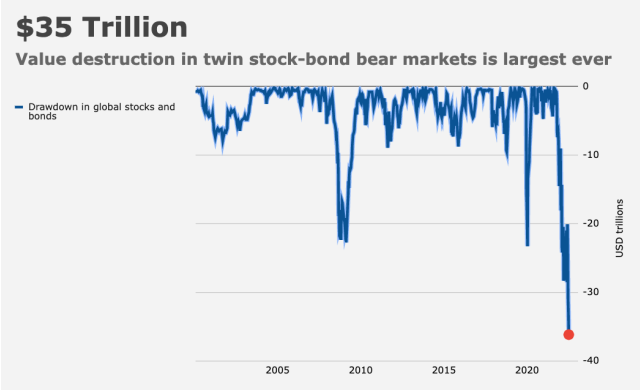

A possible secular transition

After two decades of ultra-low inflation and ultra-low interest rates we may now be transitioning to an era of higher inflation and higher interest rates. Early adapters to that transition will have a trading advantage.

I try to determine “investor sentiment” in macro markets and then decide if I want to trade with or against it. A key part of that determination is asking myself, “what will they do now?” For instance, I noted above the Pavlovian response after two decades of low inflation is to “buy the dip.” If I believe people have bought the dip I expect they will probably buy more if prices rally, but if prices fall they might start selling. I want to be short in that scenario.

I have believed for years that ultra-low interest rates effectively “forced” people, who should have remained savers, to become traders and speculators. In the search for “yield,” people took on leverage and stepped down the quality ladder. They (knowingly, or, more likely, unknowingly) took on more risk than was prudent, but the more it worked the more they took on.

Many times, over the years, when Michael Campbell, the host of the Moneytalks radio show asked me, “What is the biggest mistake investors are making,” I would reply, “Reaching for yield.”

I live in a small town on an island off the west coast of Canada. I’ve visited Calgary, Vancouver and Victoria in the past few weeks and I’ve been astonished at how much the cost of taxis, hotels, and restaurants has gone up. Apartment rents have soared, yet people seem to be spending money like never before. My son tells me you can’t get into a restaurant in Vancouver without a reservation.

Credit card debt is at record highs, and total household debt rose at the fastest pace since Q1, 2008 in Q3 2022.

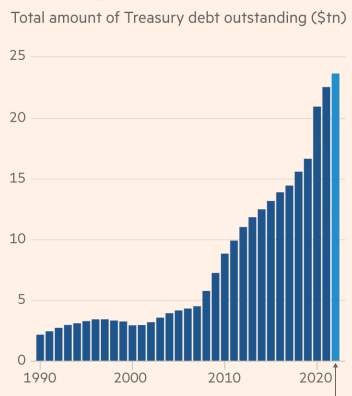

Governments have discovered “fiscal stimulus” and “balancing the budget” is history. Higher interest rates and higher deficits create exponentially rising debt service costs. The “easiest” way for governments to deal with rising debt service costs is not to cut services, not to increase taxes, but to allow inflation to rise.

As we transition from a low-inflation environment to a higher-inflation environment different “actors” will jockey to “stay ahead of the pack.” Workers will want higher wages to pay for higher-priced goods and services, while the providers of goods and services will charge higher prices to cover their rising costs.

Some “actors” who have no leverage to increase their income will be “left behind” in this transition, and other “actors” will flourish.

My short-term trading

In the “on my radar” section of last week’s NOTES, I thought the recent rapid moves across markets were overdone, and I would look for opportunities to fade those moves. I shorted the S+P on Tuesday and the Euro on Wednesday. I covered both positions on Thursday for decent gains, and then, on Friday, I re-shorted the S+P and the Euro and held those positions into the weekend.

If markets move in my favour next week, I will try to add to these positions; if markets go against me, my stops will take me out with slight losses.

On my radar

Many brilliant, highly-trained professionals continue to disagree with each another about what will happen with inflation, the economy, Ukraine, Taiwan, WW3, the new cold war, interest rates, stocks, gold, energy, currencies, covid, Trump’s chances of being re-elected President, and so on.

I can’t help but have opinions on these issues, but I try not to let those opinions have much weight in my decision-making process when I buy or sell a market.

I believe that there are millions of people trading the same markets that I trade, and I have no idea who they are, what they think or what motivates them, how much they know, who they know, how much power or influence they have, or what their time frame or risk threshold is.

I trade price action in liquid markets. I keep my size small, I use stops, and I’m willing to be wrong. I have more losing trades than winning trades, but my average winning trade is bigger than my average losing trade. Every once in a while, I have an unusually large winning trade, and I try very hard never to have an unusually large losing trade. I make money by grinding it out and managing risks, not by having a great crystal ball.

A recommendation

I subscribe to several services and have a network of friends sharing services. I spend hours daily reading reports, watching market videos and listening to podcasts. A staggering amount of good (and bad) information is available on the Internet. You can access a long list of services and books I like by clicking the “recommended” button at the top of this page.

I want to especially recommend the Heisenberg Report. I’ve been reading it for a few years, and I’ve been amazed at the volume and quality of his work. The subscription cost is $7 a month, which in this inflationary world is ASTONISHINGLY cheap! (He makes up for it by having thousands of subscribers!) You have free access to a few reports to see if you like the service before you make a subscription decision. I don’t know him, and I’m not getting paid to recommend him.

Best wishes to my American readers for a wonderful Thanksgiving holiday with your families!

The Barney report

Barney is now 15 months old and 62 pounds. He’s getting stronger all the time, and when he pulls hard on his leash, I have to be careful not to lose my balance. When people see me walking him and he starts pulling on his leash, the most common question I get is, “Who’s taking who for a walk?” I don’t know if that is just Canadian humour or if that happens worldwide. I imagine it’s universal.

When I’m working at my desk, he often dozes beside me, but when he wants attention, he’s learned to bump my wrist with his nose so I can’t use my mouse. Clever little guy! Here he is, waiting as I write these NOTES.

The 33rd Annual World Outlook Financial Conference at the Bayshore Hotel, Vancouver, February 3 & 4, 2023

Mike Campbell’s hugely popular annual conference will be back LIVE AND IN PERSON at the Bayshore Hotel after two years of Covid restrictions. Mike and his team have again created a fantastic roster of speakers and exhibitors. I’ve attended every one of these conferences, and with all the turmoil and confusion in today’s markets, I highly recommend my readers make plans to attend. You can get all the information you need here.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s Moneytalks show for >22 years. The November 19 podcast, with special guest Frank Giustra, is at: https://mikesmoneytalks.ca.

I recorded an interview with commodity trading legend Yra Harris on November 15 for the Financial Repression Authority. We discussed macro markets with more than a few references to life in the Chicago trading pits years ago! Here’s a direct link to the interview.

I did my regular monthly review of macro markets with Jim Goddard on the “This Week In Money” show on Saturday, November 12. My old friend, Ross Clark, is on the program as is the one and only Marc Faber. You can listen here.

Headsupguys.org

Market stress can drive people over the edge – maybe people you know. Headsupguys.org is a project at the University of British Columbia that helps men deal with depression. They have had over 5 million hits on their website from people worldwide, and they have saved hundreds of lives. They are there to help. Reach out – stay alive.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.