The DJIA hit a 4-month low on Wednesday but then bounced – as fears of “higher for longer”interest rates diminished

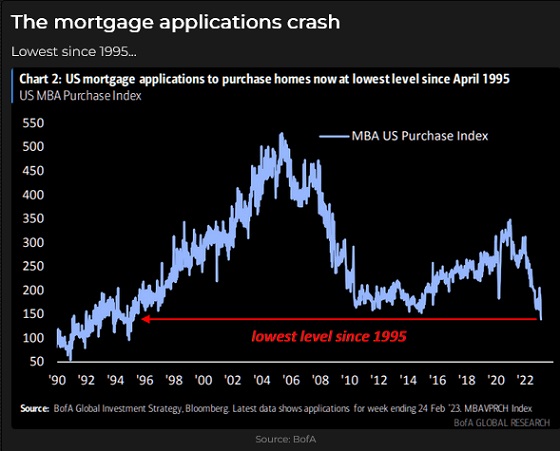

The 2-year Treasury yield hit a low of ~1/10th of 1% in August 2020 as the Fed slashed interest rates to counter the Covid Crisis. Some commentators suggest those were the lowest rates in 5,000 years.

The yield on the 2-year note began to rise in October 2021 and then rocketed higher for most of 2022, taking yields to ~4.7% by November. There was a lull for three months (amid thoughts of a looming recession), and yields fell back to ~4.1% as the market assumed the Fed was nearly done raising rates and might start to cut rates by mid-2023.

But expectations of future Fed policy took a dramatic pivot after February 2 (which I’ve previously referred to as a Key Turn Date), and the 2-year yield hit a 16-year high of ~4.95% this week – an increase of ~85bps since the KTD. The 1-year TBill yield reached a high of ~5.1% this week.

This is a chart of the 2-year futures contract. Falling prices mean higher yields.

The pivot in future Fed policy expectations keyed off the February 3 much-stronger-than-expected employment report, which underlined concerns that the “sticky” part of inflation is tied to the labour market – a shortage of workers may lead to a wage/price spiral. For example, Delta Airlines agreed this week to give pilots a 34% wage increase over four years; other airlines are expected to follow Delta’s lead.

The market’s focus on “labour” means that employment reports coming up next week, especially the UE report on March 10, will take on extra significance. Current expectations (and pricing?) are for an increase of ~210,000 jobs. The next CPI report is scheduled for March 14, and the FOMC meets the following week on March 21/22.

Eurozone inflation continues to be hotter than expected despite dramatic declines in energy costs (core CPI hit a record high of 5.6% this week), and markets are pricing the ECB to be higher for longer with a “terminal rate” later this year of ~3.9%, up from ~2.5% currently.

The German 10-year Bund fell to a 12-year low this week.

The Bank of Canada meets next week on March 8 and is expected to leave rates unchanged. The forward markets expect the BoC to leave rates as they are for the balance of the year. A month ago, forward markets expected rates to be nearly 100bps lower by December.

The Canadian Dollar made a recent high of ~75.40 on the KTD, then fell ~2 cents to this week’s lows – with a strong (traditional) correlation to weakness in the American stock market and strength in the USD. I think the assumed divergence in interest rate policies between the Fed and the BoC has become an increasingly significant factor for the CAD since the KTD. Note that the American stock indices had a peppy rally from Wednesday’s lows to Friday’s close, yet the CAD did virtually nothing – diverging interest rate policies trumped the CAD/S+P correlation.

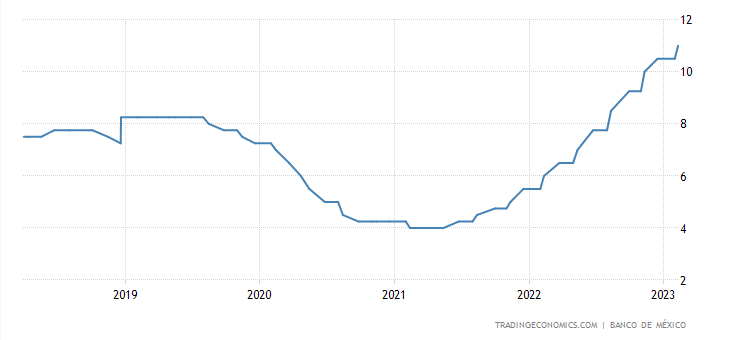

The Mexican Peso may be another example of interest rates impacting FX values. The Peso has risen nearly 9% YTD against the USD (up ~16% since the USDX peaked in late September); it is trading at > 5-year highs and is currently the strongest currency in the world.

The anticipation of “friend-shoring” may be giving the Peso a lift, but I guess that the sustained steep rise in Mexican short-term interest rates has been a significant factor. Short rates in Mexico are now ~11%.

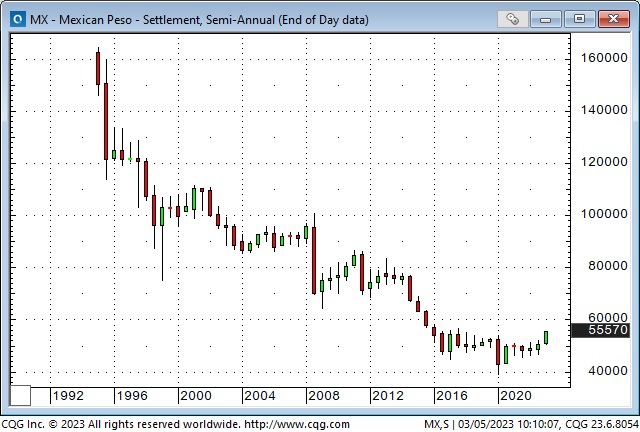

NOTE: I reread my TD Notes on March 5th and realized there was an important piece of information about the Mexican Peso that I had not included in the original post. For a trader to have earned ~16% in the Peso over the last 6 months, the FX risk would have been “unhedged” – if the Peso fell Vs. the USD, there was a risk of loss. This chart provides a useful perspective on Peso risk – since the Peso crisis in 1994, which pre-dated this chart.

Fears of “higher for longer” may have diminished this week, but did we see the beginnings of a significant turn?

Let’s start with the idea that markets are “forward-looking;” and that some participants “see things coming” and position accordingly. Concerning interest rates, some people may think that the sharp rise in rates since the KTD is overdone, that markets have already discounted the “worst case” concerning future Fed tightening, and it’s now time for the pendulum to swing the other way.

If it turns out that the employment reports next week show modest growth (and perhaps some revisions to last month’s reports) and the following week’s CPI data shows that inflation is moderating, that would likely confirm that this week’s price action was the beginning of a turn.

But the real confirmation won’t come until the FOMC meeting on March 21/22. If the Fed only raises rates by 25 bps, and especially if Powell has a dovish tone during his presser, then this week’s turn will look prescient.

In the first half of February, I noted a couple of times that I was puzzled by the stock market’s resilience in the face of sharply rising interest rates. Given that I thought markets would perceive a Fed pivot to be a “green-light special” to buy stocks, why would stocks not tumble on the realization that the Fed would be “higher for longer?”

My best answer was that the stock market was discounting the early February anticipation of higher rates from the Fed as the “last hike” and that once that was done, the Fed would stop raising and – maybe – start cutting!

As the anticipation of the Fed keeping rates higher for longer was sustained into the second half of February, stocks slumped but may have made a tactical low with the DJIA bottoming on Wednesday; the other indices bottoming on Thursday.

This week the “cash market” S+P came within five points of making a Weekly Key Reversal Up – it traded below last week’s lows and closed right on its highs – if it had closed ten ticks higher, it would have been a classic WKR. As it is, from a tactical timing perspective, I would not want to be short this market over the weekend after such a strong close. (The Vanguard Total Stock Market ETF, the Ishares Russell 2000 ETF, the Nasdaq, and the EuroStoxx 50 Index all made a classic WKR, closing above last week’s highs.)

The gold market also had a WKR Up this week after marking its high on the February 2 KTD with a WKR Down.

The long end of the US Treasury market closed strong on Friday, up ~4 points from Thursday’s low, and came close to a WKR Up. Shorter maturities closed progressively weaker as the curve continued to become more deeply inverted.

I’ve previously noted how foreign stock indices have outperformed the American indices recently (after years of American outperformance.) Look at these Canadian, British, European and Japanese stock index charts.

Toronto Stock Index

The UK FTSE

The Eurozone Stoxx 50 Index

The Japanese Nikkei

My short-term trading

I was long the S+P to start this week and was stopped for a small gain on Monday. I rebought it on Tuesday but gave back Monday’s gains. I started buying the Dow (it looked stronger than the S+P) on Wednesday and added on Thursday. I also bought the S+P on Thursday. I bought the CAD on Friday (I had a good low-risk entry point; the CAD was dead in the water as stock indices, crude, commodities, gold and other currencies rallied. The CAD might “catch up,” and if not, I will be stopped for a slight loss.) I stayed long the Dow, S+P and CAD into the weekend – nicely ahead on the stock index positions, with stops raised to lock in decent gains if the markets fall.

My trades this week were all about finding a market with a good setup where I could be rewarded if market sentiment has a tactical shift from “the Fed is going to keep tightening” to “the market has over-priced future Fed tightening.” I chose the Dow and the S+P (and later CAD), but I could have made the same bet by buying gold or bonds or Euro – I chose the stock indices because they gave me a better limited-risk entry point.

On my radar

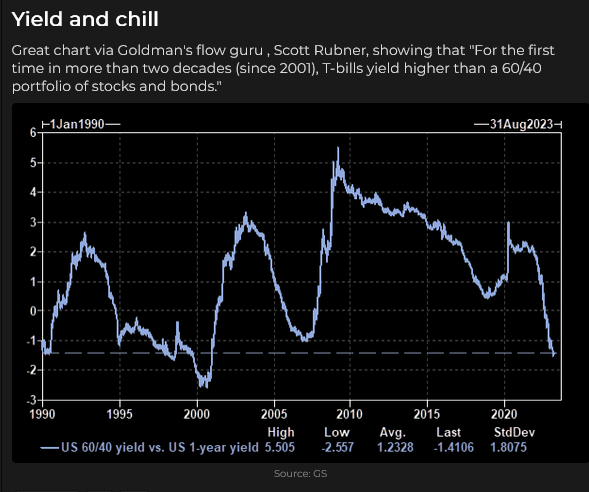

With 1-year TBills at ~5%, cash is not trash. I see multi-billion Dollar flows into money market funds not as “dry powder” waiting on the sidelines for an opportunity to get back into the stock market but as money that is happy to earn a reasonable return without the emotional swings of “investing.” After fourteen years of being “forced” by zero-interest-rate policies to try to be traders or investors, savers can be savers again.

I can’t help but have opinions about where markets (and the world) may be headed because of XYZ, but I also believe that most of the views I have may be wrong because I don’t have (and never will have) “all of the information.”

For instance, I’ve had the question, “Are bonds a buy?” on my Trade Ideas sheet for the past month. In the short-term, bonds would probably rally if the market decides a recession is developing. Bonds were down in 2021 and got destroyed in 2022, so maybe they’re due for a good year.

But bonds also had a great run from 1982 to 2020, and the downturn in 2021 and 2022 may be just the beginning of a secular change in trend – especially if, as I believe, governments embrace deficit spending. (William White has a great interview on this subject – a 10-minute read.)

So I could buy or sell bonds short, depending on my time frame. One of my favourite trading maxims is to keep the time frame of my trading and analysis in sync.

Thoughts on my short-term trading account

I want my net realized gains to be greater than my net realized losses – not every week or every month, but every year would be nice. My experience over the years tells me I have more losing than winning trades; therefore, to make net profits, my average winning trades must be bigger than my average losing trades.

But averages don’t matter. I agree with Peter Brandt that most of my winning and losing trades offset one another; therefore, if I earn net profits over a year, the gains will have come from a small percentage (10%?) of the winning trades I made.

Rule #1 is: Never blow up, and never take a BIG loss. When I initiate a trade, there are four possible outcomes: 1) a slight loss, 2) a breakeven, 3) a small gain, and 4) a big gain.

I make money by managing risk, not by picking great trades – but finding good entry points for all of my trades (winners and losers) is a great way to manage risk.

I don’t know what will happen to any trade I make, but before I enter a trade, I know exactly where/why I will exit if it goes against me. If I have been in a trade for a while and the “facts” change, I may exit the trade before it reaches my previously defined exit point.

Managing risk on a losing trade is relatively simple; managing risk on a winning trade is more complicated. I want to give the trade room to run, but I don’t want to leave too much money on the table.

I make probability guesses about different markets in different time frames: this trend has more to go; this trend is due to reverse. A lot of my probability guessing is based on positioning. For instance, if I have an idea about a potential market move, my first question is, “How much of this idea is already priced in?”

Another big part of my probability guessing comes from looking at correlations; how is one market trading in relation to other markets?

I look for price action setups in different time frames that may provide a good limited risk entry point. For instance, I thought the month-long trend of “fear” that the Fed would keep raising rates got “old” near the end of February, and I looked for hourly/daily price action setups to trade against that month-long trend.

Specifically, I won’t buy a market that is making new daily lows, but if I think the trend is due to reverse and the hourly chart shows higher lows, I might be a limited-risk buyer, which means trading small size with tight stops. If the trade starts to work, I might look for another good entry point setup to add size (but the second trade has to make sense on its own merits, as if it was the only trade I made; otherwise, I’m ruining the limited-risk edge I had on the initial trade.)

The Barney report

When it comes to eating, Barney has decided that he’ll have some of whatever I’m eating – in addition to the breakfasts and dinners we make for him. That starts with my “first breakfast” of toast and coffee. He loves toast but so far hasn’t shown any interest in coffee.

This is his “I’m joining you for breakfast” look.

Barney has also decided that he is the house watchdog. He will watch for people walking on the golf course behind our house or on the road out front and bark. His favourite lookout is from a chair by the window of one of our upstairs guest bedrooms. But sometimes, a watchdog needs a little downtime.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on March 4 on the Moneytalks podcast.

I recorded a 30-minute interview with Jim Goddard on February 10 for This Week in Money. You can listen to it here.

Headsupguys

At the World Outlook Financial Conference, I told the audience about Headsupguys and why I support their work.

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.