Break something?

The Fed has been raising interest rates for the past year to bring inflation down to its target range of ~2%. For the past several months, the market has been trying to guess “what would have to happen” for the Fed to either slow their pace of raising rates, stop, or start cutting rates.

After four consecutive increases of 75 bps from June to November 2022, the Fed reduced its pace to 50bps in December and 25bps in February. Powell explained that the moderation would allow time for the “lagged effects” of previous tightening to manifest.

From early November through late January, the forward rates market priced a “levelling off” of rates at a “terminal rate” of ~4.5% in June 2023, with rates expected to fall after that. That changed following February 2 (a date I’ve previously called a Key Turn Date) when January’s employment data (on February 3) was astonishingly strong. Throughout February, the forward market repriced the Fed taking rates higher and keeping them higher for longer, with a “terminal rate” of ~5.5% in September.

Following Powell’s Congressional appearances this Tuesday and Wednesday, the market priced an even steeper rate rise with a“terminal rate” of ~5.7% in Q4 2023. The 2-year Treasury yield rose to a 16-year high of ~5.09%.

With the Fed raising short rates at the most aggressive pace since the Volker era, the yield curve has become increasingly inverted; short rates are higher than long rates, which has historically signalled a looming recession.

The stock market’s reaction

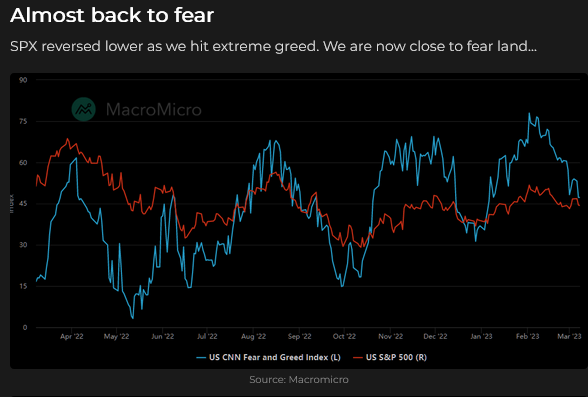

The major American stock indices fell following the 4th Fed rate increase of 75bps on November 2 but bottomed within the next two days and trended higher until the KTD on February 2. (The S&P rallied ~13% from November lows to February highs, the Nasdaq 100 rose ~22%, the DJIA rose ~8%, and the VTI rose ~13%.) The indices have remained above their November lows, although the DJIA came close to taking out that low on Friday.

What would have to happen for the Fed to “pause?”

1) If inflation (CPI, PCE) fell quickly. (That has not happened.)

2) If economic data, particularly employment data, weakened quickly. (That has not happened.)

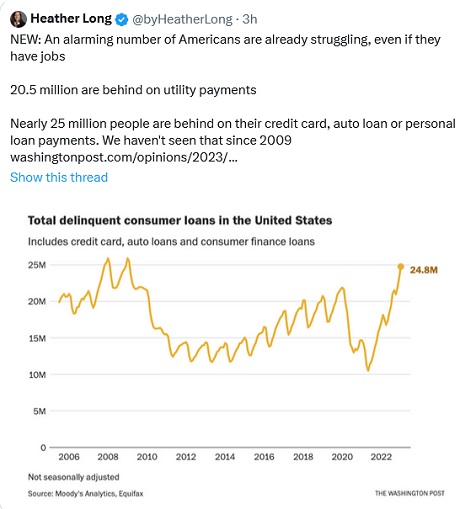

3) If something broke within the financial system due to the rapid rise of interest rates, creating a perceived contagion risk similar to what happened during the GFC post the Lehman collapse. (The Fed would likely not see weakness in the stock market as a contagion risk.)

4) If a significant exogenous event occurred, the proverbial Black Swan, for instance, a major earthquake in the US, a dramatic escalation in the Ukraine war or another important geopolitical event.

Silicon Valley Bank

North American bank shares have been under pressure since early February, with the benchmark ETF hitting a 28-month low on Friday, down >20% from the February 2 KTD.

Following Powell’s testimony, bank shares fell dramatically this week as the “troubles” at Silicon Valley Bank became more widely known. (See this Heisenberg Report about the likely consequences of the SVB failure.)

The big question for the financial markets is: does the failure of SVB create a contagion risk? Is this the “something broke” event that will cause the Fed to pause or reverse course?

This is a December 2023 SOFR (Secured Overnight Financing Rate) futures contract chart. At Wednesday’s close (following two days of Powell’s congressional testimony and before the SVB rumours became widely circulated), it indicated an interest rate of ~5.54%. The indicated rate at Friday’s close (after SVB failed) was ~4.84%, a decline of ~70bps.

This is a chart of the spread between June 2023 and December 2023 SOFR contracts. The rising prices between early February and early March represent the market’s vote that short rates would stay higher for longer. The dramatic two-day plunge on Thursday and Friday represents the market’s vote that rates will NOT remain higher for longer.

The Bond market rallied on Thursday and Friday as the stock market and short-term interest rates fell; short-covering and flight to quality buying fuelled the rally.

The US Dollar Index hit a 3-month high on Wednesday following Powell’s testimony but weakened Thursday and Friday.

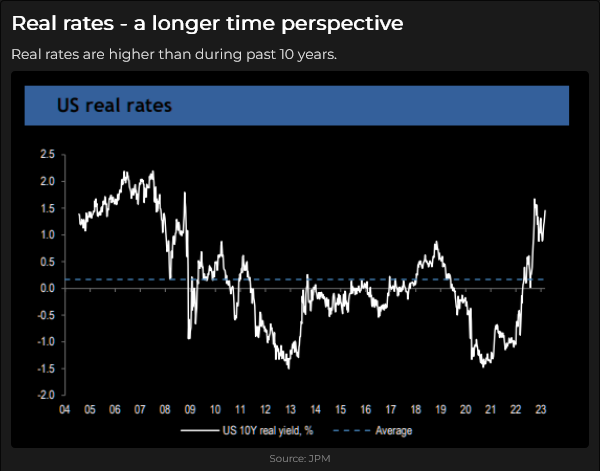

One of the reasons that the USD rallied hard in 2022 was rising nominal and real interest rates.

The Euro rose slightly as the USD fell Thursday and Friday, but the Swiss Franc soared.

The Mexican Peso, which closed last week at a 5-year high and had been the strongest currency in the world YTD, fell in response to risk-off sentiment.

The Canadian Dollar can’t catch a break; it is now down ~3 cents from the February 2 KTD, at a 5-month low. It fell early in the week as the CDN/USA interest rate spread looked to get even wider, then fell later in the week as risk-off sentiment intensified.

Gold was virtually the mirror image of the USD this week, falling ~$50 Monday to Wednesday, then rallying ~$60 Thursday/Friday on thoughts that the SVB event might lead to much easier Fed policies.

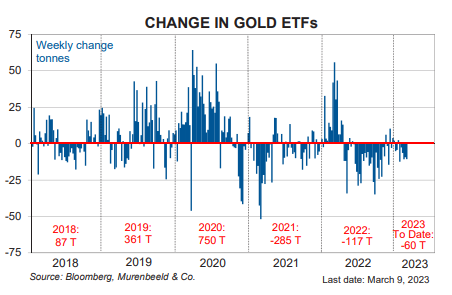

The gold ETF market has seen net selling since the Russian invasion.

The DJIA had its lowest weekly close in five months, falling ~1,800 points from Monday’s high to Friday’s low, creating a Weekly Key Reversal Down on the charts.

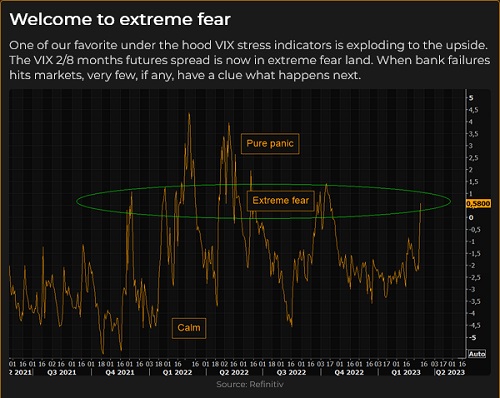

Volatility spiked higher on Friday as risk-off sentiment intensified but backed off late in the day.

The Goldman Sachs spot commodity index looked like it would register a 15-month low early Friday but bounced later in the day. The weekly close was still very close to a 15-month low.

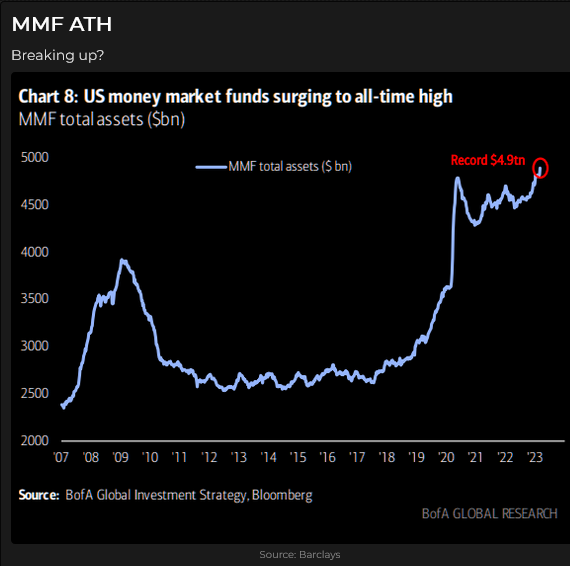

Money market funds rose to a new record high of nearly $5Trillion as investors sought refuge. TBill yields of ~5% look good against the S&P dividend yield of ~1.7% when investors get in a risk-off mood.

Market psychology going into the weekend seemed to be “better safe than sorry; sell first and ask questions later.”

My short-term trading

I began this week with long Dow, S&P and CAD positions I established last week. I had good unrealized gains on my stock index positions and raised my sell stops to ensure that I locked in decent gains if the markets turned lower.

The Dow futures had rallied ~900 points from Thursday’s low to Friday’s close, held steady in the Sunday overnight session and then rallied ~150 points to Monday’s high. When the market turned lower Monday afternoon, I moved my stops higher and was stopped out of my Dow and S&P positions. The CAD was doing nothing, so I closed the position for a slight loss, happy to get flat ahead of Powell’s congressional testimony the next day.

I didn’t trade Tuesday through Thursday, practicing patience, and I knew I was going skiing Thursday. I sat out the early wild price action Friday morning and started buying s/t bounces in the S&P Friday afternoon. I took a few slight losses but went into the weekend long. I liked how S&P VOL fell back on Friday afternoon after spiking higher in the morning.

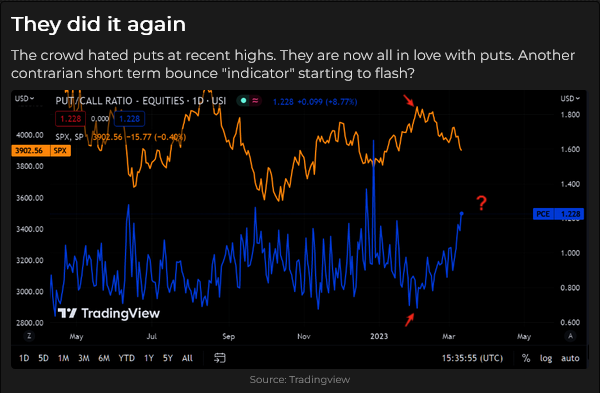

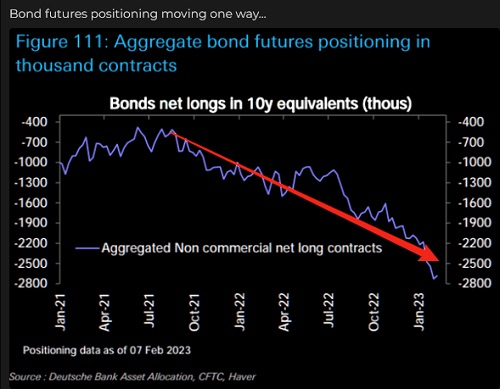

The trade I didn’t make – but should have! I was looking at buying bonds on Tuesday. The short end of the curve had sold off hard on Powell’s comments, but the long end of the market (the 30-year) was steady/better. I thought the big jump in short rates would stress the stock market (it did), and the bonds might get a bid as an alternative to stocks and on the rising possibility of a recession. I also believed that there was an enormous short position in bonds. Buying bonds was a short-term trade idea, not a Hold To Maturity investment idea.

I didn’t pull the trigger, and the 10-year traded a little lower on Wednesday, so it looked like I was right not to have made the trade. I went skiing Thursday and missed the first leg up and couldn’t bring myself to chase the rally Friday (getting a good entry point on a trade makes managing risk much easier, and I rarely ever get a good entry point if I chase a market.)

On my radar

I’m long a small S&P position near Friday’s lows; I think the panic on Friday was overdone. I might be wrong, and I’ll lose money on that brainwave. Still, I think the stock market has to find a balance here between loving the idea that the Fed may stop raising rates (I’ve previously noted that market sentiment would see that as a “green light special” to buy) and fearing that the SVB failure will set off a crash like the fall of 2008.

From a longer-term perspective, I agree that a 15-year period of ultra-low interest rates, followed by a year of dramatic interest rate increases, will probably create some “re-evaluations” across assets.

The CPI report is due early Tuesday, and the FOMC meets on March 21/22.

Quote from my notebook

“Nobody really owns anything. You have something for a while, and then somebody else gets it.” T.L. 2005

T and I were sitting on the front “porch” of his home in Scotland. He owned several homes, and this one came with 50,000 acres of shooting estate. It was 10:30 pm on the summer solstice, and there was still enough daylight to see the beautiful rolling hills stretching into the distance, patterned with stone fences and grazing sheep.

I told T that the view was beautiful; it could be a photo for a classic Scottish souvenir calendar. He agreed and then added the quote above.

We were sipping whiskey and smoking cigars, and his observation easily meshed with our contemplative mood.

I’ve thought about him and what he said that evening many times over the years. He was 60 years old at the time, one of the wealthiest men in the UK, and he died two years later, underlining the prescience of his observation.

The Barney report

Three weeks ago, we had freezing weather and an unusual dump of snow – as much as 2 feet in some places. The snow is pretty much gone now, and looking out my office window, I see only the green fairways of the golf course. But when I take Barney for an on-leash walk in the neighbourhood, a few piles of snow remain – banks created when the plows cleared the roads. Barney loves to pounce on these piles of soft snow and roll around as though he knows that he won’t be catching snowballs again for a long time.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on March 11 on the Moneytalks podcast.

I recorded a 30-minute interview with Jim Goddard on March 11 for This Week in Money. I discussed what happened in different macro markets this week and how I blend fundamental and technical analysis in my trading. It will be posted here later today.

Headsupguys

At the World Outlook Financial Conference, I had the opportunity to tell the audience about Headsupguys briefly and why I support the work they do.

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.