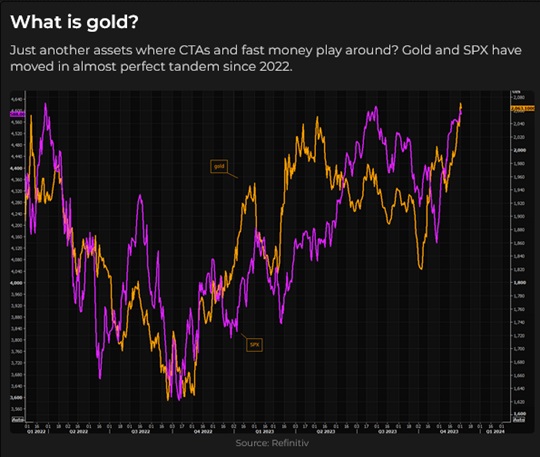

Gold soars to All-Time High, then falls below last week’s low

On Sunday evening, New York time (Monday morning Asian time), February Comex gold soared ~$60 within the first hour of trade to an All-Time High of ~$2,152. By mid-day Monday in New York, it was down ~$115 from the overnight highs; at Friday’s lows, it was down ~$140.

The Commitment of Traders report COT) as of Tuesday, December 5 (circled above) shows that speculative net long positions were ~203,000 contracts (up ~3,000 from the previous week), the highest levels since April 2022.

In the week of March 8, 2022, following the Russian invasion of Ukraine, gold traded to All-Time Highs of ~$2,080, and speculators were net long ~274,000 contracts. As gold fell ~$475 over the next seven months, speculators reduced their net long positioning to ~ 52,000 contracts, their smallest net long positioning since April 2019 when gold was ~$1,300.

February gold registered a classic Weekly Reversal this week – trading above the previous week’s highs but closing below the last week’s lows.

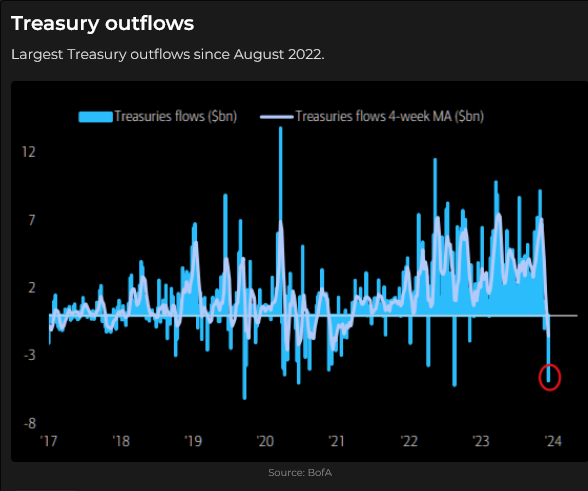

The bond rally continues

The 10-year Treasury futures contract traded to a 14-week high this week, as the 10-year yield dropped to ~4.1% from highs of ~5% reached in mid-October. This 6-week drop in yield has been the steepest in ~40 years as markets have embraced the notion that the Fed is done raising rates and will start cutting rates in early 2024.

The December 2024 SOFR futures contract rallied over 80 bps from mid-October lows to last week’s highs but gave back as much as 29 bps this week as euphoria over aggressive Fed cuts in 2024 was tempered.

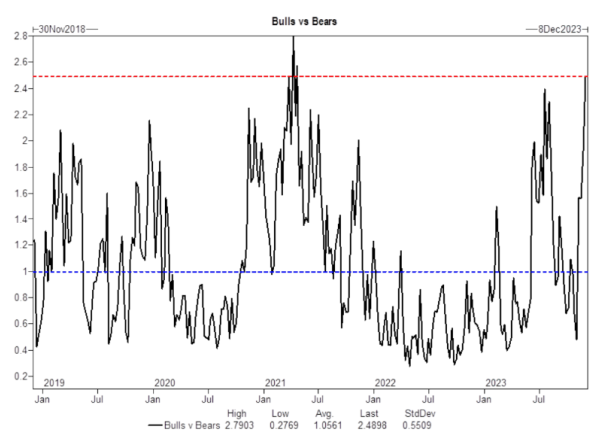

The stock market rally continues, with laggards bid as bullish sentiment intensifies

The S&P 500 futures rally seemed to lose momentum over the last two weeks after a spectacular rally off the late-October lows, but Friday’s close was the highest since July and was only ~4% away from the December 2021 All-Time Highs.

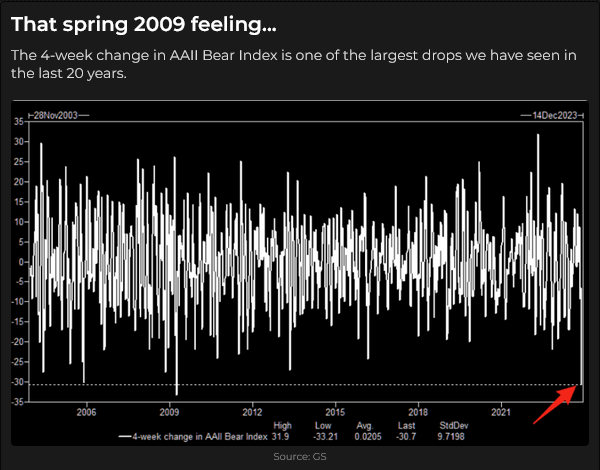

Market sentiment is clearly “risk-on” as traders anticipate new All-Time Highs in the leading stock indices. Market breadth has widened as risk appetite has ramped higher. And, speaking of risk appetite…

Currencies

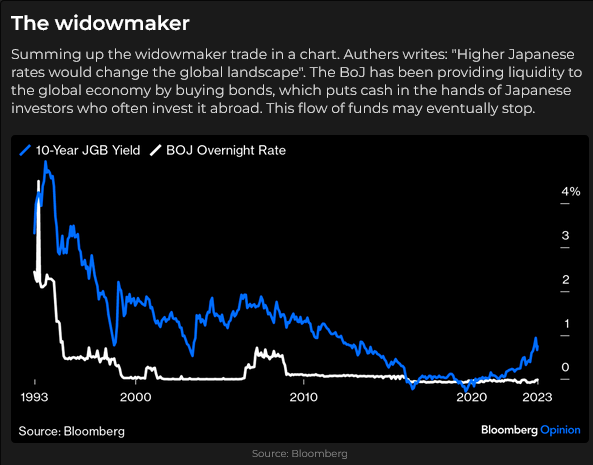

The Japanese Yen fell to 33-year lows in mid-November as the BoJ continued to resist any meaningful increase in interest rates, but traders have bid the market higher in anticipation of an eventual capitulation from the BoJ. The Yen exploded higher on Thursday as traders thought they saw a “straw in the wind” from the BoJ, but without any “real action” from the BoJ, prices settled back a bit on Friday.

The Euro rallied ~200 points on November 14 when softer-than-expected US CPI data ignited aggressive short-covering, but the “Anti-dollar” has dropped back to pre-CPI levels over the past two weeks. Perhaps the CPI report or FOMC comments this coming week will rekindle bullish Euro sentiment.

The Canadian Dollar also jumped higher on the November 14 US CPI report but has sustained its gains better than the Euro since then. The COT reports show a multi-year high (~70,000 contracts) in net speculative short positions in the CAD as of November 14. Those short positions have been reduced to ~58,000 as of December 5 (as CAD has rallied), but that is still a historically huge net short position. If the CAD can sustain its gains or rally from here, there may be more short-covering. Speculators were net long the CAD as recently as July/August.

Energy

Nymex WTI crude oil futures traded at a 13-month high of $95 in late September but touched a low of $68 this week and have closed lower for seven consecutive weeks. My friend Joseph Schachter reports that real production cuts from OPEC+ appear to be a fraction of “agreed” cuts.

The 6-month forward WTI futures curve is now in contango. When WTI traded at $95 in September, the 6-month forward contract was ~$10 backwardated.

Cameco shares traded at a 16-year high last week after more than doubling in the previous 12 months but fell back a bit this week.

Commodity index

The Goldman Sach (energy-heavy) commodity index is down ~16% since September and came close to printing a 2-year low this week. Weak fossil fuel prices are a big part of the weakness, but Ag markets have also been weak. Corn is down nearly 50% from 2022 highs, with net spec shorts at 2.5-year highs.

My short-term trading

I started this week flat and did minimal trading as I had cataract surgery on Tuesday with a follow-up inspection on Wednesday. My vision is greatly improved following the surgery.

I shorted the S&P on Wednesday when the market fell back after hitting the highs made last Friday and again on Monday. The market rally from late October had lost momentum, and I thought a decisive break of support around 4550 might have good follow-through, but support held, and I covered the short for a tiny loss.

I bought the CAD on Friday when it steadied after falling Monday to Thursday but was stopped for a slight loss. With equity markets firm near the end of the day, I re-bought the CAD and held the position into the weekend.

I wrote last week that I would try to get short gold based on COT positioning if I saw a good “technical failure.” There was a terrific technical failure, but the action on Sunday/Monday was too wild for me, and I didn’t put the trade on (knowing I would be away from my desk for most of Tuesday and a good chunk of Wednesday due to the surgery.)

On my radar

US CPI data Tuesday and the FOMC meeting Wednesday could dramatically impact markets. I’ll be getting cataract surgery on my other eye on Tuesday, with a follow-up inspection on Wednesday, so I’ll probably not be initiating any trades on those days.

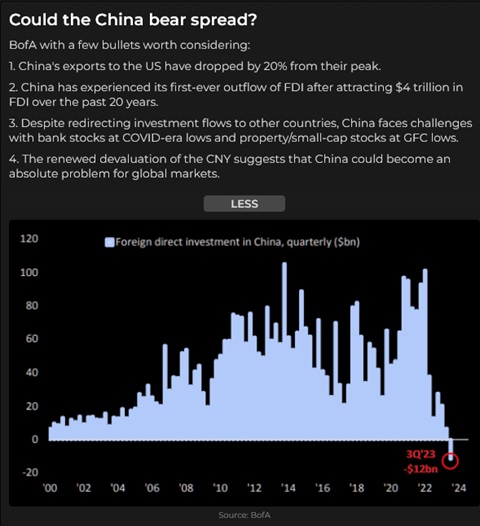

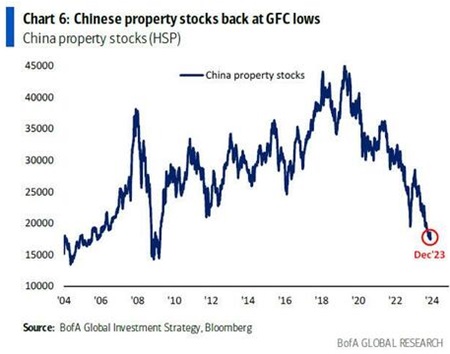

Inflation has been falling, and expectations seem to be that it will keep falling. (China is in deflation, with CPI down 0.5% YoY.)

TRUMP: Trump seems likely to be the Republican candidate for the November 2024 election, and I suspect that markets will start trying to “price in” the possibility of him becoming the president.

Gaza: Two weeks ago, I thought the conflicts in Ukraine and Gaza were nearing the “negotiation” phase. I still think that way about Ukraine, but the Israel/Hamas conflict is at risk of broadening as more Palestinian citizens are killed.

I think “bullish enthusiasm” is getting close to “irrational exuberance,” but I need confirmation that it’s time to get short.

China is a worry. The one-person autocratic rule, where people who disagree disappear, is not a suitable environment for innovation. Maybe the leveraged boom times are over.

I’ve had a busy week. I hope to write more market comments next week.

The Barney report

The Pacific Northwest rainforest gets a LOT of rain during the winter, but Barney needs to get out for at least three walks a day.

Listen to Victor talk markets with Mike Campbell

On today’s Moneytalks show, Mike and I talked about the wild swings in the gold market, the bond market and falling crude prices. You can listen to the show here. My segment with Mike starts around the 54-minute mark.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. S subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.