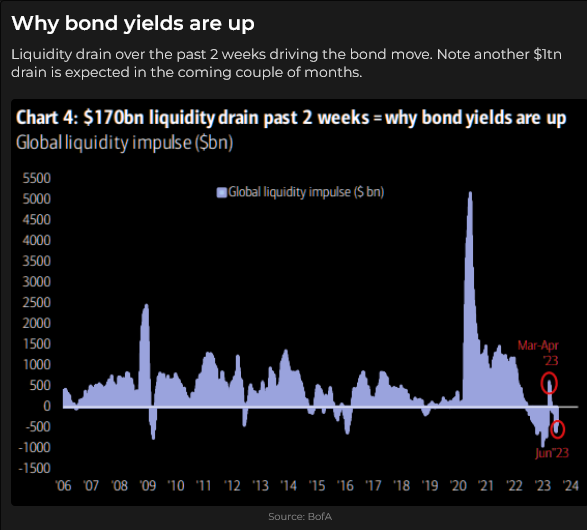

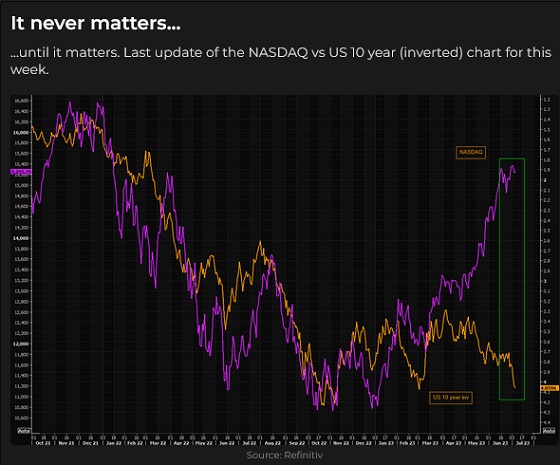

Real and nominal interest rates surged higher this week

Interest rates across Europe, Canada and the US rose this week, with yields on the long end sharply higher.

The yield on the US 10-year T-Note (~4.07%) is at a 15-year high; the 10-year UK bond yield (~4.70%) is also at a 15-year high; the 10-year Canadian yield (~3.57%) is at a 13-year high, and the 10-year German yield (~2.6%) is at a 12-year high. Following Thursday’s much-stronger-than-expected ADP employment report, the US 2-year Treasury yield hit a 16-year high of ~5.1%. Bond prices fall as yields rise.

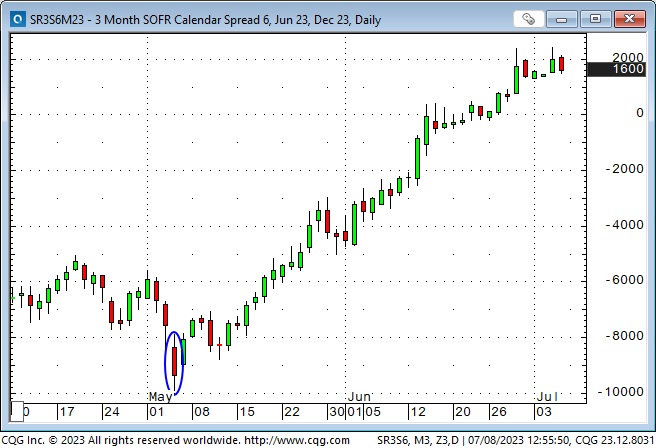

The “turning point” for credit market pricing was the first week of May 2023, when bank share ETFs hit their lows and began to rally. The heads of the ECB, the BoC, the BoE and the Fed also reminded markets that week that interest rates would have to remain “higher for longer.”

The market’s shift from “fighting the Fed” (not believing the Fed would stay “higher for longer”) to “starting to agree” with the Fed also began during the first week of May when the SOFR market was pricing rates to be ~100bps lower in December 2023 than they would be in June 2023. That spread now has Dec at ~20 bps premium over June.

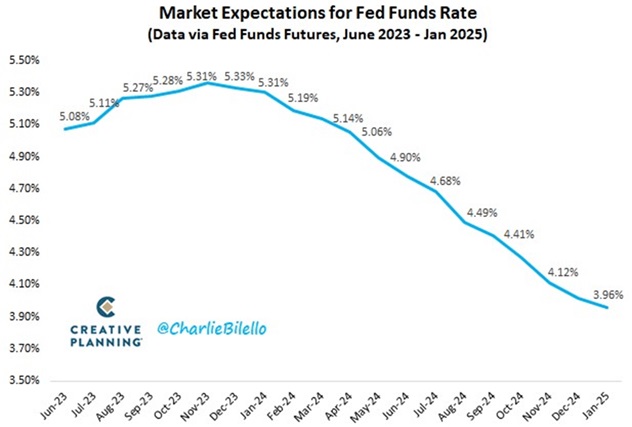

Another way of seeing how the market has embraced “higher for longer”

In December 2022, the forward market expected short rates to peak at around 4.9% in May/June 2023 and to decline to ~4.3% by December 2023. The market now expects short rates to peak at around 5.33% in December 2023 and fall to ~ 4.3% by October 2024.

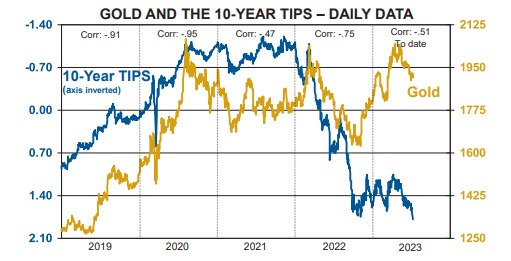

Rising nominal interest rates, declining inflation, and expectations of “higher for longer” have helped real interest rates rise to multi-year highs

Implications of rising interest rates

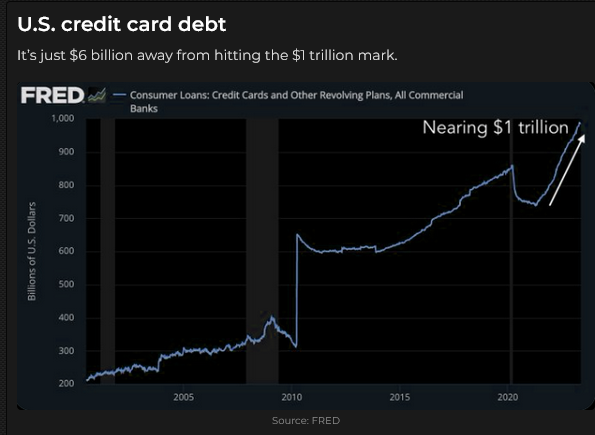

Higher interest rates mean higher debt service costs for individual, corporate and government borrowers.

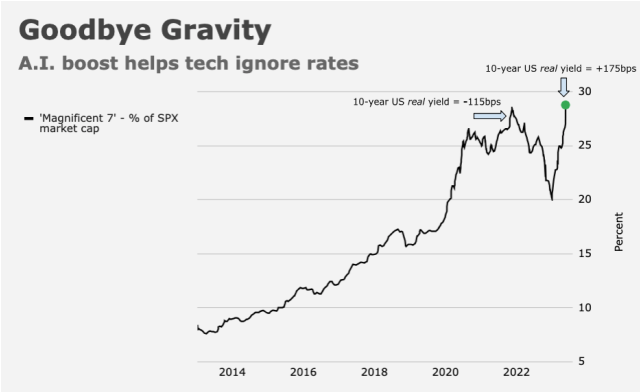

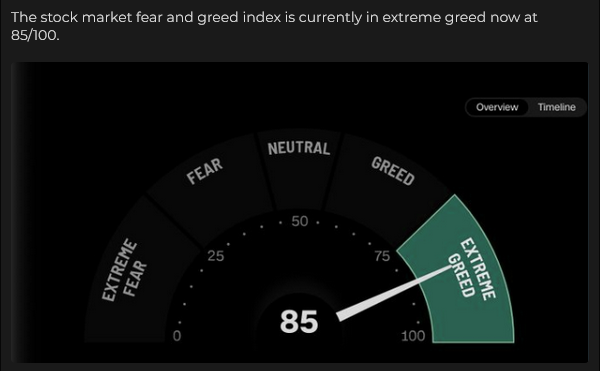

Higher interest rates may also dampen enthusiasm for risky investments.

Markets expect the BoC to raise rates by 25 bps this coming Wednesday and the Fed to raise rates by 25 bps on July 26.

Equities

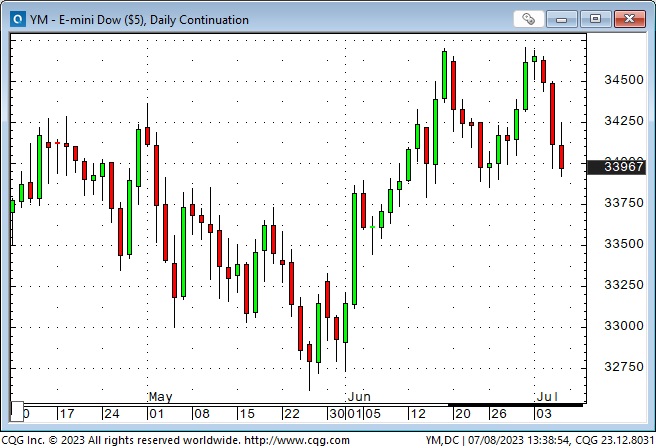

The Nasdaq 100 futures made marginal new highs this week but closed lower. The DJIA closed lower Wednesday through Friday.

Currencies

The US Dollar Index traded to a 4-week high on Thursday following the stronger-than-expected ADP employment report but couldn’t sustain the gains (it’s hard to be bullish when a market fails to rally on “good news”), then fell hard following Friday’s government employment report.

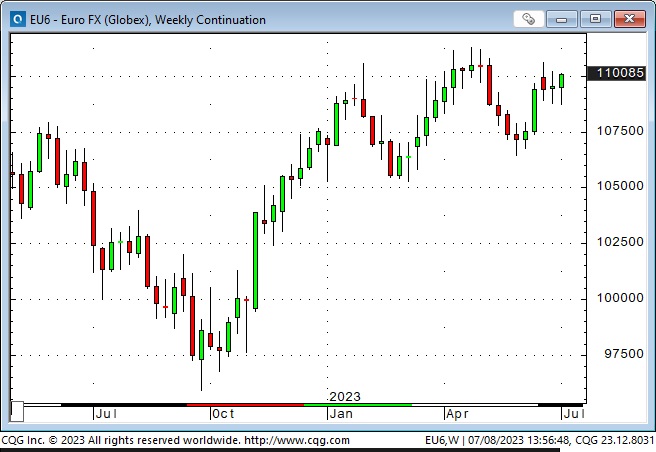

The Euro (the Anti-dollar) traded to a 4-week low on Thursday but then rallied hard on Friday to register its highest weekly close in nine weeks.

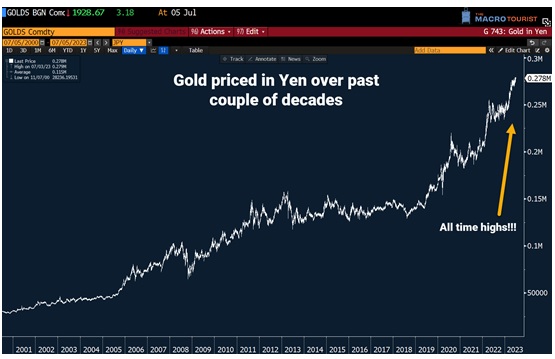

The Yen touched an 8-month low last week, rallied overnight Thursday on ideas that strong wage gains in Japan may lead the BOJ to tighten policy, and then rallied hard on Friday following the US employment report. Speculators are hugely net short of the Yen, so short-covering may have accelerated Friday’s rally.

Abeconomics started in 2012 as a broad program to revitalize the Japanese economy. Since then, the Yen has fallen ~50% against the USD and the Euro. Perhaps that is about to change.

The Canadian Dollar reached a 9-month high last week as speculators appeared to “throw in the towel” on their substantial net short positions, then tumbled nearly 1.5 cents to Thursday’s low as the spread of US interest rates over Canadian rates widened and as “risk-off” sentiment took equity markets lower. The CAD bounced over a half-cent on Friday on the stronger-than-expected Canadian employment report, and as the USD fell against virtually all currencies.

Gold

Gold touched a 3-month low last week on continuing liquidation of speculative positions in the futures and ETF markets. Gold rallied a bit this week with support from the weaker USD, but rising interest rates (real and nominal) are not good for gold.

This chart from Martin Murenbeeld:

Energy

WTI futures bounced >$6 from last week’s lows to register the highest weekly close (~$74) since April 28. Gasoline and heating oil have been stronger than WTI for the past couple of months and closed the week at their best levels since late April.

My short-term trading

I was flat over the long weekend. I shorted the Euro on Tuesday after it rallied on Monday to near last Friday’s highs (~1.0975) but then fell back. I had a bearish bias on the Euro and saw 1.0975 as strong resistance. The market drifted lower Wednesday before the employment reports and then spiked lower on the Thursday ADP report.

The Euro didn’t stay down on the ADP report, which concerned me because I thought it was a bullish report for the USD, but I stayed with the trade. I was stopped for a slight loss on Friday morning when the Euro rallied after the government employment report.

I shorted gold on Wednesday after it made a 6-day high but then turned lower. I was ~$20 ahead on the trade at Thursday’s lows as the USD showed strength and as interest rates moved to new highs, but I was stopped for a tiny loss on Friday when gold popped higher on the employment report.

I went into the weekend with no positions.

On my radar

I read a wide variety of market analyses, and I acknowledge that there are many highly qualified and experienced people who truly disagree with one another about what lies ahead for the markets. I know it is easy to find a confirmation bias, so I try to see “both sides of the story.” That also keeps me from staying in a losing position – I may have a strong opinion on a market, but it is “weakly held” because I know I might be wrong.

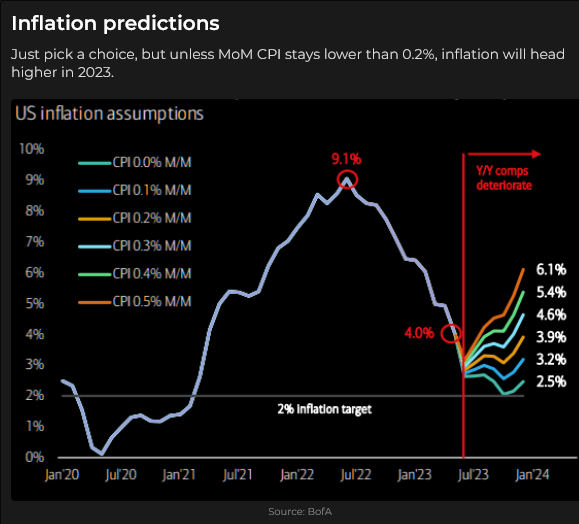

Inflation and inflation expectations have had a significant impact on all markets. If I knew what would happen with inflation, I would probably have greater trading success. But I don’t know; I only have my bias, and I have to guard against that being wrong.

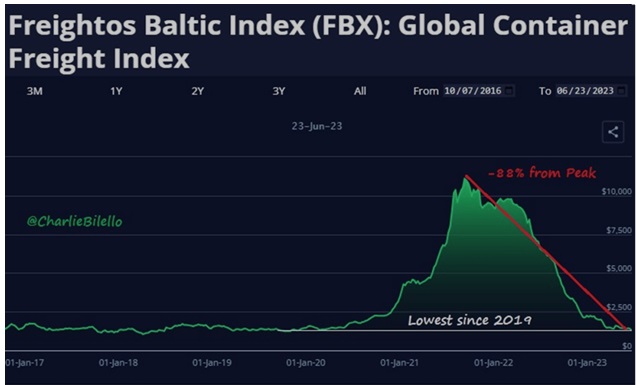

I believe inflation (and interest rates) will stay “higher for longer.” I think “everything changed” when governments embraced MMT during the Covid crisis and embarked upon greater deficit spending, devaluing our currencies’ purchasing power.

Supply chain shortages due to the Covid crisis and the Ukraine war certainly contributed to the spike in inflation, but much of that has been washed out.

I expect more unions to strike for higher pay as people see their currency’s purchasing power decline and try to “catch up” to rising prices. When one union gets higher pay for their workers, that pressures other unions to strike to get higher pay for their members, and so on. People who get a pay raise can afford (?) to pay higher prices; thus, a wage/price spiral develops.

Central banks are trying to reduce inflation by raising interest rates, but higher interest rates are inflationary for people, corporations and governments because of rising debt service costs.

There seems to be no effective political constituency for governments to stop deficit spending, so currency debasement (which is inflation) will continue.

So where do we go from here? I expect “the authorities” will try to keep inflation “contained” – nobody wants runaway inflation, but getting it back below 2% without a nasty recession isn’t going to happen, and there is certainly no political will to deliberately launch a nasty recession. (A recession could result from an exogenous shock.)

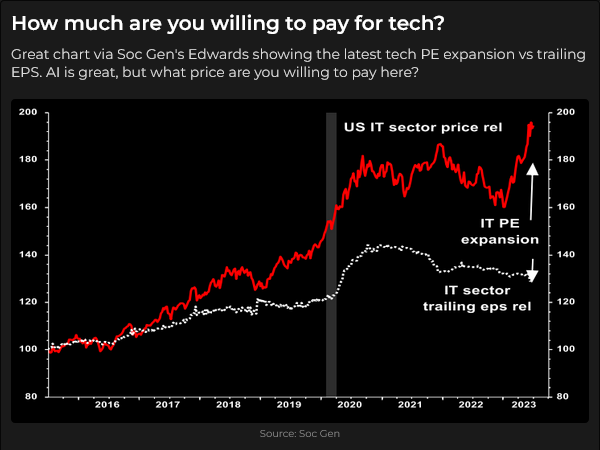

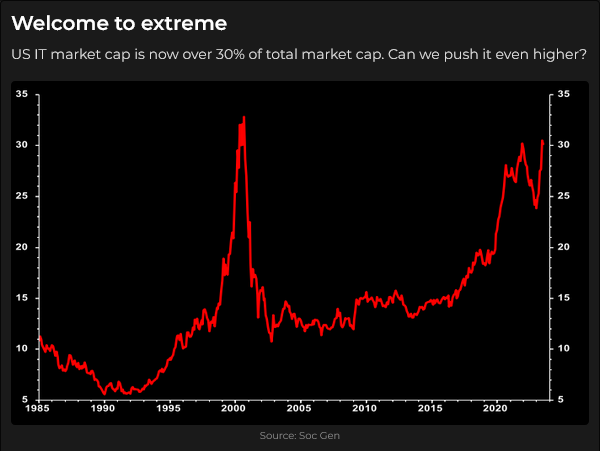

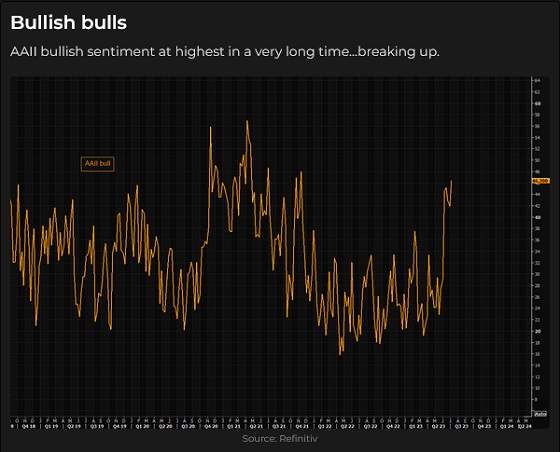

On a short-term time frame, stock indices look “frothy” to me, but stocks may look like a good inflation hedge to someone with a longer-term time frame (institutional money).

On a short-term time frame, bonds might get a bid if the stock market wobbles, but on a longer-term horizon, bond yields will rise if inflation persists.

I’ve been bullish on the USD since January 2021, save for a couple of months last fall, not so much because I think the USA is great, but because it’s not as bad as most other jurisdictions. I’ll stay with that bias, but price action trumps my bias for short-term trading.

The Barney report

I took a full 4-day holiday over the weekend, and Barney and I had a lot of great walks; we even got into the ocean one day (I’ll get photos of him in the ocean next time – I couldn’t risk dropping my phone in the water!)

Here’s a picture of Barney doing what he loves – running with a big stick!

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did a 9-minute interview with Mike Campbell on his top-rated Moneytalks podcast on July 8. We discussed interest rates, inflation, union strikes, how higher interest rates increase inequality, etc. You can listen to the podcast here. My segment with Mike starts around the 1.19-minute mark.

I did a 30-minute interview with Jim Goddard on July 1 on the This Week In Money Podcast. We discussed my Macro market views, the mega-cap stock rally, interest rates, currencies, gold, how people love to believe market “stories” (and how seldom they ever “come true,”) and how trading is different for me now that I no longer work for some of the world’s biggest commodity brokerage firms.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.