Is buying the Yen in anticipation of another “Plaza Accord” the Trade of the Year or just another attempt to catch a falling piano?

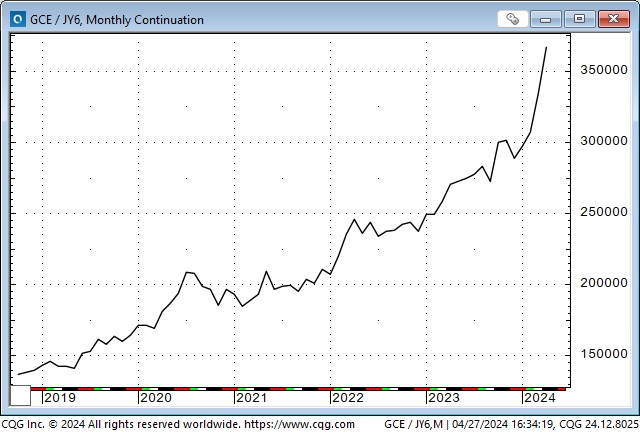

The BoJ did nothing at their scheduled meeting this week, and the Yen collapsed to a new 34-year low against the USD and hit an All-Time low against the Euro (which has only been around for 26 years.)

The Yen has fallen >50% against the USD since it made All-Time highs in 2012. It is down ~35% in the last three years.

The OECD calculates that the Yen is ~64% undervalued against the USD on a Purchasing Power Parity basis.

A weaker Yen contributes to rising tourism revenues (Japan is cheap, and the food is excellent!), increasing profit margins on exported goods (like cars to the USA) and rising import costs on things like oil.

Japanese people, institutions and corporations have substantial overseas investments (which puts downward pressure on the Yen when they convert to foreign currencies to make investments), and they will earn significant profits if/when they bring their money home and convert it back into Yen (converting foreign currencies into Yen will boost the Yen.)

Sophisticated investors have used the Yen as a funding currency in carry-trade investments (for instance, borrowing Yen at cheap rates and investing in Mexican Pesos at higher rates). Currency speculators who have shorted the Yen against virtually any other currency have made profits.

Speculators’ net short position in Yen futures is at a 9-year high, according to the Commitments of Traders Report (COT.) The CME Yen futures open interest has surged by ~20% to All-Time highs over the last month as the Yen fell ~5%, and the daily volume on Friday (following the BoJ meeting) was about double the recent average daily volume (X quarterly delivery periods).

I’ve traded currency futures for nearly fifty years, and one of my key observations has been that currency trends often run far longer than what seems to make any “sense,” and then they turn on a dime and go the other way.

Traders have referred to speculators selling Japanese bonds as the “widowmaker” trade for years. For most of the past twelve years, trying to bottom-pick the falling Yen has been another version of the “widowmaker” trade. Why is this time any different?

Two reasons: 1) Japanese and South Korean finance ministers met with American counterparts recently and warned about “excessive volatility in the FX markets,” and 2) speculators who are short Yen may be concerned that intervention will diminish their profits and they may decide to limit their risks by covering some of their short positions.

The “back story” on potential coordinated intervention (a la the Plaza Accord) may be less about the rising cost of Japanese energy imports and more about the “damage” that cheap Japanese imports are doing to American manufacturers.

Critics will point out that intervention won’t work without any real change in the “fundamentals,” and currency speculators will use higher Yen prices created by the intervention as an opportunity to reload (or add to) their short positions.

Other currencies

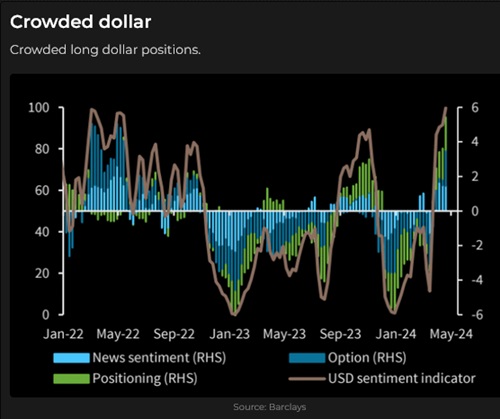

In addition to bearish YEN positions, net speculative positioning in the currency futures market is very short CAD, AUD and CHF, very long MEX, and is now lightly short EUR for the first time since summer 2022. The effective aggerate net long USD speculative positioning across all currency futures is at a 5-year high.

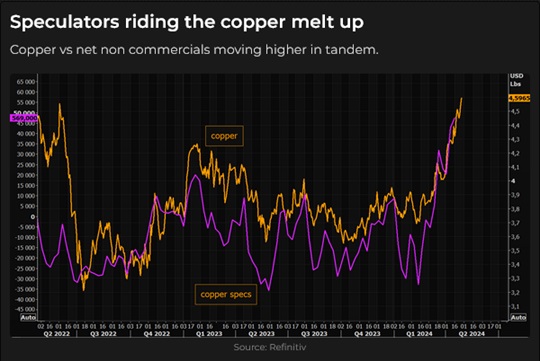

Copper

Comex copper prices have surged to 2-year highs, up ~26% from February lows to this week’s highs. Open interest has jumped to near All-Time highs, and speculators’ positioning has soared from essentially flat to net long 66,000 contracts in the last seven weeks. Volume this month appears to be a record high, with still two days left in the month.

The COPX ETF of global copper miners has jumped to 13-year highs as investors react to the prevailing bullish supply/demand outlook for copper.

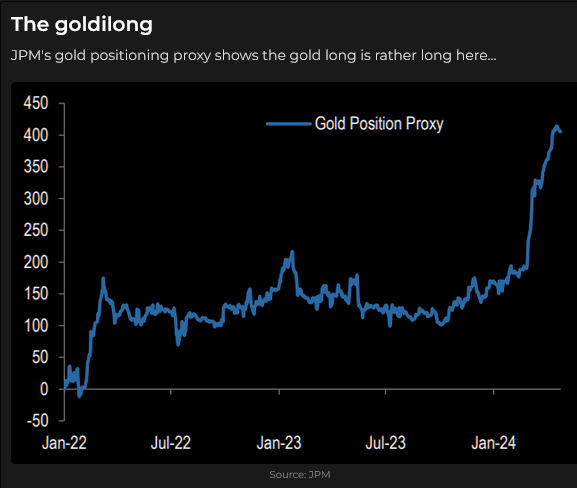

Gold

Comex gold futures rallied ~$250 (11%) from late March to mid-April All-Time highs but closed ~$100 below those highs this week. The frenzy of Chinese retail buying that spurred gold to its highs slowed this week following the imposition of higher margin requirements on the Shanghai futures market.

The Yen price of gold has nearly doubled in the past three years. In USD terms, it is up ~28%.

Natural gas

North American Natural Gas prices are near 25-year lows (at multi-decade lows on an inflation-adjusted basis) as supply is plentiful. Cheap and abundant natural gas gives North America a competitive advantage over countries with higher energy prices.

US Equities

After rallying ~30% from October to March, S&P futures fell ~7% to last week’s lows but recovered about half of those losses this week.

META’s quarterly report disappointed the market, and the share price fell on Thursday.

GOOG and MSFT had better-than-expected reports, and GOOG shares soared to new All-Time highs on Friday, reflecting a market cap of over $2 Trillion.

The CAT quarterly report disappointed the market, and the share price fell. This bellwether stock may be a window into the US economy outside Silicon Valley and Wall Street.

Interest rates

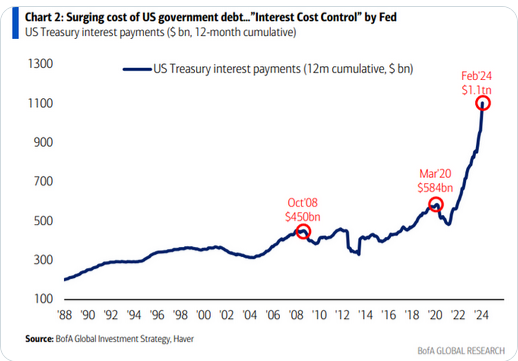

Short- and long-term interest rates rose again this week (the 10-year yield touched a high of ~4.72%), and the forward market is pricing only one 25bps cut from the Fed before the end of the year.

My short-term trading

I started this week with a long CAD position I established last week. I closed that for a decent gain on Tuesday, with the CAD up about one cent from last week’s lows.

I shorted the S&P on Wednesday for a decent gain and bought it on Thursday for a modest profit. My net P+L for the week showed a respectable gain after a couple of weeks of slight losses. I was flat at the end of the week.

On my radar

The September Treasury Quarterly Refunding Announcement lifted the bond market from 16-year lows. The next QRA is on Monday, and refunding details will be announced on Wednesday.

The FOMC meets on Tuesday and Wednesday. No policy change is expected, but there may be some indications of future changes.

The Non-Farm Payrolls report is due on Friday. Other employment reports (JOLTS and ADP) are earlier in the week.

ISM manufacturing is on Wednesday; ISM services are on Friday.

AAPL and AMZN report next week.

I may bet against the USD by buying one or more currencies with large speculative net short positions.

The Barney report

Barney sleeps in several different places throughout our house, and he never stays in one place for more than a couple of hours. Lately, he’s been coming into my bedroom about an hour before sunrise to wake me up. “Hey Papa, it’s time for our morning walk!”

My wife took this photo of him yesterday when they were on a walk along the Englishman River. What a handsome boy!

Listen to Victor talk about markets

Mike Campbell and I discussed the currency markets, particularly the Yen, on the Moneytalks show this morning. We also talked about copper and natural gas. You can listen to the entire show here. My 6-minute spot with Mike starts around the one-hour and one-minute mark.

I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show last Saturday. My friends Ross Clark and Danielle Park were also on that show. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.