An Apple a day keeps the bear away

AAPL surged to new All-Time Highs on Friday, up ~56% from its January lows. The market cap is now ~$3.05 Trillion. MSFT hit ATH two weeks ago and closed Friday down ~3% from those highs. The MSFT market cap is now ~$2.5 Trillion. Taken together, the market cap of AAPL and MSFT is ~15% of the S&P 500 Index market cap of $36.7 Trillion.

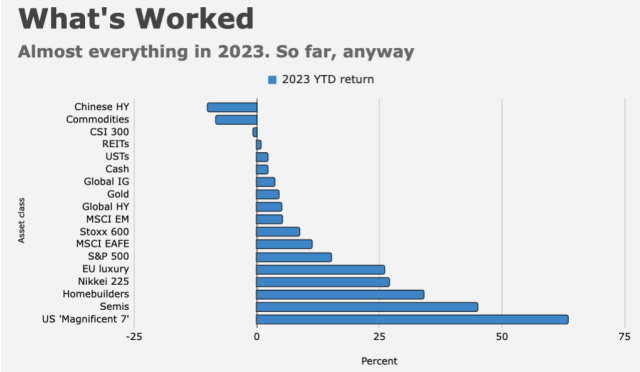

The “Magnificient Seven” (AAPL, MSFT, GOOG, AMZN, NDVA, TSLA, META) have a combined market cap of ~$11 Trillion and have risen ~60% YTD. The remaining 493 other S&P 500 stocks have a combined market cap of ~$25.7 Trillion and are up ~5% YTD. The S&P 500 share index is up ~16% YTD, trading at the highest levels in 15 months.

The total market cap of all the Toronto Stock Exchange stocks equals AAPL’s market cap. (The TSE market cap is ~CAD$4 Trillion. At an exchange rate of .7550 = ~ USD 3 Trillion.)

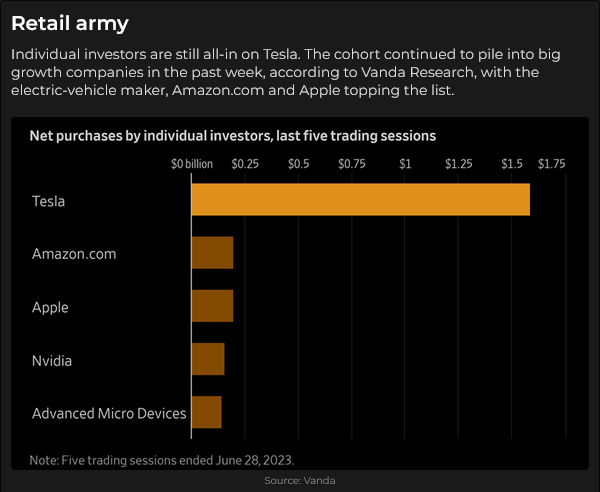

TSLA, the world’s most actively traded stock, is up ~140% YTD.

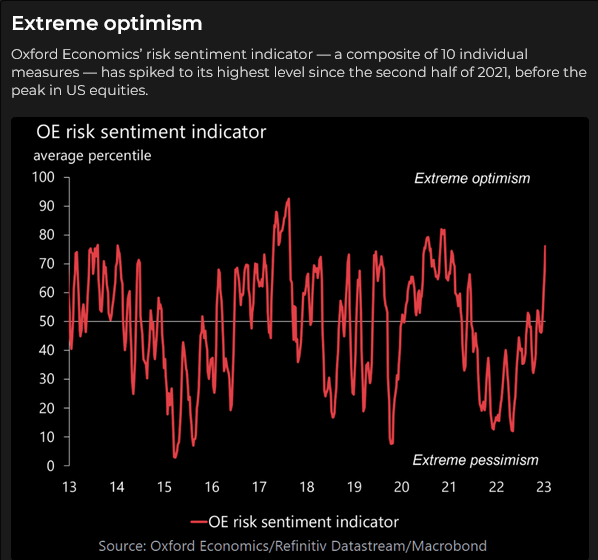

Stock market volatility has fallen to the lowest levels in nearly two years.

The IPO market is quiet while investors are aggressively buying popular stocks.

Interest rates

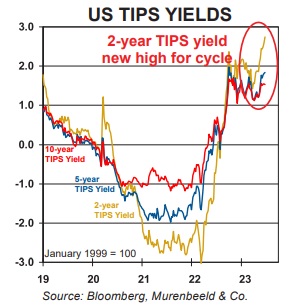

With inflation exceeding Central Bank targets, the market expects administered rates to keep rising. The BoC is expected to raise rates by 25 bps on July 12. The Fed and the ECB are expected to raise rates by 50 bps before December, while the BoE is expected to raise rates by >100 bps before year-end.

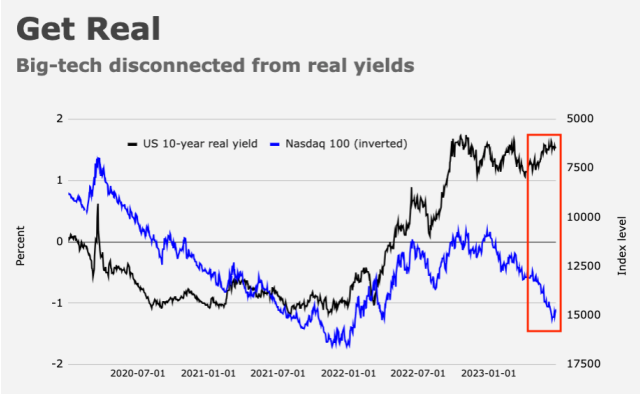

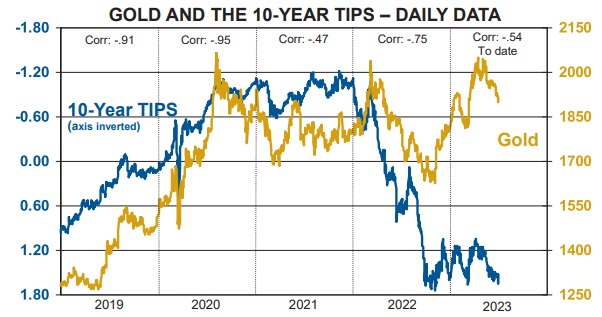

Real interest rates are rising as central banks increase nominal rates while inflation is falling.

Currencies

The US Dollar Index hit 20-year highs last fall and fell back ~12% to this year’s lows. It closed this week near the mid-point of its YTD narrow sideways range.

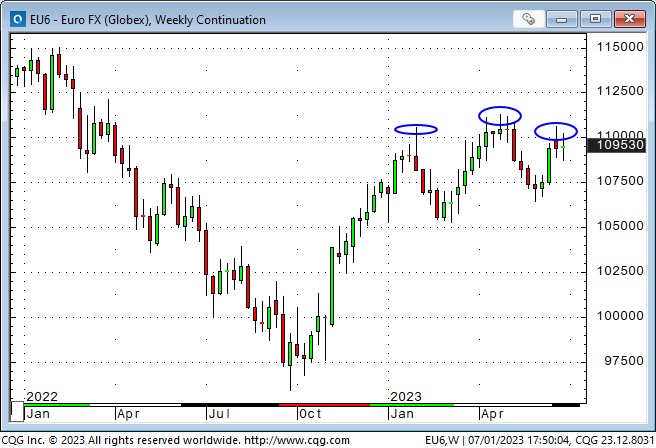

The Euro hit a 20-year low last fall, then rallied about 15% to this year’s highs as ECB monetary policy became more aggressive. A potential head and shoulders topping pattern may be forming on the weekly chart.

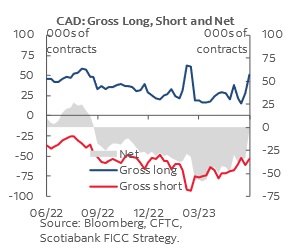

The Canadian Dollar hit a 9-month high above 76 cents on Tuesday but fell back nearly a full cent by Friday. The soaring US stock market helped boost the TSE to its biggest YTD weekly gain but did nothing to help the CAD. (Correlations work until they don’t!) Perhaps the 3-cent CAD rally throughout June needed a correction as the premium of US short rates over Canadian short rates widened this week.

Canadian Dollar COT data for the week ending Tuesday, June 27 (the day the CAD hit a 9-month high) shows a 6-year high in net speculative CAD buying as speculators “threw in the towel” on their sizable net short positions. Speculators have been net short CAD since it fell from ~77 cents to ~72 cents in three weeks last September. The net speculative positioning hit its nadir following the March lows and has been shrinking as the CAD rallied over the past three months. Net CAD speculative positioning is now essentially neutral after being net short for ~9 months.

The Japanese Yen hit multi-year lows last fall, rallied into January/February, but has been trending lower since then and is now nearly back to last fall’s multi-year lows.

The Japanese Yen COT data shows that net short speculative positioning is now ~20% larger than when the Yen made 32-year lows against the USD last fall. The Yen closed this week at a 15-year low against the Euro and an 8-month low against the USD.

Gold

Gold spiked to All-Time Highs in August 2020 (~$2,063) when governments and central banks reacted to the Covid crisis with aggressive fiscal and monetary stimulus. Gold made a new high in March 2022 (~$2,079) on geopolitical concerns when Russia invaded Ukraine, and then on May 4, 2023, it made a new All-Time High (~$2,085) when it looked like central banks might be ready to stop raising interest rates. But gold has fallen nearly $200 since early May, touching a 4-month low this week, as central banks “made it clear” that they would continue raising rates and as real interest rates continued to rise.

Record central bank gold buying last year was seen as a significant bullish “story” for the gold market. Countries that were not on “good terms” with the US were thought to be ramping up their gold holdings as “insurance” against the US blocking their access to financial markets during a possible “dispute” in the future.

This was indeed a bullish story in that the central banks were reducing the supply of gold available to the market. Still, I thought it was ironic to see gold bulls, who usually believe central bankers are idiots, so pleased with central bankers!

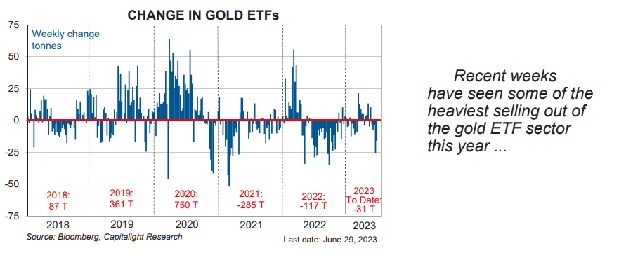

Gold prices have been under pressure (in the futures and ETF markets) since early May as speculators liquidated the long positions they built up during the rally from late February to early May. (I wrote about the rise and fall in Comex gold open interest several times in May.)

Soaring tech stocks have been a negative factor for the gold market. As I said in my interview with Jim Goddard on the This Week In Money podcast, “For speculators, buying gold these days, while the mega-cap tech stocks have been soaring, is like dancing with your Grandmother!”

My short-term trading

I started this week short EUR, CAD, GBP and the S&P.

I added to my short S&P on Monday as the market traded below Friday’s low. I thought the 100+ point correction from last week’s highs had more to go. I covered those positions for a slight loss when the S&P turned higher early Tuesday morning.

I had shorted CAD on Thursday (June 22) and stayed with it going into the weekend because CAD had slumped almost a half-cent on Friday. I lowered my stop to limit my risk and was stopped for a minimal loss on Monday.

I shorted CAD again on Tuesday after it made new highs and fell below Monday’s lows. On Friday, I covered the position for good gains when CAD bounced back after making 10-day lows.

I had shorted the Euro Thursday last week when it fell back from making 1-month highs. (A great setup.) I was over a full cent ahead on Friday’s lows and lowered my stop to lock in profits. I was stopped for a decent gain in the Sunday overnight session.

The Euro bounced back above my original shorting level on Wednesday, and I shorted it again on Thursday. The market dropped more than a full cent before the Friday PCE report, and I lowered my stop to lock in profits. I was stopped after the PCE report for a small gain.

I had shorted the Pound last Friday after it traded to 14-month highs (on the surprise 50 bps raise by the BoE) on Thursday and then closed near the day’s lows. I wanted to be short the Pound, but my entry was not a good setup. I exited the trade on Tuesday with a slight loss when the market traded above the Thursday and Friday highs. ( Interestingly, the Pound never got as high as my stop. If I had not exited my position, I would have caught the breakdown on Wednesday and Thursday.)

Going into the long weekend, I was flat, and my net P+L had a modest gain on the week.

My best trading move of the week: Not buying the T-Notes on Monday. As I wrote in the On My Radar section of last week’s Notes, I was looking for an opportunity to buy bonds if it looked like stocks would keep falling, and the market moved to price in a looming recession.

On Monday, the T-Notes traded to a 15-day high, and the S&P futures hit a 6-day low, but I couldn’t pull the trigger – the setup wasn’t right! If I had bought the T-Notes, I would not have seen even one tick of daylight on the trade. The market was a whole point and a half lower at Friday’s lows.

The Barney report

Barney loves to find golf balls! We were out on the golf course Wednesday evening after the golfers were gone and walked beside a creek that crosses a fairway. Barney would dart into the long grass on the side of the creek and come back out with a golf ball (he finds them by smell.) When he gave me the ball, I gave him a treat. He found two dozen falls in about 20 minutes, and we only quit because I ran out of treats!

He was a happy wet dog when we got home.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on his top-rated Moneytalks podcast on July 1. We discussed surging tech stocks, inflation, the market’s interest rate expectations, currencies and gold. You can listen to the podcast here. My segment with Mike starts around the 1.04-minute mark.

I did a 30-minute interview with Jim Goddard on July 1 on the This Week In Money Podcast. We discussed my Macro market views, the mega-cap stock rally, interest rates, currencies, gold, how people love to believe market “stories” (and how seldom they ever “come true,”) and how trading is different for me now that I no longer work for some of the world’s biggest commodity brokerage firms.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.