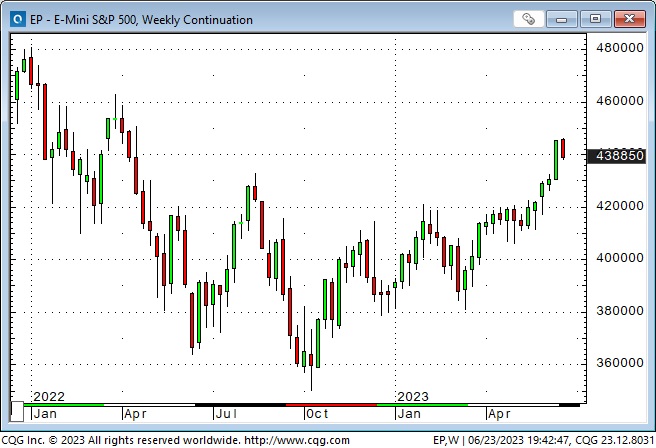

Soaring stocks “pause”

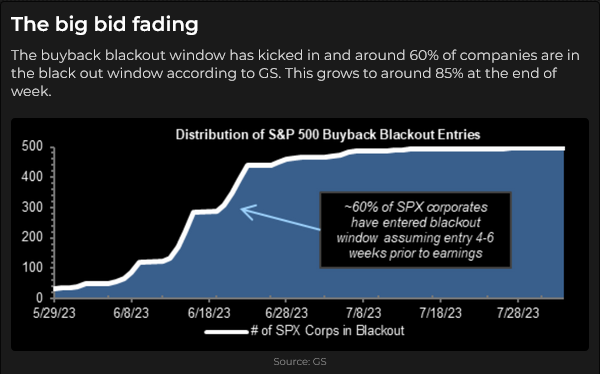

AAPL closed at new All-Time Highs this week, but many other stocks and the leading indices took a “pause.” Perhaps there was too much talk about “over-bought” or worries that corporate buybacks are going into their quarterly blackout period. Or maybe it was worries about institutional rebalancing next week or mounting “evidence” that the looming recession may be just around the corner.

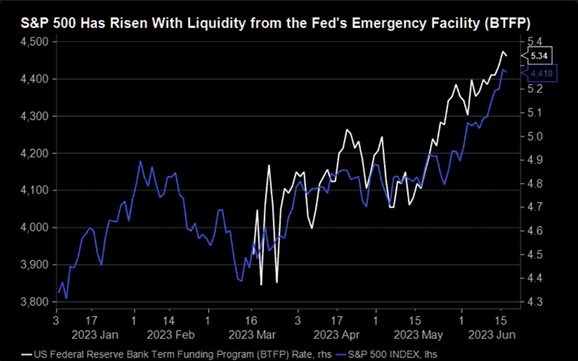

The leading stock indices’ most recent “low” was made in March when the “banking crisis” hit the markets. Analysts had worried that the rapid rise in interest rates over the preceding 12 months, after a decade+ of zero interest rates, would cause “something to break,” and the “banking crisis” fit the bill. Interest rate futures quickly priced short-term rates to fall ~2% by December.

But the Fed and the Treasury took extraordinary measures (pumped billions of dollars worth of liquidity into the markets) to counter the crisis, igniting a stock market rally. A.I. then captured the market’s attention, and the flow of funds into stocks became a tsunami.

I wonder if “The Magnificient Seven” caught a “safety” bid this week as the indices fell. (From a portfolio manager’s point of view, it’s hard to be faulted for owning AAPL, TSLA or NVDA!))

Volatility was down this week, and it’s unusual to see stock indices down without VOL rising. Maybe VOL is lower because option buyers hit the beach, so we shouldn’t read too much into that. The upside is that options are relatively “cheap” for anyone who wants to make a directional bet on where stocks go from here.

Currencies

The US Dollar Index bounced a bit this week, with most of those gains coming on Friday after Eurozone PMI numbers painted a recessionary picture.

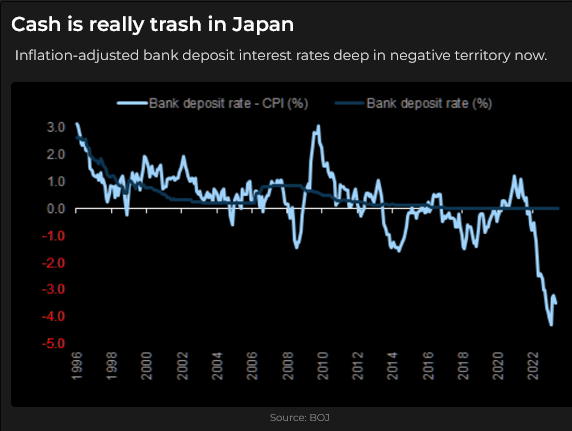

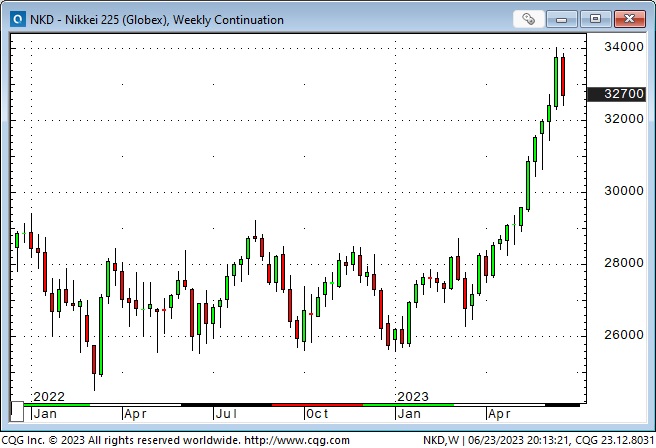

The Yen closed the week at a 9-month low against the USD and a 15-year low against the Euro. CPI inflation is running at a 42-year high, but the BOJ has made no change to their “easy as she goes” monetary policy. The Nikkei index has soared as the Yen tumbled but reversed sharply this week. The net speculative short Yen positioning in the futures market had grown larger than it was when the Yen made a multi-decade low in October.

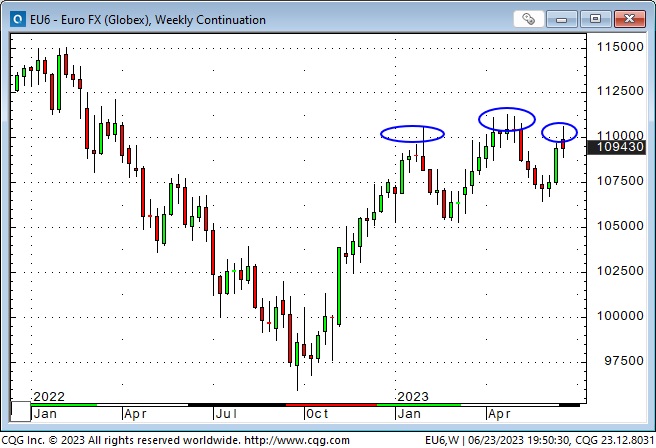

The Euro rallied ~4% from late May lows to this week’s highs but turned lower Thursday and tumbled on Friday. The price action on the weekly chart could be a developing lower high – which might further develop into a classic head and shoulders top if the Euro falls below the May lows.

The tepid Chinese “re-opening” is not good news for European exporters – China is their largest market.

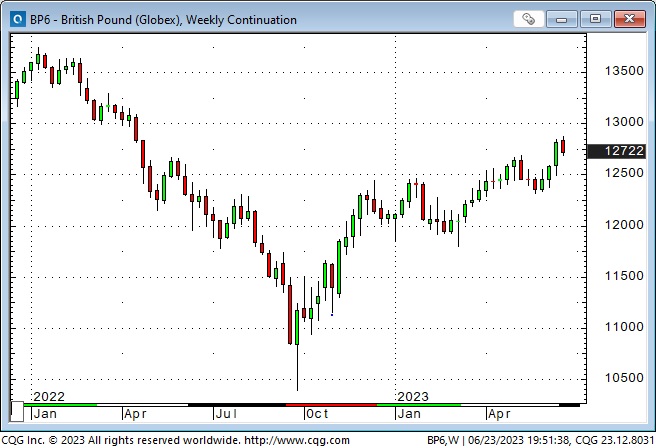

The British Pound hit a 37-year low last September, then rallied back ~20% to this week’s high. The high was made after the BoE “surprised” the market with a 50bps hike, but the joy didn’t last, and the Pound closed lower on the week.

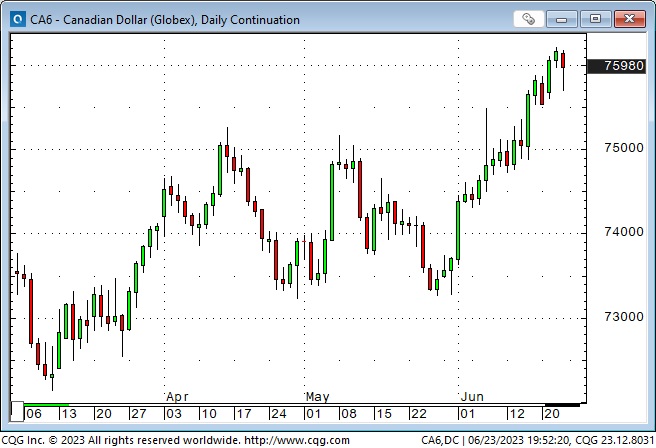

The Canadian Dollar traded above 76 cents this week, reaching a 9-month high against the USD. The BoC raised short rates by 25bps on June 7, and the market is pricing a good chance of another 25bps on July 12. The CAD made this week’s high on Thursday and fell back on Friday as the USD rose against virtually all other currencies. Still, it was interesting to see the CAD rally this week as global stock markets fell and as commodities, especially crude oil, were lower.

Interest rates

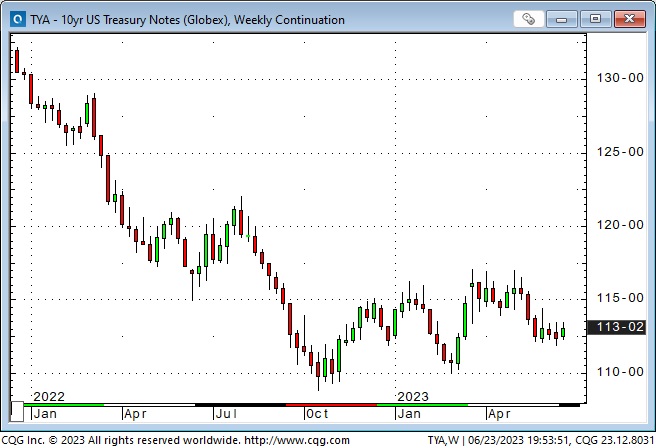

Forward short rates are pricing in a 25bps hike from the FOMC on July 26 after last week’s “pause.” Prices on the 10-year T-Note hit 15-year lows last fall (the yield was a 15-year high of ~4.06%) and have trended slightly higher, causing yield curve inversions to steepen.

Some US economic indicators point to a slowdown. Still, housing starts are strong (there is a supply shortage as homeowners with low mortgage rates keep existing homes off the market due to high potential refinancing costs), and the “service economy” (75% of the economy) keeps chugging along. US air travel is at its highest since 2019.

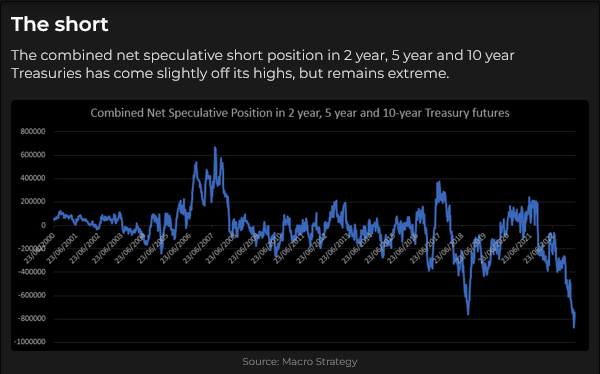

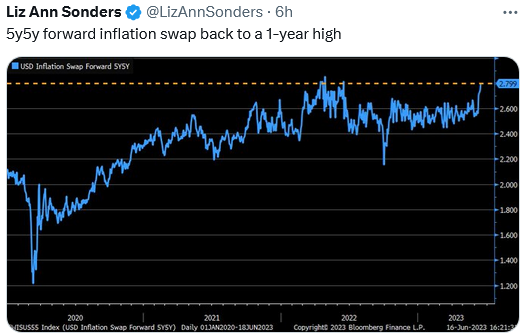

The COT data shows speculators are currently hugely net short of Treasury futures. In the short term, Treasuries could get bid if stocks fall and market sentiment sees a recession coming, but in the longer term, the prospect of massive government deficits likely means higher inflation and higher bond yields.

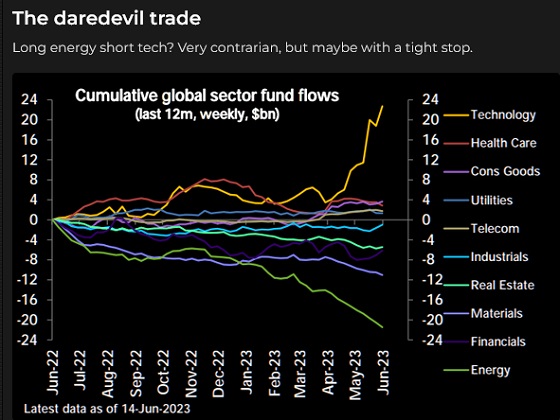

Energy

Nymex WTI has averaged ~ $71 for the past two months despite production cutback announcements from OPEC+, and Natural Gas has averaged ~$2.50.

Cameco’s share price touched a 12-year high last week.

The Canadian Federal government recently added another tax on gasoline, causing the price to rise ~18% near my home. As I was filling my car the other day, I realized that government climate-change zealots will probably adopt a program of constantly raising taxes on fossil fuels to punish recalcitrant citizens for not “going electric.” You can see it coming!

Recommended reading for perceptive views on energy: Doomberg and Robert Bryce. For excellent coverage of what energy stocks to buy/sell, go to Joseph Schachter.

Gold

Comex gold futures fell to a 3-month low this week, down ~$175 from the brief spike to All-Time Highs on May 4. Powell’s Congressional forecast of additional interest rate hikes this year, a stronger USD, and (modestly) higher real rates weighed on the gold price.

Late breaking news on Friday night: Wagner leader Prigozhin and 25,000 mercenaries are on a “March to Moscow.” This may boost the gold market over the weekend.

My short-term trading

I started this week short gold, CAD and the S&P. I shorted Euro on the Monday holiday. I covered the CAD and EUR on Tuesday for a net break-even. I covered the gold and the S&P on Wednesday for decent gains.

I re-shorted the EUR on Thursday and held it into the weekend with ~80 points of unrealized gain.

I re-shorted CAD on Thursday, was stopped for a slight loss and reshorted it Thursday night. I held that position into the weekend.

I shorted the S&P and the GBP on Friday and held those trades into the weekend.

In summary, I’m going into the weekend long the USD against the EUR, the CAD and the GBP, and I’m short the S&P.

On my radar

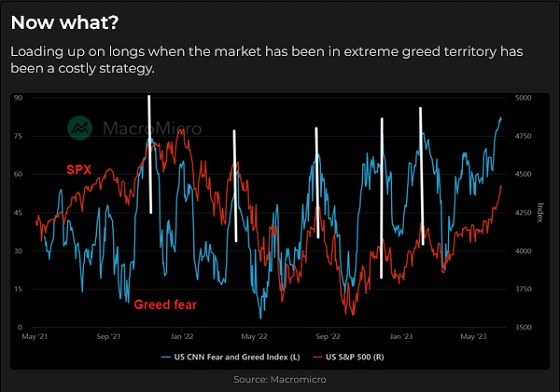

I think the stock market could break. I’m probing with small short positions and hope to size up if the break develops.

I’m looking for opportunities to buy the USD against other currencies.

I’m watching the bond market for a (short-term) buying opportunity.

The Yen may be a great buy at some point, but FX trends almost always go further than I can imagine, so I’ll wait.

Energy seems destined for higher prices – but when to buy?

Bill Blain wrote an excellent essay on the toxic Phillips curve in his June 23 letter. In essence, the Phillips curve is dogma for command economy fans (like central bankers), and, at heart, the message is that to get inflation down, the Central Banks need to ramp up unemployment and drive the economy into a recession.

What if we didn’t have Central Banks trying to manage an immensely complex economy with Old School central planning blunt instruments?

Before central banks were “running the world,” we had booms and busts. The best cure for high prices was high prices, and the best treatment for low prices was low prices.

How could we possibly get away from more and more intrusive / bigger and dumber government central planning? It will probably take a disaster/revolution because they won’t quietly disappear.

The Barney report

We bought a wading pool for Barney in preparation for the hot summer weather. He tried it out before we added water and seemed to like it.

We also bought him a new bed/cushion, and he immediately took to that. He never sleeps in one place for more than a few hours, then moves to another spot.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on his top-rated Moneytalks podcast on June 24. We discussed why the stock market was falling this week, what to expect from central banks in July (more interest rate increases), action in the currency markets and the trades I’ve been making. You can listen to the podcast here. My segment with Mike starts around the 1.23 mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.