Is the market plunge in China a Black Swan?

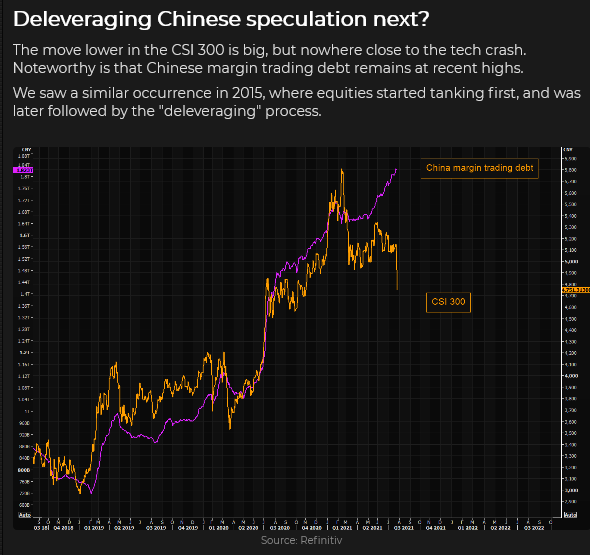

American Big Tech has been pulling the broad American share indices higher; in China, Big Tech has been pulling the broad Chinese share indices lower. Chinese regulators have been clamping down (Big Time) on Big Tech for the past few months, and share prices have tumbled – this week, they crashed.

The Chinese Authorities scrambled to issue “nothing to worry about” statements, and there was a dead cat bounce on Thursday, but prices turned lower Friday. Chinese policymakers care about policies, not share prices.

Is the market plunge in China contagious?

Even the most diehard bears have to acknowledge the strong correlation between the Fed’s expanding balance sheet and the rally in the American stock market. Their acknowledgement also has to include the notion that the stock market will crash if the Fed tries to “normalize” monetary policy. Therefore, the Fed is trapped. They have to stay easy “forever,” and the stock market will keep rising if they do.

Capital keeps flowing to the “sure thing” stock market. All dips are buying opportunities. Passive investing recognizes that if you keep buying the indices, month after month, regardless of price, you will come out ahead.

But what if the market plunge in China is contagious? Could the American equity market experience a (gasp) correction even as the Fed maintains its current ultra-easy policies? Who saw that Black Swan coming?

There will be consequences.

As noted last week, American Big Tech is carrying the broad stock market higher – the American stock indices are blowing away the Rest Of The World.

But there will be consequences if the American indices lose their leading position. For instance: soaring prices for American Big Tech draws capital into America (and into the USD) from the rest of the world. The USD stays strong on account of this capital inflow – despite record-high trade deficits.

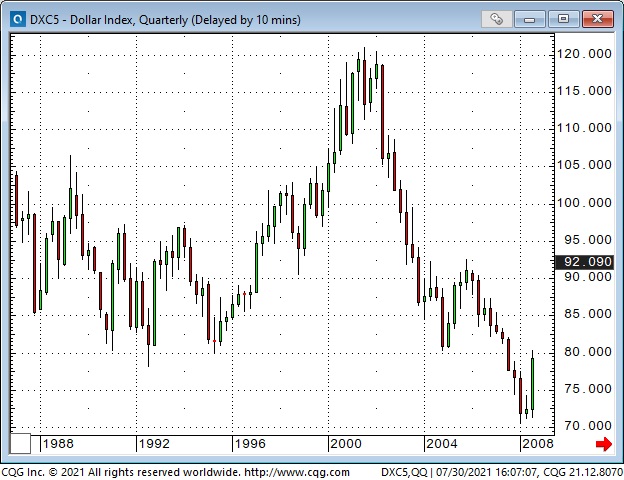

This condition is reminiscent of the late 1990s when the DotCom boom pulled capital into America and boosted the USD. The USDX rose ~50% from 1996 to 2002 and then (a year after the DotCom bubble ended) the USDX began a multi-year decline and fell >40% over the next 6 years. Capital flows matter.

What would happen to the inflation/deflation argument if the plunging Chinese stock market took the American stock market down? Would it be another aspect of China exporting deflation to the rest of the world?

Would this be a good time?

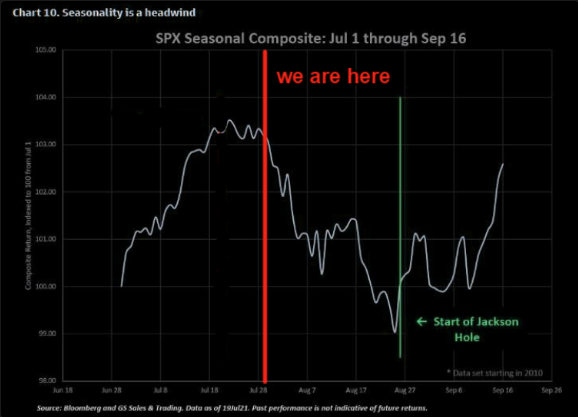

The S+P and the Dow rallied back from last week’s early dip to make new All-Time Highs again this week – but the indices have really gone “sideways” this week, and we are entering a seasonally weak time of the year for stocks.

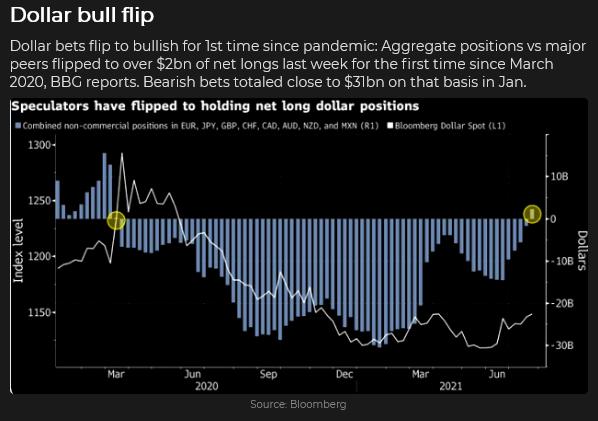

The US Dollar rose in early July and fell in late July.

The USD hit a 3-month high in mid-July but was weaker into month-end. The Fed’s decision to maintain their existing easy policies at this week’s meeting added to the soft tone.

Speculators have been net short the USD since the Covid panic in March 2020 and finally, seven months after the USDX turned higher on January 6, speculators have covered all of their net short positions and have gone modestly net long.

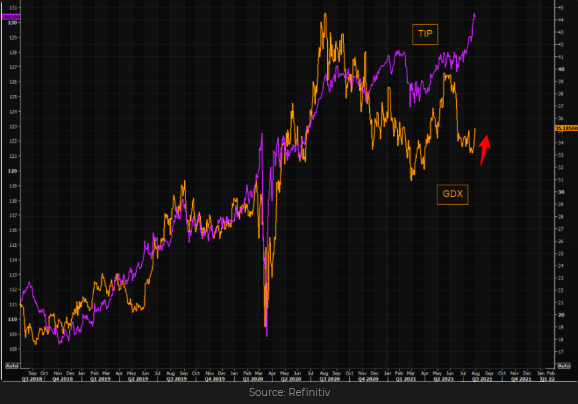

Gold loses correlation with real interest rates.

Gold maintained a tight correlation with (falling) real interest rates from the 2018 lows through the 2020 highs but lately, real interest rates have been setting new lows, and gold has not rallied. In this chart, the TIPS (Treasury Inflation-Protected Securities) rise as real interest rates fall.

I have noted in previous blogs that gold has had a very tight negative correlation with the USD this year.

Commodity indices continue to sizzle.

Commodity indices hit multi-decade lows last year, but the rally off those lows has been the hottest since the spectacular gains made from late 2007 to July 2008 – when WTI hit $147 (and famous analysts were forecasting $200, or more by yearend – actually yearend prices for WTI were ~$32.)

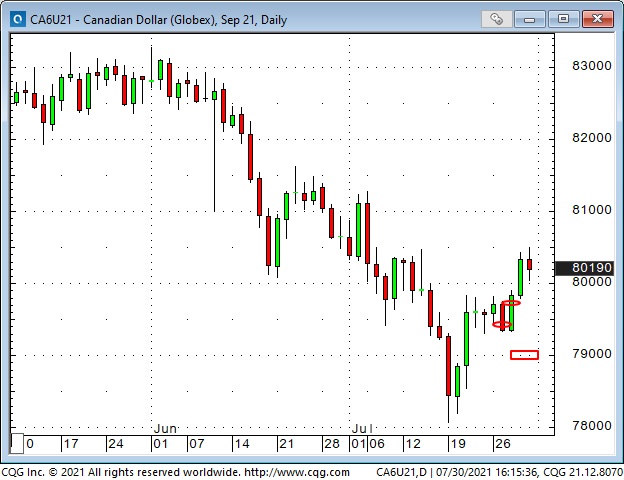

The Canadian Dollar

The CAD has had a strong positive correlation with the commodity rally and the stock market rally from last year’s lows until June 1, 2021. The CAD rose from ~68 cents to ~83 cents, and speculators, particularly since early November last year (Biden election and Pfizer announcement), kept increasing their net long positions.

The USD began a strong 6-week rally at the beginning of June, and the CAD began a strong 6-week decline. Speculators initially added to their net long positions (they were “buying the dip“) as the CAD fell, but they turned sellers by late June / early July. It seems that they exited most of their bullish positions as the CAD dropped from ~80 cents to ~78 cents.

My short term trading

I started this week with a short option collar on the bond market – I was short 166 calls and short 16250 puts. The options expired at the end of this week, and I would collect 100% of the option premiums if the bonds were anywhere between my strike prices at expiry.

Last week I had shorted 169 calls when the bond market reversed off its highs near 167. 90% of the call premium evaporated within two days as the bond market tumbled (as the stock market rallied.) The “easy money” I made on that trade got me looking for more opportunities to profit from shorting bond options – hence the collar.

I became uncomfortable with the collar trade as early as Sunday night when I realized I was trying to pick up nickels in front of a possible steamroller (Chinese markets were falling, there was a Fed meeting mid-week.) Compounding the problem, I discovered I couldn’t place GTC stops against my positions. Given the overnight risk (when I was asleep), I realized the positions were potentially much riskier than I had thought.

I exited both sides of the collar before the Fed meeting. I made a small net profit on the trade but left most of the option premium on the table. The option premiums evaporated after the Fed meeting. If I had stayed with the trade, I would have collected 100% of the option premiums. The underlying Sept bond contract never came near either of the strike prices.

You could say I chickened out by not staying with a winning trade. I get it. But bond vols were staying high, and the tumbling stock market in China and the prospects of the Fed surprising the market (again) both presented the opportunity for me to get smoked on the trade – in exchange for a pretty modest max possible gain.

I bot and sold a few stock market positions: small profits and small losses offset each other.

I bought the Yen as it rallied on Tuesday. I thought it could catch a “haven” bid if the stock market weakened – and I knew there was a huge spec short position on the Yen, so if it started to run, those specs might become buyers. I covered the position for a small gain on Friday. The Yen had rallied Thursday but started to fall back Friday as the USD rallied against most currencies. I decided to go flat rather than take the weekend risk on a trade closing near its Friday lows.

I also shorted the CAD at 7950 on Tuesday (around the same time I bought the Yen.) The CAD had rallied 1.5 cents off last week’s lows and looked to be held down by resistance around the 80-cent level. It had been trending lower for six weeks and might resume that downtrend – especially if there was weakness in the American stock indices (Chinese tech indices were down hard at multi-month lows on Tuesday.)

I hedged the short CAD by selling 79 strike puts that expired in 10 days for 25 ticks. The vol on the puts was ~8.5%, which I thought was high for the CAD. If the CAD tumbled below 79 cents (and kept going) the max gain on the (futures and options) trade was 75 ticks. I thought that if CAD gained any downside momentum that I would probably sell more – that this trade would be an initial short CAD trade.

I placed the stop on the short futures position just below Tuesday’s high (if the CAD rallied above that level I didn’t want to stay short.) My stop was hit early Wednesday for a loss of 25 ticks. I stayed with the short puts until Friday and closed them for 3 ticks. The net loss on the trade was 2 ticks.

The only trade I have on at the end of the week is a small-size short S+P (the market looks tired here and the risk/reward on the trade looks good.)

My P+L was about unchanged on the week. I don’t know exactly, and it doesn’t matter. I executed on some trading opportunities, I managed my risks, and that’s my job. Some weeks I make a few bucks, some weeks I spin my wheels.

On my radar

Pro-risk sentiment has driven stock and commodity indices on a relentless uptrend since last November. I keep thinking we’re WAY overdue for a correction, but I won’t short the market without some sign that a correction has started. I’ve been probing with initial small short positions (thinking that I’ll add if the market builds downside momentum) and despite some winning trades, my P+L is small net down as a result – the cost of having an opinion!

Thoughts on trading

Ducking a bullet is as good as catching a winning trade as far as my P+L is concerned.

When I put on a trade I (almost always) enter a stop. If the market goes against me to the stop point I don’t want to be in the trade. The stop is my max risk point. Obviously, the market might gap through my stop sometimes but my stop is at a point where I know I’m wrong on the trade.

If I’m buying some cheap options I probably won’t use a stop. If I’m doing a limited risk spread I might not use a stop.

My stop is my backup line of defence – if the market goes there I definitely want out. I don’t always wait for the market to hit my stop. Sometimes, if the market is moving against me I’ll just get out and cancel the stop.

If I’ve been in a trade for a while and it isn’t working, especially going into a weekend, I’ll just get out. There’s no point hanging onto a trade that isn’t working – within the timeframe I chose when I put on the trade.

I know I don’t know very much about any market. I may have an opinion on where or why I think a market should go, but it may go there for reasons I didn’t even know existed. It’s easy to be right or wrong for the wrong reason.

I therefore try to pay more attention to “how” a market moves rather than on “why” I think it moved.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.