Sleepy summer market reacts to strong employment data

The stronger-that-expected US employment report on Friday was the key event of the week – in that it strengthened the idea that the Fed’s required “substantial further progress” was in the process of being met. Therefore, the report pulled forward the timeline for the Fed to begin tightening policy.

The market reaction to this new way of “seeing things” caused interest rates and the US Dollar to rise while the stock market underwent another “rotation” with tech stocks weaker Vs. the broad market.

The 10-year T-Note futures contract closed Friday at a three-week low, creating a weekly Key Reversal Down.

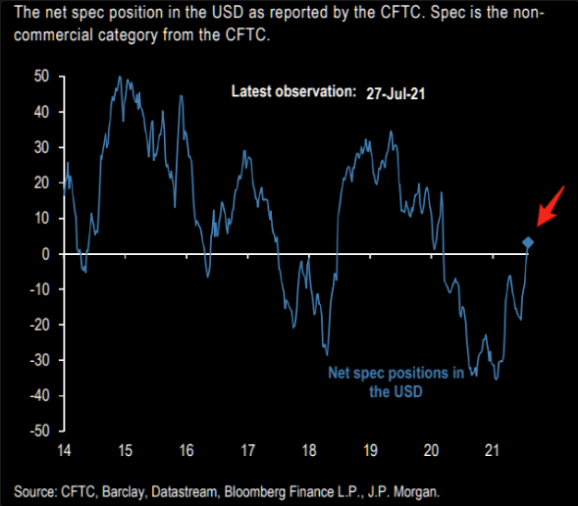

The US Dollar index closed on its highs for the week – the Euro had its lowest weekly close since November 2020. Net spec positioning had been bearish the USD – it turned small bullish last week for the first time since March 2020.

Gold was down over $50 Friday-to-Friday as it continues its strong negative correlation with the USD; silver had its lowest close since December 2020.

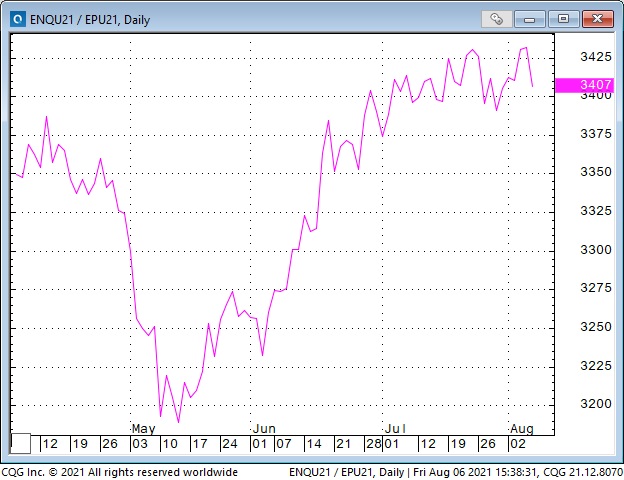

The Nasdaq 100 outperformed the S+P Monday to Thursday this week, but that reversed following the employment data. (Tech stocks like lower for longer interest rates.) This chart shows the NAZ outperforming the S+P from mid-May (remember that Key Turn Date?) to Thursday this week.

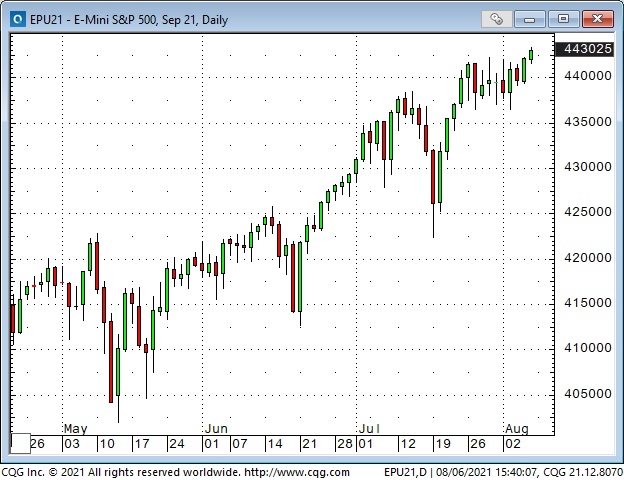

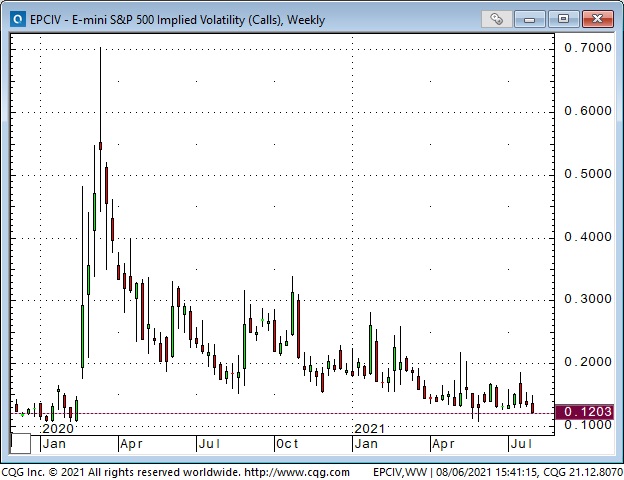

The S+P, the DJIA and the TSE all closed Friday at All-Time Highs. Bank shares gapped higher on the UE data (banks like a steeper yield curve); implied vol on the S+P futures closed the week at an 18 month low.

Chinese tech indices tumbled last week, but that fall didn’t seem to affect American tech indices this week. If anything, perhaps money flowed from Chinese tech and helped buoy American tech to new highs.

The broad American stock indices have outperformed the broad Chinese (and most other countries) stock indices for years.

The Canadian Dollar (and virtually all other currencies) fell against the USD following the American employment report. Weaker crude oil prices this week also weighed on the CAD.

WTI crude oil prices fell this week as the supply/demand picture going into the fall is being re-assessed (OPEC+ increasing supply.) The front-month premiums over the deferred months fell dramatically this week.

This chart shows the premium of Sept 21 over Dec 21 falling like a stone lately.

My short term trading

At the end of last week, the only position I had was a small short on the S+P. I thought the market looked tired. I was stopped Sunday night for a small loss.

I shorted the Dow futures Monday after they fell back from making new ATH on the cash market opening (no follow-through on the upside, maybe the market goes lower.) By Tuesday morning, I was >300 points ahead on the trade, and I tightened my stop – which was hit later Tuesday for another small loss.

The Dow and the S+P seemed to be chopping back and forth within a narrow range for the past ten days. I thought that could continue (across markets) into the Friday UE report, so I decided to take a brief summer holiday and enjoy time with friends visiting from out of town. I’m flat at the end of the week.

On my radar

Markets were clearly not positioned for the strong US employment report – just as the markets were not positioned for the Fed surprise at the June FOMC meeting – prices changed quickly and dramatically in the interest rate and currency markets – less so in the equity markets.

Perhaps currency and interest rate markets are more sensitive than the equity markets to any anticipation that the Fed will make a policy sea-change. The bond market has been rallying since March – people who saw inflation ahead had trouble with that. Bond price action the past few weeks looks like a double-top – if indeed the Fed starts to communicate that they are going to pull policy tightening forward, then bonds could tumble, and the yield curve could steepen.

Given that the ECB and BoJ are not expected to change policy, any perception that the Fed will tighten would likely boost the USD, negatively impacting currencies and commodities.

Quick question:

A lot of people are asking why the Fed keeps buying $120 Billion of paper every month. Some folks argue that enough is enough, and the Fed should stop – or at least start cutting back. We also see that all of the QE isn’t going through the banking system and into loans to people and businesses – check out the reverse repo market flows.

Let’s say that the Fed decided to start tapering QE (and told us they were doing so because they see it’s just “piling up” in the banking system – that it is losing its effectiveness in terms of stimulating the economy.) Do you think the market would see such a policy change as “purely technical” or as the beginning of tightening?

Thoughts on trading

I took some time off this week. I felt out of sync with the market, and I could easily imagine it drifting sideways into the Friday employment report and then ripping one way or another. It’s easy to get sucked into sitting in front of my screens all day, every day – taking a break seemed like a good idea. (A good, long-time friend likes to remind me that there is a rumour going around that the markets will be open again next week!)

I’ve been thinking about how the market likes to find a balance – an equilibrium. This morning the markets experienced a shock from the unexpectedly strong UE data – prices moved quickly to new levels and then started to find a “balance” between buyers and sellers.

I’ve written before that I like to find markets where speculators are positioned heavily on one side – where they are at risk of being substantially wrong if the market goes against them. This positioning sets up a potentially asymmetrical trading opportunity. If I take the other side of their trade, I could experience a small loss or a big win – if the market goes against them and they accelerate the break by liquidating their positions.

Of course, speculators are often heavily positioned according to the market trend, and we’ve all heard that the trend is your friend. So betting against the trend may have a low probability of success – which may mean that the perceived asymmetrical trading opportunity is only an illusion.

The “trick” would be in the timing. Don’t bet against the trend, but be ready to trade against the speculators positioned in line with the trend – once the trend is broken. Ah, Grasshopper: now you will please define “trend” and “trend break!”

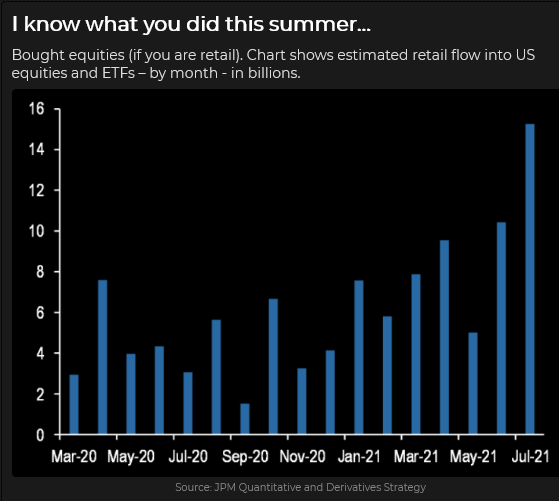

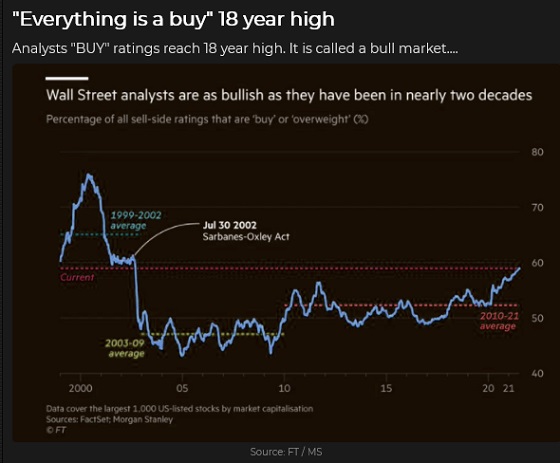

Speculators (and people who don’t think of themselves as speculators) are massively positioned long equities. The trend (on a variety of timelines) has been their friend. It may well continue. But I couldn’t help noticing that “retail” has been coming into the market in size lately – and I hear the echo of Bob Farrell reminding us that the public always buys the most at the top.

Be careful out there.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.