Stocks tumble and rebound from Friday to Friday.

The DJI futures contract dropped and rebounded ~1,400 points from last Friday’s high to this Friday’s high. A 2,800 point round trip in a week.

The Nasdaq, S+P, and the Vanguard Total Market ETF rallied from Monday’s lows to make new All-Time Highs.

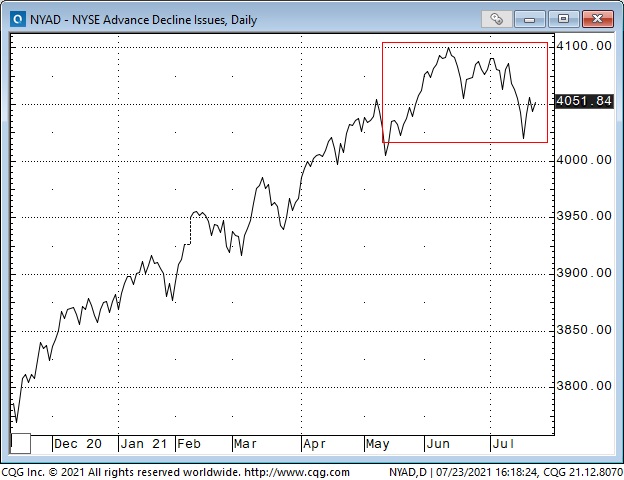

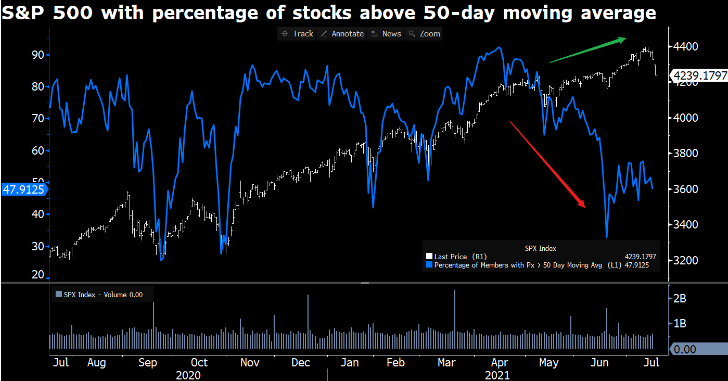

The NYSE (and the S+P) Advance/Decline line fell to a 2-month low early in the week. The falling AD line represents weaker market breadth – fewer and fewer stocks are “carrying” the indices higher. The divergence between the AD lines rolling over while the indices make new highs may be an early warning. Stay alert.

S+P 500 index option volatility spiked on Monday but fell back as stock markets rallied for the rest of the week.

Chinese Big Tech is a drag on the broad market.

While Big Cap Tech in the USA is pulling the broad indices higher, Big Cap Tech in China is a drag on the broad indices.

Big Cap Tech in the USA is why American stock indices outperform the Rest Of The World. There is a LOT riding on American Big Cap Tech.

Crude Oil tumbles and rebounds

From Friday to Friday, the WTI crude oil chart looks very much like the S+P 500 chart: a $7 tumble from last Friday’s highs to Tuesday’s lows followed by a $7 rebound to this Friday’s close. That’s a 10% decline followed by a 10% rebound inside a week.

Bond price action this week is the inverse of the S+P and WTI

Bond prices have been rising (yields have been falling) since March – confounding the consensus view that long-term interest rates “were definitely” going to be much higher by Q3 because of “surging inflation.”

The pace of the bond market rally picked up speed in July, with prices peaking Tuesday as stock indices were recovering from their lows. When stock indices rallied Tuesday through Friday, bond prices fell.

The US Dollar sustained its recent strength.

The USD surged higher in mid-June (when the Fed indicated that they might actually raise interest rates a bit sometime in the distant future) and has sustained (and added to) those gains the past few weeks – relatively unfazed by the dramatic swings in stocks, bonds and WTI this week.

The Canadian dollar followed the S+P and WTI – up and down

The CAD tumbled over 2 cents from last week’s highs to this week’s lows but then rebounded as the S+P and WTI bounced back from their lows. (The CAD had a high week-to-week correlation with both the S+P and WTI from last year’s lows until early June when the CAD started to tumble while the S+P and WTI continued higher.) The strength of the USD Vs. nearly all currencies since the beginning of June has pressured the over-valued CAD lower.

Gold has been highly correlated with the USD this year.

Gold rallied almost $250 from the end of March to the beginning of June as the USD weakened but then fell nearly $175 in June as the USD rallied – thanks to (among other things) a perceived “change in tone” from the Fed. Gold had modest losses this week as the USD had modest gains.

Crude oil gets the headlines, but coal and NatGas have soared.

My short term trading

In last week’s “On my radar” section, I said: My recent bias has been that pro-risk positioning across markets is WAY overdue for a substantial correction – this week’s price action looks ominous.

I had no open positions coming into this week but hoped to find a spot to get short stock indices. Unfortunately, Dow futures tumbled ~400 points from (my) Sunday midnight to the NY opening, as Europe played “catch-up to last Friday’s sell-off in the USA. The Monday day session tumbled another 400 points in the first hour of trading, and I couldn’t bring myself to sell into that hole, which was a good thing because the market turned around a couple of hours later and began a 1,300 point rally into this Friday’s close!

The rectangle on this chart contains the price action in the S+P futures between midnight Sunday (Pacific coast time) to the first hour of trading during Monday’s NY floor session.

Instead of selling stock indices on Monday, I decided to sell short-dated OTM bond calls. Bonds had rallied the past few days as stocks had weakened and bond vols had jumped sharply. I put on the trade and immediately didn’t feel right about it. My recent bias had been that stocks were WAY overdue for a correction, yet here I was making a trade that was counter to my bias. I was mixing up the time frames between my analysis and my trading!

The trade had gone a few ticks in my favour, so I closed it out – which was a good thing because bonds jumped more than a full point higher the next morning. But by then, stock indices had started to rally back from their lows, so I re-shorted the calls with bonds at 5-month highs.

The calls were more than 2 points OTM and expired in 10 days. Bond prices tumbled sharply over the next two days, and over 90% of the option premium evaporated, so I covered the position for a decent profit. (I shorted the calls at 41 with Sept bonds just below 167, and covered at 4 with bonds around 164-half. The delta on the calls was ~28% when I sold them so I ended up making 37 ticks while bonds fell about 2.5 points.)

I covered the position because the risk profile on the trade had changed dramatically. I sold the calls for 41 ticks; they were now 3 bid at 4 – not much meat left on that bone, and there was still 8 days until expiry, and, at best, I would probably cover them at 2 instead of waiting for them to expire. So, why hold a position that could only improve by 2 ticks – but could go hugely against me if bonds had a big rally?

Later in the week, I shorted the Dow and the Russell (the weakest of the stock index futures.) the P+L on those trades offset one another. I was probing to see if I could get an initial short position on and, if it started to work I would add. Net/net the trades weren’t working and I stepped aside.

I bought the Yen on Thursday with a tight stop, thinking it would rally if stock indices rolled over. I liked the risk profile on the Yen. It had been trending lower all year as the market was generally in a pro-risk mood, and speculators had built a historically large net short position. If the Yen began to rally, then short-covering of those positions would accelerate the rally.

The Yen had traded to a 6-week high Monday when stocks tumbled but fell back as stocks rallied Tuesday through Thursday. The setup was simple: I could buy the Yen, risking a few ticks if it made new lows for the week, but if stocks turned lower, I could see the Yen jumping 150 points – or more.

I bought the Yen and was stopped out overnight Thursday. I will keep my eye on the Yen as another way to play a potential reversal of the pro-risk sentiment that is currently so strong across markets.

At the end of the week, I shorted a bond collar – I sold both OTM puts and calls on options expiring next Friday. If the September bond contract remains between 162 and 166 until expiry, I will collect 100% of the premium. I’m not expecting to hold both positions to expiry, but I think bond volatility may “settle down” over the next few days, and time decay will work strongly in my favour.

My net P+L was up on the week, thanks to shorting the bond calls.

On my radar

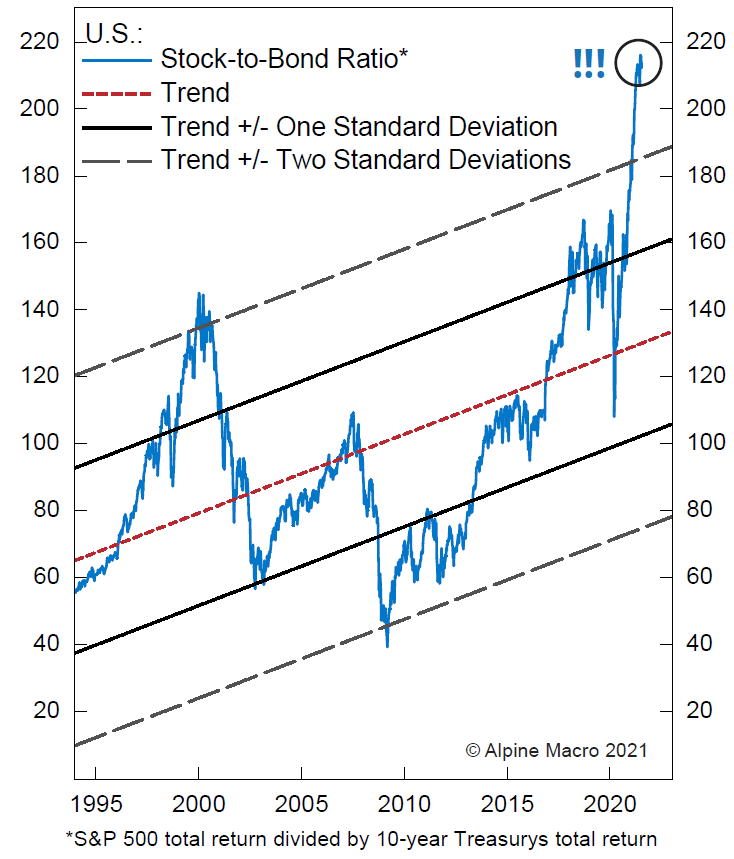

I still think that pro-risk sentiment is WAY overdue for a correction across several markets, and I’ll watch for opportunities to jump on that. I particularly like to find trades, like the Yen, where speculators are heavily positioned one way and will need to cover those trades if the market moves against them.

A recent example of this kind of setup was the Canadian Dollar. Speculators built a large net long position as the CAD had a long, steady rally from the November 2020 Key Turn Date (Biden election and Pfizer vaccine announcement) to a 6-year high at the beginning of June. CAD has a high historical correlation with commodities, and I think specs saw buying CAD as not only a pro-risk trade but also as a play on the commodity rally.

As the CAD started to fall away from its early June highs (as the USD started to rally against nearly all currencies) speculators “increased” their positions (they were Buying The Dip) which “turned up the heat” on them when the CAD continued to fall. (The latest COT data shows that net long spec CAD positions were slashed in half as CAD fell from around 80 to 78 cents July 14 to July 20.)

Thoughts on trading

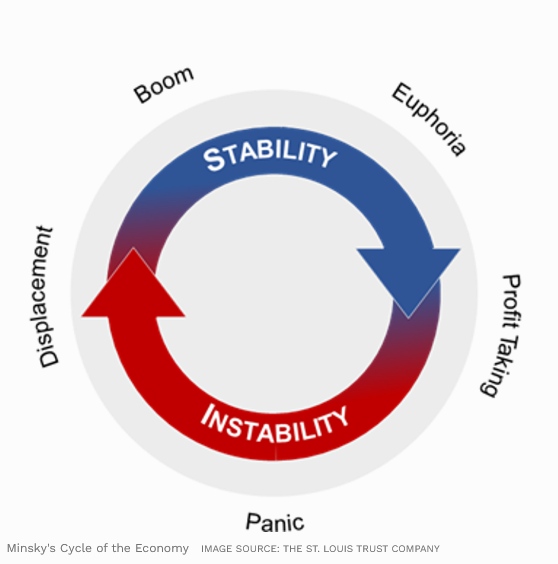

Hyman Minsky told us that, “Stability breeds instability.” One aspect of stability is complacency – an expectation that things will continue as they have been.

For instance, the complacent belief that stocks only go up. That belief is the bedrock of passive investing ($7 trillion, and counting) whereby people keep buying a basket of stocks every month, regardless of price, because, well, because they believe that, over the “long haul,” stocks only go up.

Traders have to take risks to make money. The key is to take the right kind of risks. I like to take risks where I lose a little money if I’m wrong, but I make a lot of money if I’m right.

For instance, I like to watch a “narrative” build; sometimes, I will buy into it in its early stages. (George Soros said that if he sees a bubble forming, he likes to jump in.) As a narrative gains traction, more and more people buy into it, and prices rise. (Think of Netflix or Peleton as the play on “working from home” during the early days of the lockdowns. Or think of copper as the “must-have” play on everything going electric.) As my old friend Bob Hoye likes to remind me, “People will believe the most preposterous stories – as long as the price keeps going up!”

Narratives have a shelf life. Sometimes it may be a few days, sometimes it may be a few years, but at some point, the narrative gets old, and people look for the New Kid In Town. I want to be short whatever they’re leaving behind.

Picking the right time frame (for you) is the starting point in deciding what risks to take, but managing a “trade in progress” is the most important thing.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.