Markets react to a “slowing” Fed

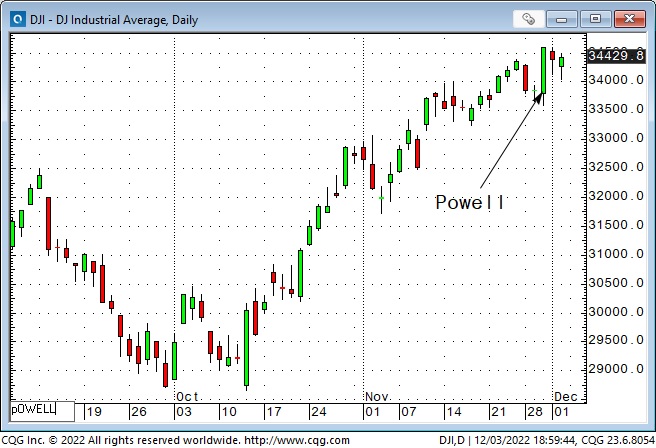

Leading up to Powell’s scheduled Wednesday speech, some market participants were likely positioned for a re-appearance of “tough-guy” Powell – the man on a mission to bring down inflation and damn the consequences.

But Powell sent those participants scrambling to reverse their positions when he said, “it makes sense to moderate the pace of our rate increases.”

The Dow futures soared ~1,000 points over the next three hours to close the day at a new 7-month high, bond prices rallied, and the US Dollar Index fell – November was its weakest month in thirteen years.

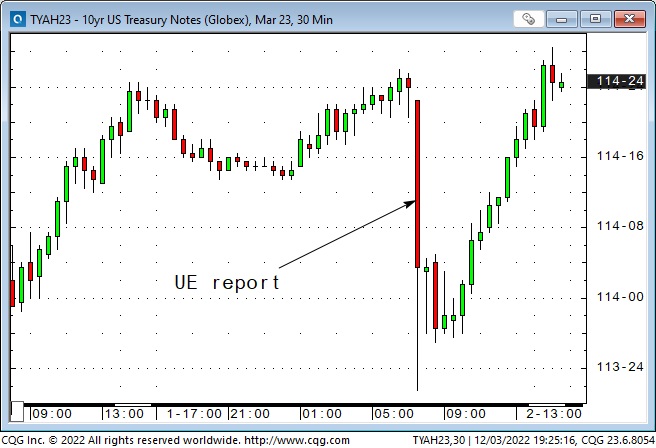

The employment report early Friday morning was much stronger than expected, and stock index futures initially tumbled, wiping out more than half of the Wednesday gains. But, as the day progressed, the indices rallied and closed higher on the week.

There has been a LOT of discussion about Friday’s UE report – essentially, people (who really know their stuff) saying that employment is not nearly as “hot” as the Establishment report (that’s the report that made the headlines on Friday) makes it look. For instance, the Household survey (done separately from the Establishment survey) shows almost zero net job gains since March 2022 – while the Establishment survey counted 2.7 million job gains.

I’m not an economist; I’m a trader, and from a trader’s perspective, the Friday morning price action (stock indices and bonds fell hard on the number, then rallied back all day) looks like markets over-reacted to the report and then, re-assessing the data, corrected that mistake over the balance of the day.

The Dow has closed higher for eight of the last nine weeks, gaining ~6,000 points (21%) since the lows made on the October 13 Key Turn Date. The Dow is now down only ~6% from January’s All-Time High, the S+P is down ~15%, the Nasdaq is down ~29% (from November 2021 ATH), and the TSE is down ~8% (from April 2022 ATH.)

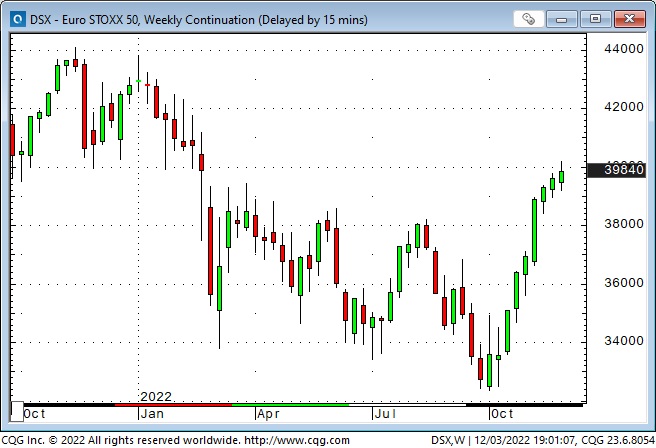

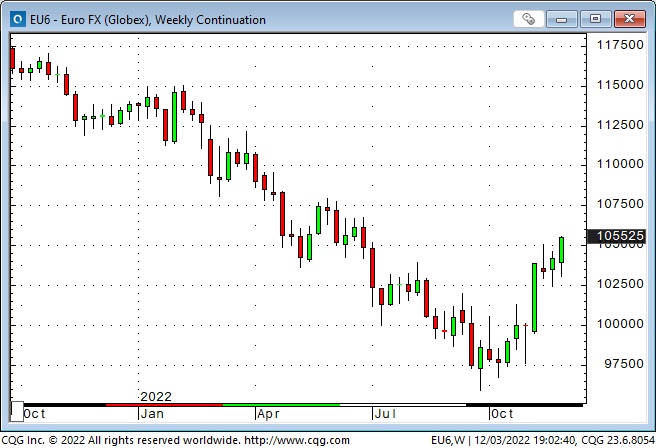

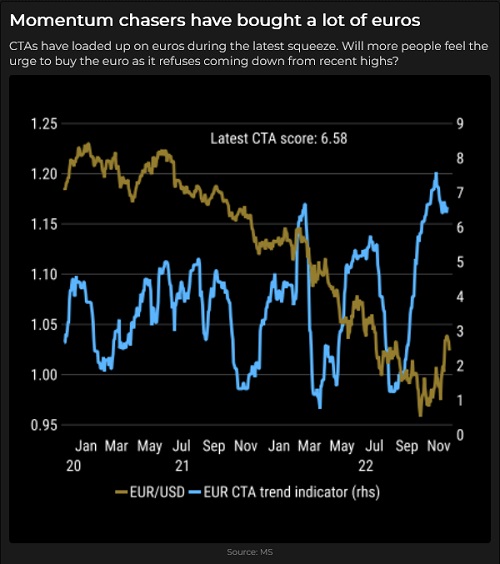

The Euro Stoxx 50 Index futures have closed higher for nine consecutive weeks, rising ~24% from their early October lows. The index is now only ~10% below the ATH made in November 2021. The Euro Stoxx 50 Index rally coincided with a rally in the Euro currency, which is up ~10% from late September 20-year lows.

Stocks and bonds are rallying for different reasons

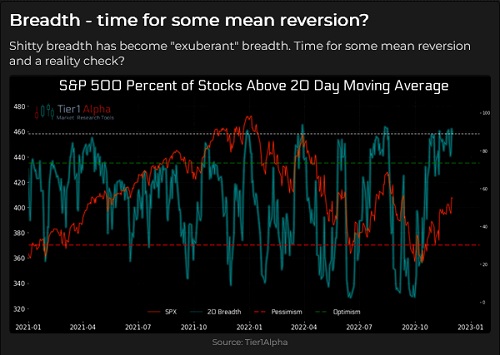

The Fed has been raising rates to cool inflation, and stock markets have been guessing how high rates will go and when they will fall. Since the June lows, and especially since the October lows, stock markets have been looking for a “buy signal” – if the Fed is pretty much done raising rates, that’s a “green light special” to buy.

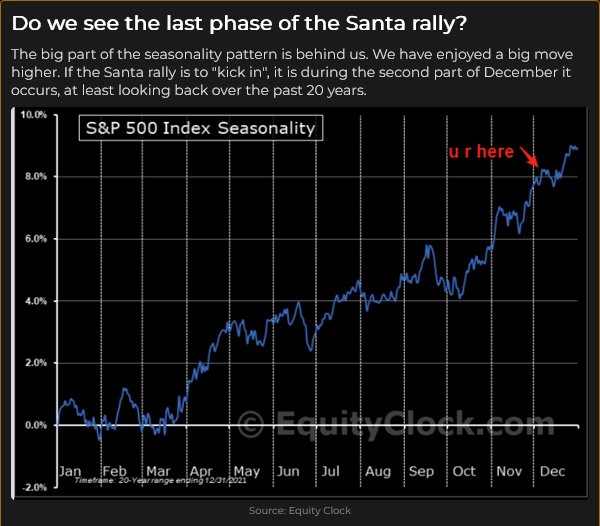

The stock market rally off the October lows has not been driven solely by expectations of an “easier” Fed; the stock market is seasonally strong this time of the year; January sees the most significant monthly inflows of retail money into stocks, corporate buybacks are aggressive, money managers who are underweight stocks will “have” to chase this rally or risk losing AUM, and, the granddaddy of them all, people believe stocks only go up (look at the multi-decade charts, you have to own stocks!)

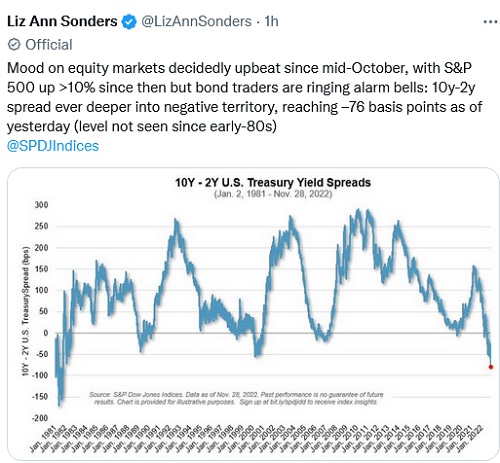

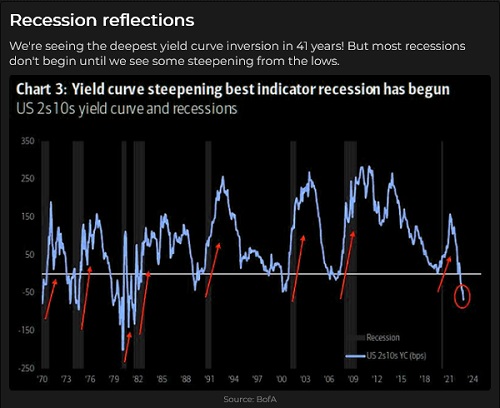

The bond market has a different view of the Fed’s activities. Bond prices tumbled all year as the Fed raised rates, especially from August to October, when the Fed raised rates aggressively. Still, for the past few weeks, the bond market has been expecting the Fed to slow and then halt its interest rate increases in 2023 because the Fed will have driven the economy into a recession.

Two more thoughts on bonds

While everybody is trying to guess when the Fed will stop raising rates, it seems that people are forgetting about the QT program, which is now shrinking the Fed’s balance sheet by ~$95B a month (and taking liquidity out of the market.) I wondered what the impact of QT was and found that David Rosenberg figures it is about 20bps of tightening per month. If that’s right, then counting November to the beginning of March, that’s another 80bps of “stealth” tightening in addition to any interest rate bumps from the Fed.

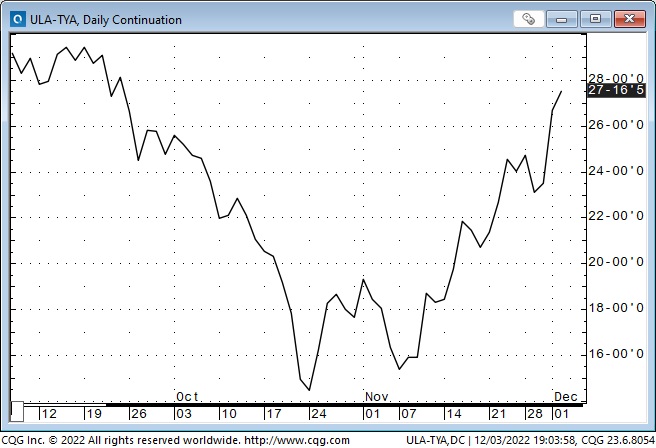

I’ve traded the bond market from the long side since late October. While I’ve made money, I’ve left a lot more on the table! I’ve been taking guidance from the duration bid – the long bond is rising much faster than short-dated bonds, helping to pull the whole curve higher. This chart shows the point gain of the Ultra-long bond future over the 10-year T-Note future.

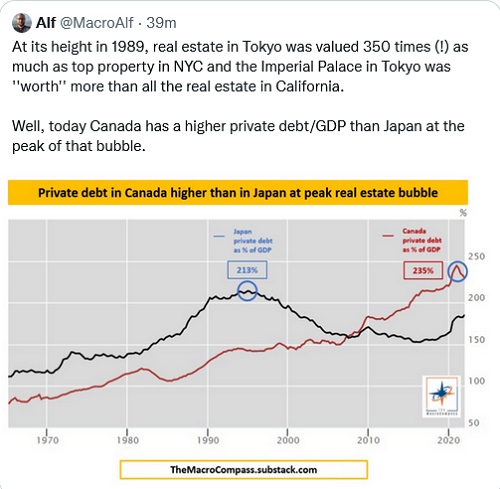

From a macro asset allocation perspective, I expect the next several months will be an excellent time to be underweight stocks and overweight top-quality bonds.

Currencies

The US Dollar Index hit a 20-year high in late September and has fallen ~10% since then. In late September, the British Pound hit a 37-year low, the Euro hit a 20-year low, and the Japanese Yen hit a 32-year low in mid-October.

I’ve traded currencies for more than 40 years, and I’ve noticed that currency trends seem to go way further than makes any “sense,” then they turn on a dime and go the other way. That certainly seems to have happened with the major currencies recently. This Economist magazine cover is from Dec 2007, and the USDX had fallen ~10% that year.

The main factor driving the acceleration of the USD rally from February to September this year has been the perception that the Fed would be much more aggressive than other Central Banks.

Now that markets are pricing “Peak Fed,” the USD has weakened – traders who had built up big short positions in other currencies against the USD have been unwinding those positions – and non-commercial accounts in the currency futures market have swung to being net long the Euro.

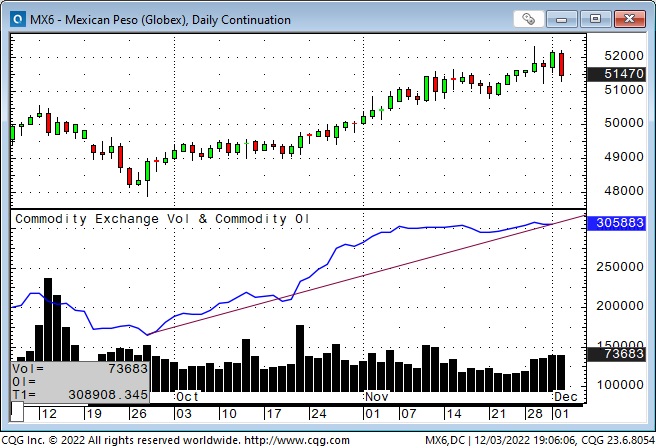

I’ve been watching and occasionally trading the Mexican Peso. Interest rates are much higher in Mexico than in the US, so forward futures contracts trade at deep discounts to the spot or nearby futures. (Despite those forward discounts, there is virtually no open interest in the forward contracts.)

The Peso has been rising steadily since late September (when the DXC5 peaked) and has broken out to nearly a 3-year high (on a continuation chart basis), while open interest has soared ~ 80%.

Do speculators think “friend-shoring” will cause Mexican exports to the US to soar? Has the Peso been bid up as a high-yield play against a weakening USD? Do the record-high open interest (outside of a brief delivery spike in December 2019) and hugely net-long speculative positioning flag an over-bought market ripe for a correction if the USD catches a bid?

From a macro asset allocation perspective, I expect the next several months will be an excellent time to be overweight the USD. I think the bond market’s expectation of a recession will likely play out, and it will hit the Rest Of The World harder than it hits the USA.

Precious metals

Gold and particularly silver rallied in November as the USD weakened and interest rates, especially real rates, fell. My guess is that this rally was more short-covering than aggressive new buying (although PM bulls always get aggressive when the price is going up. Silver has rallied ~$5 (27%) from mid-October lows!)

Energy

The front-month WTI futures contract briefly traded below $74 on Monday for the first time since December 2021, and the 6-month forward spread briefly went into contango for the first time in nearly two years. The futures bounced back ~$10 by Thursday, and the market closed ~$4 higher on the week. The (energy-heavy) Goldman Sachs commodity index (GIC5) touched a new low for the year on Monday.

NYMEX crude, gasoline and the GIC5 have trended lower since June. Reduced demand from China has been a factor, and OPEC+ will have a virtual meeting tomorrow to discuss supply/demand issues and prices.

In last week’s Notes, I asked why leading O+G companies’ share prices remained near multiyear highs while NYMEX fossil fuel prices were substantially below this year’s highs.

I found some interesting answers to that question in Kevin Muir’s Private Twitter feed on November 29 (Kevin was asking the same question I had asked, and his subscribers answered:)

The O+G industry has changed – not just a levered oil trade – they are generating FCF, not burning cash – they pay good, well-covered dividends (5 – 8%), strong balance sheets, low CAPEX, low valuations and management doing buybacks. Upside may be limited because many (woke) institutional accounts avoid carbon investments.

In last week’s Notes, I also asked why CAT share price was ripping higher if people thought a recession was coming. A long-time friend and market pro answered with a link to a piece on Bloomberg:

By Christopher Ciolino

(Bloomberg) — Infrastructure spending, restocking of lean

dealer inventories and near-record backlogs may help cushion

construction-machinery producers from a deteriorating economic

backdrop. A number of US infrastructure-related bills and

secular growth trends around grid modernization, electrification

and connectivity could provide a multiyear tailwind for

Caterpillar Inc., Deere & Co., CNH Industrial NV, Terex Corp.

and Oshkosh Corp., Bloomberg Intelligence analyst Christopher

Ciolino said in a note. Even as the Architecture Billings Index

(ABI) turned negative in October for the first time since

January 2021, nonresidential construction strength largely

appears intact, with most companies seeing few signs of demand

destruction.

My short-term trading

I started this week short an S+P position I put on last Friday – thinking that the market had run up too fast. The market gapped lower Sunday afternoon and continued to fall once the Monday “floor” session started. I covered the trade for a decent profit Monday morning.

I poked at the short side a couple of times Monday afternoon and Tuesday morning, with a net zero result, but I wanted to be flat ahead of Powell’s Wednesday speech.

I let 30 minutes go by after Powell started speaking, but when I saw that the market seemed determined to go higher, I bought the S+P and sold it going into the close for a 40-point gain.

On Thursday, I shorted CAD futures and short-dated CAD puts (looking for the CAD to fall but with some risk offset from the short puts.) I got cold feet ahead of the Friday morning UE report and closed the trade for a slight loss.

The CAD fell ~half a cent on the UE report but followed other markets (stocks, bonds, FX) that bounced back after the initial decline. The CAD bounce-back was weak, so I re-shorted it and held that position into the weekend.

I tried to buy T-Notes on Friday after they started to rally from the initial break on the UE report. I usually use market orders when I decide I want to get into a market, especially in a market like T-Notes, which is a one-tick bid/offer market with thousands of contracts on both sides, but the market was rallying hard, so I put bids in below the market, hoping to catch a brief setback. I never got filled, and for the sake of two ticks, I left a whole point on the table! Have I mentioned before that trading is not a game of perfect?

On my radar

Bill Dudley (former NY Fed President) says the Fed wants a recession. I won’t argue with that. I’ll be looking for opportunities to buy bonds and the USD and to short stocks and other currencies.

The Barney report

We got our first snowfall of the season this week. Barney hadn’t seen any snow since he was four months old, and he loved it!

The 33rd Annual World Outlook Financial Conference at the Bayshore Hotel, Vancouver, February 3 & 4, 2023

Mike Campbell’s hugely popular annual conference will be back LIVE AND IN PERSON at the Bayshore Hotel after two years of Covid restrictions. Mike and his team have again created a fantastic roster of speakers and exhibitors. I’ve attended every one of these conferences, and with all the turmoil and confusion in today’s markets, I highly recommend my readers make plans to attend. You can get all the information you need here.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s Moneytalks show for >22 years. The December 3 podcast, with special guest Tony Greer, is at: https://mikesmoneytalks.ca.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.