Will the Fed choose financial stability over fighting inflation?

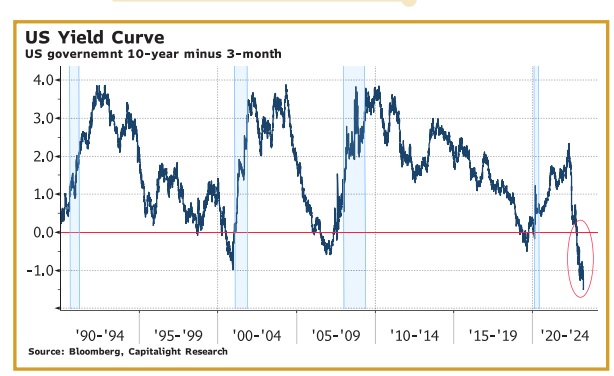

Markets have been trying to guess when the Fed will stop raising rates for months. There are several “reasons” why the Fed might change policy, including “something important breaks,” the economy goes into recession, and/or inflation falls.

But it seemed that every time investors expected the Fed to be on the verge of changing policy, Powell would remind them that inflation was a serious problem, that he was determined to get it down and that the Fed would stay “higher for longer.”

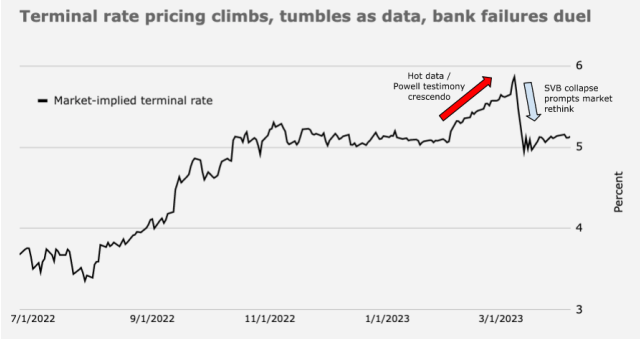

Following his hawkish congressional testimony a month ago, the Secured Overnight Funding Rate (SOFR) market was pricing short rates of ~5.5% from June through December. The market was “agreeing” with the Fed that there would be no cuts this year.

Then the Silicon Vally Bank ignited the “banking crisis,” and the SOFR market repriced December rates from ~5.5% to 3.5% within five trading days.

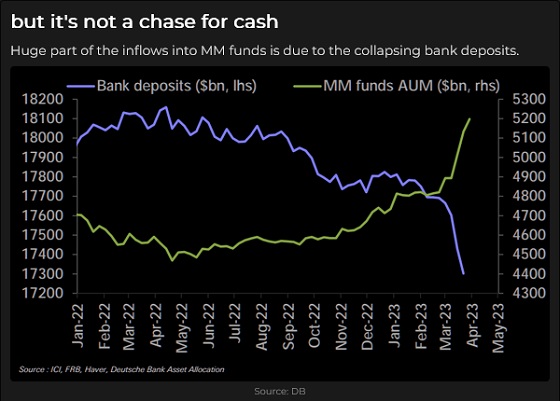

The “banking crisis” was quickly “contained,” albeit not without “collateral damage” to some of the “walking wounded” such as Credit Suisse, but the flow of funds (~$500 Billion in the last six weeks) from bank deposits to the higher yields and safety of money market funds was sustained, at a slower pace, and the SOFR market priced in one more 25bps raise from the Fed (likely in May) with short rates falling ~75bps from June to December.

Stocks

North American and European stock indices made their lows around mid-March and trended higher into the first week of April, while volatility metrics showed that “stress” was greatly diminished. Bank share indices, however, remained downtrodden.

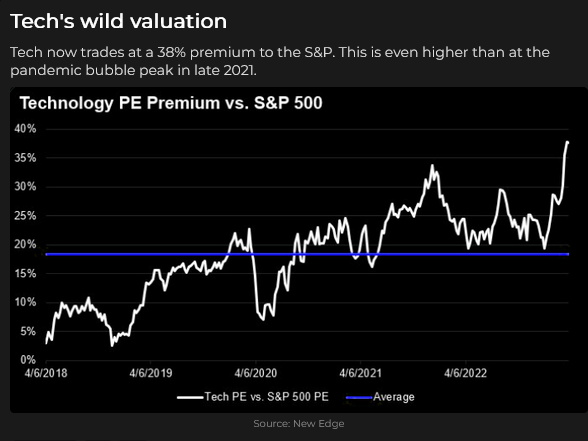

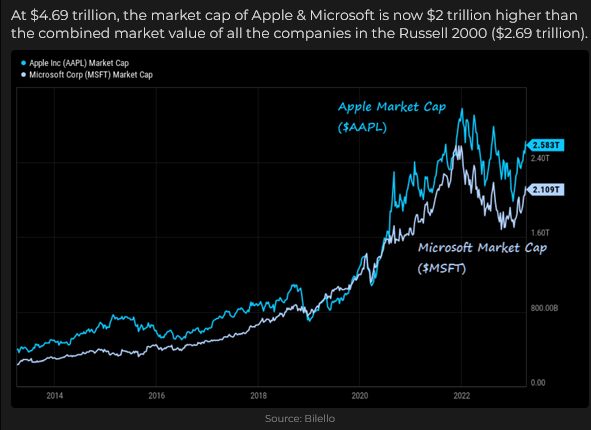

The stock market rally was led by Supercap tech (the Nasdaq 100 hit a 7-month high.) Actually, without Supercap tech, there wasn’t much of a rally, and when Supercap tech lost momentum in the first week of April, so did the indices.

The loss of momentum this week seemed to be tied to various metrics showing a “softening” of what has previously been a “robust” labour market. As much as the stock market, especially tech, loves lower interest rates, the question is, if the cycle of higher rates is ending and rates are headed lower because the economy is slipping into a recession, is that good for stocks or bad?

Persistent near-record low unemployment and substantial wage gains (a tight labour market) have been the strongest argument against an easier Fed monetary policy. The thinking has been that if the Fed pauses or cuts while labour markets are tight, a wage/price spiral could develop, which would “wipe out” the Fed’s efforts to cool inflation. The market is sensing that the labour market is changing, and so will the Fed.

Another factor: the consequences of the Fed raising interest rates so much / so quickly after a decade of near-zero rates may not be over. Perhaps something else will “break” due to the Fed’s aggressive monetary policy. The March “banking crisis” may be only the “tip of the iceberg” of too much leverage, after a decade of near-zero interest rates, colliding with a challenging refinancing environment.

Bonds

The US 10-year Treasury yield was at a 4-month high in early March at ~4.07%; this week, yields hit a 7-month low at ~3.25% as various employment metrics depicted slower job growth/wage gains.

Gold

Gold traded lower on Powell’s “higher for longer” congressional testimony, then rallied on the “banking crisis” and took another leg higher this week as interest rates ( particularly real interest rates) fell to 7-month lows and as the USD weakened. Gold is up ~ $225 (12%) from early March lows to a 13-month high; silver is up ~$5 (25%).

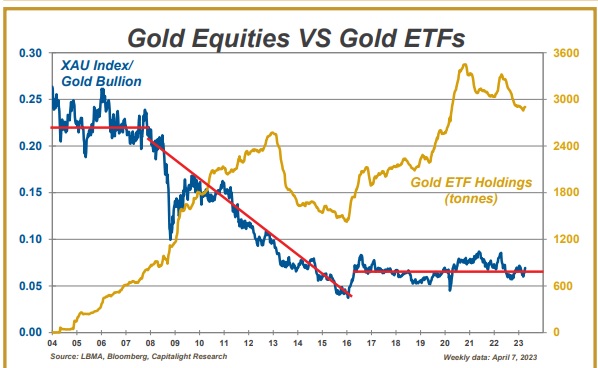

I’ve been puzzled by the underperformance of gold shares relative to gold over the past few years (especially recently when energy costs were low.) My “old school” way of looking at gold shares was that they were a levered play on gold – as the gold price rose relative to operating costs, the gold company’s EPS should increase exponentially – and the shares should jump – but they haven’t.

I believe investors became unhappy with gold mining companies after the 2008 – 2011 commodity bull market when the companies developed a reputation for burning cash and making ill-considered acquisitions etc. That “distrust” of company management seemed to “cheapen” gold mining shares relative to gold (and the gold mining industry began to consolidate.)

This chart of weekly Comex gold futures Vs. the GDX (the VanEck Gold Miners ETF) shows how dramatically gold mining companies have underperformed bullion since 2011. Note the underperformance since gold hit All-Time Highs in August 2020. Gold is the pink line.

My long-time friend Martin Murembeeld, in this week’s Gold Monitor, argues that We have believed part of the reason for this loss in premium was the introduction of gold ETFs. We argued at the time that gold ETFs would inevitably eat into investors’ appetite for gold equities. (Prior to gold

ETFs, a gold investor was faced with the choice of buying bullion from a bullion bank/ shop or buying gold equities. The introduction of gold ETFs changed that choice dramatically!)

Martin believes that the impact of gold ETFs on gold equities has run its course, and since we are quite bullish on the gold price for the coming years, we are very inclined to overweight gold equities versus gold bullion in

the gold portion of our portfolio.

I’ve read every weekly Gold Monitor for the last thirty years, and I highly recommend the report to any readers with a serious interest in gold. You can request a free trial here.

Kevin Muir, the Macrotourist, is another friend who has written a long-term bullish piece on gold this week. (I’ve read all of Kevin’s Macrotourist reports over the past five years, and I recommend him to my readers.)

Kevin believes that we have hit the point where the Fed must choose between fighting inflation and financial stability. If the Fed chooses the tight road, the financial markets will likely revolt, and eventually, gold will be the beneficiary. On the other hand, if Fed chooses financial stability over fighting inflation, then gold wins too as monetary conditions loosen.

Kevin believes Central Banks, especially China, will remain major gold buyers. He writes I am not buying gold because of some doomsayer’s prediction of the imminent collapse of the US dollar or a much-hyped coming financial Armageddon. In fact, compared to most bearish market pundits, I am downright optimistic about the economy’s ability to muddle through the upcoming rebalances. However, that doesn’t mean that China and other Central Banks won’t be on the gold bid for years to come. Nor does it mean that gold isn’t an attractive diversifying addition to a portfolio.

Concerning timing, he writes, over the last month, as the regional bank crisis has intensified, gold rallied, and if markets were to settle down, gold might well give back some of its recent gains. However, that will simply be a chance to add at better levels. I don’t know the direction of the next $100 or $200 move, but I feel more confident that the next $500 or $1,000 is up.

Energy

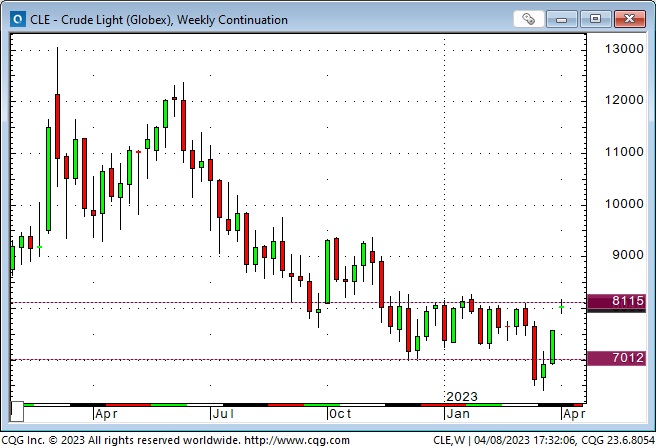

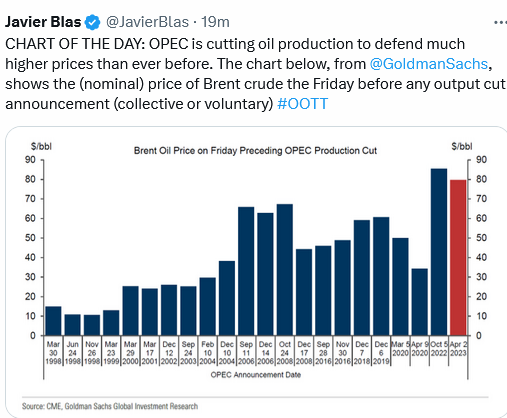

OPEC+ announced ~1MBD production cuts last weekend. WTI rallied to around $82 –the high end of the range for the previous four months. WTI is up ~28% from the 16-month lows on March 20.

Currencies

The USDX hit a 3-month high after Powell’s “higher for longer” Congressional testimony but has weakened ~ 4% since then.

The Canadian Dollar hit a 5-month low after Powell’s testimony (when the USD hit a 3-month high) and has rallied back ~2 cents to this week’s close. The CAD rally was highly correlated to the rising stock market. I’ve previously noted that net speculative short positioning in CAD futures was at multi-year highs and that any rally in CAD would probably induce some of those shorts to cover. The BoC has a scheduled meeting Wednesday, April 12, and is expected to leave rates unchanged.

My short-term trading

The only position I held to start this week was short gold. I was stopped near Monday’s highs for a slight loss (I had made a little money last week when I rolled my position into June – so my net short gold experience in the previous two weeks was a tiny loss.) Given the Tuesday/Wednesday rally, I was happy to have been stopped.

I shorted the S&P Sunday afternoon and was stopped for a slight loss early Monday morning. I re-shorted the S&P Monday and was stopped for another small loss. I re-shorted the S&P Tuesday and have held that position into the weekend. (I was ~50 points ahead at Thursday’s low.)

I shorted CAD Monday morning and was stopped for a slight loss. I re-shorted CAD on Tuesday and have held that position into the weekend. (I was ~50 points ahead on Friday’s close.)

On my radar

The market is sensing a change in the labour market, which will lead to an easing of Fed policy – because the economy is sliding into recession/stagflation. The March CPI data will be reported Wednesday, April 12, and will have a bearing on the Fed’s next meeting on May 3.

Governments consistently running massive deficits = reduced purchasing power of currencies = inflation. As Central Banks “fight” inflation by raising interest rates, they also increase prices by increasing financing costs. “Marginal” parts of the economy that are “stretched too thin” and can’t increase income/margins will be the most vulnerable.

There may be no Long Term Capital or Lehman “moment” in this cycle, but the cumulative weight of millions of “re-financings” at sharply higher rates may tip the economy into a recession. The markets may react “slowly at first, and then suddenly,” as Hemmingway’s character described his descent into bankruptcy in The Sun Also Rises.

April 4 may have been a Key Turn Date, but it’s too early to say. If different markets roll over without taking out the April 4 highs, that would confirm the KTD.

The NAZ hit a 7-month high on April 4 after rallying ~13% from the “banking crisis” lows; the S&P hit a 6-week high; the long bond hit a 7-month high; the EUR hit an 8-week high, with net spec positioning very bullish; the Swiss hit an 18-month high; the CAD and AUD hit 6-week highs; WTI hit a 9-week high.

The Comex futures gold breakout above $2,000 on April 4 was on low volume (only 37% of the volume on March 13 when gold rallied on the authorities’ “containment” of the “banking crisis.”) If gold can’t sustain $2,000 I may get short again. If gold weakens, I might short silver, up ~25% in a month – it has recorded an Exhaustion Alert, according to my friend Ross Clark.

The Barney report

I get “The Barns” out for a 1-2 hour off-leash run in the forest three or four times a week. Lately, he’s been loving the opportunity to jump up on something to get a look at things from “higher ground.”

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on April 8 on the Moneytalks podcast.

I recorded a 30 interview with Jim Goddard on April 8 for This Week In Money. I talk about my Big Picture view of what impacts all the markets (changing Fed policies) and drill down to several specific markets. You can listen here.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.