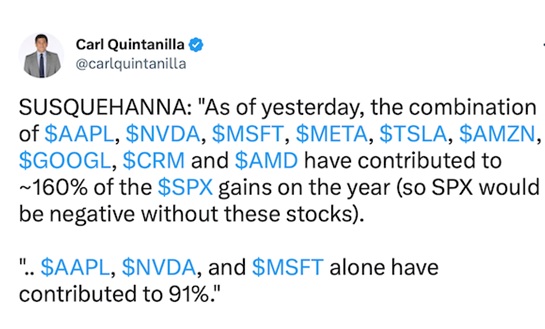

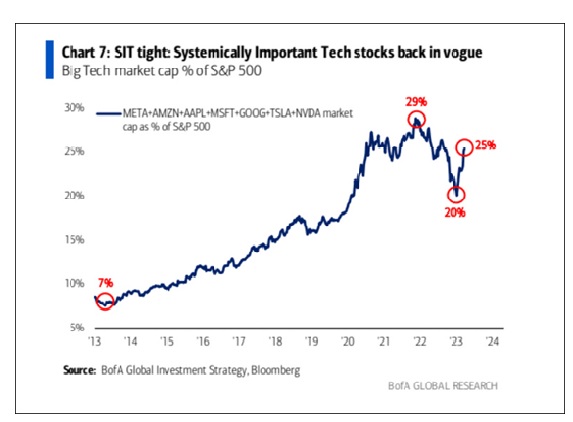

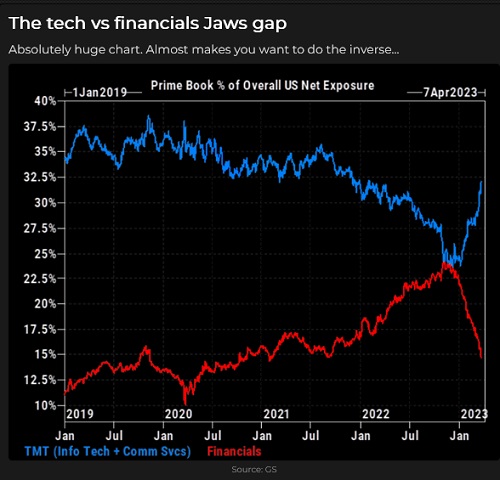

Supercap tech stocks soar, leaving the rest of the stock market behind

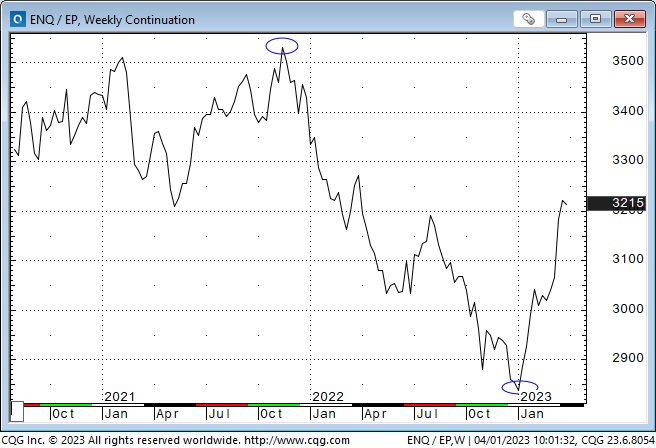

The Nasdaq 100 is up ~24% from its early January lows to a 7-month high; the S&P is up ~8%, the DJIA is up ~1.5%, and the TSE is up ~3.5%.

AAPL and MSFT are up >30% from January lows; TSLA and NDVA are up >100%. Without the Supercap tech stocks, the S&P is nearly unchanged YTD.

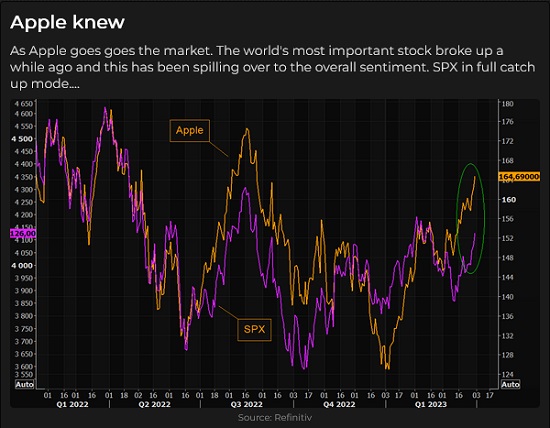

This chart of the Nasdaq 100 relative to the S&P has a similar pattern to the chart above. The NAZ hit an All-Time high in November 2021 and trended lower for much of 2022 while the Fed raised interest rates aggressively. Is the YTD rebound in the NAZ/S&P spread a “tell” that the Fed is about to reverse course?

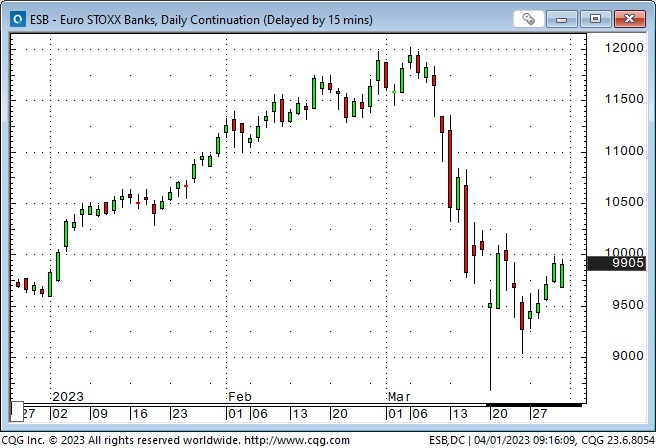

Bank shares tumbled into mid-March but haven’t bounced back as stress over the “banking crisis” dissipated.

Volatility metrics spiked during the “banking crisis” but fell back quickly as the “stress” dissipated.

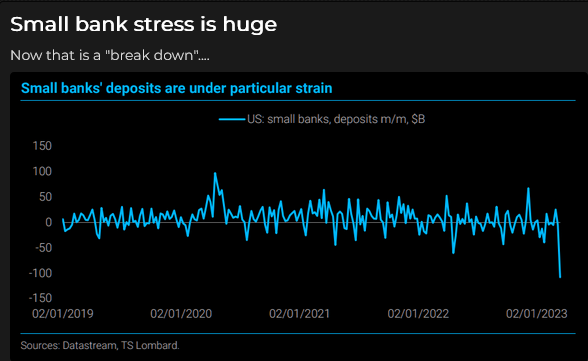

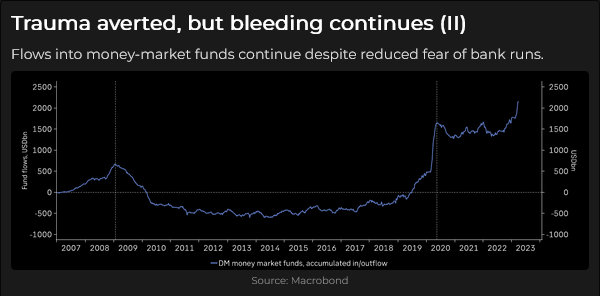

While stress in the broad market has faded, small banks are a different story.

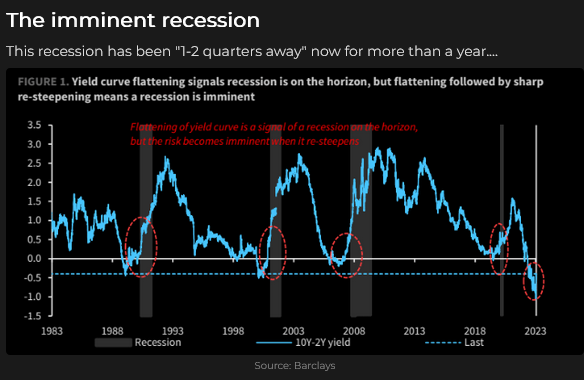

Small banks losing deposits (to bigger banks and money market funds) may be a “key” lingering effect of the March “banking crisis” if it results in those banks (dramatically) tightening their lending policies – precipitating a recession.

Gold rallied nearly $200 on the “banking crisis” and briefly traded above $2,000 for the first time since Russia invaded Ukraine. A weaker Dollar and lower interest rates also helped the gold rally. The net speculative long position on the Comex jumped to ~$36 billion as of Tuesday, March 28, a 9-month high (reinforcing my view noted here last week that retail bought the highs – so far.)

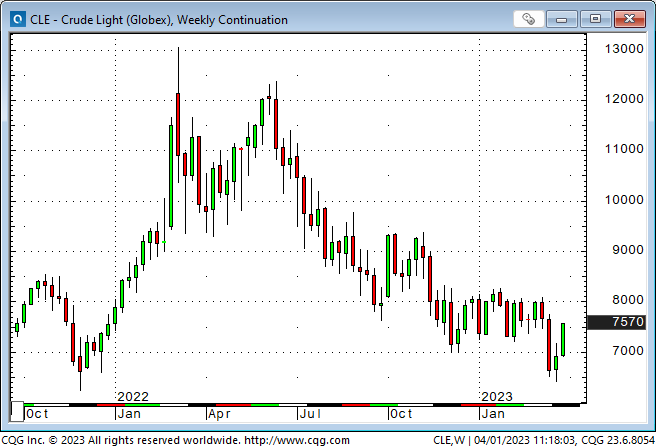

WTI crude oil fell to a 16-month low below $65 on “collateral damage” from the “banking crisis” but had bounced back ~$11 (17%) at this week’s close.

The US Dollar index rallied to a 3-month high in early March as markets priced in the Fed sustaining a “higher for longer” interest rate policy following Powell’s congressional testimony but then fell as the “banking crisis” hit.

The Canadian Dollar hit a 5-month low following Powell’s testimony but rallied ~2 cents from those lows to this week’s close. The initial leg of the rally seemed correlated to USD weakness; this week’s rally seemed related to the “risk-on” rally in the equity indices.

The Scotiabank FX Sentiment Report noted that net speculative short positioning in CAD futures was at a 4-year high last week and that “Combined positioning across Speculative, Real Money and Leveraged Accounts reached the most bearish on the CAD since 2008.” The report noted that such positioning is prone to a squeeze.

In an email to a friend this week discussing the CAD, I said, “ I treat “positioning” with great respect when I’m looking to make a trade. (My favourite question is, “How much of that idea is already in the price?”) I look for buying opportunities in a market where specs are heavily short and the price is not falling. After decades of trading the CAD, I note that it often changes less on Canada-specific events and more on correlation to 1) US/CAD interest rate spreads, 2) commodity prices (esp. WTI), 3) risk on/off sentiment as manifest in the S&P, and 4) general strength/weakness in the USD (specifically, EURUSD.) The strength of the CAD correlation to these factors waxes and wanes over time.“

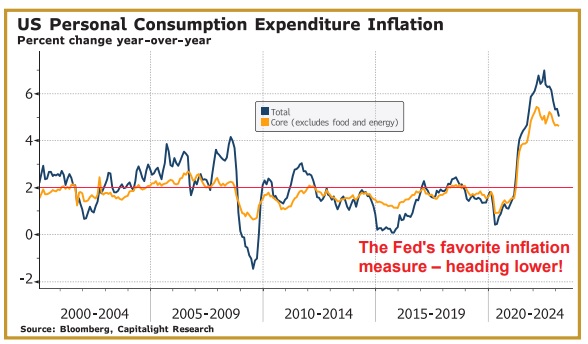

Is inflation coming down?

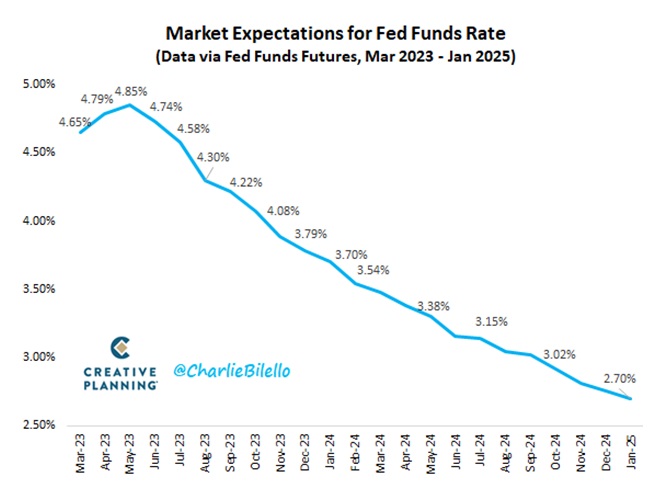

The PCE data Friday morning was about as expected and supported the idea that the Fed has “no reason” to raise rates aggressively. The forward interest rate market is now pricing in one more 25 bps bump in May, with rates falling after that, down ~50bps by December.

As noted in previous TD Notes, the market is now “fighting the Fed” in that the forward market is pricing a decline in short-term interest rates, beginning in June and throughout all of 2024, while Powell has repeatedly said that the Fed is NOT planning to cut rates this year. (He seemed to allow that rates might fall next year.) Does the market see inflation falling and/or a recession coming?

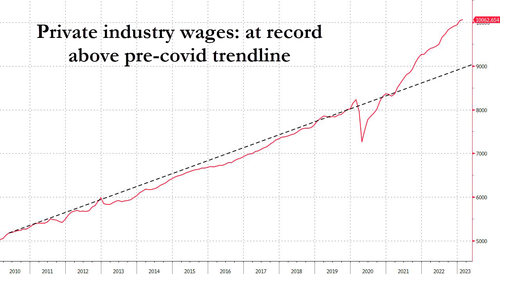

Through his words and his actions, Powell seems determined to get inflation and (especially?) inflation expectations down. Given the labour market dynamics, he may be worried that a wage/price spiral is possible and that it will be hard to squash if it does materialize.

The March American employment report (estimated ~+225,000) will be released on Friday, April 7 (Good Friday – markets will be thin), while the Canadian report date is April 14.

My short-term trading

I started this week long the S&P and short gold. The S&P rallied Monday, and I raised my stops. The market fell back on Tuesday, and I was stopped out for a 24-point gain. `The S&P rallied ~160 points from Tuesday’s lows to Friday’s close, but I didn’t re-load my long position. (I even went (briefly) short on Thursday, resulting in a slight loss!)

I stayed short gold all week – rolling my position from the April contract to June – the only position I held into the weekend.

Thoughts on trading

Have I mentioned before that trading is not a game of perfect? I have traded the stock indices from the long side over the last three weeks and have had relatively tiny net gains – compared to the ~300-point rally that happened.

My trading time frame was out of sync with my analysis time frame. (My analysis was that the “banking crisis” had created opportunities for a significant reversal – I wrote that babies had been thrown out with the bath water – but my risk management was on a “hair trigger” alert to the possibility of the “crisis” getting substantially worse.)

My trading time frame was “too short” because of “too tight” risk management strategies – “too tight” relative to my account size. One solution, in hindsight, would have been to take profits on quick gains rather than trail stops behind the market. Another solution would have been to use wider stops to catch more significant moves. (My stops could have been twice as wide and still have limited losses to a fraction of 1% of equity.)

The previous week I had similar problems getting stopped out of long WTI and long Mexican Peso positions – and not re-loading as those markets went substantially higher.

Trading can never be a game of perfect, but if I do an honest assessment of my trading, I believe I can improve my results!

On my radar

Money managers have been underweight stocks (anticipating a recession?) and have chased this rally. There was very strong market-on-close buying at Friday’s month-end close. The “pain trade” would be for stocks to continue higher.

I’ve stayed short gold, anticipating it would fall back if/when the “banking crisis” faded. So far, gold has sustained its gains, so I’ve moved my stops to breakeven. I’m NOT long-term bearish gold.

I had made a note to myself to buy CAD (see reasons above) but didn’t get it done – I saw long CAD as the “same trade” as long S&P.

Net speculative long positions in the Euro are at a one-year high. Given some of the “problems” I see in Europe (Paris on fire, Germany closing perfectly good nuclear power plants, Ukraine), I will look to get short Euro. The “double top” below 110 this week and last may signify a developing turn.

Inflation: I believe people realize that the prices of things they buy are rising much more than the CPI, and they will try to increase their income to “catch up” with rising costs. One way to “catch up” is to change jobs, another way is to demand a raise, and another way is to go “on strike.” With government fiscal policies embracing deficits, the purchasing power of currencies will continue to fall, and inflation will be sustained at a higher level than we’ve seen over the past twenty years.

The Barney report

Barney is a year and a half old, still a puppy in many ways, but he is learning to follow some commands – sometimes. I’m much more willing to let him run off-leash now than I was a year ago because he’s constantly checking to see where I am, and he will (usually) come back to me if I call him.

This is a classic Barney look. If you love dogs, you know exactly what’s happening here.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on April 1 on the Moneytalks podcast.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.