The Fed is likely done raising rates in 2023

Markets were focused on US employment data during the last week of summer, and after the JOLTS, ADP and BLS reports, the chances of another rate increase from the Fed this year fell to ~30%.

Since April, short-term and long-term interest rates have been trending higher in Canada and the USA but turned modestly lower this week.

The price action in the bond market on Friday had a “buy the rumour, sell the news” look, given the unexpected jump in UE from 3.5% to 3.8% – but it could also represent profit-taking ahead of the long weekend on the prospect that markets will open next week with a BANG – which means that whatever narratives were “popular” during the dog days of summer will be shoved aside as some “new thing” arrives with great urgency.

The Fed and the BoC have raised interest rates for the past 18 months to slow inflation, and both Central Banks have cautioned markets not to expect interest rate cuts until inflation is well on its way back to their target levels.

But throughout 2023, markets have persistently expected (hoped that) the CBs would stop raising rates. However, persistent inflation and more robust-than-expected economies have forced markets to keep extending the timeline for the first rate cut – “higher for longer.”

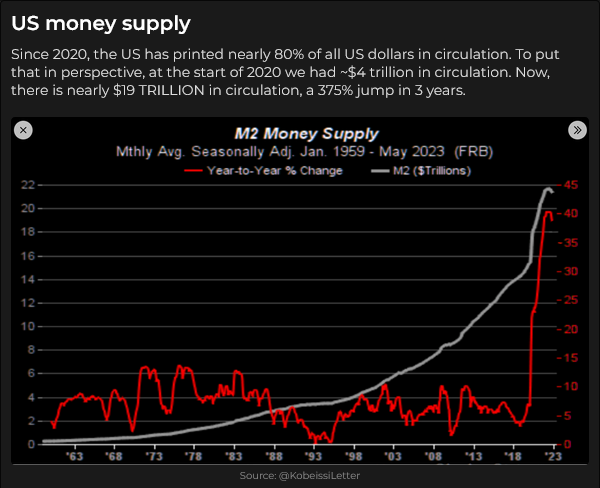

The Canadian and American economies may have been stronger than expected because of massive fiscal stimulus and debt-fueled robust consumer spending.

The Fed likely sees softening employment as KEY to lowering inflation (consumers won’t have the income to cover their increasing debt service costs – and will reduce spending – which will slow the economy and reduce inflation.)

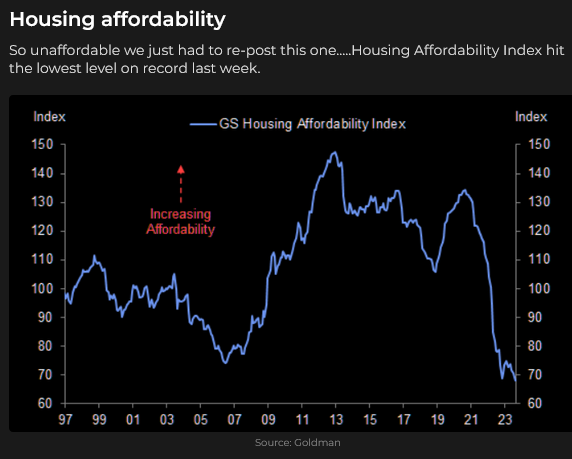

US credit card debt is now >$1Trillion, and interest rates on that debt are at record highs >20%. 30-year mortgage rates in the USA are at 20+ year highs.

Will the stock market see a slowing economy as good news or bad news?

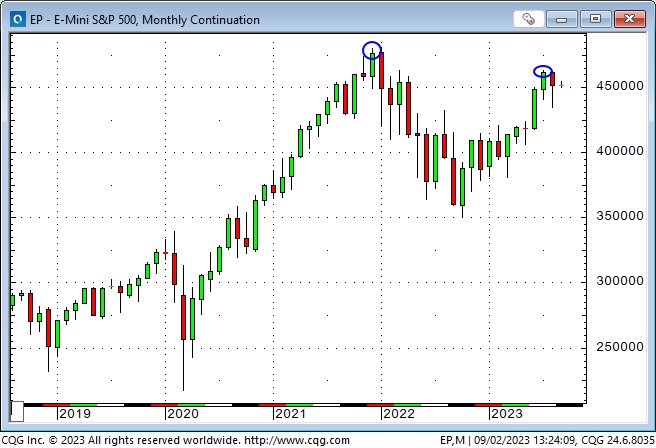

The S&P and the DJIA had their highest-ever monthly close in July (outside of December 2021) but closed lower in August despite a sharp rally in the last five days of the month.

The price action in the leading stock indices on Friday had a “buy the rumour, sell the news” look to it (just like the bond market), with prices hitting resistance levels and closing lower on the day.

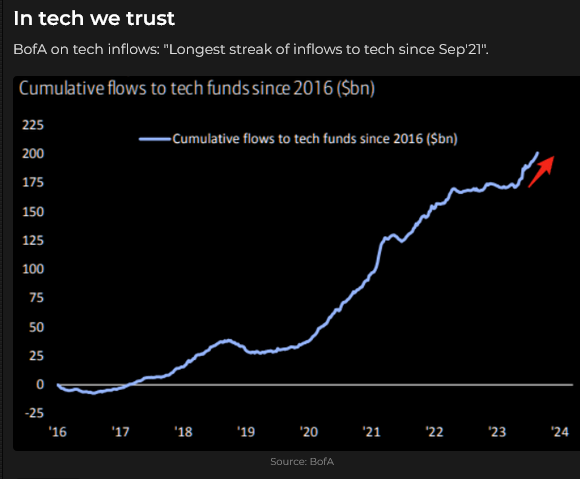

Overall, stock market sentiment seems bullish, but the enthusiasm for Megacap tech may mask weakness in the broader market – or do people buy Megacap tech these days as a “defensive” maneuver?

Stock market volatility metrics fell to four-year lows on Friday. Is that a symptom of complacency, or just what happens on a sleepy Friday afternoon at the end of summer?

The Toronto Stock Market Composite Index has gone broadly sideways since October – they need some Megacap tech stocks.

Currencies

The US Dollar index hit a 15-month low in mid-July but has closed higher for the past seven consecutive weeks.

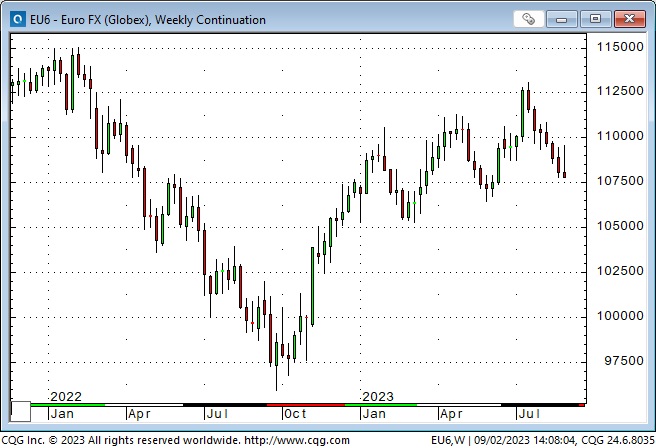

The Euro (the Anti-dollar) hit a 17-month high in mid-July but has closed lower for the past seven consecutive weeks.

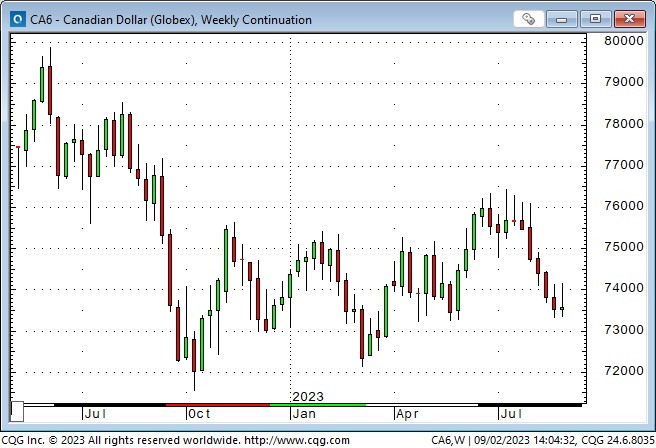

The Canadian Dollar reached a 10-month high in mid-July but closed lower for six consecutive weeks. The CAD barely escaped closing lower again this week following the announcement Friday morning of a much weaker-than-expected Q2 GDP. (The Bank of Canada won’t raise rates this coming week!)

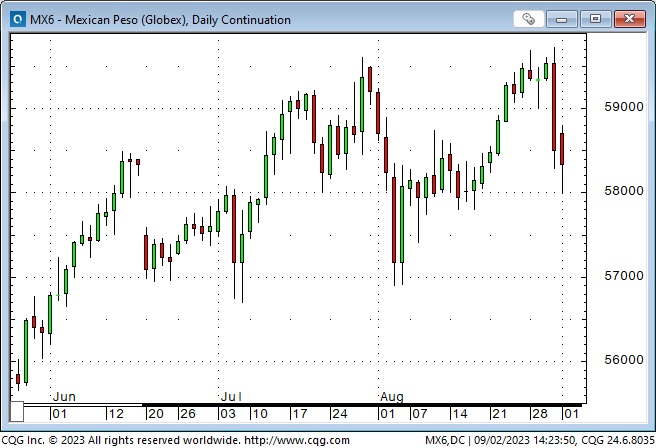

The Mexican Peso hit an 8-year high against the USD on Thursday (and has been the “strongest currency in the world” for the past year) but dropped as much as ~2% mid-day Thursday after the Banco de Mexico announced that they would cut a currency hedge program.

Gold

Gold dropped ~$120 from mid-July to mid-August as the strong USD and rising real and nominal interest rates created a toxic environment, but it rallied ~$60 the past ten days (perhaps inspired by softening real rates?)

Energy

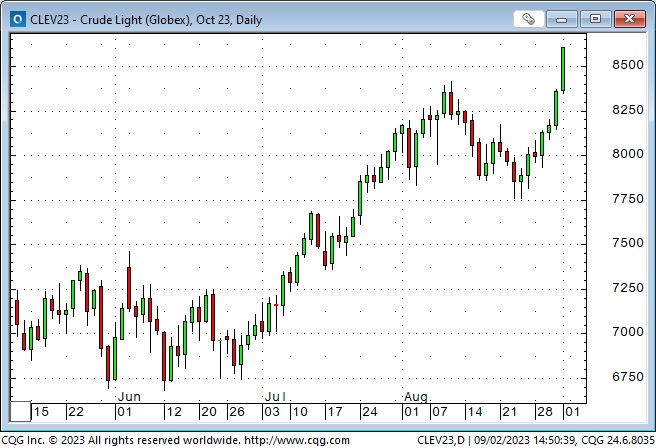

WTI crude oil rallied 6 of the last 7 trading days, gaining ~$8 (10%), and is up ~$19 (~28%) from mid-June lows.

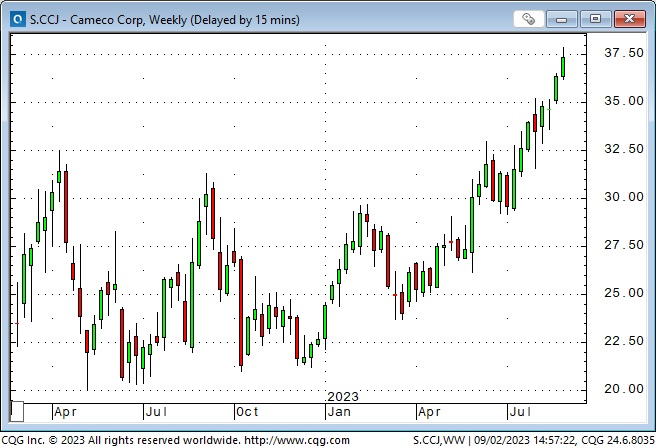

Uranium prices have rallied, and Cameco has soared to 11-year highs, up ~$15 (68%) YTD.

My short-term trading

I started this week-long T-Notes and CAD – positions I established Friday last week. (Both markets had been trending lower for six consecutive weeks, and I was looking for a bounce. I used small size and tight stops – I was going against strong trends!)

I was stopped on the short CAD (for a slight loss) near the lows on Tuesday. I rebought the CAD a couple of hours later as it rallied off the lows and covered the trade late Thursday (the profit was a bit more than the previous loss) as I wanted to reduce risk ahead of the UE and Canadian GDP reports Friday morning.

I covered the long T-Note on Friday for a gain of 42 points when the rally on the softer-than-expected UE data started to stall. (The market tumbled as much as 32 points from the early high – I was glad to be out!)

I shorted the MEX on Thursday morning when it rolled over after taking out Monday’s 8-year high. I thought the Peso was at risk of a correction (it had flown too high and fast), so I was looking for a good “setup” to get short. When it took out the overnight lows, I went short with a 20-point stop just below the early morning highs.

Minutes after I got short, the Peso tumbled over ~80 points from my entry level. I looked for a “reason” and found that the Banco de Mexico had announced they would cut their currency hedge program (whatever that meant!)

I kept the position into the weekend, lowering my stop to breakeven. (This may be a “turning point” for the high-flying Peso, so I don’t want my stop too tight.)

I shorted Dow futures on Thursday after the market made a new high for the rally that began last Friday but then reversed and fell below Wednesday’s close. I thought the rally in the stock indices from the previous week’s lows was vulnerable to rolling over, and the Dow looked the weakest of the group. I held the trade into the weekend.

I shorted gold on Friday after it rallied into resistance ~$1980 on the UE report (gold would love to see interest rates decline) but quickly fell back from those highs as the USD rallied against all currencies. I held that trade into the weekend.

I took another stab at buying the Yen on Tuesday when it rebounded from 9-month lows. I bought OTM options rather than futures (option volatility across many markets is historically cheap.) I was nicely ahead on the trade following the UE report Friday, but the trade was underwater by the end of the day, with the USD up sharply against all currencies. I kept the trade into the weekend because the options were practically worthless – so I’ve got a lottery ticket on a Yen rally!

All in all, my P+L had a good week. I de-risked into the long weekend, and I’m looking forward to the markets re-opening on Tuesday.

On my radar

Over the years, I’ve seen markets return after Labour Day with a substantial change in sentiment/narrative. I can’t quantify that, but I’d rather be relatively flat and be prepared for whatever happens rather than carry any BIG position into the post-Labour Day market.

The UAW contract expires on September 14, and the two sides seem a long way apart. Over the summer, I’ve written several times that we should expect more strikes as people try to “catch up” to rising costs.

There is a slowdown underway in China and Europe, especially Germany. Taiwan elections are scheduled for January.

I don’t know who to believe about “what’s happening” in the Ukraine war, but it doesn’t look like it will end soon, and I can imagine tensions soaring in a heartbeat.

The looming recession has been postponed, but if it looks like it will finally arrive, I can imagine the narrative quickly switching from the current “soft landing” to a “hard” one.

Congress will try to find some “middle ground” on several issues, especially spending, but I don’t think “middle ground” exists, especially as politicians jockey ahead of the 2024 elections.

In short, after a pleasant, low-volatility summer, I’m expecting more bad news than good this fall – and I acknowledge that’s not unusual for me.

Thoughts on trade sizing

I recently talked with an old friend who has been an active and successful trader for years. When I told him I have less than 10% of my net worth in my trading accounts, he said, without malice, “Oh, so trading is just sort of a hobby for you, right?”

I hadn’t thought of it that way, and I can understand why he would say that, but “hobby” was a bit harsh!

The truth is, I’ve purposely been trading what I call “chickenshit” size. In my multi-decade career as a commodity broker, I saw (and heard about) many people blowing up – losing everything. Friends took their own lives because of market losses.

I’ve seen markets move in ways and at speeds that nobody could have expected. I’ve been on both sides of those moves, and I’m grateful I wasn’t over-committed when I was wrong.

I keep saying that I make money from trading not because I’ve got a great crystal ball but because I’m good at managing risk.

I also kept my trade size small over the last three years because I’m “learning” how to make a living from trading rather than being a broker. (For many of my last 20 years in the brokerage business, I traded HUGE size for my client accounts and was almost always in the “Chairman’s Club.”)

My trading has been better this year (and I don’t just mean that my P+L is bigger), so I’m planning to increase my size this fall, but it will be incremental.

Jimmy Buffet

I had a few tears this morning when I learned that Jimmy died at age 76. I loved his music, and I saw him perform three times. I met him in 1983 in Tahiti. He was there to record the One Particular Harbour album, and I was on a Club Med vacation. He and his band were playing at a tiny venue in Papeete, so I flew over from Morea to see the performance. I had a cheeseburger in paradise with his band before the show.

The following day, I went to the small airport to fly back to Morea and saw Jimmy ordering a cafe au lait and a pastry (in reasonably good French!) We got to talking and sat together on the 15-minute flight. He wanted to see The Bounty (Dino De Laurentiis was filming a remake of Mutiny on the Bounty in Morea with Mel Gibson and Tony Hopkins.)

I told Jimmy I’d been listening to his Changes in Latitudes album on my Sony Walkman on the beach at Club Med, and he gave me a cassette of some of the songs he had recorded for his new album. Then he suddenly said, “I can’t give you that; it’s the only one I have!” So I gave it back.

He said the “real” reason he was in Tahiti was so his daughter could tell her little friends she got to go to Bora Bora for her birthday.

I’ve been thinking lately that I should visit some of my old (and older) friends; Jimmy’s death has inspired me to get started on that.

The Barney report

The endless summer has continued here on the Island, and Barney and I have been out for off-leash walks almost every day. (We walk him thrice daily, but he needs to go to a safe place to be off-leash.)

Between walks, he has several different “resting places” around our house, but he loves to get comfy around my desk or my bed!

Listen to Victor talk about markets

On September 2, I talked with Mike Campbell on his Moneytalks podcast about this week’s action in the credit, currency and stock markets. You can listen to our discussion here. My segment with Mike starts around the 59-minute mark.

On August 25, I did a 30-minute interview with Jim Goddard on This Week In Money. I discussed the Key Turn Date in July that led to bond yields and the USD rising for six consecutive weeks. We also discussed the developing troubles in China, the Nivida quarterly report, Jackson Hole, the Tucker Carlson/ Donald Trump interview and the trades I’ve been making. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.