Will the Fed pause/pivot before or after “something breaks?”

The Fed is determined to continue tightening monetary policy until inflation falls. Stocks and bonds have fallen sharply, and the US Dollar has soared as inflation has remained “hot” despite the Fed’s continued efforts.

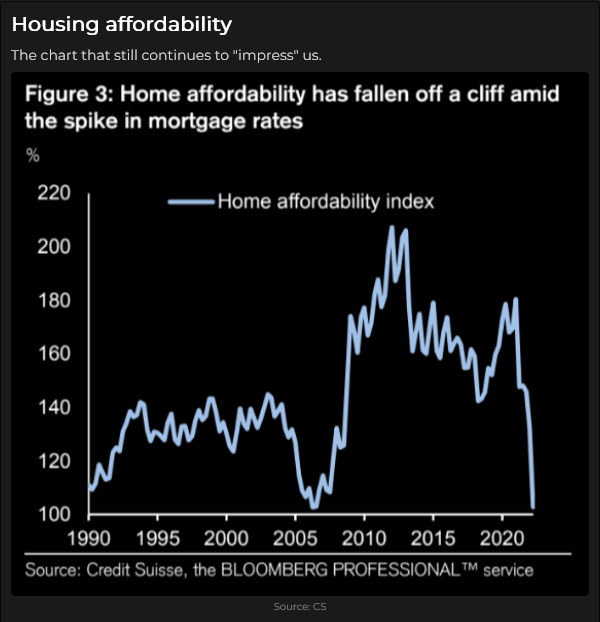

The market “knows” (and we assume so does the Fed) that “something will break” as a result of sustained, aggressive monetary policy. Mortgage rates at 7%, for instance, are having more than a “dampening” impact on the formerly red-hot real estate market.

The thing we don’t know is “what” will break and whether it will be significant enough to cause the Fed to “back off.” (Somebody or some company, or some industry or some country is badly “offside” because of the dramatic rise in interest rates and the US Dollar – so far they have remained below the market’s “radar,” but a “black swan” will be discovered and the markets will “front-run” a possible Fed pause/pivot.)

It’s possible that nothing breaks, the economy slows down, inflation rolls over as supply/demand issues come into balance, and the Fed “pauses” to see what happens next. This is the “soft landing” scenario, and as unlikely as it seems, it may happen.

Many Fed critics foresee a “hard landing” scenario, wherein Fed policies have little impact on inflation but crash the (global) economy into a nasty recession – which would cause a dramatic “pivot” in Fed policies!

Markets are in “hunkering down” mode

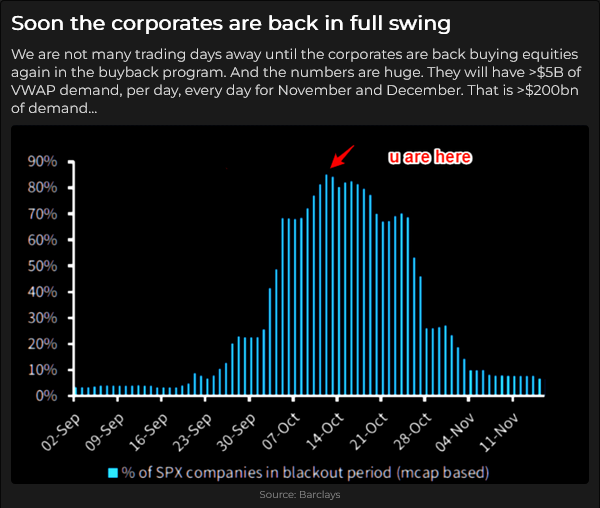

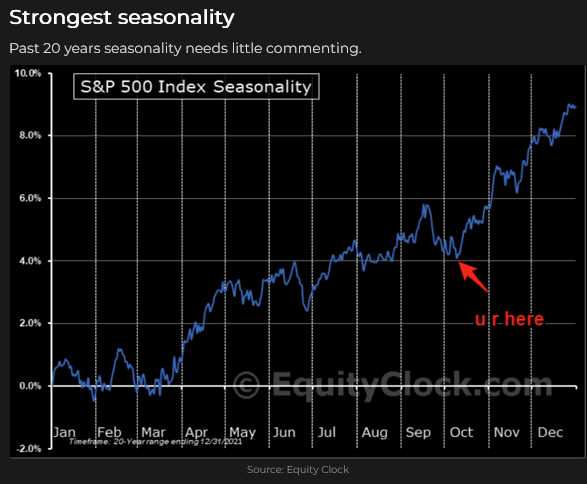

The leading stock indices have trended lower YTD (with a few dramatic bear market rallies en route) and are now back to their levels when Biden was elected two years ago. Earnings season began this week, with expectations that companies will be dialling back future expectations. Corporate buybacks are expected to gradually resume over the next couple of weeks as the market enters the “seasonally” strongest period of the year.

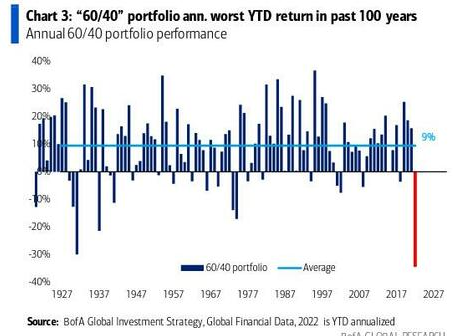

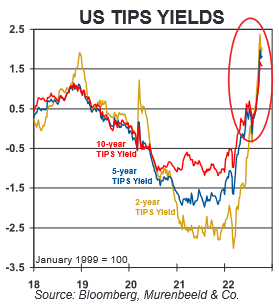

The bond market decline has been steeper, with 10-year Treasury yields closing this week above 4% for the first time since October 2007 – fifteen years ago. The Fed is selling bonds – reversing their previous QE policies, and governments are planning to issue bonds as they step up fiscal stimulus and support programs.

The combination of falling stocks and falling bonds has been dreadful.

The Utilities ETF hit All-Time highs five weeks ago, then plunged ~22% to 18-month lows this week.

The US Dollar rally that started two weeks before Biden’s inauguration in January 2021 has accelerated this year as capital flowed to America for safety and opportunity and the Fed was seen as the most aggressive major central bank.

The Canadian dollar has fallen >5 cents in the last five weeks and is down ~13% from the 6-year highs made in June last year.

The Euro is down ~22% from last year’s high.

The Yen is down ~30% from last year’s high – hitting a 32-year low this week as it ripped through levels where the Japanese government intervened to support the currency last month. The extreme weakness in the Yen “opens the door” for other Asian currencies to fall against the USD even though “old school metrics” show that Asian currencies are grossly under-valued relative to the USD.

The New Zealand dollar is down ~26% from last year’s highs, and the Aussie is down ~22%. (Canadian snowbirds might consider heading Downunder this winter instead of going to the US or Mexico.)

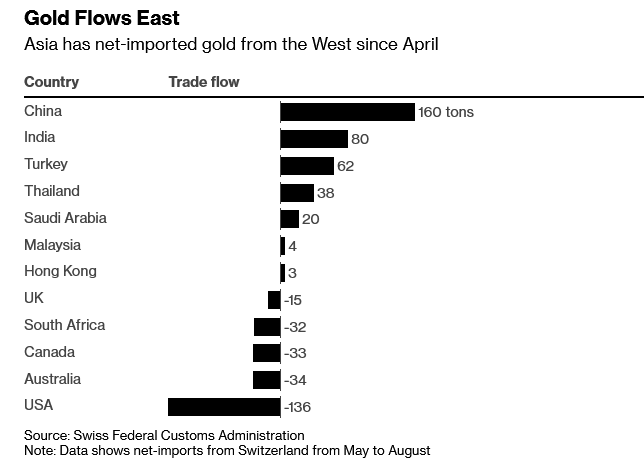

Gold has fallen ~$450 (21%) to a 30-month low after hitting All-Time highs on the Russian invasion. Positioning in Comex futures and global gold ETFs shows investors have lost interest in gold. Managed money accounts are net short gold on the Comex – a rare event that has previously foreshadowed a rally. Soaring real interest rates and the strong USD remain toxic for gold.

WTI crude oil futures had a steep ~$18 rally off the late September lows but gave about half of that back this week.

My short-term trading

I bought the S+P, gold and the Euro on Tuesday, looking for a bounce after those markets had fallen sharply the previous few days. I got enough of a bounce to raise my stops to around breakeven, but then BoE Governor told the UK pension fund industry that they had three days to fix their problems ( the BoE was not deviating from their tightening mode), and markets fell hard. My stops got me out with slight net losses.

I did nothing on Wednesday before the CPI report scheduled for early Thursday.

The CPI report was hotter than expected. Stocks fell sharply (The Dow futures dropped ~750 points in five minutes), while interest rates and the USD rocketed higher.

About an hour after the CPI report and after the “day session” had started, I bought the S+P and gold, looking for a bounce. The stock indices soared to make new highs for the week, and gold rallied a bit. Near the end of the floor session, I decided to take profits on both positions. I thought I had caught a big bounce in the S+P, which had been trending lower, so I should take profits rather than stay with the trade. If the S+P had been trending higher, I would likely have kept the position.

I made about 90 points on the S+P but only made a couple of dollars on gold. (I bought gold because I expected the USD to weaken as stocks soared, and gold gave me a “short USD” trade without “country risk.”)

After the Thursday floor session closed, I had second thoughts about getting out of my long S+P, so I repurchased it. I thought if the market rallied up through 3750, it would ignite more buying. (Sentiment and positioning had been very bearish – a rally above 3750 might have set off a short-covering run.) The S+P rallied overnight (but didn’t get to 3750), and I raised my stop to near breakeven. I was stopped for a slight loss when the Friday day session started and was glad to be out as the market fell all day – giving back about half of the Thursday rally. My P+L had a good week, and I was flat going into the weekend.

On my radar

There is a lot of stress across markets. Volatility is high; liquidity is thin, sentiment and positioning are very bearish, and many markets have had extreme moves. Markets have been hunting for “Peak Fed” for a few months without success, which leaves them in a “fragile” condition – which means they are vulnerable to violent short-term moves, which may happen with seemingly little provocation. Buyer beware.

Without getting too fancy, I think we are simultaneously transitioning to a “new world” on several fronts. Our “old school” way of measuring risk or understanding how things work will be a handicap rather than a benefit. Please take five minutes and read this excellent interview with Russell Napier to get some idea of what I mean by transitioning to a new world.

You could say that “it’s never different this time,” and I won’t argue with that; there are always good trading opportunities if you’re willing to look for what “is” happening rather than what you think “should be” happening.

I watch inter-market relationships – how markets trade relative to other markets. Soaring interest rates seem to be the driving force across markets, but (and this may be a personal bias) I think the soaring USD might be a dark horse, might be the cause of something BIG breaking, which would set off a chain of events (a Fed pivot) which would lead to trend reversals across markets.

I wonder if other pension funds (outside the UK) were using similar strategies to “hedge” interest rate risk. The problems caused by those strategies (and I don’t think they are solved) may have been unique to the UK. Still, pension funds pay attention to (and sometimes copy) what other pension funds are doing. Given the dismal performance of key pension fund assets YTD, I wouldn’t be surprised if the UK pension funds were the proverbial canary.

Quote of the week

“The risk of recession is far, far greater than the risk of uncontrolled inflation.” Jeremy Siegel, Professor of finance at the Wharton School

A quick word about next week’s Trading Desk Notes

I will be in Calgary next weekend at Josef Schachter’s annual energy conference. I’ll have my laptop with me, working out of a hotel room, so I suspect the Notes will be shorter than usual.

The Barney report

We continue to have a fantastic “Indian summer” on Vancouver Island, so Barney and I keep having long, off-leash walks in the afternoon sunshine. Barney developed quite a taste for blackberries over the past few months, and he will eat them right off the vine if he gets the chance, but he prefers to have Papa picks great big juicy ones and feed him by hand.

Speaking of food – I was preparing dinner last night – steak and salad – and when I went to the fridge for a moment, Barney grabbed my raw steak off the kitchen counter and ran away. We cornered him in the living room, and I got my steak back, with Barney looking very sheepish. There’s never a dull moment with a dog in the house!

Victor will be in Calgary October 20 – 22 to attend Josef Schachters’s Annual Energy Conference

The conference will run all day Saturday, October 22, at Mount Royal University in Calgary. Josef and his team have organized a fantastic conference, and if you have any interest in the energy markets, I highly recommend that you make plans to attend. Get all the info you need

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The October 15 podcast, with Paul Beattie as Mike’s special guest, is at: https://mikesmoneytalks.ca.

I did my regular 30-minute monthly interview with HoweStreet Radio yesterday. I talked about the macro markets I trade. Ross Clark and Marty Armstrong were also on the program. You can listen here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.