Wicked bipolar sentiment swings across asset classes this week

The DJIA was upbeat early Monday, building on last week’s late rally and hit 12-week highs. But then, more bad news from the banking sector started to spread, and the DJIA closed at the day’s lows. The banking worries intensified as the days passed (KRE fell to two-and-a-half-year lows, down ~56% from 2022 All-Time Highs), and even with the FOMC signalling a likely “pause” on Wednesday, the DJIA was down >1,350 points from Monday’s highs to Thursday’s lows – which were the lowest levels since late March.

But AAPL’s quarterly report saved the day after Thursday’s close with beats across the board and an announced $90 Billion share buyback program. AAPL jumped ~$10 (6%) from Thursday’s low to Friday’s high. The weekly close was the best in 13 months. (For perspective: AAPL’s market cap is ~$2.75 Trillion. The $90 Billion share buyback is larger than the market cap of >80% of S&P companies!)

The DJIA gapped higher Friday morning as Megacap tech fuelled a return of bullish sentiment. The stronger-than-expected employment report (UE at a 50-year low of 3.4% likely means the Fed will be “higher for longer”) caused a brief pause in bullish enthusiasm, but stocks across the board, including the banking sector, closed green on the day.

Volatility metrics hit an 18-month low on Monday, spiked to a 6-week high by Thursday, then fell like a stone on Friday as stocks rallied.

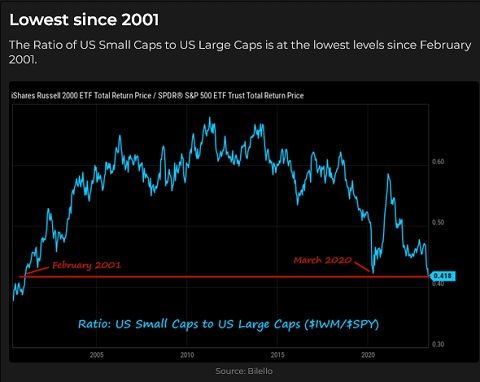

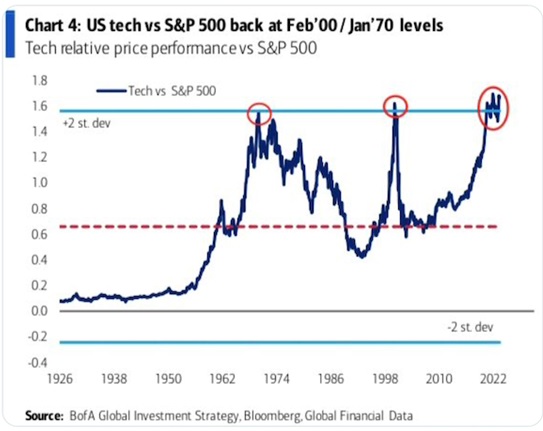

Megacap tech IS the stock market

The big question: can an Index rally driven almost entirely by a handful of Megacap stocks be sustained? The answer: so far, so good.

AAPL is up ~$50 (40%) from early January lows, and MSFT is up ~$90 (41%). The average PE on the seven Megacap tech stocks is ~30X and ~16X on the other 493 S&P stocks.

What could possibly go wrong? Well, an Asian geopolitical event. A recession. A Black Swan – for instance, an essay in the weekend FT, “Apple Is A Chinese Company,” might make some folks nervous about Apple’s “pristine” reputation.

Money market funds had net inflows of ~$100 Billion over the past two weeks, with total assets rising to new All-Time Highs above $5.3 Trillion.

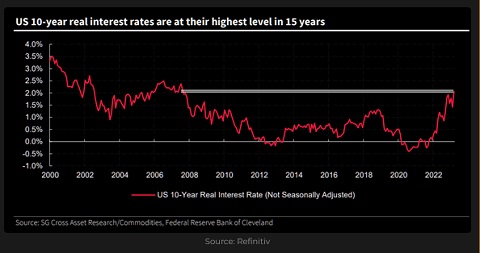

Interest rates

The heads of the ECB, the BoC and the Fed all signalled this week that getting inflation down to targets will take “some time,” but they are “determined” to get inflation down – even if it means higher interest rates. As expected, the FOMC and the ECB raised rates by 25 bps, with Fed funds now at the highest level since 2007. The American debt-to-GDP ratio is now twice what it was in 2007 (so the consequences of raising interest rates so sharply may be more “profound.”)

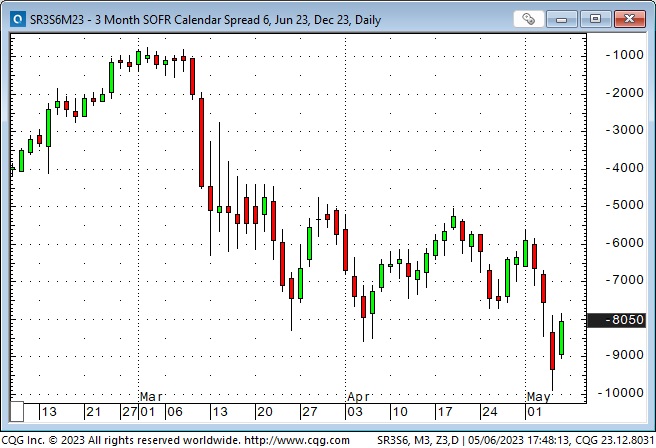

Fed Chair Powell and Bank of Canada Governor Macklem suggested they don’t expect to cut rates this year despite markets pricing such cuts. The SOFR futures market is currently pricing December 2023 rates ~80 bps below June 2023. The Canadian BA futures markets are pricing December 2023 rates ~35 bps below June 2023.

Why are markets’ pricing rate cuts in H2 2023 when the central bank heads say it won’t happen? Perhaps the markets are pricing in the “chance” that “something else breaks” due to the sharp increase in rates after a decade of near-zero rates. Perhaps markets are pricing in the “most anticipated recession ever” hits in H2.

Currencies

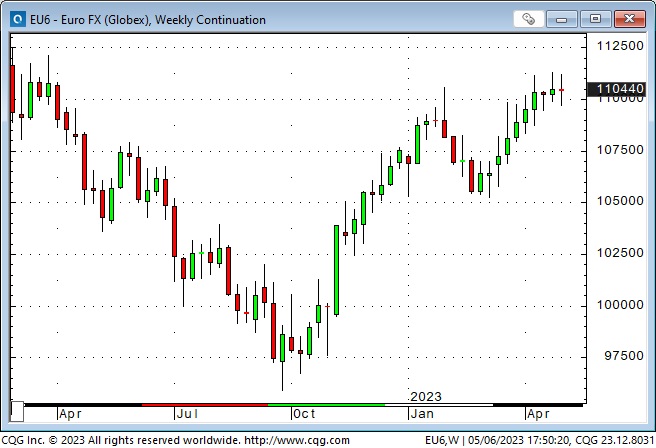

The US Dollar index had its lowest weekly close, while the Euro (the AntiDollar) had its highest weekly finish in over a year this week.

The Euro has trended higher against ALL other G10 currencies since late last year and has, by far, the largest net long positioning against the USD.

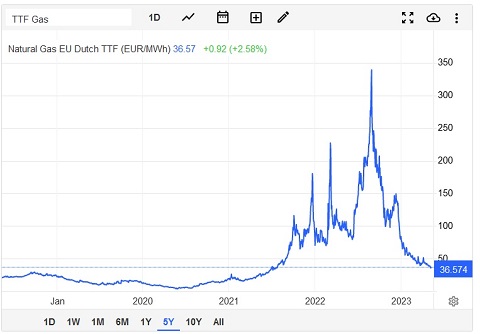

I wonder if the Euro rally from 20-year lows last September was a bounce-back from over-sold levels (the British Pound has just hit 37-year lows against the USD, and the Yen was at ~32-year lows against the USD) in combination with a re-assessment of the prospect of Europe “freezing to death in the dark” because of energy scarcity and high prices. (See the chart of European Natgas below. Nat gas prices had fallen ~50% from August highs by early October when the Euro began to rally.)

The Canadian Dollar fell on Tuesday as “risk off” sentiment hit all markets but turned higher on Wednesday and Thursday and then “rocketed” higher on Friday following 1) Macklem’s “determined to get inflation down” speech Thursday afternoon, 2) much stronger-than-expect Canadian employment data Friday morning, 3) strong “risk-on” sentiment in the stock markets on Friday post the AAPL report, and 4) likely heavy short-covering from speculators who have recently held a huge net short position against the CAD.

The CAD usually has correlations with 1) stock market risk sentiment, 2) commodity prices, especially energy prices, and 3) the US Dollar (if the USD is up against most currencies, it is likely also up against the CAD), but this week it was difficult to see what (if anything) CAD was correlated with!

Energy

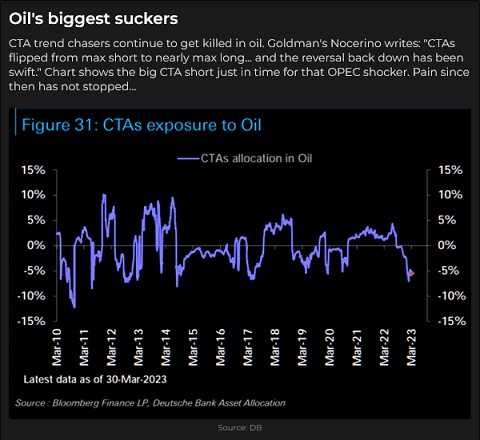

WTI crude oil gapped ~$5 higher following the “surprise” OPEC+ production cuts announced over the weekend at the end of April, but within three weeks, WTI prices had “closed the gap” and kept falling. The momentum of the breakdown accelerated this week, with prices falling ~$12 (16%) from Tuesday’s high to Thursday’s low, then rebounded on Friday, closing ~$8.5 (13%) above Thursday’s low.

Thursday’s low was made in thin late afternoon trading when the “bottom fell out.” Prices plunged ~$4 and rebounded $3 within a few minutes.

I’m always interested in how traders are positioned in different markets. Apparently CTA trend followers have not had a good time lately in the choppy crude oil markets.

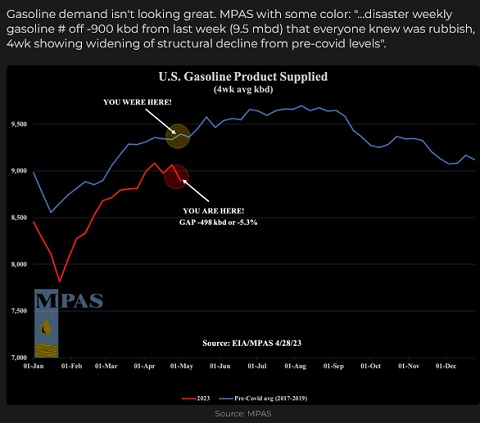

Gasoline and heating oil (diesel) prices declined from the post-OPEC+ production cut highs even more dramatically than WTI as American transportation fuel demand remained below pre-covid levels.

American natural gas prices are down ~80% from last year’s highs.

European Natgas prices are down ~90% from last year’s highs.

Commodity indices

The Goldman Sachs commodity index is heavily weighted with energy products which helped drag it down to 18-month lows this week. The commodity indices have declined since last fall, even as the USD has trended lower.

Gold

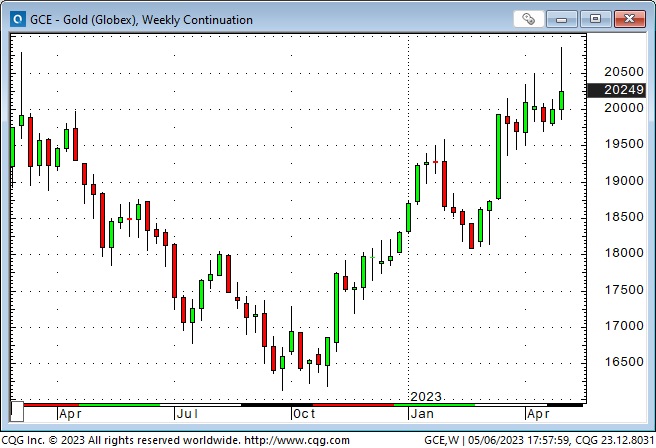

Gold has rallied>$450 (27%) from last November’s lows as the USD trended lower. Reports of substantial central bank purchases have helped fuel the rally.

Comex gold futures briefly (two minutes) traded to new All-Time highs ($2,085) jumping ~$35 in 2 minutes in thin late-afternoon trading on Wednesday (the same time WTI prices spiked to new lows.)

Comex gold futures dropped nearly $80 from the Wednesday overnight record high to Friday’s low (the robust American employment data Friday morning increased the chances of the Fed staying “higher for longer.”)

Comex open interest rose ~50,000 contracts in the last week. This may indicate that speculators are aggressively chasing this market higher.

In this week’s Gold Monitor, my friend Martin Murenbeeld notes, “Correlations of gold with the dollar and gold with the 10-year TIPS yield have declined significantly in recent weeks! This strongly suggests that gold is reacting to other factors in the environment – i.e., banking problems, central bank demand and debt limit issues.”

I will host the Moneytalks podcast on May 13 (Mike Campbell will be on vacation), and Martin Murenbeeld will be my feature guest. If you’re interested in gold, be sure to listen!

Thoughts on Trading

I’ve been a Stan Druckenmillar fan for decades. Here’s a link to an 18-minute conversation he had recently with the head of Norges Bank Investment Management. I love to hear Stan’s thoughts on trading!

Here’s a great screen shot of some “trading rules.” You don’t have to cynical to be a good trader – but it helps!

My short-term trading

I started the week flat and shorted the CAD on Monday. I’d had a good run short the CAD the past two weeks, and it had bounced into resistance, so I got short. I covered the trade Tuesday for 40 points.

Because I was short the CAD, I did not short the S&P (they are often highly correlated), but I shorted the S&P Wednesday twice and came out money ahead.

I reshorted the CAD on Wednesday but was stopped for a 20-point loss on Thursday.

I was flat at Thursday’s close (ahead of Canadian and American UE reports early Friday morning) and stayed flat into the weekend.

My P+L had an uneventful week, despite the market’s wild swings. I’m OK with that; I may find more trading opportunities next week!

On my radar

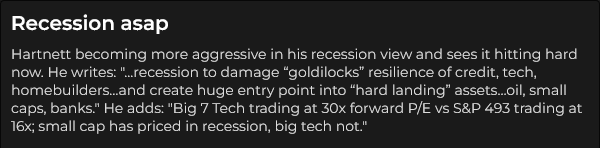

Michael Hartnett is Managing Director and Chief Investment Strategist at BofA Merrill Lynch Global Research. He is often called Wall Street’s biggest bear, but he has been “very right” in many of his market “calls” over the last year.

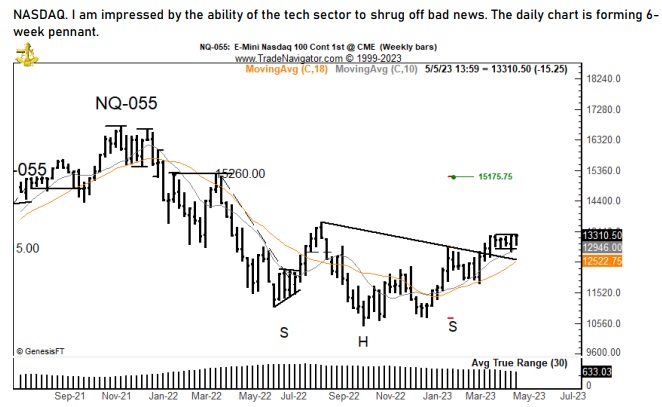

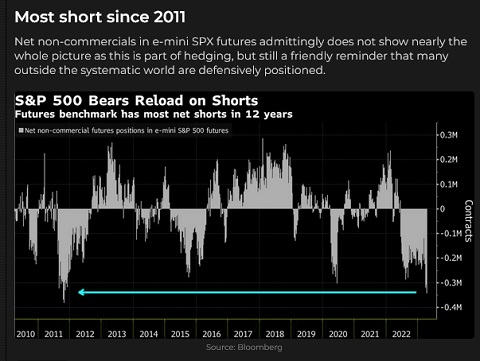

My bias is that the stock market is more likely to have a big break than a big rally, but I’ve got to be patient and pick good entry points. This chart and comment from Peter Brandt make me realize I could be wrong!

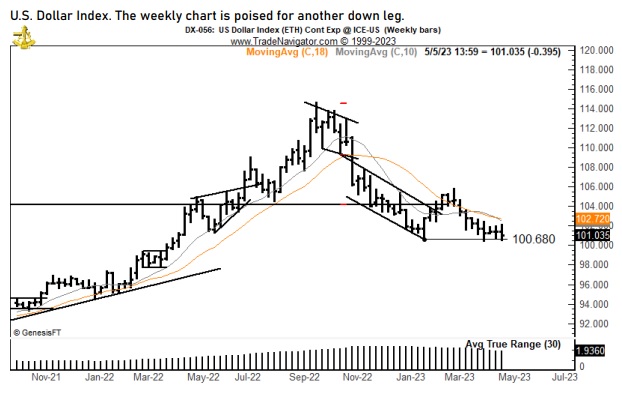

My bias is that if markets go into “risk-off” mode, the USD will rally, especially against the Euro, but this chart from Peter Brandt makes me realize I could be wrong!

The Barney report

Barney and I are home alone again this weekend, with my wife in Vancouver visiting family and friends. We had a great walk in the forest yesterday (he loves chewing on a good stick), and he was on my bed early this morning, ready to play a little ball before breakfast!

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on May 6 on the Moneytalks podcast. Our session starts around the 1.08 minute mark. (I also interview Ozzy Jurock about the real estate markets starting at the 57 minute mark.)

I recorded a 30 minute interview with Jim Goddard for This Week In Money on May 6. I talked about my Macro views as well as my thoughts on several different markets that I trade. I also had some “practical” advice for traders who are “new to the game!” You can listen here. My interview starts at the 42.15 minute mark, following Ross Clark and Martin Armstrong.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.