Stock market sentiment is extremely negative – with good reason!

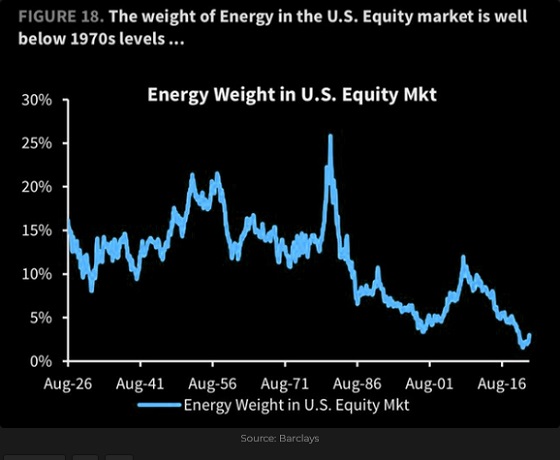

The leading stock market indices have closed lower for seven consecutive weeks (the DJIA is down for eight straight weeks – its worst in 90 years.) The S+P was briefly down >20% from ATH on Friday before rallying into the close. Virtually all sectors, save energy, have been falling. Estimates of global stock market losses = ~$25 Trillion, or more than one full year’s GDP of the USA.

Liquidity is thin (as people back away), volatility has been wicked, and short-term price action has been astonishing ( the DJIA fell nearly 1,000 points early Friday, then rallied back about 700 points into the close.)

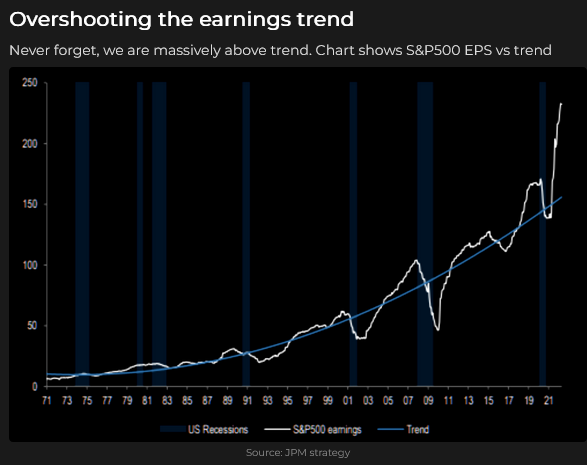

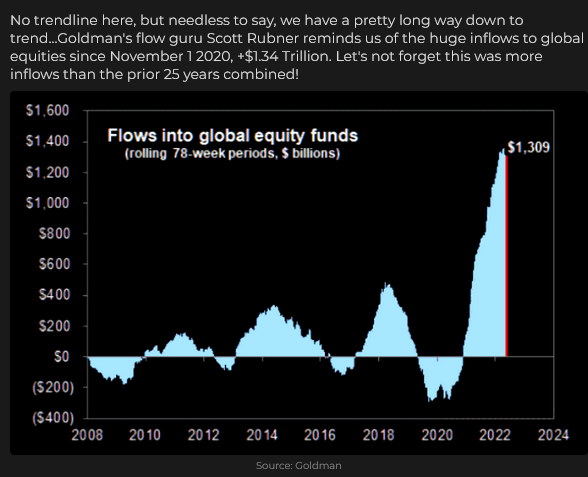

The S+P doubled from the 2020 lows and is up ~7X from the 2008 lows. Perhaps a correction was due after such spectacular gains.

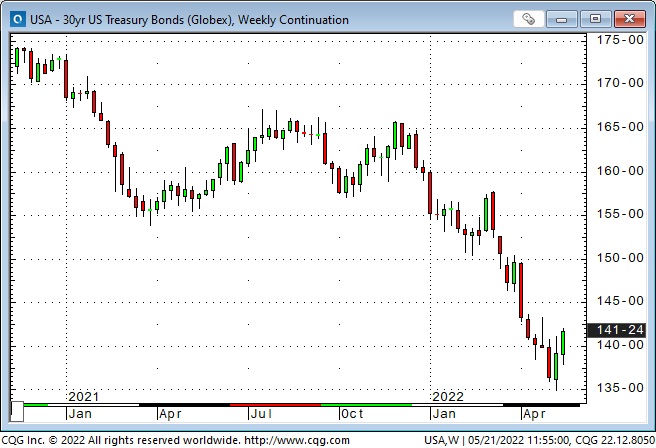

The 40-year trend of lower interest rates helped boost asset prices

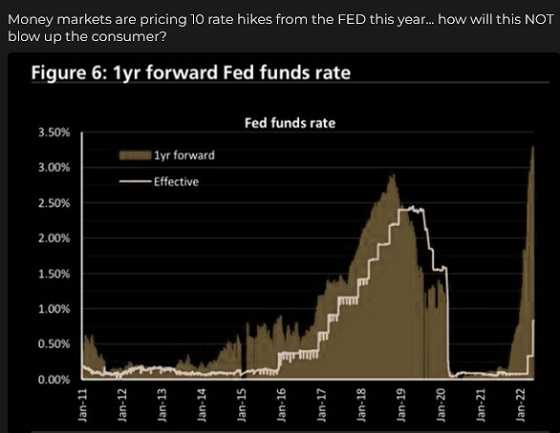

Interest rates hit > 1,000-year lows in the summer of 2020 (when the US Treasury yield hit 0.50%) but have been trending higher since then, with a strong leg higher beginning last fall when the market started to price in central bank tightening even as the Fed talked “transitory.”

In this chart, falling bond prices = higher yields.

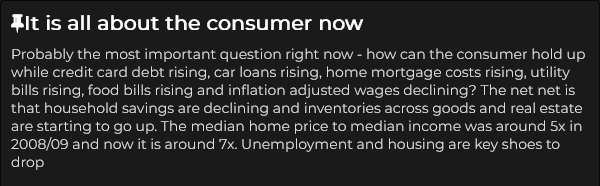

The Fed now seems determined to cool inflation (“there will be pain, but the pain will be much greater if we don’t bring down inflation”), and the market now fears the Fed will tighten into a recession.

The forward market more than fully priced in this Fed tightening cycle and has corrected. The June 2023 Eurodollar future hit a low of ~9625 on May 4 and has backed off 50 bps. The 10-year Treasury yield topped out May 9 at ~3.12% and has backed off to around 2.8%.

Who suffers as the Fed fights inflation?

In previous blogs, I’ve wondered if the Fed would be willing to “throw the stock market under the bus” to cool inflation – especially given that inflation would be a HUGE issue heading into the mid-term elections. A falling stock market tightens financial conditions, so in that respect, the Fed is probably OK with the recent decline.

Full employment is part of the Fed’s mandate, but job losses are coming because the Fed wants to cool inflation by reducing demand. The Fed would like to arrange a “soft landing,” but they admit that may be beyond their control.

As Richard Russell used to say, “Everybody loses money in a bear market.”

The US Dollar Index hit 20-year highs but has fallen back

Capital flows to the US Dollar in times of trouble, and it also flows to the USD in search of opportunity. The recent strength of the USD reflected both of these motivations. The combination of a risk-off environment and the perception that the Fed would raise interest rates more aggressively than other central banks contributed to the 7% rally in the USDX from late March to mid-May.

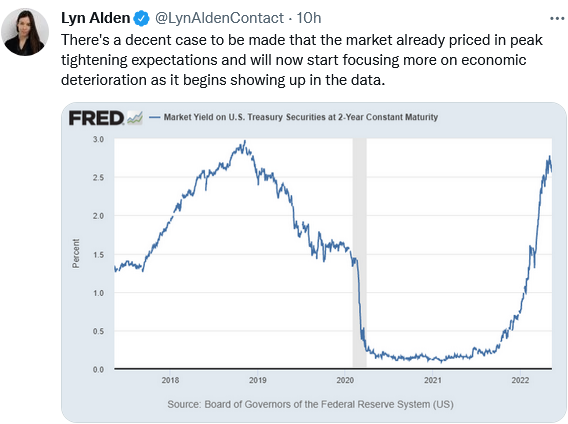

But this week, the correlation between intense risk-off sentiment and a rising USD reversed: stock indices fell sharply (risk-off), but so did the USD. Perhaps the market senses that “peak tightening” has already happened and/or the stunning recent strength of the USD was overdue for a correction.

Are recession worries cooling energy prices?

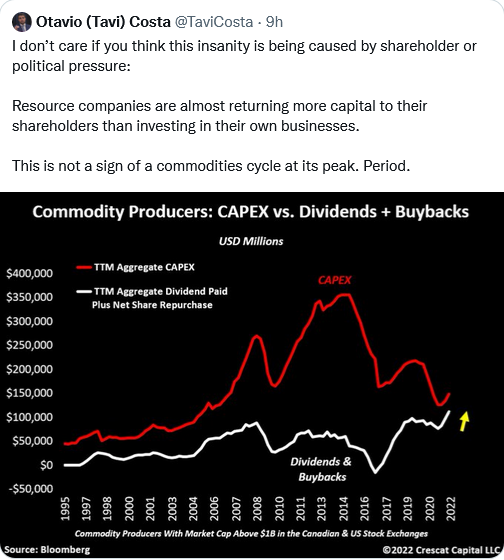

The bullish energy narrative has been powerful, and prices have soared. Demand has risen, but the prospect (and the current reality) of supply shortages have driven prices higher. OPEC continues to raise its production targets, but it cannot deliver on those targets while warning that spare production capacity is tight.

I’ve written many times about ass-backward government energy policies having expensive consequences, but the sad reality is that energy production can’t meet demand without a recession.

One thing that seems inevitable: a lot more money will have to go into the energy markets to increase production – from all sources.

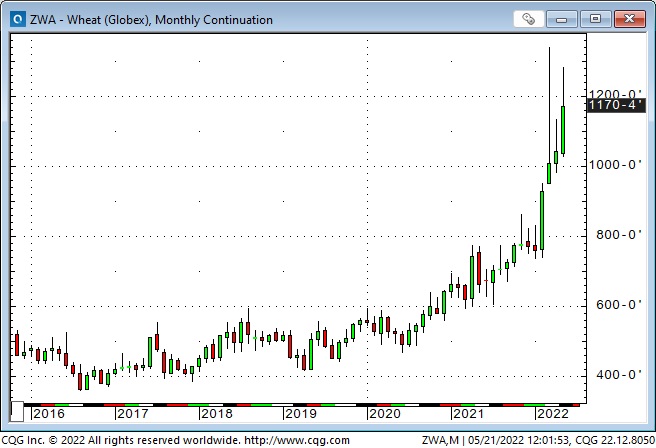

Food shortages?

The Economist cover this week was “The coming food catastrophe.” Although the Economist (and other magazine covers) have a history of signalling market reversals, they may be right. I sincerely hope they are wrong, but there is a real risk of food shortages that could bring unimaginable consequences.

My short-term trading

I started this week flat but thought that stock indices and the USD might reverse recent trends. In last week’s notes, I wrote that I would buy the CAD if sentiment turned risk-on.

I bought the CAD and stock indices (S+P and Russell) several times this week. I traded small positions with tight stops; I had a couple of good winners but took several small losses.

At the end of the week, my P+L was down 0.50%. On Friday, I bought the S+P 30 points off the low and remained long into the weekend (still thinking that this market is going to bounce!)

On my radar

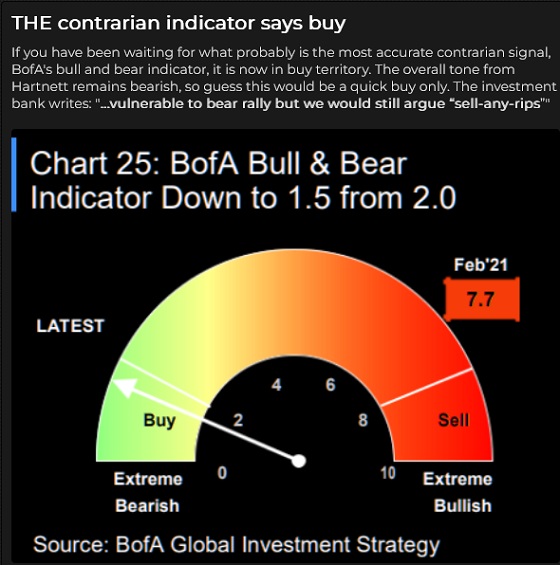

Equity market sentiment is extremely negative, and any sign of a bounce could lead to a swift bear market rally. I will be looking for some follow-through to the late Friday rally. There are seven trading days left before month-end. I expect to see significant rebalancing (buying) from pension funds and mutual funds. Corporate buybacks could also be a factor.

On Friday, the S+P briefly broke below a double-bottom (took out a wack of stops?) but swiftly rebounded above that support level. A failed breakdown may signal a rally.

The weakness in the USD this week, especially when risk-off sentiment was so strong, may signal a change in trend.

Thoughts on trading

This week was an example of playing good defence. I was fundamentally wrong to think that risk-off sentiment was due for a bounce, but my risk management limited the damage to my P+L.

Trading is clearly not about economics; it is about psychology, and the market’s mood got darker this week, not brighter.

What is “Risk Management?”

One of the great benefits of writing this blog is that I get terrific questions, comments and suggestions from readers I would otherwise never meet. This week a reader in Poland asked, in essence, what do I mean when I say that I make money from managing my risks, not from having a great crystal ball.

The more I thought about his question, the more I realized it was a great question, so I will write about different aspects of risk management every week.

Here’s my (edited) reply to his question:

My risk management style has changed over the years. For instance, in the early 1980s, when I was a currency analyst for a large American commodity firm, I traded very aggressively – that is, I took much bigger positions (relative to my account size) than I do now.

I also believe that each trader has to find a style of risk management that suits their personality and trading style.

Risk management defines a trader’s style – its essence is to “live to trade another day.” Since “anything can happen,” I deal with probabilities, not certainty; I want to organize my trading to limit losses.

I will give this some more thought, and I might create a new “Risk Management” section in my TD Notes. Thank you for giving me that idea!

The Barney report

I take Barney for two types of walks: He gets two or three 20-minute walks throughout the day so that he can stretch his legs and do his business, but I also take him out for a “long” walk, never less than an hour, and usually to a place where he can run off-leash. He likes the forest trails, and lately, he’s been investigating the creeks. So far, he has only been wading, but I expect sometime this summer, he will go swimming for the first time. Another milestone!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The May 21 podcast is available at: https://mikesmoneytalks.ca.

I also did my monthly podcast on Howe Street Radio last week. You can listen to the May 14th 37-minute interview here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.