“Don’t fight the Fed,” they say, but what will the Fed do?

The markets understand that the Fed is determined to cool inflation by raising interest rates another ~125bps between now and December. But then what? The forward markets see the Fed beginning to cut interest rates in early 2023, likely in response to recessionary pressures. But if inflation stays high and employment remains strong, the Fed will keep raising rates.

Markets are searching for the “Peak Fed” moment

If you believe markets have “fully-priced” future Fed tightening, the Peak Fed moment was the June 15 FOMC meeting (when the Fed raised rates by 75bps) despite the Fed’s forecast for many more hikes to come.

That FOMC meeting may have been Peak Fed because the market had already priced in those increases and started reducing future rate expectations following the meeting – thinking that the path of Fed tightening would produce (or amplify) a recession.

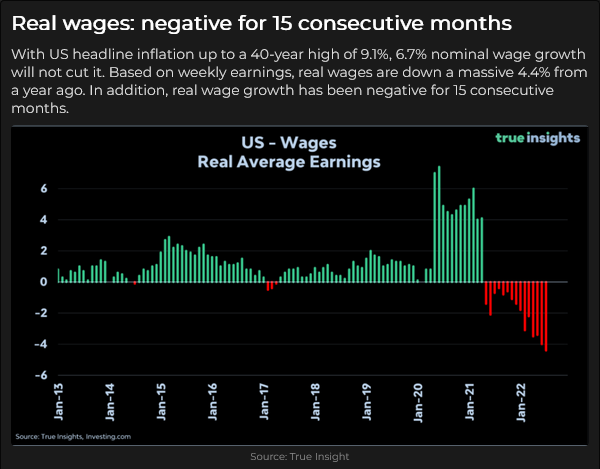

If you believe inflation will stay “higher for longer,” Peak Fed is somewhere in the future. This week’s CPI (9.1%) and last week’s strong employment report suggest inflation may be “higher for longer.” (Falling real wages may create pressure for higher wage demands.)

Markets are searching for Peak Fed – when the Fed pivots away from continually raising interest rates – because Fed policy is THE driver of price discovery across assets. If markets get the idea that Peak Fed has passed, then (all else being equal!) things that were shunned during the rising rates period will be embraced – without fighting the Fed!

10-year T-Notes have rallied from the 12-year low made on June 15 – FOMC day

The 10-year Treasury yield hit a 12-year high (3.5%) on June 15 and has fallen since then (currently ~2.92%.) Do bonds see a recession coming, or do yields ~3% offer an excellent alternative to a soggy stock market?

Equity markets have a “dammed if you do, dammed if you don’t” problem

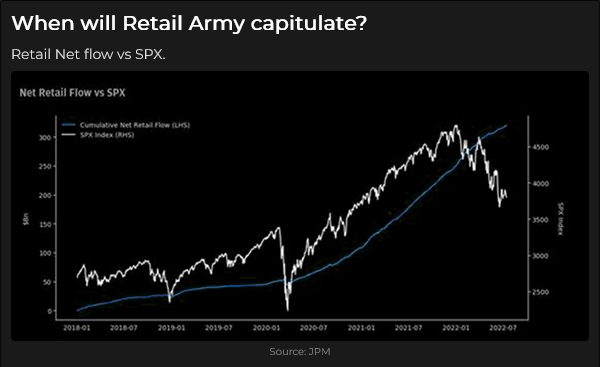

Rising interest rates have been a problem for stocks this year, but if interest rates start falling because the market decides a recession is coming, that’s bad news for earnings. The major stock indices have chopped up and down since the FOMC meeting.

The US Dollar hit another 20-year high this week

The prospect of an aggressive Fed has helped drive the USD higher against all major currencies, with the Euro dropping below par for the first time in 20 years – down~12% YTD. (The DXY US Dollar Index is mostly the Euro and other European currencies. The Eurozone has been struggling with geopolitical and energy issues, but all US Dollar indices show a strong USD.)

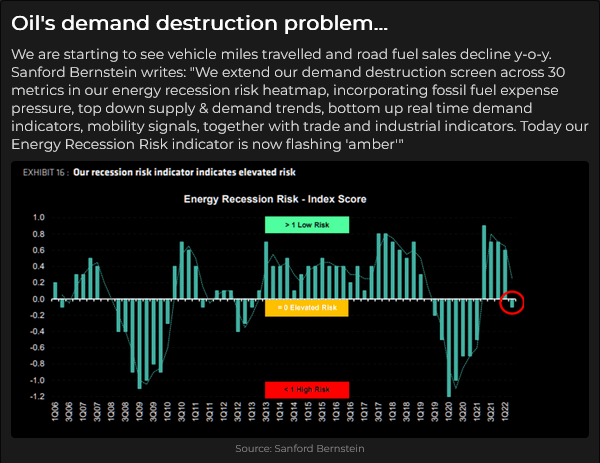

Commodity indices peaked a few days ahead of the FOMC – and have closed lower for six consecutive weeks

The prospect of the Fed tightening into a recession has not been good news for commodities – a recession would likely mean demand destruction. Commodities (especially energy) were the “hottest – most crowded” sector of the market YTD and were vulnerable to a “positioning adjustment.”

Gold has dropped as much as $385 (18%) from March All-Time Highs

Historically, gold has rallied on high inflation, but the soaring USD and rising real interest rates have been toxic for gold – in US Dollar terms. Comex gold futures have fallen for five consecutive weeks – down ~$175 from last month’s highs. This is the lowest weekly close in 16 months.

(Actually, gold has held up reasonably well. The last time real rates were at current levels, gold was ~$1,500. The last time the USDX was at current levels, gold was ~$350!)

My short-term trading

I started this week with a small S+P position I bought last Friday. I covered that for a slight loss as soon as markets opened Sunday afternoon. I bought the S+P five times Monday to Thursday, looking for a bounce. I traded small sizes with tight stops and lost money on four trades. I missed the 140-point rally from Thursday’s low to Friday’s close (the rally I had been trying to catch!)

I bought the CAD twice, breaking even once and losing a bit on the other trade.

I bought gold Wednesday when it bounced off 10-month lows and was nicely ahead on the trade at one point, but I was stopped overnight for another slight loss.

It was a frustrating week with very choppy price action. I lost money but using small size and tight stops saved me from getting destroyed as I tried to catch a turn in market sentiment. I was flat at the end of the week; my P+L was down ~0.5% on the week.

What does risk management mean – how do I apply it?

The essence of risk management is protecting your capital so that you can live to trade another day.

My friend Dennis Gartman used to say that there were two kinds of capital: the money in your account and mental capital. In his opinion, mental capital was the most important. If you lost your trading capital, you could always find some more money somewhere, but if you lost your mental capital, your willingness to keep going, you were done.

Another way to understand “protecting your capital” is to ask yourself, “What will I do when I’m wrong?”

That question implies that you clearly define what “wrong” means and have a contingency plan to protect your capital when you’re wrong.

Another question that helps identify risk management is, “Am I trying to make money or prove that I’m right?”

Many traders develop a “good” reason for taking a position in the market, and they get their ego involved in the decision-making process. They “have done their homework” and have determined that “X” must go up because of “Y.” If they have used this process before and it has produced profitable results, they will likely be determined to be proven “right” once again.

I’m willing to acknowledge that I don’t know what will happen. I “do my homework” and take risks, but I understand that there’s better than a 50/50 chance that I’m wrong on every trade, so it is “routine” for me to have a plan, and to stick with my plan, to limit losses on every transaction.

I spent decades as a commodities broker and watched 100s and 100s of people lose millions and millions of dollars. There were two main reasons; they used too much leverage, and either didn’t have a plan to limit their losses or didn’t stick with their plan. (We called that a cancel-if-close order!)

I believe every successful trader finds a “way” to trade that suits them. Some people are day-traders; others have a much longer time horizon. Some people swing for the fences; others are content to hit singles. Some of the “big names” are willing to confess that they made horrible mistakes during their early days and are grateful to have survived – but they have set rules for themselves never to make that mistake again.

I wish every trader success, whatever your style, but it truly is a marathon, not a sprint, and if you don’t conserve your capital, you won’t succeed.

Quote of the week

The British Open

It is the 150th Open this week, and Tiger missed the cut. I won’t watch it as much as I watch the Masters, but I had the pleasure of playing the Old Course several years ago in a two-club wind, and I’ll remember that experience forever.

The Barney report

Barney came to us from a lovely lady (Laurel Pickels in Pemberton, BC) who had great success breeding pure-bred Golden Retrievers for many years. But a Border Collie “jumped the fence” at the wrong time, so Barney is part Golden and part Border Collie, which means he is an amiable dog who can run like the wind (and instinctually tries to “herd” me when I take him for a walk.)

I took Barney to the beach twice this week (record low tides), and he had a great time playing in the ocean with two Goldens. He could barely walk back to the car after 30 minutes in the water and curled up in Papa’s chair for a nap as soon as we got home!

(The painting on the wall is an original watercolour of the Merc floor in 2001 – painted years ago by the wife of a long-time friend and commodity broker.)

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 15 podcast is available at: https://mikesmoneytalks.ca.

I did my monthly 30-minute podcast with Jim Goddard on July 9 and talked about macro markets, Dutch farmers, and risk management. You can listen to This Week In Money – A Howe Street Radio feature.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.