Weaker-than-expected CPI ignited a risk-on surge across currency, credit and equity markets

“A man hears what he wants to hear and disregards the rest.” Paul Simon, The Boxer

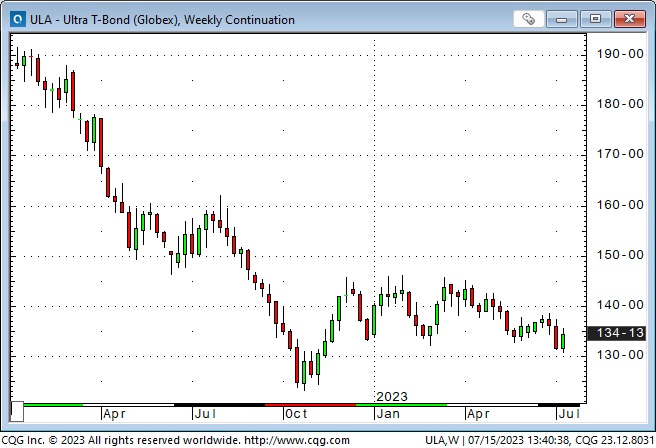

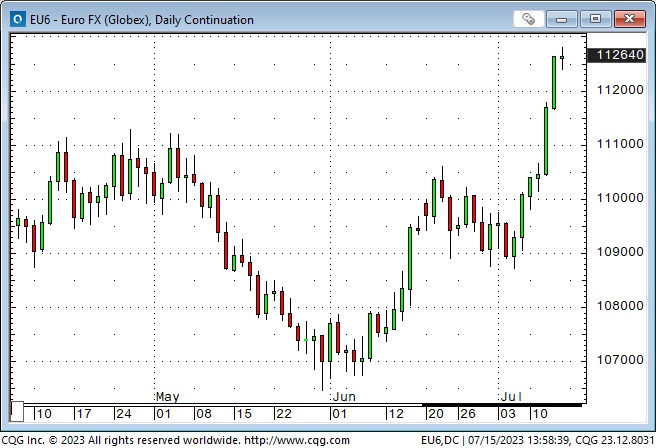

The US CPI report Wednesday morning was slightly weaker than expected and kicked off a surge of “risk-on” sentiment that accelerated existing short-term trends in currencies and equities: the US Dollar index had its worst week in eight months and is down ~13% from Q4/22 highs, the S&P hit 15-month highs and is up ~28% from Q4/22 lows. Bond prices rallied sharply from last week’s multi-month lows, and the short-end re-priced Dec 2024 from ~100bps below current levels to ~150bps lower.

The Bank of Canada raised rates by 25 bps to a 22-year high

The BoC noted that CPI inflation is not expected to fall to the 2% target before 2025 and that recent declines in headline inflation were mainly due to lower energy prices. Markets are pricing ~50% chance of one more 25bps bump before year-end.

The Canadian Dollar rallied along with virtually all other currencies following the US CPI report, but the rally was much weaker than the rallies in Euro, Swiss, Sterling or Yen. The CAD touched a 10-month high early Friday but dropped below pre-CPI levels, while the EUR closed the week at 17-month highs.

The CAD had a daily Key Reversal down on Friday. Canadian CPI data is due Tuesday, July 18.

Sterling, which hit 37-year lows against the USD last fall, hit 15-month highs this week, up ~6% since late May. UK interest rates are higher than US rates – the 2-year spread hit a ~53bps premium this week, a 10-year record. (Buy the Pound at these prices for a 0.50% annual interest rate premium? I think this move has more to do with “positioning” than bargain hunting! I believe the Pound is WAY OVERBOUGHT – Commercial net short COT levels at 16-year highs- and I will look to get short if I find a good risk/reward setup.)

The Yen, which traded to 32-year lows against the USD last fall, has popped ~5% since the beginning of July. (People expect the BOJ to finally tighten monetary policy – but they may be looking at China and demuring.)

The Swiss Franc has been in a world of its own, soaring ~16% Vs. the USD from last year’s lows to (essentially) 12-year highs, and it is only ~2% away from All-Time Highs against the EUR. (The brief spike to ATH occurred last September when the Swiss Franc soared on “flight to quality” buying as the British Pound collapsed to 37-year lows Vs. the USD.)

This chart shows the Swiss rallying Vs. the Euro.

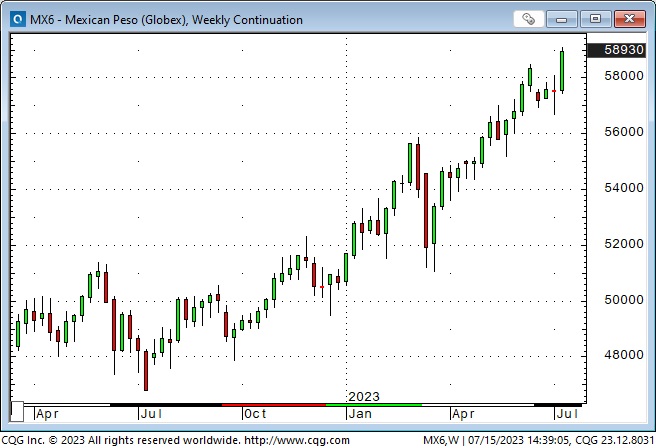

The Mexican Peso, with short-term interest rates more than double American rates, has rallied >50% against the USD since the Covid crisis and is now at 8-year highs. (However, it is now worth ~35% of what it was worth following the 1994 Peso Crisis.)

Gold

Comex gold futures spiked as much as $25 on the CPI report but ended the week up less than $20 from pre-report levels. The gold rally was subdued despite the sharp tumble in the USD and (real and nominal) interest rates. As I noted last week, with the stock market sizzling, buying gold is like dancing with your grandmother!

My short-term trading

I was flat at the beginning of the week and stayed flat until after the CPI report early Wednesday morning. (Given my macro outlook, almost any position I would have taken ahead of the CPI would have lost money!)

The CAD had a feeble response (compared to nearly all other currencies) to the US CPI report, and I shorted it on Wednesday morning as it fell back from its post-CPI highs. My tight stop was hit for a slight loss.

I was happy to be out of my short position as the CAD traded to a 9-month high on Thursday, but when it made a new high on Friday and then reversed, I re-shorted it and remained short into the weekend with ~50 points of unrealized gains.

My macro view was that the risk-on surge (across markets) following the CPI report was overdone, and short CAD looked like a great way to fade the “irrational exuberance.” The highly levered Canadian economy and consumers are vulnerable to higher interest rates.

I shorted the S&P Friday morning as it fell away from 15-month highs made in the overnight session. I stayed short into the weekend, ahead by ~10 points on the trade.

On my radar

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine. In my view, those two aspects of the financial markets operate simultaneously. Both are measurable, and both are indispensable.” Warren Buffett, paraphrasing Ben Graham in a letter to shareholders in 1987.

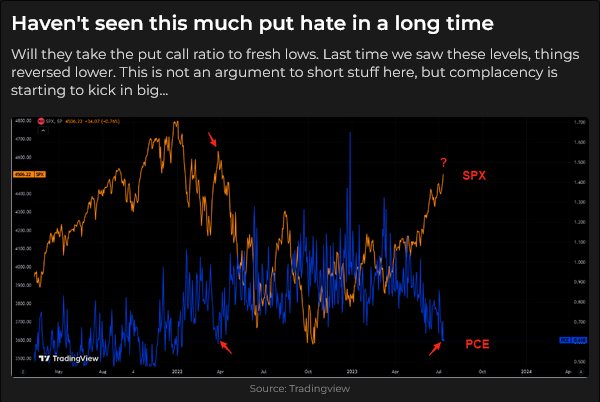

Mr. Market (as Ben Graham called him) wants to believe that the Fed (and other Central Banks) are close to cutting interest rates. I think Mr. Market is wrong, and I’ll be looking for opportunities/setups to trade against him.

The key to my success in fading him will come from patience, timing and risk management. When animal spirits are running hot, there’s no telling how high, high is.

Mr. Market seems to be fixated on falling inflation, and everything else doesn’t matter – until it matters.

I’m always willing (and prepared) to be wrong, but I’ll take the “over” on inflation and Central Banks staying higher for longer.

People, especially lower-income people, know that the prices of things they (need to) buy are going up faster than the CPI, and they will do what they can to make more money – to try to “keep up.” I expect lots of strikes.

I’m also “old school” enough to believe that ever-increasing deficit spending is the primary force that is diminishing the purchasing power of our currencies, and I don’t see that ending.

I agree 100% with my old friend, Hubert Marleau, in Montreal, that the Fed will eventually accept an inflation target of 3%.

I’ll be looking to buy the USD against the Euro, the Pound and the CAD, but not the Yen ( not until after it rallies when the BoJ tightens monetary policy.)

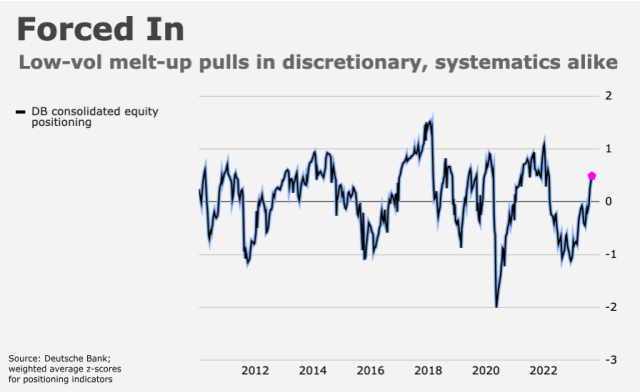

I’ll look for opportunities to short stock indices, which I think have been aggressively bid higher on FOMO. Friday may have been a reversal day.

I may sell deferred SOFR futures now that they have rallied on hopes that the Fed will soon start cutting rates. At the same time, I may buy bonds if they catch a bid because stocks are weakening. I don’t see those trades contradicting each other because I think the yield curve will steepen.

Thoughts on trading

Is “being early” the same thing as “being wrong?” My answer is “yes,” but I also believe there’s nothing wrong with being wrong except staying wrong. If you enter a trade on a pre-determined time frame and then lengthen your time frame to avoid “being wrong,” then you are staying wrong.

Nobody ever gets close to shooting a perfect score in golf (well, apparently, two former leaders of North Korea did get close), and I believe that traders, like golfers, have to settle for being less than perfect; they have to be willing and prepared to be wrong on every trade they make. The best golfers play the game one shot at a time. The best traders have a similar approach to trading – win, lose, or draw; it’s only a trade.

The Barney report

Barney and I have been “home alone” most of this week; my wife is in Vancouver helping her friend with a family matter, and we’ve enjoyed a lot of walks in this hot and dry summer weather. We didn’t get to the ocean – but I hope to do that next week.

Barney loves to chew on a good stick. I used to worry that he would swallow chunks of wood and we’d have to take him to the vet, but he doesn’t. He loves to chew, and he spits out the pieces.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did a nine-minute interview with Mike Campbell on July 15 on his popular Moneytalks podcast. We talked about the reaction of different markets to the CPI number, the Bank of Canada interest rate bump, gold and why I’m short the CAD. You can listen here. My interview starts around the 1.13-minute mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.