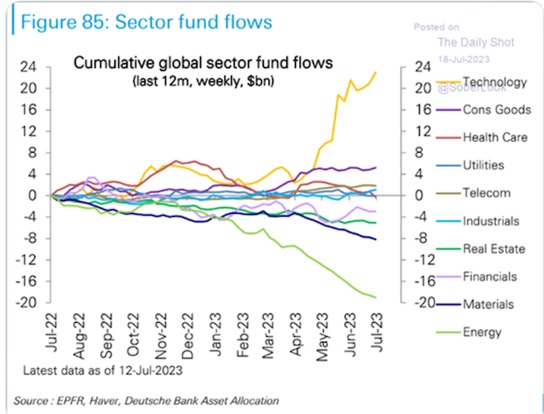

A turning point in sizzling tech stocks?

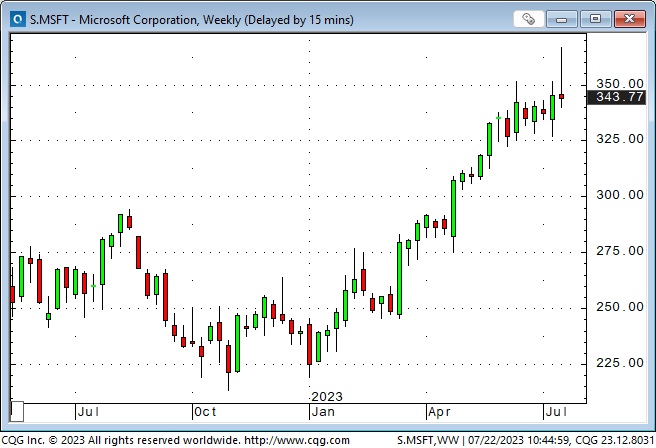

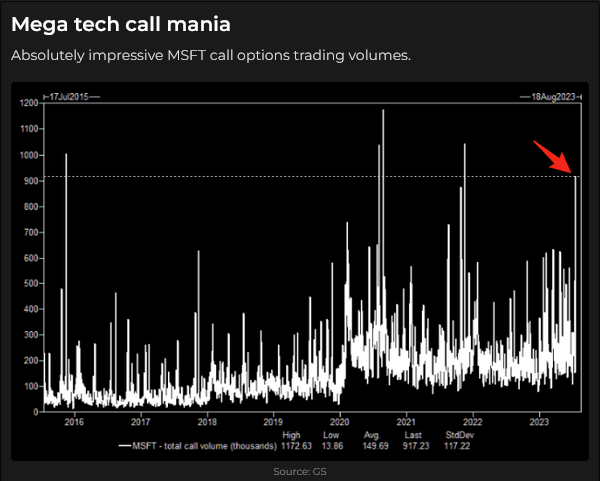

On Tuesday, MSFT announced plans to invoice corporations for employees using Microsoft AI. Within an hour; the share price rose >$20 to new All-Time Highs, adding ~$100 Billion (~4%) in market cap. By Friday’s close, those gains had evaporated, leaving the weekly chart with an ominous shooting star candlestick pattern.

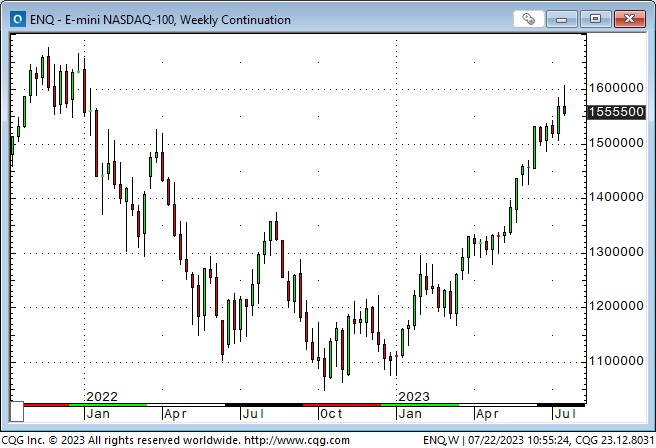

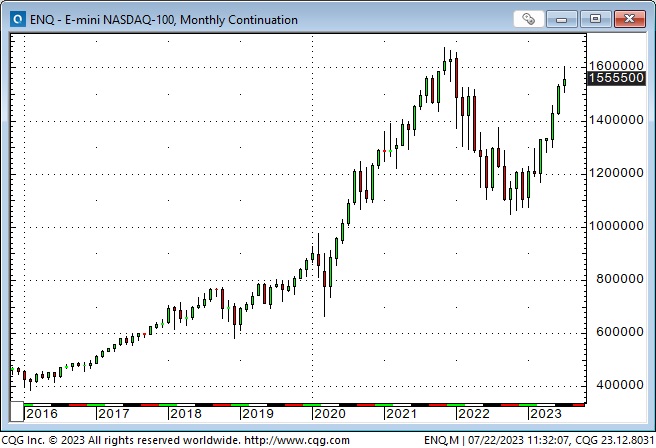

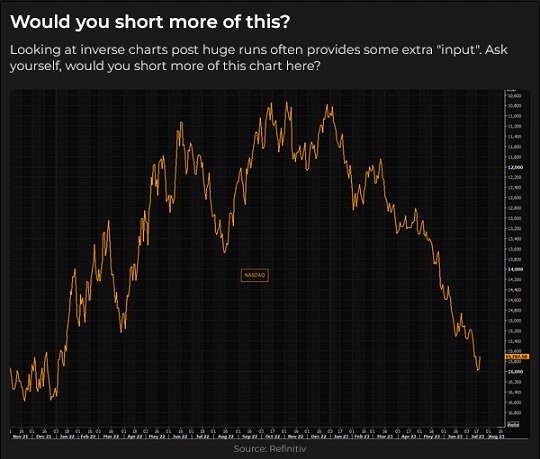

The bullish enthusiasm for MSFT on Tuesday spread to other stocks, and the leading American stock indices all rallied to new multi-month highs, with the Nasdaq up ~45% YTD (its hottest-ever first-half performance.) The Nasdaq traded marginally higher on Wednesday but closed lower on the day. On Thursday, it had its most significant YTD daily decline, and it dropped further on Friday, creating a bearish shooting star on the weekly chart. (After Wednesday’s close, TSLA and NFLX quarterly reports weighed on sentiment.)

The DJIA and the S&P were relatively unfazed by the weakness in the Nasdaq and closed the week at ~15-month highs.

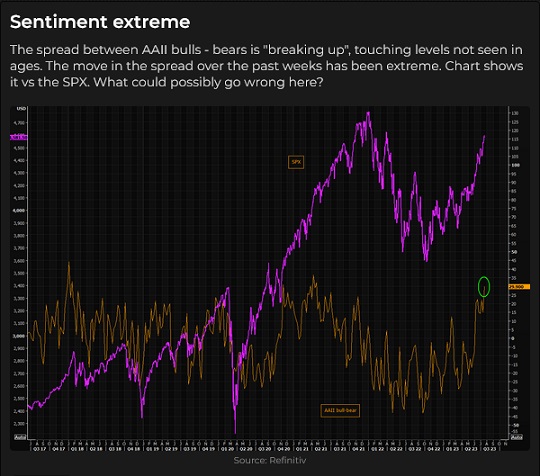

I’ve been skeptical of the “Magnificient Seven” rally for a few months, thinking that sentiment bordered on “irrational exuberance.” However, I respected the power of the rally and patiently waited for an opportunity to fade it. I thought the “$100 Billion in an hour” surge in the MSFT market cap may have signalled a top, and when the Nasdaq dropped below Tuesday’s highs on Wednesday, I got short and remained short into the weekend. I’m (as usual) trading small size, and my initial time frame is (as usual) short. I’ve lowered my stop to lock in some gains if the market rallies, but I’m willing to be patient with this trade; if downside momentum develops, this market could fall a long way.

I shorted the S&P last Friday but covered that trade for a tiny loss on Monday (the market had traded below Friday’s low but didn’t want to stay down, so I got out.)

One of my favourite chart patterns (regardless of time frame) is a “lower high.” If the Nasdaq falls from this week’s high of ~1600000, it could be a great short. (I don’t trade off monthly charts because I would have to risk “too much” money if I was wrong on the trade, but I always look at markets from a variety of time frames, from monthly to intra-day, when I’m looking for an opportunity to enter a market.)

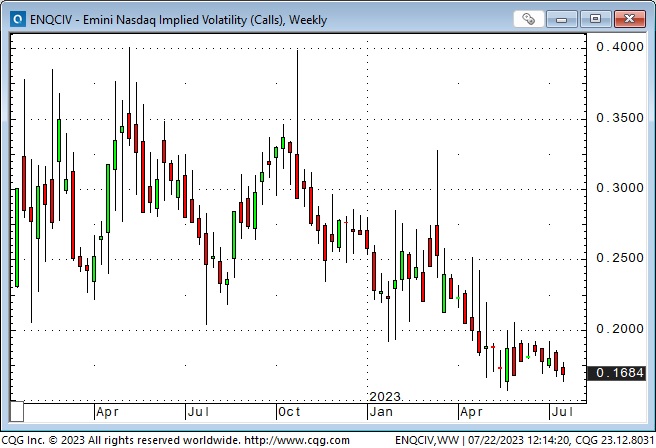

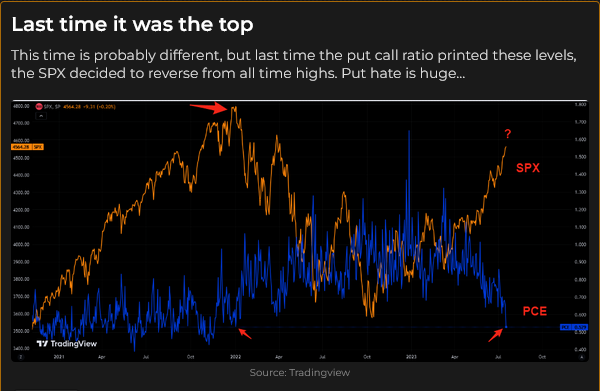

Volatility remains near 2-year lows, despite the sharp drop in the Nasdaq Thursday and Friday. This could mean that Mr. Market sees the drop as only a brief correction or that he hasn’t “seen” it yet, given that the S&P and the DJIA closed higher on the week. I’d expect VOL to jump if markets trade lower this coming week.

Ross Clark, my long-time friend and excellent technical analyst, published a ChartsandMarkets.com report on Thursday noting exhaustion alerts, bearish divergences and sequential 9 sell setups in the largest cap stocks and indices.

Currencies

The USDX rallied ~1.5% this week after hitting 15-month lows last week. The rally ran into resistance around the 101 level – a level that was support in April and May.

I watch cross-market correlations closely, and it was hard to miss that the USD rallied sharply Thursday and Friday as the Nasdaq tumbled.

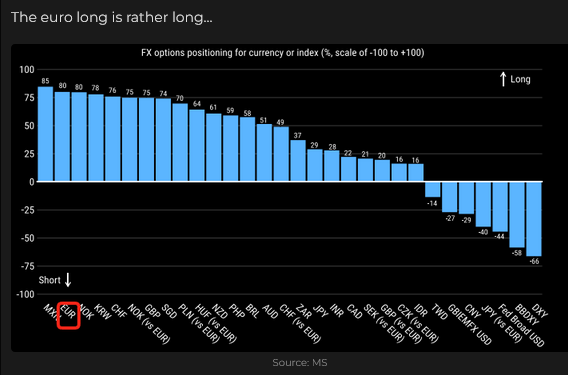

I’ve been puzzled why European currencies have rallied against the USD. The biggest speculative net short USD position is long EURUSD (the Anti-dollar), and speculative net long positions in GBPUSD are at multi-year highs. Just as I’ve been skeptical of the “Magnificent Seven” rally, I’ve been wary of the European currencies’ rally against the USD. I’ve patiently waited for the rally to end (in my many years of trading currencies, I’ve noticed that FX trends often go WAY further than what I think makes any “sense,” and then they turn on a dime and go the other way!)

I’m worried I missed an excellent opportunity to short EUR and GBP this week. I’ll be patient and see if another chance develops!

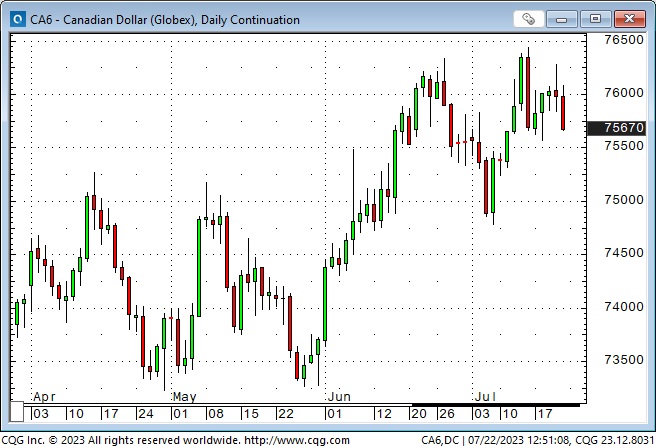

I shorted CAD last Friday when it reversed lower after trading slightly above Thursday’s highs. I covered the trade for a 35-point gain on Tuesday after it took out Monday’s lows but then began to rally back. Canadian CPI was reported softer than expected on Tuesday, and CAD weakened on that news but didn’t stay down. (It seemed to want to follow the S&P higher.) I covered my short position because CAD “should” have fallen on the soft CPI report (less reason for BoC to continue raising rates) but didn’t.

I re-shorted CAD on Wednesday (about the same time I shorted NAZ) but was stopped for a 26-point loss on the overnight highs! I put the trade back on as the market fell away from the overnight highs and stayed with the trade into the weekend with ~40 points of unrealized gains. I like being short CAD when it closed Friday on its lows and with stock markets looking like they could open lower next week.

Gold

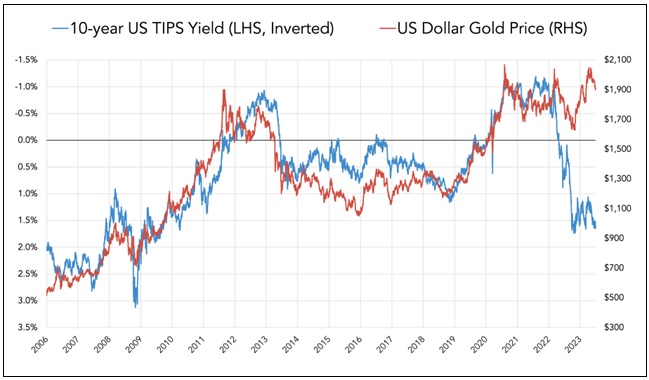

Gold fell from All-Time Highs of ~$2085 on May 4 to ~$1900 on June 29. The USD and real interest rates were rising in May, which pressured gold, but the USD was weak in June and tumbled to 15-month lows in July, and gold has not had much of a bounce – which might have been expected, given the weakness in the USD.

Correlations wax and wane, so I’m not too concerned with the gold/USD correlation breaking down for a month. As noted in the last two TD Notes, retail interest in gold has fallen as stock prices have soared.

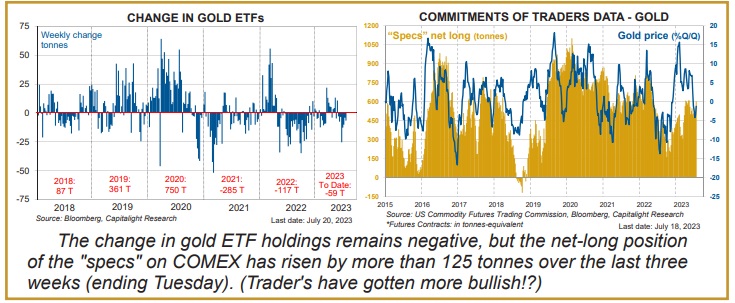

These charts are courtesy of Martin Murenbeeld:

I’ve previously written about how gold shares have underperformed gold. John Hathaway and Shree Kargutkar at Sprott have written a (10-minute read) thoughtful essay on this topic. You can see it here.

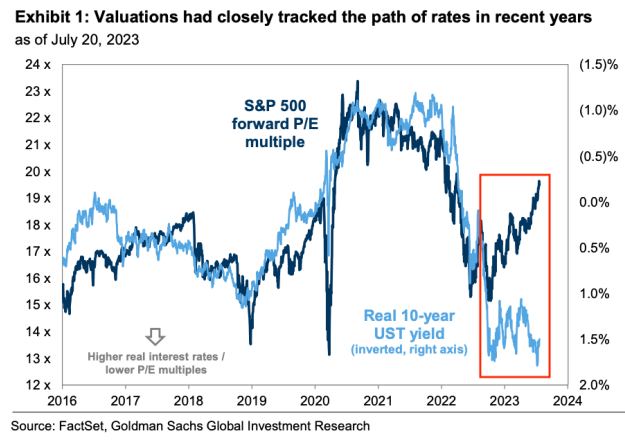

The sharp rise in real interest rates over the last 18 months has not been as much of a “drag” on the gold price as we might expect from the past 15-year correlation. Any move higher in real rates could be a severe risk to the gold price, especially if the USD strengthens.

Interest rates

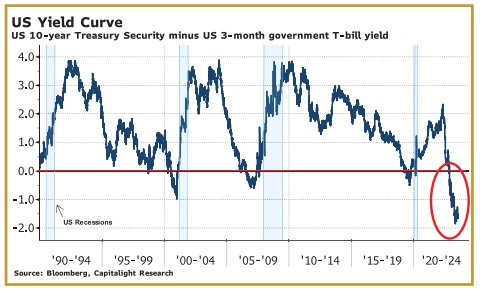

I wrote the following last week and haven’t changed my mind: I may sell deferred SOFR futures now that they have rallied on hopes that the Fed will soon start cutting rates. At the same time, I may buy bonds if they catch a bid because stocks are weakening. I don’t see those trades contradicting each other because I think the yield curve will steepen.

My short-term trading

I’ve detailed my trades above. I’ve gone into the weekend short the Nasdaq and CAD.

On my radar

I’ll be looking for opportunities to add to my short Nasdaq and CAD positions and to buy the USD Vs. European currencies. If stocks start to wobble, I may buy bonds (for a trade, NOT to Hold To Maturity!)

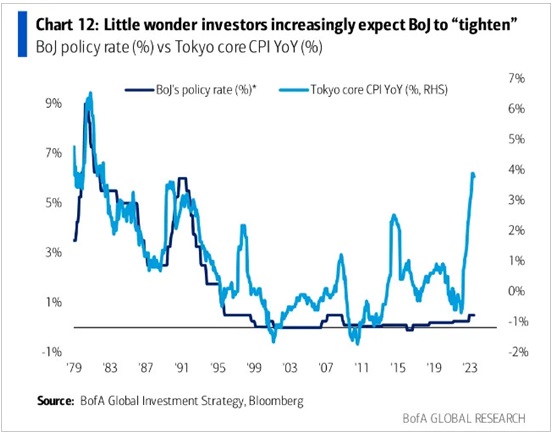

The Fed is expected to raise rates by 25 bps on Wednesday, the ECB is expected to raise rates by 25 bps on Thursday, and the BoJ is expected to do essentially nothing on Friday. Mr. Market hopes Powell will signal that the Fed will “pause,” I guess he will maintain his “higher for longer” stance. Lagarde will likely do the same. If the BOJ decides to raise rates, the Yen will probably jump.

The Barney report

Barney and I went to the ocean at low tide again this week. He ran, swam, chased the ball, played with other dogs, and slept in my car all the way home.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on July 22 on his popular Moneytalks podcast. We discussed Microsoft’s run-to-record highs, the subsequent fall in the Nasdaq and why I got short. We talked about large speculators having their “least bullish” position in WTI futures in several years – and why that might be bullish, and I told Mike that I thought inflation and central banks would stay higher for longer. You can listen here. My interview starts around the 1.30-minute mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.