Choppy price action this week

WTI made a 7-year high at $77 on Tuesday, then tumbled ~$6 into Thursday’s low but bounced back $4 by Friday’s close.

Prices on the long bond have been soaring the past two months ( yields have been falling), but the market appeared to have a blow-off top Thursday, and prices closed down hard Friday.

The S+P closed at a new All-Time High on Wednesday but then tumbled 70 points in the overnight session and closed lower on Thursday. By Friday’s close, the market had rallied back >80 points (roughly equivalent to 800 Dow points) to make a new All-Time High close.

The US Dollar Index rallied Tuesday and Wednesday to hit a new 3-month high but gave it all back Thursday and Friday.

The Japanese Yen hit a 17 month low last week (and net speculative short positions hit a 17 month high), but the Yen jumped higher this week as a “haven” play when stock markets wobbled.

The DJIA closed this week at an All-Time High, up ~1,600 points (~5%) from the lows it made four weeks ago following the “shocking” news that the Fed might actually raise short-term interest rates a tad sometime in the distant future.

Another Key Turn Date?

In my June 19 blog, I reviewed the May 10-12 Key Turn Date (a date when several different markets reversed course.) I wondered if the long bond starting a major rally had been the “leader of the pack” when all of those markets reversed direction on the KTD – as people started to dump inflation/reflation trades.

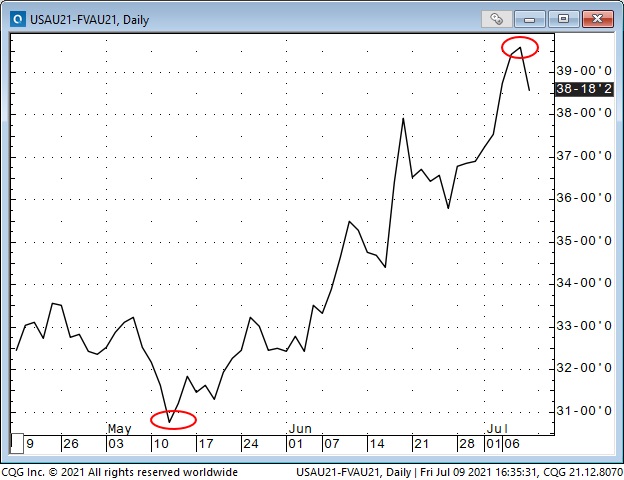

For instance, people who expected inflation had been positioning (in huge size) for the yield curve to steepen, but from the May KTD until this week’s high in the bond market, the yield curve flattened with a vengeance as bond prices rose. (This chart shows the price of the long bond futures contract rallying sharply against the price of the 5-year note futures contract from the May KTD to Thursday.)

Maybe this week’s blow-off top in the bond market will mark another KTD if/when people re-embrace the inflation/reflation narrative.

My short term trading

I turned short-term negative the USD Friday of last week. The USD had rallied to a 3-month high mid-week but fell back on Friday, and I thought it might have more of a correction. My positions were long the Euro and short puts on the CAD. I closed both those positions for small losses early this week when there was no follow-through to the USD weakness.

I bought CAD calls this Friday. On Thursday, the CAD had fallen to a 3-month low as commodity indices (especially WTI) and the stock market were under pressure, and bonds were printing 5-month highs (there is no inflation.) The CAD was down ~4 cents from its Jun 1st highs on Thursday, and when it bounced higher on Friday, I sensed a possible sea-change across markets and bought the calls.

I made some decent money shorting the Dow Wednesday and re-shorted it Thursday. That position looked good going into the cash market close but I was stopped for a breakeven in the over-night market. (The market rallied 650 points from the Thursday over-night lows to Friday’s close – one very good reason to use stops!)

On my radar

Buying calls on the CAD was a “toe in the water” trade – I’m wondering if the run we’ve seen in several markets from the May KTD to this week’s blow-off top in the bond market is about to reverse. If so, then I could be looking to short bonds, positioning for the yield curve to steepen, buy commodities etc.

The Japanese Yen has been trending lower YTD. Net speculative short positions are the largest they have been in 17 months. The Yen rallied a bit this week when the stock market turned lower. If the stock market wobbles again, the Yen might rally some more, with short-covering adding to upside pressure.

Speculators are net bullish on the Euro – it rallied against the Yen for more than a year, but that trend has reversed a bit the past few weeks. I think the long Euro / short Yen trade has been a pro-risk trade, and pro-risk sentiment might be changing.

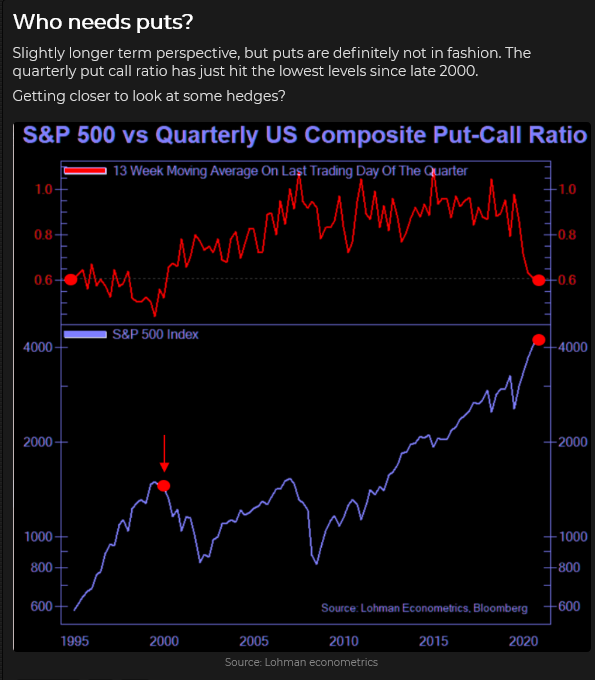

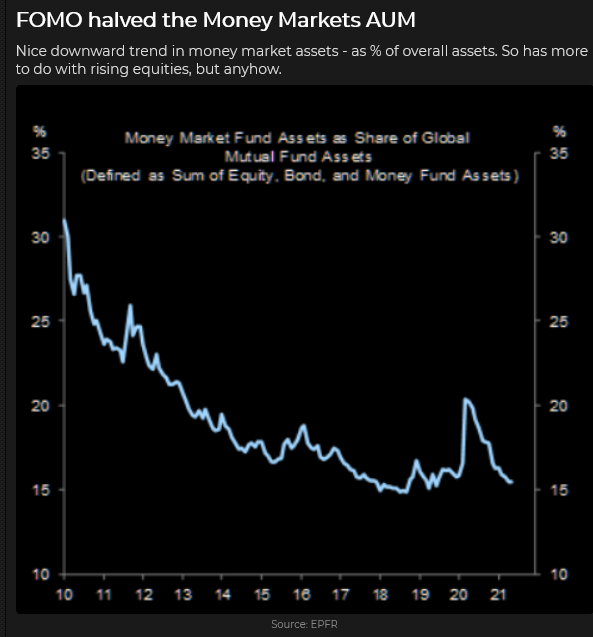

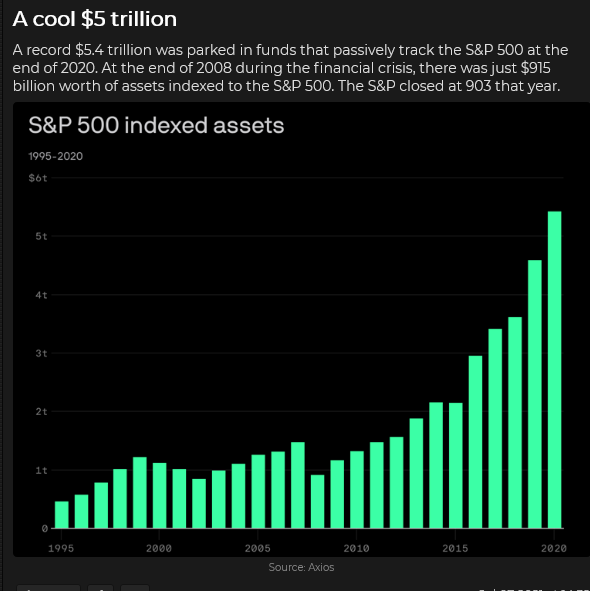

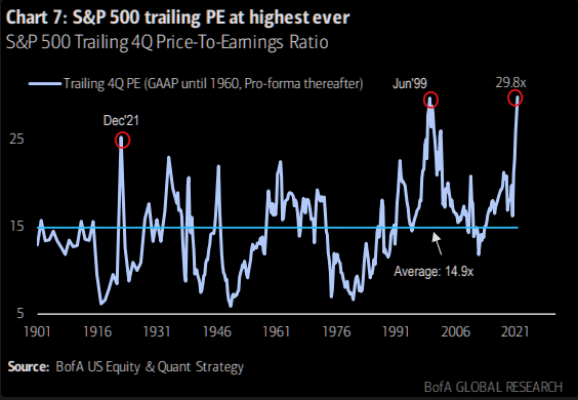

I continue to think that bullish enthusiasm for the stock market is WAY over the top – and the indices are vulnerable to a sharp correction. I won’t short new highs, but I will watch for signs of weakness – and then I’ll take small short positions.

Thoughts on trading

I spend several hours a day reading market research, opinion/comment. It’s a hard habit to break after all these years, but I’m not sure that it contributes much to my P+L. I’ve justified spending all that time by saying that every once in a while, I get a good trading idea – or get alerted to something I didn’t know, or wasn’t thinking about.

I’m not looking for “buy this – sell that” advice. If anything, I’m trying to gauge market sentiment – how much of a certain idea or opinion is already priced into a market? How vulnerable is market positioning to contrary news?

I’m not hoping that I can have a “revelation” about the market – that I can “see the future” and make a fortune based upon my unique insights.

On June 3rd, I posted a piece by Peter Brandt about the differences between trading to make a living and trading to make a fortune. I posted that piece to help my readers make the right (for them) trading life choices. I’m definitely in the “trading to make a living” camp – which means that for me, a trade is just a trade – no individual trade is important – no individual trade idea is worth losing a lot of money over.

With all the reading I do, I can’t help but have biases about where I think the markets might be or should be going, but increasingly I’m agnostic about that and make my trading bets based on what I see in price action.

I particularly like to find price action that seems to run counter to market consensus. For instance, the Yen rallied this week after trending lower for several months, and I know speculators are heavily short. If the Yen sets back, does not make new lows, and then trades above this week’s highs, I might be a buyer.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.