Major US stock indices hit new highs on inauguration

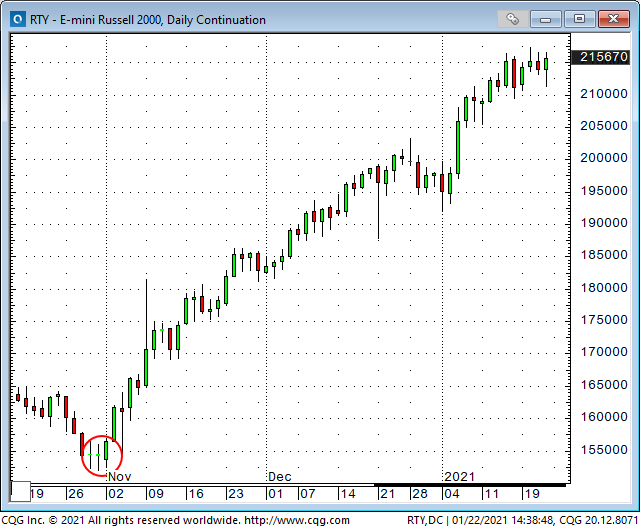

The major American stock indices hit All Time Highs this week when Joe Biden was inaugurated as the 46th POTUS. Since the Nov 1st Key Turn Date, just before the election, the DJIA and S+P have gained ~19%, the Nasdaq 100 ~23%, the Russell 2000 ~40%, while the Vanguard Total Stock Market ETF (VTI) is up ~22%.

Markets don’t like uncertainty

The old adage is that markets don’t like uncertainty, and immediately after the election there was some degree of uncertainty as to who had won. As time went by the market became increasingly certain that Biden had won, especially following the Georgia run-off elections, and his inauguration “sealed the deal” with markets celebrating the coming rollout of Biden’s agenda.

Is this as good as it gets?

Given the current level of bullish enthusiasm I wonder if this will be seen as a classic case of, “buy the rumor, sell the news.”

Pro-risk sentiment seems to have priced in that an aggressive program to halt the spread of the virus, massive fiscal stimulus, and a compliant Federal Reserve will quickly produce a strong economic recovery.

What could possibly go wrong? Well, we could be in for a long term struggle with the virus and its knock-on effects, and fiscal stimulus may be slower to arrive and much smaller than expected due to political bickering.

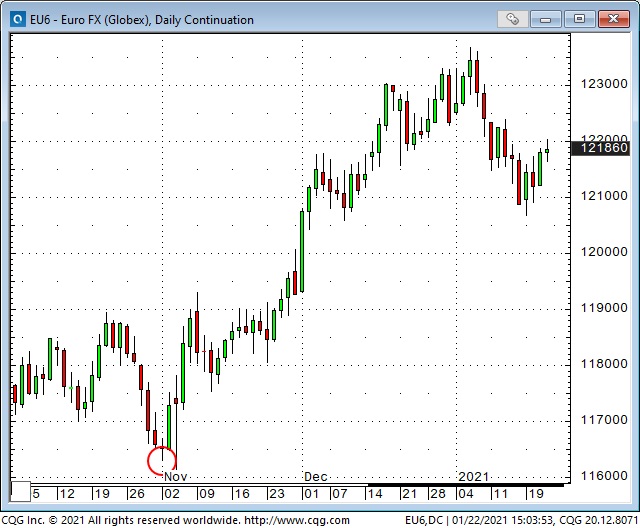

The US Dollar may be sending a message

I’ve previously written that the US Dollar may have had a cathartic inflection point on January 6th when protestors stormed the Capital Building. The US Dollar Index hit a 32-month low that day and has bounced a bit since then. Net bearish speculative positioning on the US Dollar in the currency futures market is at an All Time High and sentiment is broadly USD bearish.

Inter-market relationships

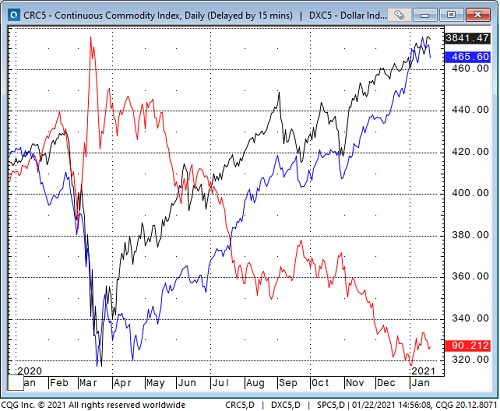

I have also written about the inter-market relationships that constitute the pro-risk trade. Since the crisis last March the US Dollar Index has trended lower while stocks and commodities have trended higher. There has been a strong negative correlation between the US Dollar and stocks/commodities.

in this chart RED is the US Dollar Index falling from March 2020, Black is the S+P 500 Index and BLUE is the CRB Index, both rising from March.

If the US Dollar has indeed turned higher then stocks and commodities may be due for a correction.

Trading the US Dollar

The day after the storming of the Capitol Building I shorted the Euro, the New Zealand Dollar and the Mexican Peso (against the USD) using small position size and tight stops because I was fading a powerful multi-month trend. As the markets moved in my favor I moved my stops to breakeven and then moved then further to lock in some profits. I was stopped the following week with small profits in all positions. In hindsight I had my stops too tight – but trading is not a game of perfect – and the markets will give me another chance to get long the USD.

What would be the best way to trade a reversal of pro-risk sentiment across stocks, commodities and currencies?

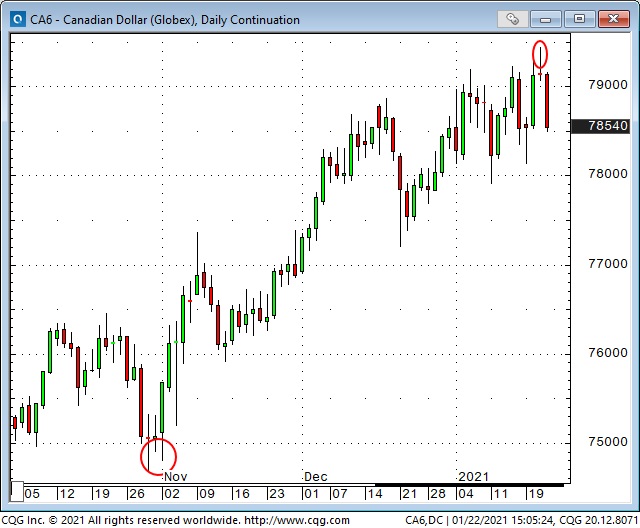

Shorting the Canadian Dollar could be a win on all three “legs” of a reversal in the pro-risk trade because for the past several months the CAD has been highly correlated to rising stocks and commodities and a weaker USD.

Bank of Canada comments at their Jan 20th meeting were a little more upbeat than expected, US stock indices rose to new All Time Highs, and the CAD jumped to its best level in nearly 3 years. I sold the CAD short the next day when it made a marginal new high and then turned lower intraday. Since I’m fading a strong multi-month trend I’m trading a small position with tight stops. If the CAD continues to fall I hope to add to my position. I will also be looking for opportunities to short other currencies against the USD.

Another currency on my radar screen is the Chinese offshore Renminbi. It made a new multi-year low against the USD in May and then began a strong rally that seems to be pausing (or setting up for a correction) the past couple of weeks. (In this chart lower prices means it takes fewer Renminbi to buy one USD.)

Currencies have been showing that the pro-risk trade may be turning, are commodities now confirming that?

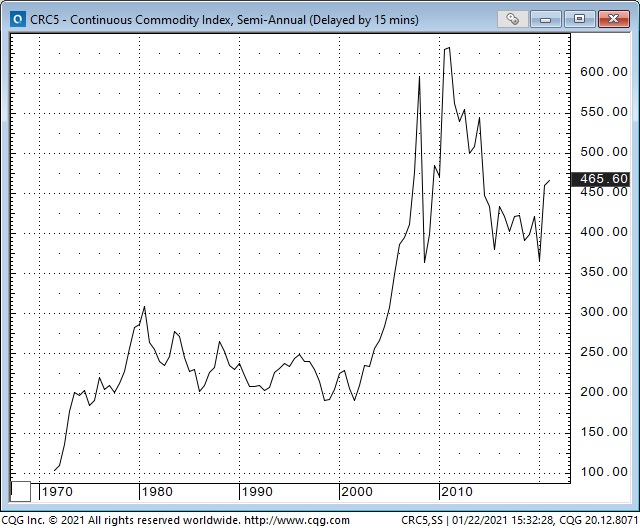

The broad commodity market index is showing signs of topping after rallying ~47% from the 15-year lows made last March. This may simply be a reaction to the recent strength of the USD or it may be a confirmation that the entire “three-legged” (currencies, commodities and stocks) pro-risk trade is starting to reverse.

Soybeans have been one of the star performers in the CRB Index for the past few months. Keep an eye on Copper and crude oil which have also had strong multi-month rallies. If they also start to correct that will increase the “volume” of the message.

Has a new multi-year commodity bull market started?

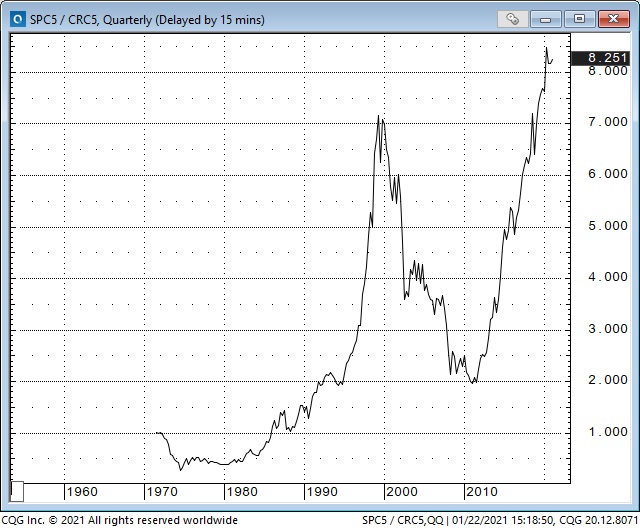

I recently published a longer-time frame report (Mikesmoneytalks.ca – Inside Edge) noting that commodity indices are the cheapest they have been relative to stock indices in over 100 years.

This chart shows the S+P rising relative to the CRB index during the 1980s and 1990s, then falling against the CRB from the top of the dotcom bubble in 2000 until 2011 when China was a HUGE buyer of commodities, and then, for the last 10 years the S+P has staged a HUGE rally against the commodity index – rising to the highest ratio level in over 100 years.

I plan to up-date the report and post it here sometime within the next 2 weeks, but I’ll leave you with these thoughts:

- There was an inflation driven commodity bull market from 1971 to 1980, followed by a dull bear market for the next 20 years (when capital flowed to the stock market,)

- There was a “China” driven commodity bull market from 2002 to 2011, followed by a brutal 10 year bear market that I think ended in March 2020,

- The 15 year low in the CRB commodity index last March probably marks the beginning of another commodity bull market. I’m expecting a correction in the short term, but I think the next major multi-year move in commodities will be higher – against the dollar but also against stock indices.

Victor Adair retired from the brokerage business last summer and is therefore no longer licensed to provide investment advice. This blog and everything else on this website is therefore not intended to be investment advice to anybody about anything.