Peak Fed Hawkish – Or Minsky Moment?

Peak Fed hawkish means the markets have WAY over-anticipated the consequences of Fed tightening (the Fed will stand down) – Minsky moment means there has been a sea-change at the Fed, and you ain’t seen nothing yet! Both opinions have eloquent spokesmen; recent short-term price action has been choppy as markets decide which view will prevail.

Equities

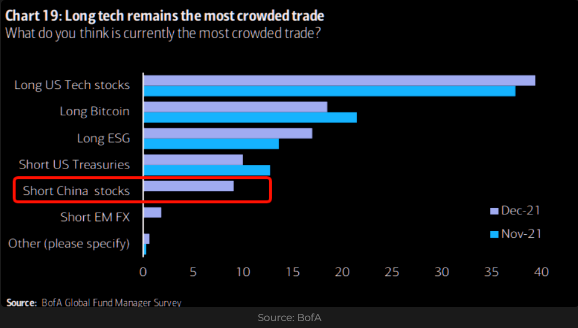

All major North American stock indices are off their highs, but the BIG action has been the rotation from sector to sector. Bank shares love higher interest rates; non-profit tech has tumbled (the bear market in crap continues.) Long-suffering Value has outperformed Growth. Emerging markets are up after a miserable 2021.

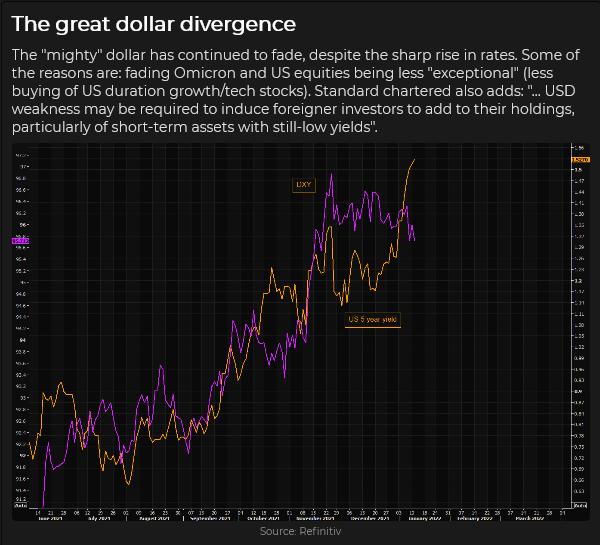

Big Tech has been the main reason American Indices have HUGELY outperformed the ROW – if that changes, then capital flowing away from US markets may weaken the USD.

Emerging market ETF:

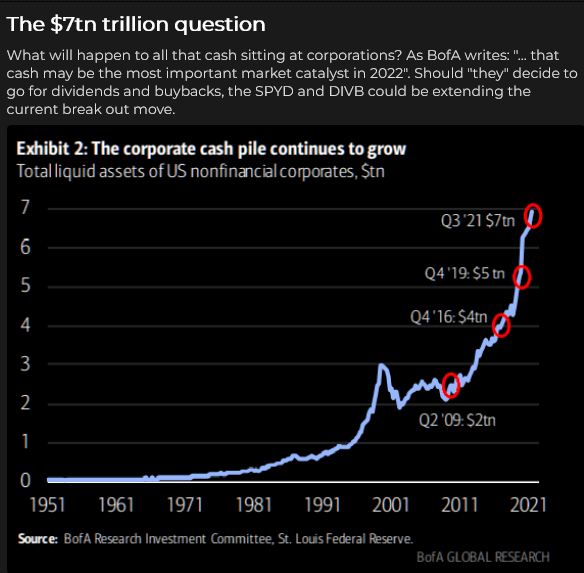

Buybacks have been a BIG source of support for the market – will that continue?

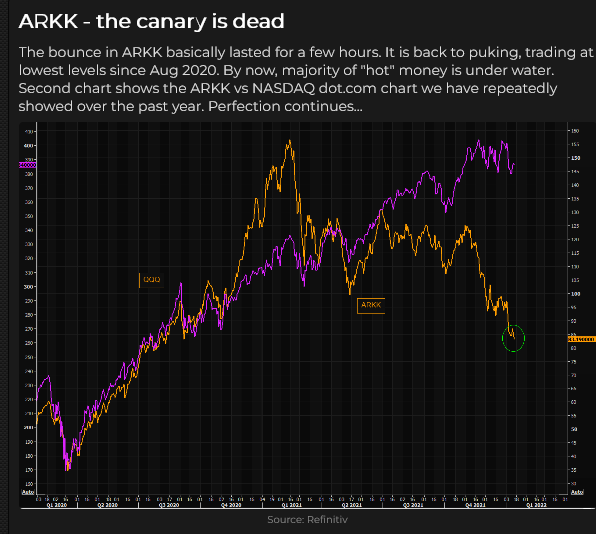

AARK Vs. QQQ

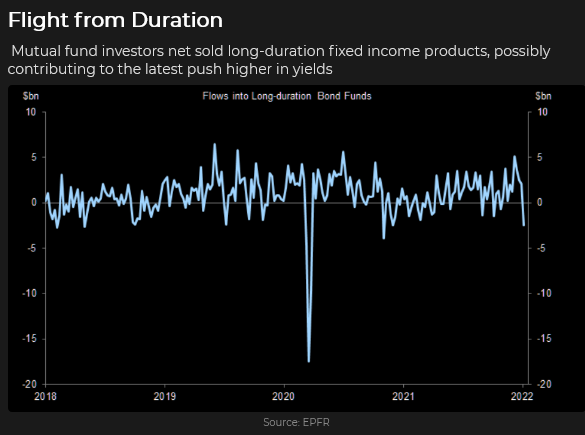

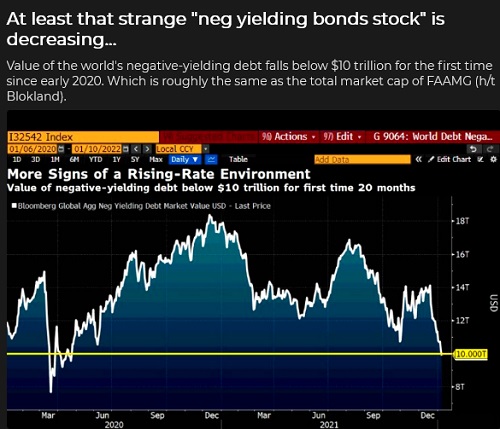

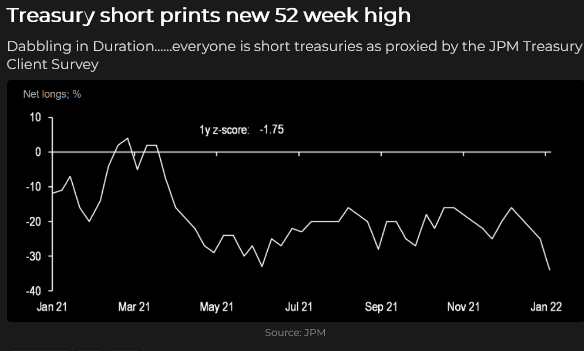

Interest Rates

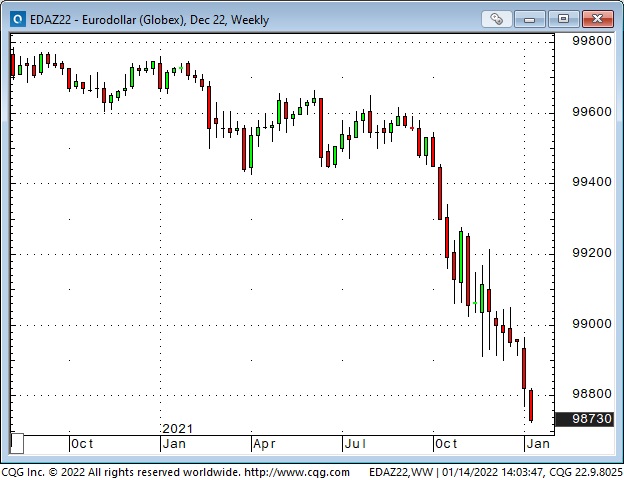

Nominal and real rates have surged higher (but real rates are still negative.) Eurodollar futures are pricing in four quarter-point increases this year.

Currencies

THIS WEEK, the US Dollar Index fell to a two-month low (currency traders are taking the Peak Hawkish view) after a steady rally since early last summer. Remember, currency trends ofter reverse around the turn of the year.

In this chart, the purple line is the USD Index; the gold line is the yield on the 5-year Treasury.

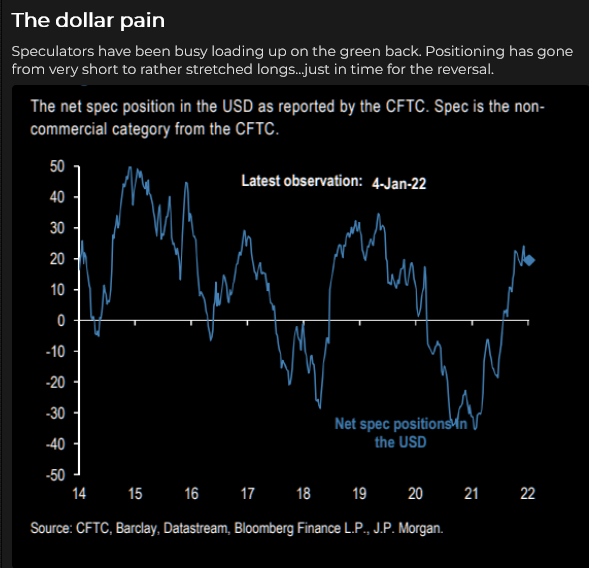

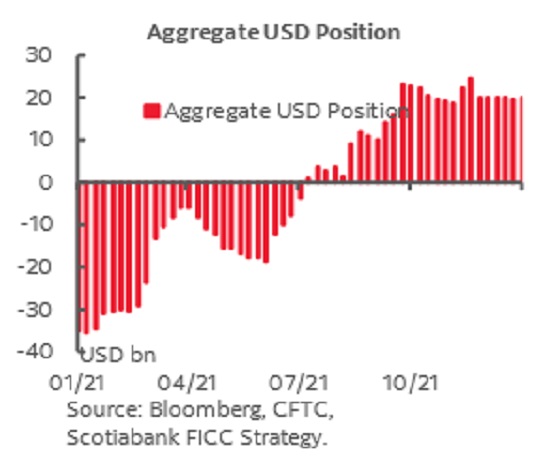

Futures market speculators have been net long the USD against other currencies. (AUD and Yen have been the big shorts.)

This chart shows weekly positioning to the week ending Jan 11, 2022.

The Canadian Dollar ignored weak equities the past two weeks but rallied on strong commodities and a weak USD. Traders are expecting the BoC to increase rates at their Jan 26 meeting.

The Euro rallied out of a narrow two-month range – perhaps the ECB will increase rates to “fight” soaring inflation in the Eurozone.

The Yen hit a five-year low last week – but caught a bid this week as the USD and the stock market fell. Futures market speculators were nearly $10B short as of Jan 11, 2020 – an eight-week high.

Gold

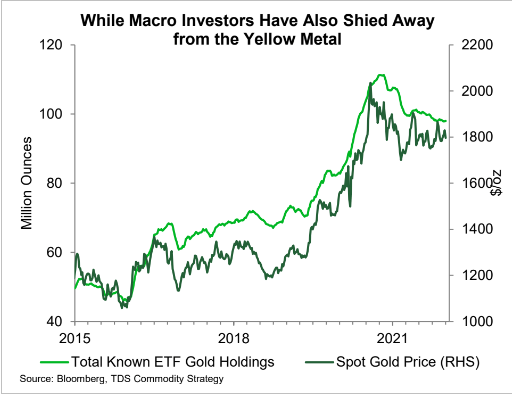

Rising real interest rates (they’re getting less negative) have not been good news for gold. Still, gold has also struggled to benefit from recent weakness in the USD and has not caught a “worry” bid from stock market weakness or geopolitical concerns.

I trade gold in the futures market, but I pay attention to the gold ETF market as a good “sentiment” indicator of longer-term investor interest in gold. They have been shunning gold for the last 18 months – chasing other things. If gold starts to rally, they will begin rebuying gold ETFs.

Comex speculators are net-long the equivalent of ~620 tonnes of gold as of Jan 11. Their record net long position was >1,050 tonnes equivalent around the 2020 Covid panic.

Commodities

WTI crude oil has rallied >$20 from the Thanksgiving collapse and is approaching the seven-year highs made last October/November, despite the recent “risk-off” tone in other markets.

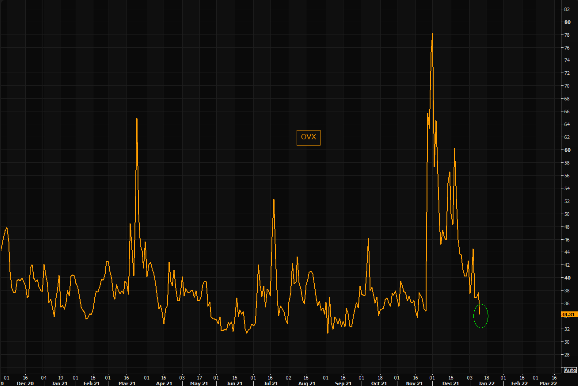

Crude oil VOL spiked on the Thanksgiving collapse – it is now back to before Thanksgiving levels.

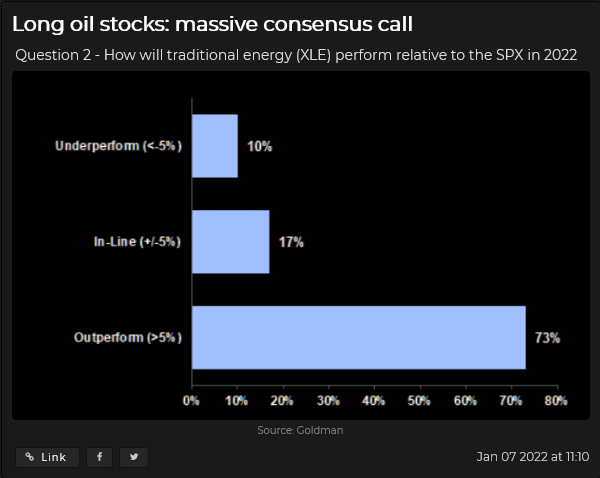

Energy stocks were dogs in 2020 but were big winners in 2021. This graphic from a Goldman Sachs survey of client expectations shows that they expect more of the same for 2022.

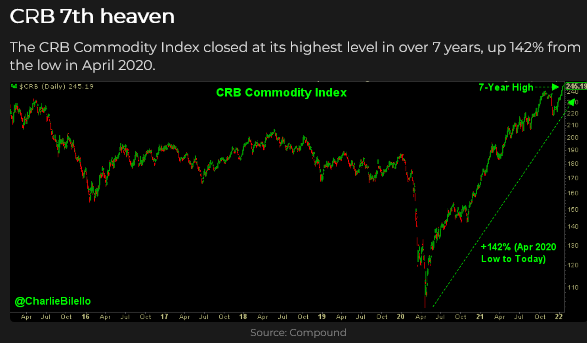

The CRB commodity index hit new seven-year highs; the Goldman Sachs index has returned to the seven-year highs made last October – different commodity weightings account for the differences in the indices. Beware magazine covers?

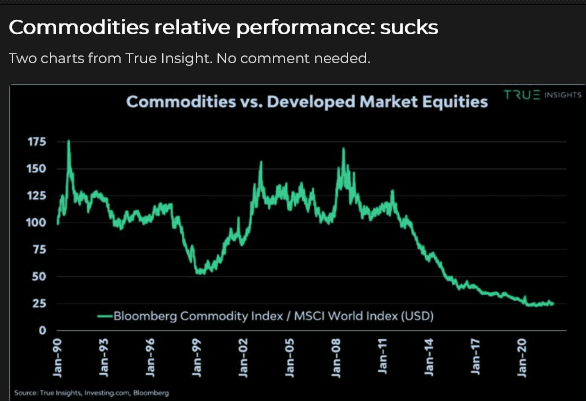

Everybody knows commodities are cheap relative to the high-flying stock market – but this chart shows how CHEAP commodities are – or how EXPENSIVE stocks are! (Maybe the long-term value pairs trade is to buy commodities against shorting stocks. But people doing that over the last five years have not made any money – the $64Trillion question is, why should it work now? )

On My Radar

There is SO much going on that it’s impossible to keep up to date, which is why I trade price action rather than the “news.”

But I don’t ignore the news. I read a wide range of market comments – to get an idea about sentiment and speculative positioning – to anticipate how speculators may react to events.

(I see a lot of marketing crap dressed up as analysis, almost always designed to provoke a fear response. I don’t like this bullshit, but folks need to realize that bad actors are out there, and they know how to take your money.)

I also try to forgive myself for missing SO many things that seem obvious in hindsight.

There is always “tension” in the markets, less during complacent times and more during stressful times. Volatility fluctuates with changing tension levels – so I’m always watching volatility.

I’m also always watching inter-market and intra-market relationships. For instance, if the USD is falling against most currencies, but gold is stuck-in-the-mud, that may be a “tell” that gold is a short if the USD rebounds.

The Peak Hawkish guys take the view that the Fed is all bark and no bite. That the Fed will “back off” if the stock market has a hissy-fit, and that with all the debt in the world, they can’t raise interest rates without causing the economy to tank. They also think that there is a good chance that the Fed is late (again) and will be tightening into an economic slowdown – exacerbating the problem. Their trade: buy Eurodollar futures.

The Minsky moment guys think that a severe correction is WAY overdue, so it will be nasty. Their trade: buy OTM S+P puts.

I could see it going either way – the back-and-forth between which view is ascendant will ramp up the tension, volatility and create choppy price action – a trader’s market!

Passive investing is on my longer-term screen. The primary rationale for passive is that active managers don’t beat their benchmarks (on a multi-year horizon) and are expensive relative to passive, so why not just buy the indices if you want to be in the stock market? (For a great history of the development and growth of passive read Trillions by R. Wigglesworth.)

More than half of all the new money going into the market these days is passive. The sales pitch (in addition to what I’ve noted above) is that the stock market always goes up (over the long-term), so make regular contributions to a passive fund, ignore short-term fluctuations, and you’ll have a lot of money when you retire. Just look at these stock market charts over the last 100 years!

There are various estimates of how much of the total market cap is now passive; Bank of America says that ~54% of US domestic equity funds are passive. Whatever the number, it is HUGE, and has grown exponentially over the last decade.

In some respects, passive is a perpetual motion machine. The more money that flows into passive investments, the more powerful they become. The fund managers “buy the indices” according to weightings. So for every new dollar coming in, the fund managers put ~25 cents into the top 10 stocks – regardless of their price. The passive investment industry holds essentially zero cash and is ~100% invested at all times, with minimal trading. (If a new company is added to the indices, like Tesla in Dec 2020, then the fund managers rebalance their holdings to include the appropriate weighting for Tesla.)

I keep an eye on passive investing because someday, some people who own those investments (individuals and institutional accounts) will start selling. They won’t sell on a 10% correction – they’ve been told to ignore the minor ups and downs, but if the stock market has been trending lower for months and is off 30% or more, they will start selling, and their selling will create more selling.

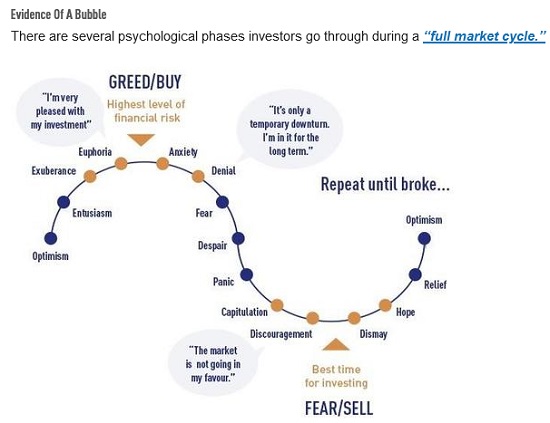

On this full market cycle chart, I would expect to see passive selling start around the “Fear” point and continue to “Dismay.”

Mike Green is an experienced market pro tracking passive investments. I highly recommend his recent interview with Daniel DeMartino Booth. “Shattering the Myth About Passive Investing.”

My Short-Term Trading

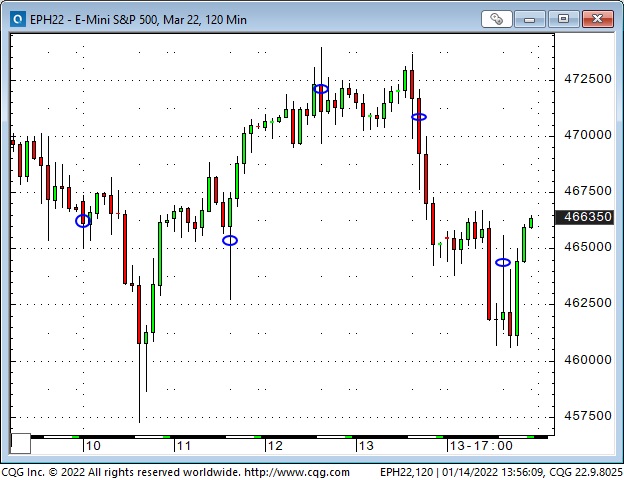

I started this week with long positions in the S+P and the Euro, looking for a bounce in the S+P after last week’s steep decline, and looking for an upside breakout in the Euro after six weeks of sideways action. During the Sunday overnight session, I was stopped for small losses in both positions. With the S+P down hard early Monday, I was glad to be out.

I bought the S+P early Tuesday and was stopped for a slight loss. I rebought it Tuesday and sold it Wednesday for a 70 point gain. I shorted the S+P Thursday and covered it for a 73 point gain Friday.

I bought the Euro Tuesday and sold it for a 76 point gain Wednesday.

I bought CAD calls Tuesday and sold Wednesday for a 21 point gain.

I bought gold Wednesday and was stopped Thursday for a $10 per ounce loss.

I’m flat going into the weekend. My net P+L for the week was a gain of >1.5%.

Thoughts On Trading

Could you make money by flipping a coin to decide whether to buy or sell a market? I remember pondering that question years ago – I even considered setting up a separate account to experiment with the idea, but I never did.

I was considering the coin flip idea back then because I noticed there were nearly always some “experts” forecasting higher prices while other “experts” were forecasting lower prices. People seemed to follow the experts who told them what they wanted to hear.

If the coin flip idea gave me a 50/50 chance of being right on the market direction (without my bias getting in the way), then if I applied good risk management techniques (cut losses quickly, let profits run), maybe I would be able to make money over time.

Another reason why I thought the coin flip method might work was because many famous CTAs were using technical analysis exclusively to make their buy/sell decisions. They were making HUGE money without paying any attention to what the “expert” forecasters said!

I didn’t set up a “coin flip” account because I thought it was important, no, necessary, to have an “edge” in my trade selection process – and the coin flip method didn’t provide an “edge.” (If I had thought about it more, I might have realized that my “edge” would come from sound risk management, not from trade selection.)

I was reminded of my coin flip idea a few years ago when I read some comments by Peter Brandt. Peter pointed out that managing trade risks is more critical for long-term success than trade selection.

I agree, and in recent Notes, I’ve written about focusing on “when” to enter the market rather than “why.”

These days, I don’t flip a coin to make trade decisions, and I do pay attention to bullish and bearish market analyses to get a feel for sentiment and positioning risk. (For example, I’m more likely to act on bearish market price action if I believe speculative positioning is HUGELY long.)

Sizing is a critical trading risk because my objective is to avoid taking any BIG LOSSES. Big losses not only hurt my P+L but, more importantly, they destroy my mental capital, my willingness to trade. My default sizing is to trade smaller rather than bigger. I don’t want any trade to be HUGELY important (as in, Please God, this trade has got to work!)

I’m reminded of friends telling me about being in the pit, holding too big of a position, and having the market go hard against them. They had to ask someone else to liquidate their trade – they could NOT do it themselves.

Concentration is a subset of sizing. For instance, if I hold positions in several different markets (thinking I’m diversified), I’m exposed to concentration risk if all of those positions benefit from a falling dollar – and the dollar rises. Correlations often go to one in a crisis – producing concentration risk.

Quotes From The Notebook

I don’t remember if these are somebody’s quotes or my own observations – either way, they’re worth a moment of consideration.

Big Change takes forever to arrive – then happens fast.

My comment: We knew the Fed would “turn” someday, and when they finally turned, it seemed to happen fast.

Respect uncertainty.

My comment: If you don’t feel some degree of uncertainty, you don’t have all the information.

There are always unintended consequences.

My comment: This is what they meant when they told you the road to hell was paved with good intentions.

Complacency is irrational.

My comment: With all due respect to Rudyard Kipling, if you remain complacent while other people are freaking out, you probably don’t understand what’s happening!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

The Barney Report

Barney thinks I should stop looking at my screens and start playing with him – and his bear. He may be right. I’ve noticed that my P+L has been improving since I started taking him for long morning walks while the markets were open.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.