Old School valuation metrics don’t matter these days, we’re trading mass psychology

In 3 of the last 5 weeks the DJIA futures have had more than a 1,000 point high/low range. Last Friday the index closed at a 6 week low, opened down Sunday afternoon and then rallied ~1,600 points to this Friday’s high. Old School valuation metrics don’t apply to price action anymore, and why should they considering that the US national debt has jumped ~$5 Trillion (~20%) within the last year, and there’s a LOT more of that coming. A dollar just ain’t what it used to be!

Markets are expecting Washington to soon approve another major stimulus program and the US virus/vaccination narrative took a positive turn this week.

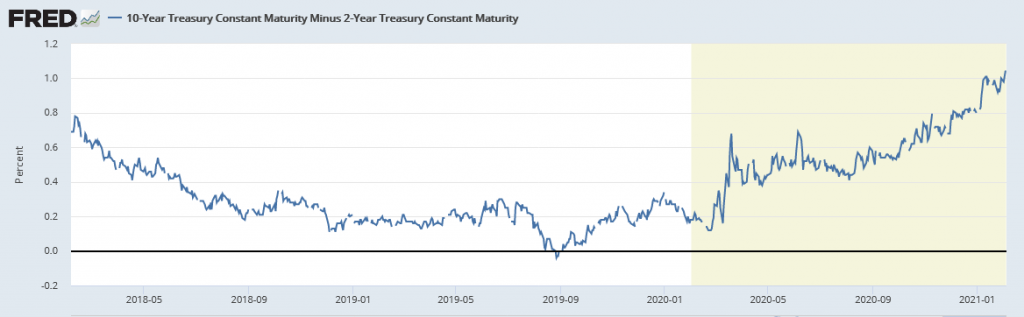

Bond yields and inflation expectations are rising

The US long bond tumbled for the last 7 consecutive days ahead of next week’s auction, prices have been in a steady downtrend since last August 6th (the same day that gold hit its All Time High.)

Inflation expectations are rising with the 5-year breakeven sharply higher. The 2/10 year yield curve is the steepest it has been in ~4 years as long bond prices fall but the short end stays rock solid, thanks to the Fed.

Gold has been struggling

Gold started strong this year (with the USD at 3-year lows) but fell $180 from January’s highs at Thursday’s low. Gold open interest on the Comex is down ~50,000 contracts (~9%) since the January highs and in the global gold ETF market there has been ~10 tonnes of net selling since the highs last August. On the positive side, total ETF holdings are very near ATH at 3,765 tonnes.

Crude oil has been smoking hot

WTI crude oil soared nearly $6 this week to >1 year high. That’s up ~$23 (67%) since the November 1st Key Turn Date. Open interest is up nearly 350,000 contracts (~13%) in the last 7 weeks. Aggressive spec buying in the front months has caused backwardation to steepen dramatically.

The US Dollar keeps rising

The US Dollar Index rallied ~2.7% from a 3-year low on January 6th even as the major stock and commodity indices rallied. I’ve been writing for the past several months about the very strong negative correlation between a WEAK Dollar and STRONG stock and commodity indices. On the basis of that inter-market correlation I’ve been expecting that the recent stronger USD might be signaling weaker stocks and commodities. But Murphy’s Law seems to require that once you start to count on an inter-market relationship it will change!

Why are stocks, commodities, interest rates and the US Dollar all rising at the same time?

In terms of “cause and effect” the rationale for stocks, commodities, interest rates and the USD to all be rising together may be that the market anticipates stronger economic growth in the USA than the rest-of-the-world. The USD is also benefiting from widening interest rate differentials and the covering of some of the massive-sized short USD positions.

A longer term view – a new commodity bull market has started

I’ve been writing a longer-term market view that I hope to get finished and posted here in the next few days. Essentially I think inflation is finally going to show up, created by MMT style fiscal stimulus that will diminish the dollar’s purchasing power. I’ve been a disinflation guy for 10 years but that time has passed.

Specifically, I think commodities will out-perform stocks and especially bonds. Commodities have been in a bear market for 9 years and there has not been nearly enough capex to provide the new supplies that will be needed to meet demand. So I think we could see a new commodity bull market driven by inflation and short supplies. I think the 1st leg up started at the 15 year low made last March/April. I’m looking for a correction over the next few months to set up a long-term buying opportunity.

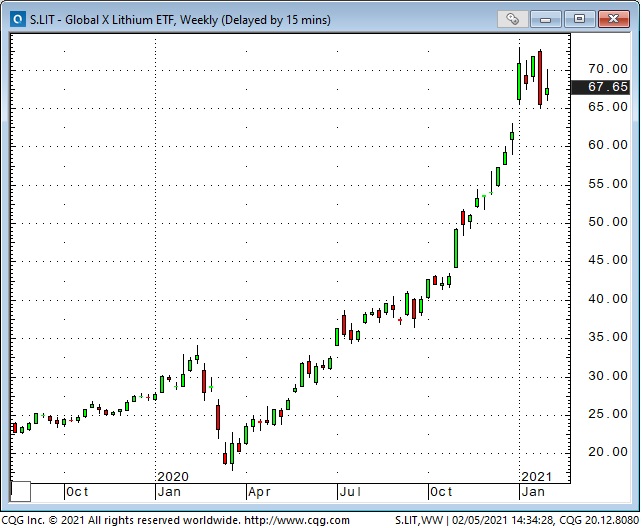

ESG and climate change policies are going to make it more difficult and expensive to source new commodity supplies. Regardless of what you think about ESG policies do not under-estimate the impact, both positive and negative they will have on commodity markets.

Speaking of ESG impact on markets check out this Lithium ETF:

My short term trading

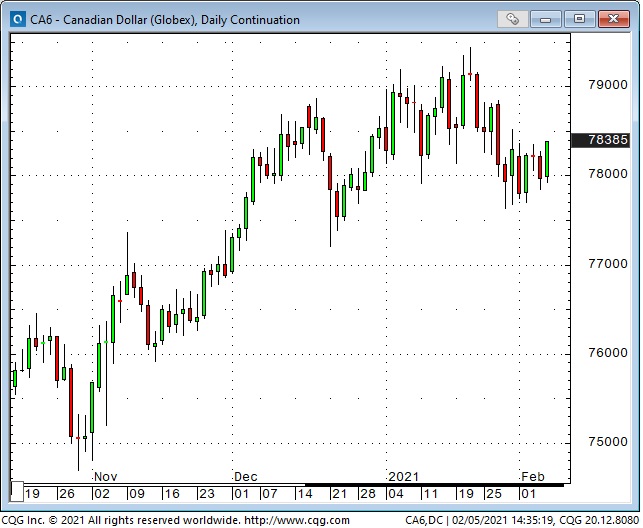

At the end of last week I was short the CAD and the S+P looking for the stock market to keep falling and the USD to keep rising. My stop on the S+P was hit early Monday resulting in a small loss and I was stopped on the CAD Tuesday for a decent profit ( I move stops behind a market if it is moving in my favor.)

I’ve been shorting CAD as the best way to trade my “USD up, stocks and commodities down” idea. (CAD has been highly correlated to that 3-way inter-market relationship for months.)

I’m thinking that stock and commodity indices may have a short term correction before the longer-term “inflation trade” kicks in (keep the time frame of your trading in sync with the time frame of your analysis) and if they do then the USD would likely stay strong so I could be back shorting the CAD.

But if commodities catch an inflation and supply/demand bid over the next couple of years buying the CAD and other commodity currencies should be a good trade.

I was “distracted” from my trading on Monday and totally missed getting short the Euro or Swiss as they broke down early in the week (In last week’s notes I pointed out how the Swiss looked like it could tumble.)

I’ve written before how it is often more painful to miss a trade than to lose money on a trade, but trading is not a game of perfect and you have to forgive yourself for misses and mistakes and bone-headed decisions and move on. Focus on the process, not the short term results.

I couldn’t bring myself to do a full 180 this week and buy stock indices. It was the right thing to do (short term) but my bias got in the way. I’m flat at the end of the week.

Victor Adair retired from the Canadian brokerage industry last year and is therefore no longer licensed to provide investment advice. This blog and everything on this website is definitely not intended to be investment/trading advice for anybody for any reason!