Stocks, bonds and gold soar; the US Dollar falls as markets anticipate Central Bank cuts

The DJIA has rallied ~4,000 points (~12.5%) in five weeks and is only ~2% away from All-Time Highs. It is up ~26% from October 2022 lows.

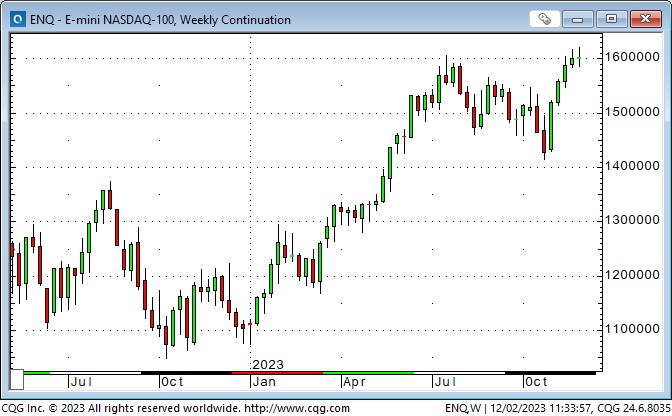

The Nasdaq 100 has rallied ~13% in five weeks and is only ~5% away from ATH. It is up ~52% from October 2022 lows.

Capital appears to be rotating out of Megacap tech stocks (after a sizzling rally) and entering the broader market. For instance, Boeing is up ~34% since late October, and ARKK is up ~40%.

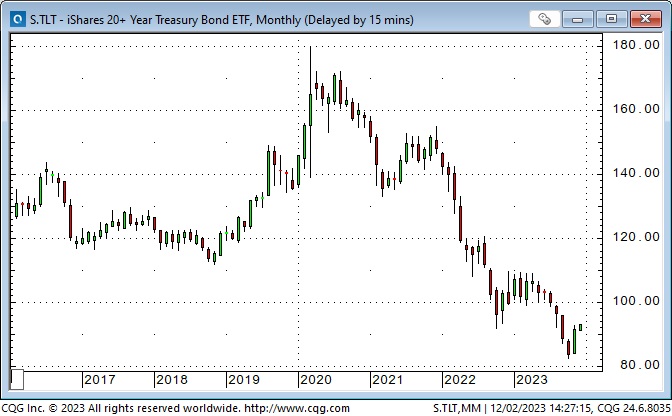

The 10-year US Treasury futures contract has rebounded from 16-year lows in mid-October. The 10-year yield has dropped from ~5% to ~4.2%, one of the steepest 5-week yield declines in 40 years.

The December 2024 3-month SOFR futures contract has rallied ~85 bps in the last six weeks (as markets anticipate Fed cuts) and is now pricing short rates ~140bps below current levels. (The SOFR contracts trade at a discount to par: 9600 =4%.)

Front-month Comex gold futures registered ATH daily, weekly and monthly closes this week, with gold up ~$260 (~15%) from early October lows. (The true ATH of $2085 for front-month Comex gold futures was made during a 2-minute spike in thin afternoon trading on Wednesday, May 3. See my May 6 TD Notes for details.)

In last week’s Notes, I wrote, “From a charting perspective, the 2020, 2022 and 2023 triple tops appear to “invite” new All-Time Highs. From a fundamental perspective, continuing government deficits, which lead to a continuing decline in the purchasing power of currencies, appear to “invite” new All-Time Highs.

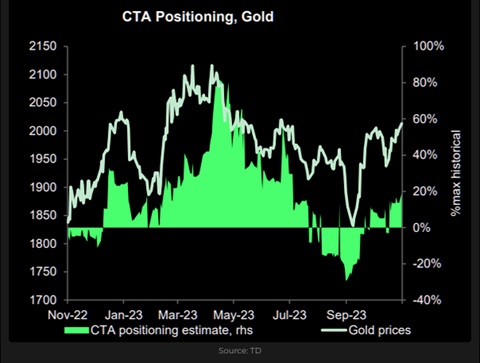

Gold has effectively rallied to All-Time Highs with net long non-commercial (spec) positioning on the Comex at the highest level since April 2022 (circled below.) Note that speculators “bought the highs” following the Russian invasion of Ukraine in February/March of 2022 and that gold fell ~$400 over the next seven consecutive months as the USD and interest rates rose. Speculators were net sellers of gold during that seven-month decline.

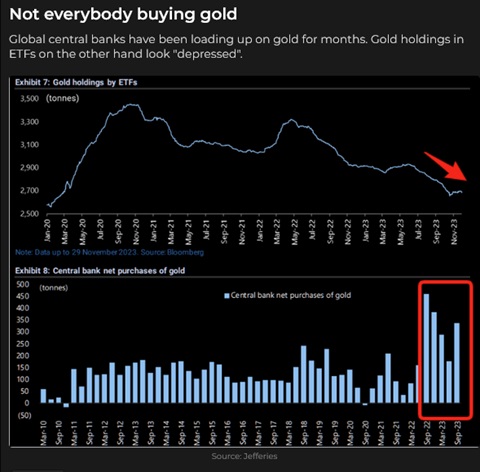

Interestingly, despite reports of continuing record Central Bank buying, the GLD ETF had net sales this week (and net sales over the last three years).

The US Dollar Index rallied ~20% (to a 20-year high) from March to October 2022 as the Fed raised interest rates aggressively. It has fallen ~4% from its recent highs as markets increasingly price in Fed cuts next year.

What happened to the “cognitive dissonance” between what the Fed said and what the market heard?

In last week’s Notes, I wrote, “Ever since the Fed started raising rates in March of 2022, markets have been betting on when they would stop and reverse. In what might be a classic example of cognitive dissonance, markets have heard the Fed repeatedly say rates will stay higher for longer but have believed that the Fed would soon be cutting rates.”

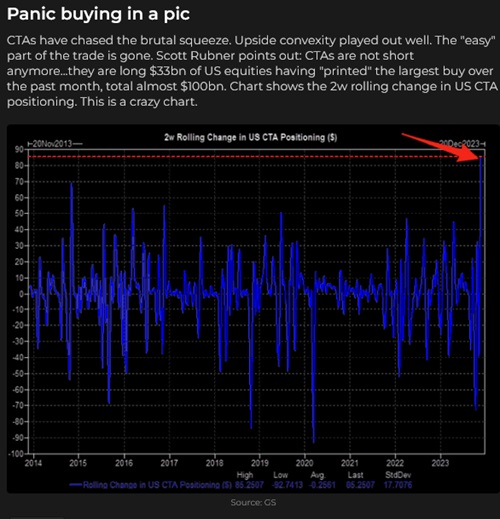

Two things happened: 1) Fed Governor Waller (a former hawk) delivered a “dovish” speech on Tuesday (and Powell did not push back hard when he had the chance on Friday), and 2) there were dramatic changes in positioning (people who were short or underweight stocks, bonds or gold chased the markets higher.)

What happened to the idea that financial conditions had eased too much too fast?

In last week’s Notes, I wrote, “The November rally in stocks and bonds, accompanied by a falling USD, has caused a substantial easing of financial conditions such that the Fed/Powell may once again “feel the need” to remind markets that they “aren’t sure rates are high enough, that rates will likely need to stay high, and, if inflation doesn’t fall, they may raise rates again.”

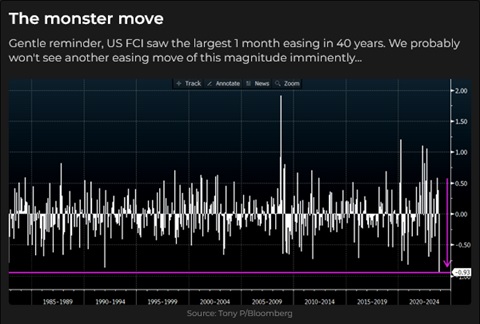

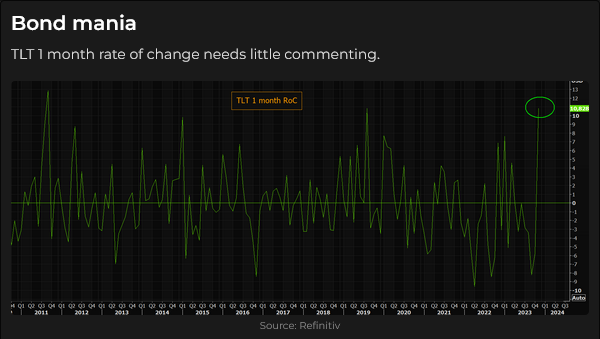

Jim Bianco estimates that November’s easing of financial conditions was the equivalent of ~90 bps of Fed cuts. With the Bloomberg Agg Bond index having its best month since 1985 and the S+P up 9%, financial conditions eased more in November than in any month in the last 40 years.

Waller and Powell certainly did not “forecast” that short rates would be ~140 bps lower a year from now (as the market is pricing), but the market seems to have taken their comments as a “signal” that rate cuts lie ahead. (“A man hears what he wants to hear and disregards the rest.” Paul Simon, The Boxer.)

While I’m skeptical that bonds are rallying because of looming Fed cuts, I greatly respect the idea that “positioning shifts” can move markets more than the “facts” may warrant. The bond market has had the most dramatic decline over the past three years that traders have seen in their lifetimes. When I look at this chart, I assume that fund managers are net underweight (or short) bonds and are starting to change that positioning. If that’s the case, the rally probably has more to go.

Energy

WTI crude oil had its lowest weekly close this week since early July and has closed lower for the past six weeks, down ~$20 from the late September highs at $95.

The OPEC+ voluntary production cuts (to be announced by individual countries) disappointed the market this week as US production hit 12.24 mbd – an All-Time High for any country in the world. With a current output of ~3.2 mbd, Brazil will join OPEC in January 2024.

Uranium shares were higher again this week, with Cameco up for seven consecutive weeks.

My short-term trading

I started this week with a long CAD position established on Wednesday last week. I covered the position on Tuesday for a gain of ~70 points following a lurch higher across FX, equity and credit markets on Waller’s comments. That looked to have been the right move on Wednesday when the CAD fell back a bit, but the market continued higher without me on Thursday and Friday. As I noted last week, net spec short positions were at a 7-year high, and if the CAD continues to rally, short-covering will accelerate the move.

I took three small losses on Tuesday, Wednesday and Thursday trying to top-pick the S&P this week. It looked like momentum was fading, but the market didn’t want to break, so I didn’t stay short. I did nothing Friday (other than wonder why I wasn’t long!) and went into the weekend flat.

On my radar

I will be monitoring the gold market for a possible short position. As noted above, the commitment of traders’ reports (COT) shows that net spec positioning has become the most bullish, and net commercial positioning has become the most bearish since April 2022. This, by itself, does not warrant fading the market, but if there is a “technical failure” of some kind (for instance, a day when gold rallies on some bullish news but reverses and closes lower on the day), I will look for a way to get short. I’m looking for a “reversal in an over-bought market,” so if the market makes new highs after I establish a short position, I’m wrong and will be stopped out.

Positioning changes can have a significant impact on prices. CTAs (Commodity Trading Advisors) had the biggest net short equity position in three years at the October lows, then bought $100 billion in November. They are now net long.

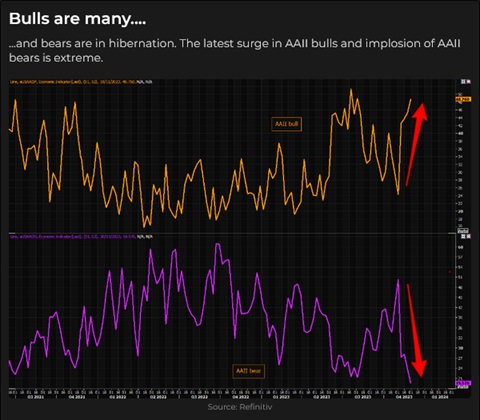

Stock market sentiment is very bullish.

Seventy thousand delegates were expected to fly into Dubai this week to attend COP28 and to pledge support for “accelerated action against the escalating climate crisis.”

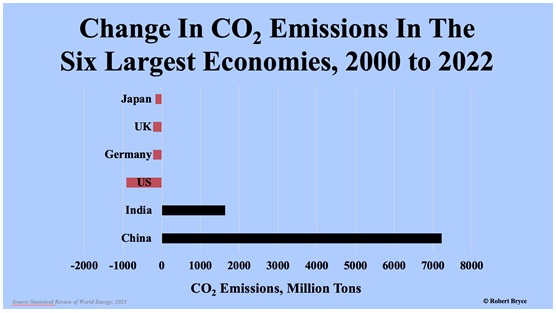

I subscribe to Robert Bryce’s substack letter, which this week included 11 charts that won’t be seen at COP28. Here’s my favourite:

The Bank of Canada meets on Dec 6. No policy change is expected.

The FOMC meets on December 12.13. No policy change is expected.

As always, the US employment reports this coming week will have the potential to rock the markets.

Quote of the Week

- About 95% of [newspapers are] going to disappear and go away forever. And what do we get in substitute? We get a bunch of people who attract an audience because they’re crazy.” Charlie Munger

The Barney report

My wife and I went to Victoria on the weekend to visit family. We left Barney with a sitter who has four goldens. He seemed to fit in OK.

Listen to Victor talk markets with Mike Campbell

On today’s Moneytalks podcast, Mike and I discussed the “Sea Change” the market is seeing in Fed policy and how that has driven big rallies in stocks, bonds and gold. My segment with Mike starts around the 1 hour, 1 minute mark. Mike’s feature guest this week was Yves Giroux, the Parliamentary Budget Officer, and they talked about government spending. You can listen to the Moneytalks podcast here.

The World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

This Week In Money

I did a 30-minute interview on November 24 with Jim Goddard for This Week In Money, discussing how the “common denominator” of the big swings in stocks, bonds and currencies has been the big swings in what the market thinks the Fed will do. We also discussed specific issues affecting currencies, stocks, bonds, gold and crude oil. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.