Stock market sentiment took another step away from “irrational exuberance” this week

I wrote in the July 22 TDNotes: I’ve been skeptical of the “Magnificient Seven” rally for a few months, thinking that sentiment bordered on “irrational exuberance.” However, I respected the power of the rally and patiently waited for an opportunity to fade it. I thought the “$100 Billion in an hour” surge in the MSFT market cap (on July 18) may have signalled a top, and when the Nasdaq dropped below Tuesday’s highs on Wednesday, I got short and remained short into the weekend.

MSFT closed this week down ~11% from the All-Time Highs made following the “$100 Billion increase in market cap in one hour” moment on July 18.

AAPL closed down ~8% this week from the All-Time Highs made on July 19.

XLK closed down ~6% this week from the All-Time Highs made on July 19.

I don’t think market sentiment has swung dramatically from “irrational exuberance” to “risk adverse,” but the enthusiasm to buy higher and higher prices has been tempered; people (and machines) who bought into the rally late may become sellers.

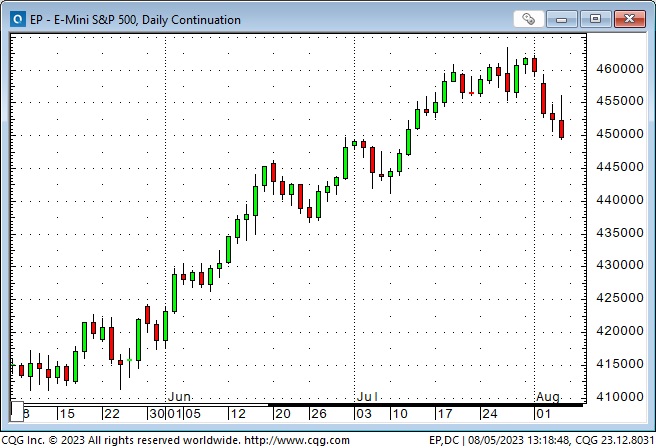

The S&P 500 index had its highest monthly close on Monday since December 2021 and then dropped Tuesday, Wednesday, Thursday and Friday, coming very close to creating a classic Weekly Key Reversal down.

The S&P rallied early Friday following the benign employment report but then ominously tumbled to close the week below Thursday’s low, creating a Daily Key Reversal Down.

Volatility metrics, which had been near the lows of the past few years, spiked higher this week.

Bond market sentiment turned aggressively bearish over the past two weeks

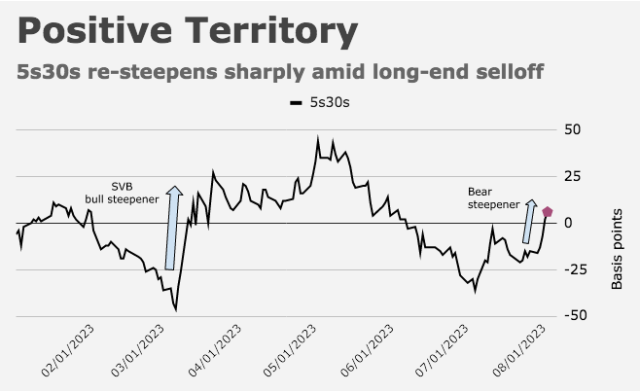

Yields on long-term bonds have soared relative to short-term bonds since mid-July as markets brace for a dramatic increase in Treasury issuance. The 30-year yield touched a 9-month high on Thursday, ~4.32%. Bond prices have also been under pressure as the long-anticipated recession continues to be postponed further into the future.

Bond prices initially printed new multi-month lows following the softer-than-expected UE report Friday morning but then rallied for the rest of the day with 2’s, 5’s, and 10s, all creating dramatic Daily Key Reversals, exacerbating the bear steepening. Friday’s bond rally may have been driven by short-covering after recent steep losses and flight-to-safety buying as stock prices fell.

Forward interest rate markets are pricing a ~10% chance that the Fed will raise by 25 bps in September and a 90% chance that they will pause.

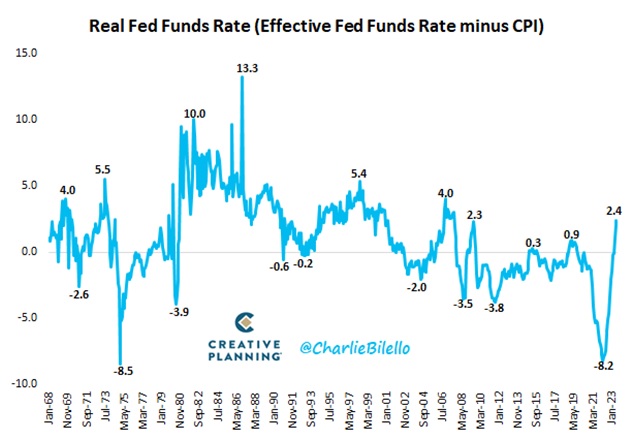

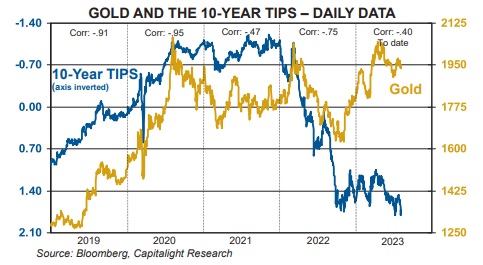

Real interest rates surged higher this week. Prices on the 10-year TIPS hit a 9-month low, while the overnight real rate rose to a ~12-year high.

The US Dollar Index has rallied ~3% after hitting 15-month lows in mid-July

The Euro has been virtually the mirror image of the USDX, dropping ~3% since hitting 15-month highs in mid-July.

The Yen has also weakened against the USD since mid-July but remains around 15-year lows against the Euro. Aside from the brief lows made last fall, the Yen is near 25-year lows against the USD, down almost 50% since Abenomics went into effect in 2012. (“The world” is short Yen, and “someday” it’s going to turn higher!)

The Canadian Dollar has been looking toppy above 76 cents (as noted here last week), and it registered a Weekly Key Reversal Down this week, despite crude oil being at 9-month highs. The CAD seemed to trade in step with the S&P this week, rallying on Monday but falling Tuesday through Friday.

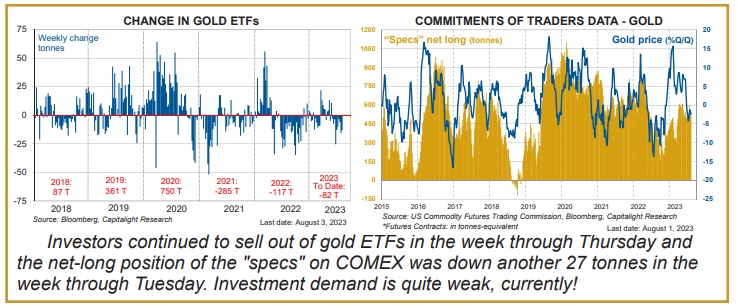

Gold was pressured by higher interest rates and a stronger USD this week but bounced back a bit on Friday when USD and interest rates fell

These charts from Martin Murenbeeld:

I pay a lot of attention to correlations, and I understand that correlations work until they don’t, but if the correlation between gold and real USD bond yields got back in sync, gold would be a lot lower. So the question is, why is gold not a lot lower, given its historical correlation to real rates? The answer is likely that “something else” positively influences the gold price, “over-ruling” the influence of real rates.

Central banks substantially ramped up their gold buying during the last year or so while the gold/real rates correlation broke down, so that could be the “something else” affecting the gold price. But I wonder if the shrinking purchasing power of currencies also puts a bid into the gold market. Martin and I both believe that continuing debt-fuelled fiscal policies will ensure much higher gold prices in the future. I recommend subscribing to Martin’s service, The Gold Monitor, for readers interested in gold. Click here to access a free trial.

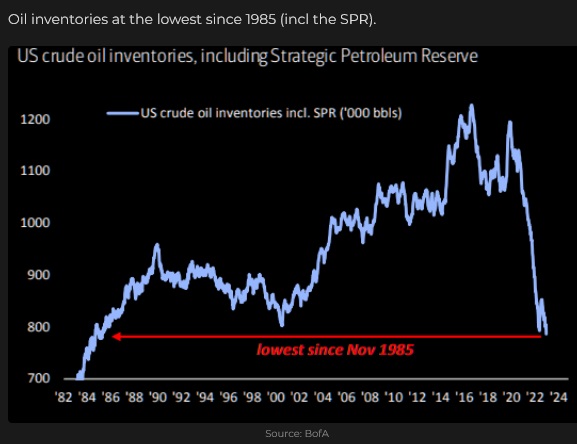

Crude oil futures came within a few cents of hitting new 9-month highs this week

Thoughts on trading – What is your edge?

My piece last week on “Edge” generated some fascinating replies. (Thank you to the readers who sent me a note.) A veteran trader from Chicago told me that his edge is an amalgam of discipline, experience and freedom. Freedom/ability to trade any market using the expertise and knowledge he has gained over the year. He stressed discipline.

On a separate note, he told me that he believed the central cause of the 08/09 financial crisis was that no one was aware of how much leverage was in the system. (I won’t argue with that!)

And then he asked, “Are we aware of how much positioning is enabled by the Yen carry trade?” He said he is fearful that we are as unaware of the size of the Yen carry as we were unaware of the size of the 08/09 leverage.

Please note my comment in the Currency section above: “The world” is short Yen, and “someday” it’s going to turn higher!)

My short-term trading

I started this week with no positions. On Monday, I shorted the CAD, the Euro and the S&P. The CAD moved sharply in my favour, and on Wednesday, I wrote OTM puts against it to hedge/lock in some gains. I covered all positions except the short CAD puts on Thursday (ahead of the Friday morning UE report) for decent profits. I covered the short CAD puts ahead of the UE report Friday morning (reducing risk) for a slight loss.

I waited more than an hour after the UE report for markets to “settle down,” then bought CAD and Yen (I couldn’t bring myself to chase the Euro!) I sat with those positions for a few hours, but when I noticed the S&P topping out on intra-day charts, I covered my positions for small profits and went into the weekend flat.

I missed re-shorting the S&P and buying bonds on Friday, but my P+L had a good week, and I went into the weekend flat.

On my radar

The S&P had its highest monthly close on Monday since December 2021, then closed down four days in a row, Tuesday through Friday. Market sentiment is shifting from “irrational exuberance” to “risk adverse.”

I think the $5.5 Trillion in money market funds is not “dry powder” that will, sooner or later, have to come into the stock market because of FOMO. I think it is “rainy day money,” earning a safe 5%, while irrational exuberance has its day.

Warren Buffet has $147B (~29% of total assets) in T-bills and $353B in stocks.

EDIT August 7, 2023: BRK traded to All-Time-Highs Monday, August 7, after Saturday’s quarterly report. Market cap ~$794 Billion.

If stocks continue to weaken, as I expect, many recent buyers (people and machines) will become sellers.

Correlations: if stocks continue to weaken, the USD will rally against most currencies, but maybe not the Yen. I’m watching the Mexican Peso (and the Mexican stock market.) They have soared and may be due for a severe correction.

The Barney report

We’ve been putting cream (prescribed by the Vet) on Barney’s nose twice daily, and his rash seems to be fading. We tossed the cone after two days.

We’ve been having our usual summer drought here on the Island – hot and dry – so I took Barney for a walk along the Englishman River this week, and he loved jumping into the river to fetch sticks. He’s full of beans and oblivious to a little rash on his nose!

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

You can listen here to a 6-minute interview I did with Mike Campbell on his popular Moneytalks podcast on August 5. We talked about how I had “called the top” on his show two weeks ago when I said the “$100Billion in one hour” market cap gain in MSFT was the “cherry on top” of the big run in Megacap tech stocks. We also talked about interest rates, currencies and gold. My spot with Mike starts around the 1 hour, 20-minute mark.

I did a 30-minute interview on July 29 with Jim Goddard on the This Week In Money show. We talked about Central banks, stocks, currencies, gold, and the energy markets and some of my thoughts about a trader’s “edge.” You can listen here – my interview starts around the 13.24 mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.