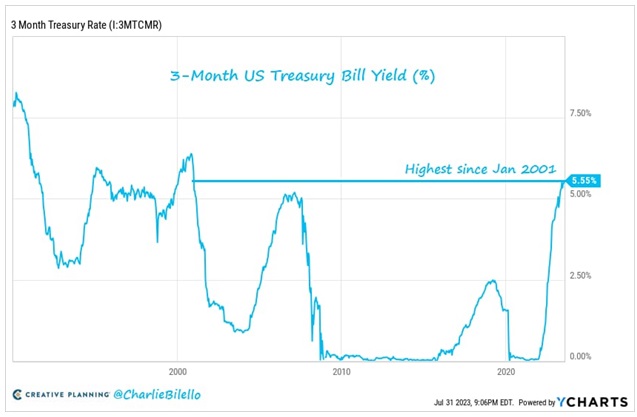

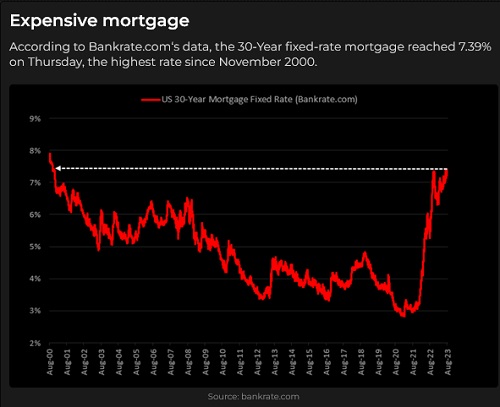

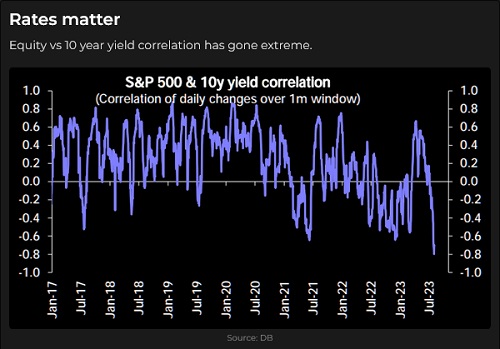

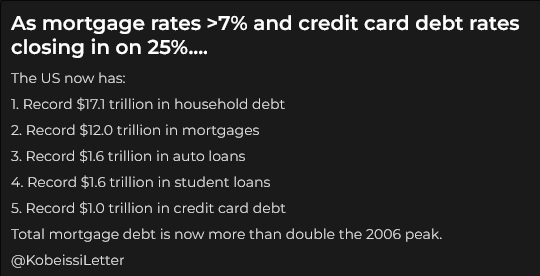

Interest rates keep rising. The 1-year T-Bill yield is at 22-year highs

Treasury yields are rising as governments issue more debt to “fund” the difference between income and expenses. People will buy US government debt, but at what price?

Governments have discovered that voters like fiscal stimulus (expect it to continue) and don’t care about rising deficits and government debt service costs.

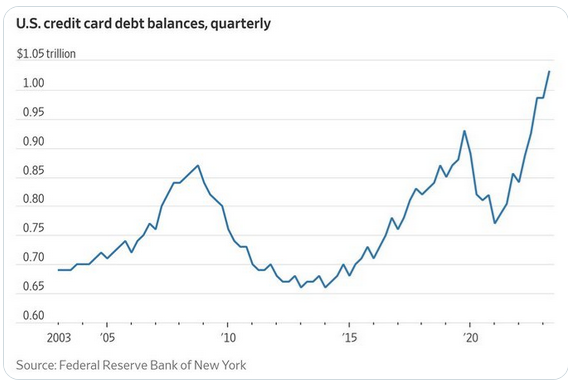

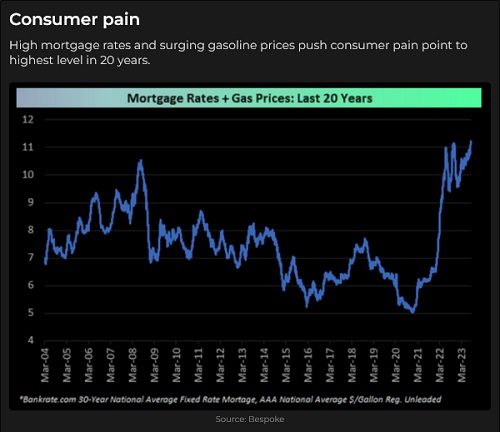

But people care about the rising cost of living. They know that the prices of things they buy are rising faster than the CPI, and they will do whatever they can to “catch up” to increasing prices. Businesses will raise selling prices; consumers will try to get paid more (expect more strikes) and will borrow more to “maintain their lifestyle.”

Fiscal stimulus devalues the purchasing power of currencies

The declining purchasing power of currencies is “inflation,” and while the Central Banks raise interest rates to “get inflation down,” they are “over-matched” by growing government deficits. Expect inflation and interest rates to stay “higher for longer.”

The Nasdaq made a significant top in mid-July

The “defining moment” was the $100 Billion increase in MSFT market cap in one hour on July 18 which took the share price to All-Time Highs. Those gains were erased within two days, and MSFT closed this week ~13% below the July 18 highs. The NAZ is down ~6% from mid-July highs.

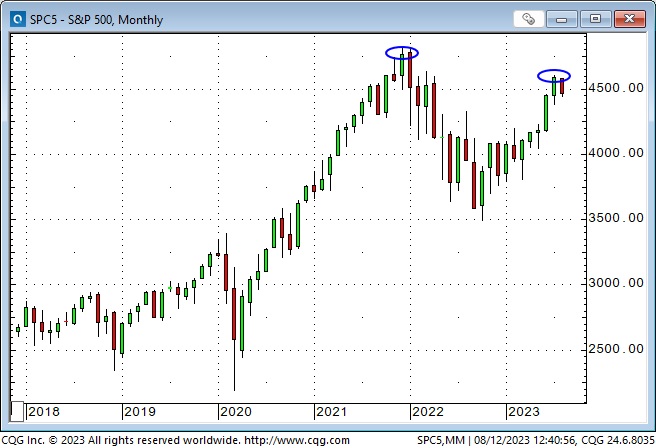

The S&P had its All-Time Highest monthly close – except for December 2021 – on July 2023 and has weakened by ~3% since then.

The DJIA made an 18-month high on August 1 and has dropped ~1% since then.

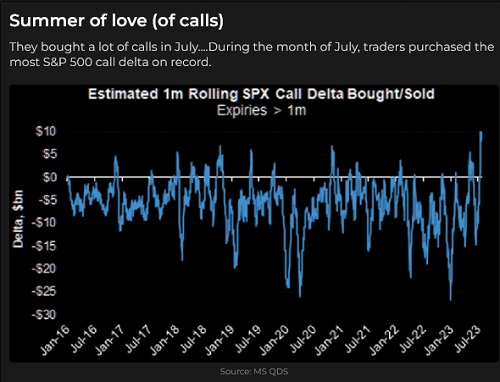

Markets move when psychology changes, and I think the FOMO buying since the SVB “crisis” lows in March has “run out of steam.” The Nasdaq led the rally and has fallen the most, but the S&P and DJIA appear vulnerable to further weakness.

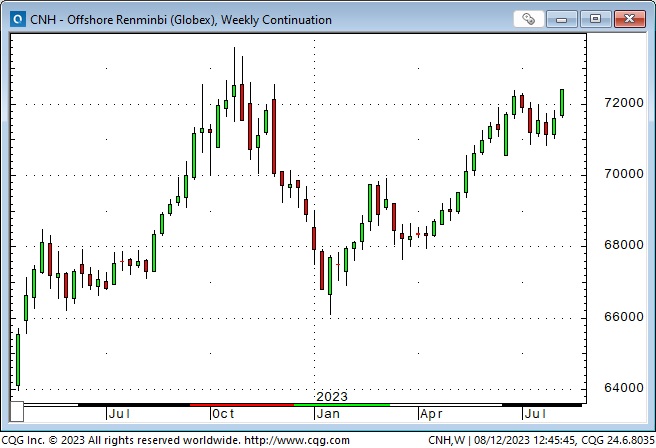

China continues to weaken

The RMB has fallen to 10-month lows against the USD as real estate woes continue and the economy struggles to “get going.” (In this chart, rising prices mean it takes more RMB to buy one USD.)

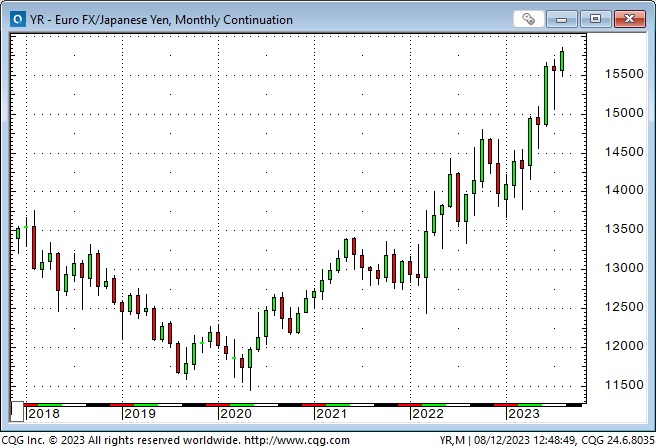

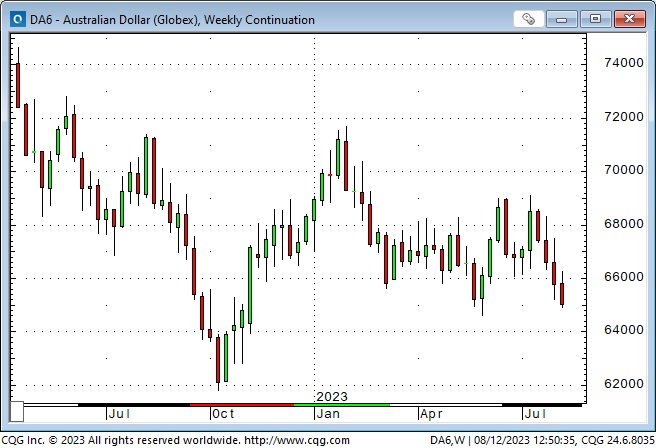

The Yen is at new 15-year lows against the Euro and near 25-year lows against the USD. Other Asian zone currencies (including the AUD and NZD) are weakening. (This chart shows the Euro rising against the Yen.)

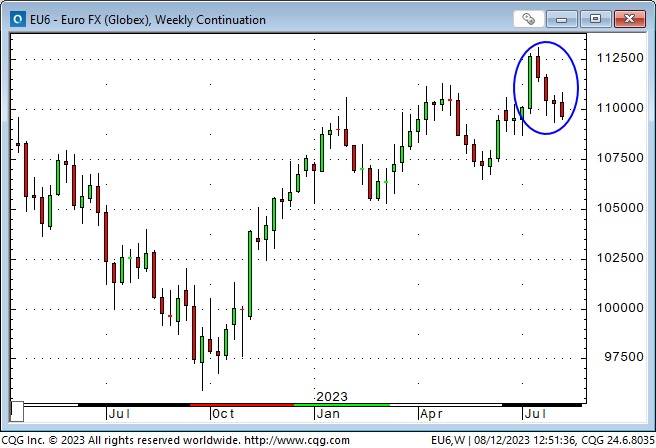

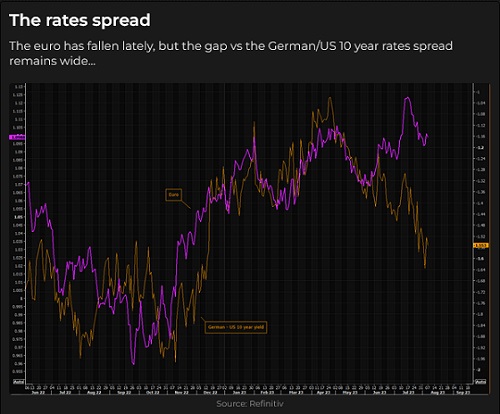

China is Germany’s biggest export market, and the Euro has closed down against the USD for four consecutive weeks.

Capital comes to America for safety and opportunity.

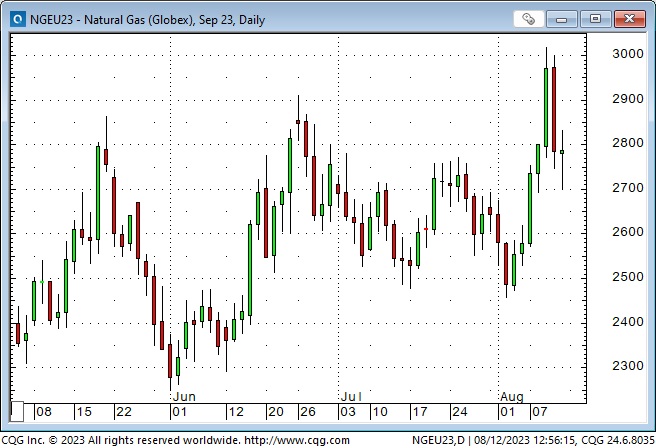

Energy markets surge higher

Front-month Nymex WTI hit a 10-month high this week, while transportation fuels surged higher.

North American Natgas prices jumped as much as 20% from last week’s lows, while European prices jumped 40% on worries of a strike at Australian LNG export facilities.

Gold

December Comex gold futures closed at a 5-month low this week as a stronger USD and rising interest rates pressured prices.

My short-term trading

I started this week with a clean slate but began trading Sunday night by shorting the Euro. Over the next few days, I was in and out of the markets several times (sometimes stopped out, and other times, I took profits when the markets moved my way.)

I was shorting the Euro, the S&P, the CAD and copper and went into this weekend short the S&P, the CAD and the Euro. I closed my short copper position for a decent gain.

My net P+L was up for the week, but very choppy intra-day price action made it difficult to have much conviction on any trades.

On my radar

“What I’m really looking for is a consensus that the market is not confirming. I like to know that there are a lot of people who are going to be wrong.” Bruce Kovner, The Market Wizards

People have built positions based on their views about inflation, monetary policy, recession probabilities, and other “fundamental” ideas. Machines have built positions based on momentum.

I develop market biases that are usually anti-consensus (sometimes I’m a trend-follower, and sometimes I wish I were more of a trend-follower!), but I use charts to find entry and exit points and to manage risk.

Stock markets have had a terrific rally since last October, especially since the “banking crisis” lows in March, and I think they have begun a correction that might develop into something more, especially if the people (and the machines) that have “pressed” their positioning lately decide to size down.

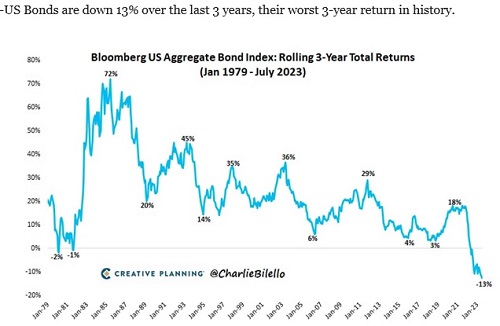

Bonds fell in the 2nd half of 2020, had a down year in 2021 and a disastrous year in 2022. Many people are now long bonds because nominal yields are the highest in a decade, and they believe the “inevitable” economic slowdown will cause bonds to rally. If the stock market falls away from recent highs, I could see bonds rally on “stocks down, bonds up” traditional thinking, but my longer-term belief is that fiscal stimulus “crossed the Rubicon” during covid, so huge deficits and massive issuance and higher inflation will keep a lid on any bond rallies, and yields will rise.

The US Dollar Index hit a 20-year high last September (with the Yen and Sterling at 30+ year lows) and then fell ~13% to 15-month lows this July. The Market’s preferred way to fade the USD over the past several months has been to buy the Euro, but also the Swiss and Sterling (Norway and Sweden, not so much.) Asian zone currencies (including AUD and NZD) rallied from October to December last year but have trended lower YTD. The BRL and the MXN have trended higher since last fall. The Mexican Peso, up ~20%, is probably the world’s strongest currency over the past 12 months.

I have nick-named the Euro the Anti-dollar, given the market’s preference to short the USD by buying the Euro, and I think it “topped out” around 1.12 – 1.13 in July. Net long speculative positioning in Euro futures has been trimmed a bit in the last couple of weeks, but if the Euro falls from here, there will be more “capitulation” selling.

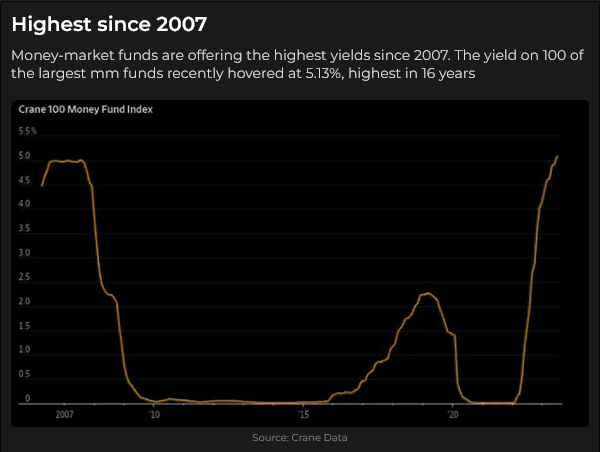

I don’t see the cash piling up in money market funds as “dry powder” that will eventually surge into the stock market in a wave of FOMO buying. I see it as “rainy day money” that can finally earn a decent return after too many years of near-zero rates.

Thoughts on trading

Choppy intra-day price action this week left me in a quandary a few times. For instance, I was twice ahead by ~40 points on a short S&P position, only to have the market rebound to my entry price. I had stayed short at the lows because I expected a more significant move, but instead, my unrealized gains evaporated with the rebound. Should I have taken the 40-point gains? Some folks would have, but I would have been kicking myself if I had, and the market tumbled another 100 points.

I’m not surprised at the choppy intra-day price action. The stock market has had a powerful advance and, barring a dramatic event is unlikely to “turn on a dime” and head lower. (Currency markets, however, are likelier to “turn on a dime.”)

When I enter a position, I almost always immediately enter a chart-derived stop. (If I’m short and the market rallies to X, I’m wrong on my time frame, and I need to exit the trade.) But as time passes and prices change after I’ve entered the market, my original stop may no longer be at the optimal price. For instance, if I’m short and the market falls, that presents “new information.” The price where “I’m wrong” if the market rallies has probably changed, so I may lower my stop.

I use stops as a “disaster prevention” tool and as part of a calculated risk/reward strategy. If I’m short a market and it rips higher (for whatever reason), I want to have an order “in the market” to get me out – especially if the rip higher happens in the middle of the night or when I’m otherwise away from my screens.

Two great interviews – from two great traders

Kevin Muir and Tony Greer were both speakers at the World Outlook Financial Conference in Vancouver in February, and I had the pleasure of sitting with them at the speakers’ dinner. Tony interviewed Kevin this week on https://www.realvision.com – it was one of the best interviews I watched this year.

Mike Campbell interviewed Tony on Saturday on the Moneytalks podcast – another great interview. Tony’s interview with Mike starts around the 6-minute mark.

For readers who can’t access RTV (the cost of a basic subscription is only ~$100 year), Kevin has given me permission to post links to two of his recent Substack blogs: https://posts.themacrotourist.com/p/ae6e232f-4fc5-4fa6-808b-228dea5d2f8e and https://posts.themacrotourist.com/p/d19c6862-3fde-4894-b101-55ec99bb497f.

When I read market commentary, watch a market video or listen to a market podcast, I’m not looking for specific buy/sell recommendations. I’m hoping to get an idea that I may be able to develop into a trade that suits my style of trading. When I write these Notes, I don’t give specific buy/sell recommendations (because markets can change a lot in a week!), but I hope readers will get an idea they can develop into a trade that suits their style.

The Barney report

I often call Barney the Snoop because he is relentlessly snooping into everything. When we have visitors, I tell them to keep the door to their bedroom closed; otherwise, the Snoop will find something and either eat it or pack it off somewhere.

We took Barney back to the Vet this week. (I hear people say their dog hates going to the Vet; Barney loves everybody, including the Vet!) His nose infection is getting better, but we must keep putting cream on it. The good news: the Vet says he can play in the ocean again!

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on August 12 on his very popular Moneytalks blog. We talked about the stock market topping and how massive government fiscal stimulus is causing currencies to lose their purchasing power – which I think is the bedrock of inflation. We also discussed the trades I made this week. My interview starts around the 1 hour, 4-minute mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.