A quick report this week – my Golf Club Championship demands my participation!

Interest rates keep rising

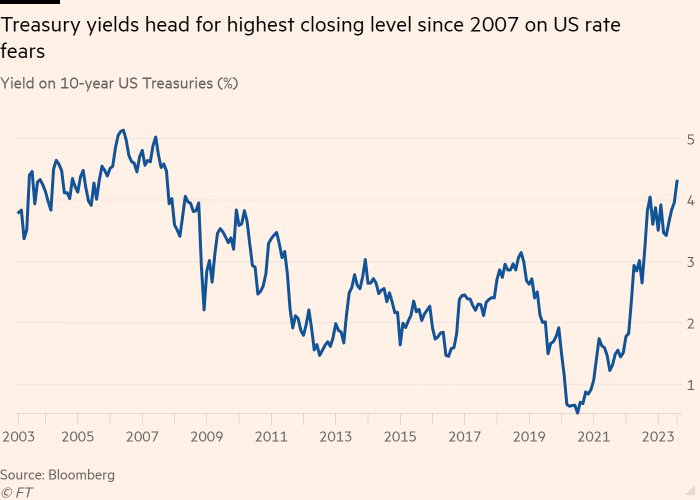

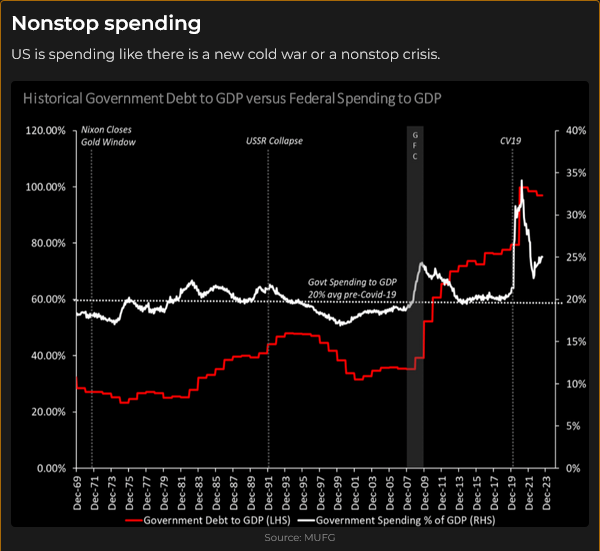

The 10-year US Treasury yield hit a 16-year high of>4.3% this week. Short rates are at 20+year highs, 10-year reals touched 14-year highs, UK Gilts touched 25-year highs, and Canadian 10-year government bonds hit 13-year highs. A stronger-than-expected US economy, rising term premiums, expectations of increased issuance, and worries that inflation may be “higher for longer” helped push yields to multi-year highs.

Bond prices made their YTD highs in early May (following the March “banking crisis” that inspired thoughts of an imminent recession.) The first leg down ran until early July, followed by a brief “relief rally” into mid-July. But mid-July proved to be a Key Turn Date across markets as interest rates and the USD rose while stock indices fell.

The stock market fell again this week

The Nasdaq 100 was down ~9% from its mid-July highs, and the S&P and the TSE were down ~5%. Volatility metrics have risen from the historically low mid-July levels as stock indices have fallen.

For perspective, The recent ~5% decline in the S&P follows a ~20% rally from mid-March to mid-July. However, it appears that people (and machines) who were late buyers of the March to July rally may have become sellers, and selling begets selling.

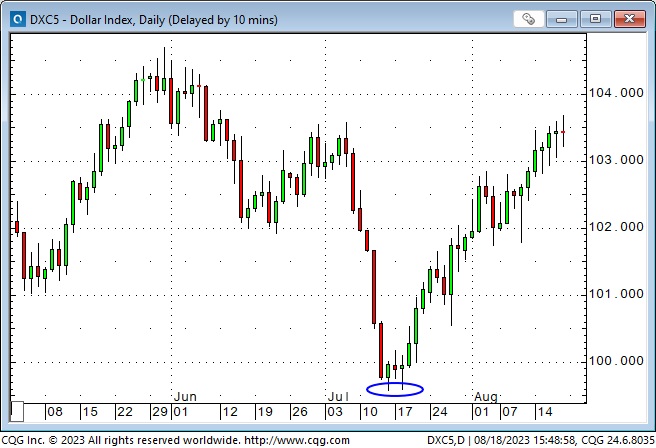

The US Dollar keeps rising

The US Dollar Index is up ~4% from 15-month lows in mid-July, with the Euro down ~4% from 17-month highs in mid-July.

The Canadian Dollar hit an 11-month high of ~7650 in mid-July but trended lower for five consecutive weeks, down ~3.5% at 7380 on Friday’s close.

The Chinese offshore RMB touched a 16-year low near the end of the week before a round of intervention halted the decline. It had dropped ~3.5% since mid-July. (Higher prices on this chart mean it takes more RMB to buy one USD.)

Gold fell ~$115 (5.5%) from mid-July highs to this week’s lows. The rising USD and real interest rates continue to be a toxic combination for gold.

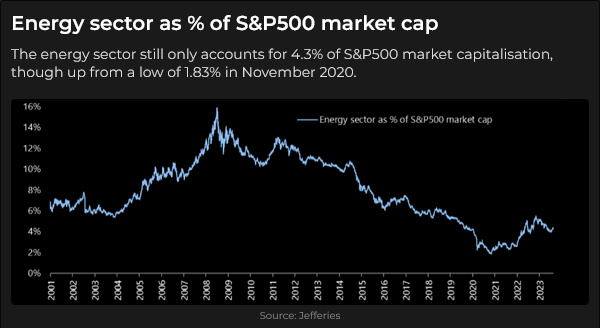

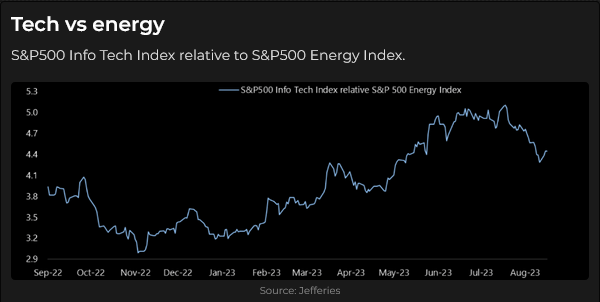

Energy

Nymex WTI crude rallied >25% from June lows to August highs and made new YTD highs (~$85) last week. Prices backed off ~$6 mid-week but rallied above $81 by Friday’s close.

Bad news from China

The weak Chinese currency may signify the market “voting with its feet” concerning China. The post-lockdown “recovery” has been a dud, and the shadow banking/real estate woes may have induced a crisis of confidence. (It’s hard to maintain confidence when the problems of WAY too much leverage are compounded by deflation.) Rather than tinkering with monetary policy, a significant blast of fiscal stimulus may be required to “right the ship.”

Thin liquidity

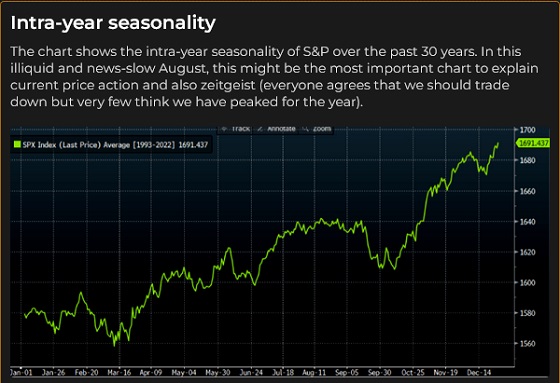

The last two weeks before Labour Day are historically a time when the “adults have left the building,” and markets can get choppy in thin liquidity conditions. Seasonality also has September/October as the weakest time of the year for the S&P.

My short-term trading

Since the “defining moment” of the “$100 Billion increase in MSFT market cap in one hour” on July 18, I have been selling stock indices and buying the US Dollar.

I started this week short the Euro, the CAD and the S&P – positions I had established last week. I covered those positions on Monday and reshorted the Euro and the S&P on Tuesday. I covered those trades on Thursday. My P+L had another excellent week, but it would have been better if I had held all three positions throughout the week. I bought the Japanese Yen on Friday, the only trade I carried into the weekend.

On my radar

It’s hard not to imagine how “wild” markets might get if “things get out of hand” in China. I’ve wondered for years if China, after two decades of highly levered growth, might become the next “Japan” – with two decades of deflation and “restructuring.”

That’s macro geopolitical worrying on a grand scale and will have little impact on my day-to-day short-term trading – but it will be in the back of my mind, along with a host of other geopolitical “loose cannons” like the Ukraine war, the 2024 elections and the naivety of the well-meaning folks who think they can see a smooth global transition to “green” energy. The path to hell is always paved with good intentions.

My friend Martin Murenbeeld has often told me that Asian currencies are hugely undervalued against the USD. I understand his reasoning, but the market has continued to cheapen those currencies, and the Yen is back to around the levels where the Japanese authorities intervened last fall. I’ve taken a small long position in the Yen; if it starts to work, I may add to my position.

I regret missing the sell-off in the bond market. I probably worry too much about cross-asset correlations – I thought being long the USD and short the stock indices was the “same trade” as being long bonds. To some degree, it was, but there was a major move in the bonds, with the long end falling harder than the short end, and I feel like I should have caught at least part of that move. (Trading is never a game of perfect!)

I’ve also not been short gold because I saw that as the “same thing” as being long the USD and short the S&P.

A friend asked me what I thought would be a good trade for the next five years. I replied that whenever I hear someone make a five-year market prediction, I wonder what they are trying to sell. Look at copper. Some people were convinced that it HAD to go a LOT higher because demand would be off the charts as “everything” went electric and low capex and other impediments meant the market would be dreadfully undersupplied. Prices hit $5 a pound 17 months ago, but today’s prices of ~$3.70 are only up ~$1 from where they were five years ago.

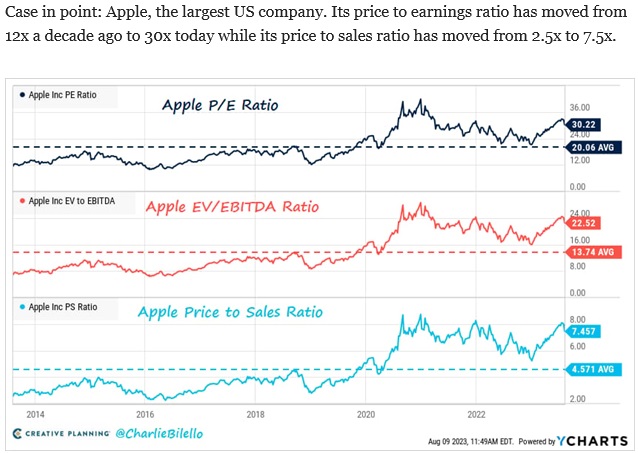

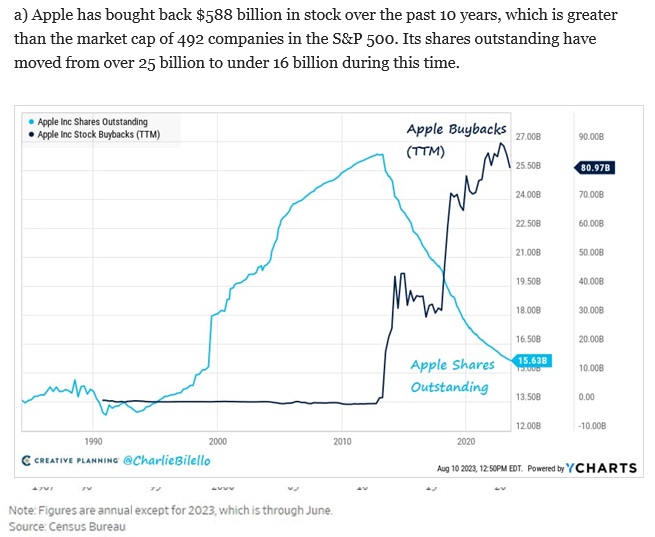

Today’s Trading Desk Notes are shorter than usual because we’ve got visitors in our house, and I have a two-day golf tournament this weekend. I’ll try to write more next week, but here are a couple of charts that may be food for thought (as a picture is worth a thousand words!)

I discovered this chart recently, and if you’re not a “chartist” (especially a Fibro-bro), this may mean nothing to you, but that retracement right on the 0.618 level is a little spooky – and “calls” for new lows.

Do you think there is a “relationship” between these two AAPL charts?

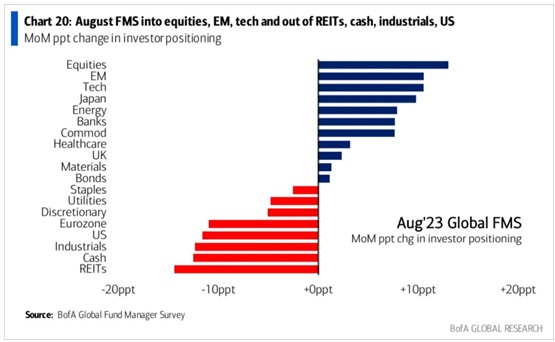

This chart is from the August edition of the Bank of America’s monthly Fund Manager Survey. It shows the investment positioning of the managers.

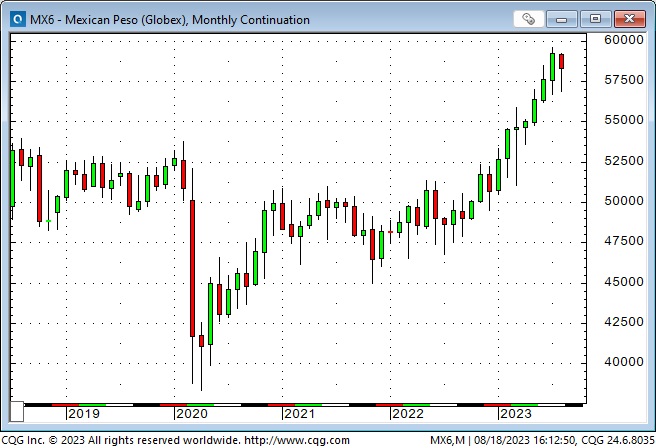

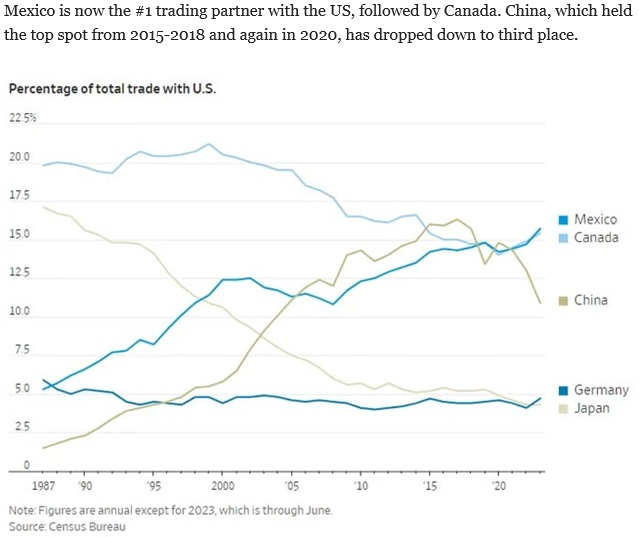

The Mexican Peso has rallied ~50% against the USD since the Covid lows of March 2020. Mexican short-term interest rates are about double US short-term rates, and the Mexican stock market has had a strong rally. Maybe becoming America’s #1 trading partner has something to do with that. Hasta la vista, Beijing!

The Barney report

The fabulous endless summer continues on our Island, and I got Barney into the ocean again this week. He loved it!

This is his favourite lookout when he is “guarding the house.”

Listen to Victor talk about markets

On Saturday morning, I will talk with Mike Campbell on his top-rated Moneytalks podcast about how sharply rising interest rates impact stock, bond and currency markets. My segment is usually near the end of the show. You will be able to listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.