Stocks down – US Dollar and interest rates up

Leading American stock indices fell to their lowest levels in over a year this week while the US Dollar Index hit a 20-year high. The Fed will launch an extended run of tighter monetary policy at their meeting next week.

Stocks

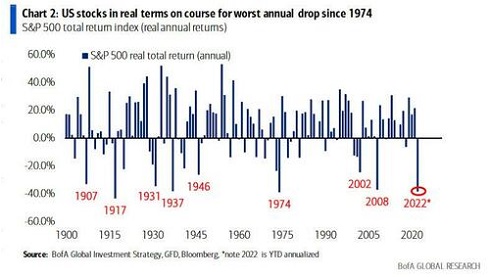

From All-Time Highs in January 2022, the S+P 500 Index is down ~14%, the Vanguard Total Stock Market ETF is down ~15%, while the DJIA is down ~11%.

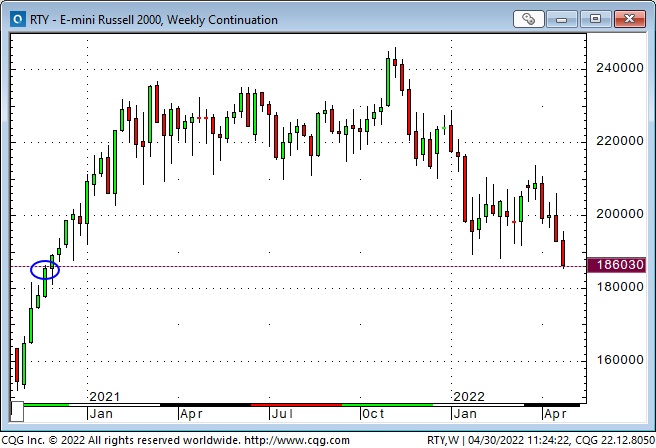

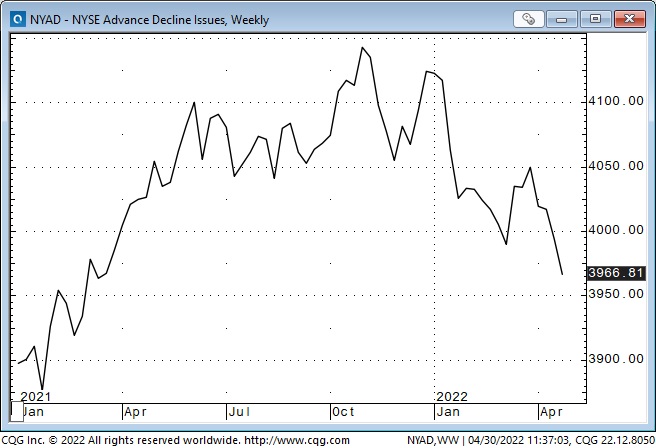

The Nasdaq Composite Index and the Russell 2000 Index peaked in November 2021 and have fallen ~24% to 17-month lows. The NYSE Advance/Decline ratio ended April at its lowest level in over a year.

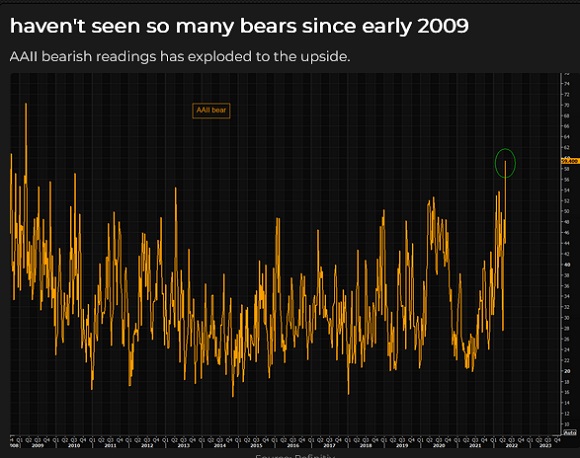

Market sentiment is extremely negative, and some analysts expect lack of growth to be a bigger problem than inflation. Implied volatility on the S+P futures had its highest weekly close since October 2020.

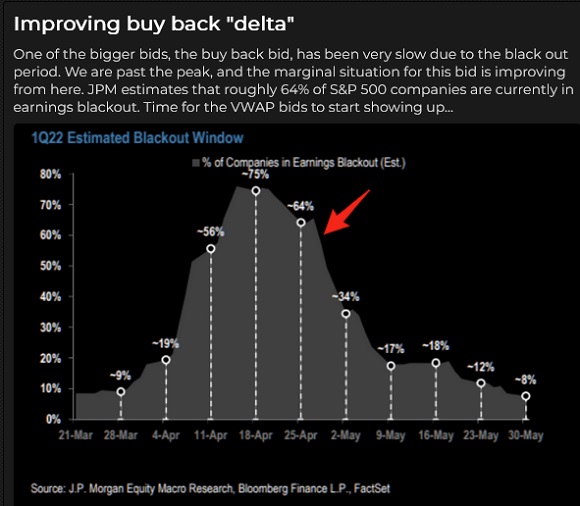

Most share buybacks have been on hold throughout the earnings season but will be back big-time in May. The total for 2022 is estimated to be an ATH of ~$1.2 Trillion.

Currencies

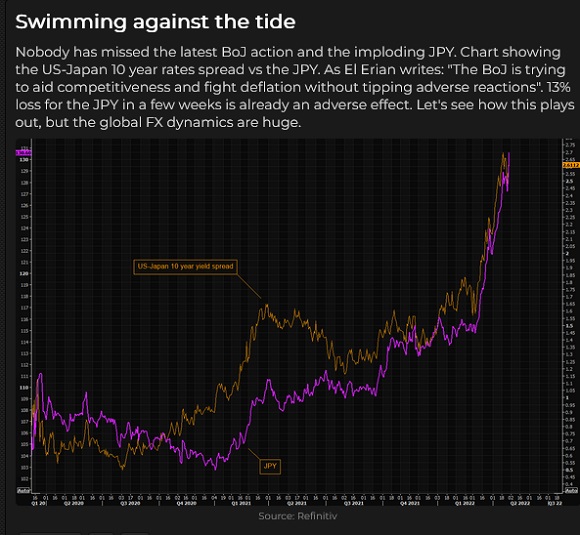

The USDX was super strong in April, registering its biggest monthly gain (5%) in over a decade. It had rallied ~17% from its January 6, 2021, inflection point when the mob stormed the Capitol Building in Washington, DC.

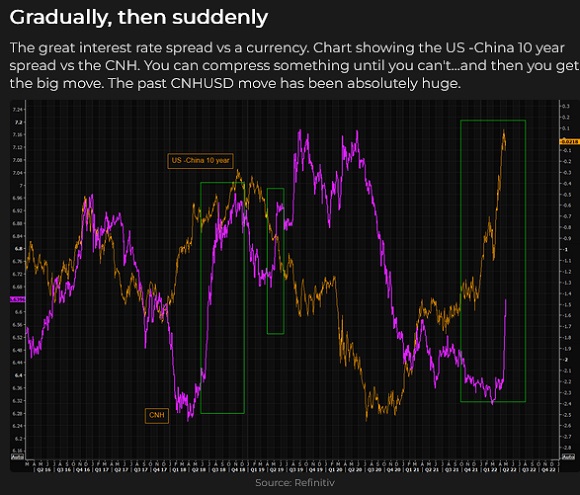

The US Dollar continues to rally against other currencies, despite massive trade deficits, as capital continues to flow to America for safety and opportunity.

The Canadian Dollar has “held its own” against the USD this year and has rallied substantially against other currencies. The CAD is at a 7-year high against the EUR and YEN.

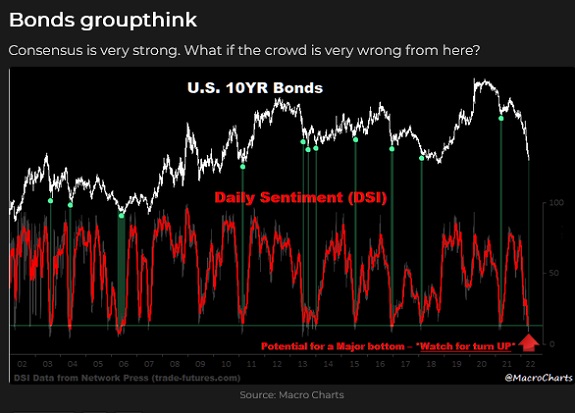

Interest rates

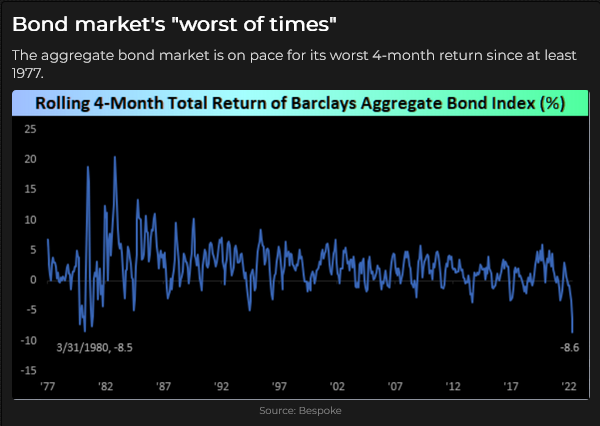

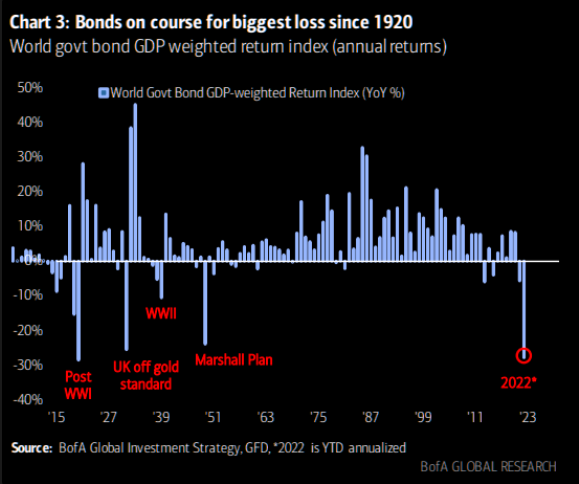

Late last year, while the Fed was still talking “transitory,” the market began pricing in higher interest rates. The re-pricing was gentle at first, but the delta (rate of change) increased dramatically starting in January.

Bond markets have been hit hard this year, as have 60/40 stock/bond portfolios.

Commodities

The broad commodity indices have tripled from the 20-year lows hit during the March 2020 Covid Panic – but are still historically “cheap” relative to equities.

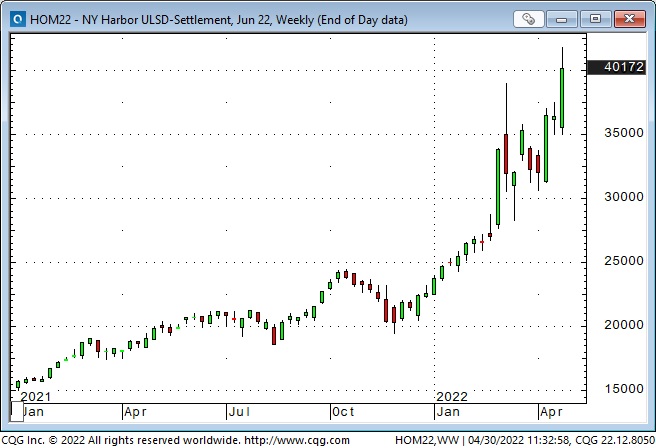

WTI crude oil hit 22-year highs following the Russian invasion of Ukraine (and Western sanctions on Russia), while heating oil (diesel) soared to new All-Time Highs.

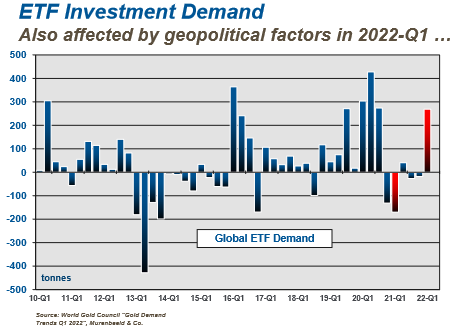

Gold briefly spiked to new ATH on the invasion but could not sustain those levels as the USD and interest rates soared. Gold dropped below pre-invasion levels this week (circled in this chart) – down ~$200 from March 8th highs.

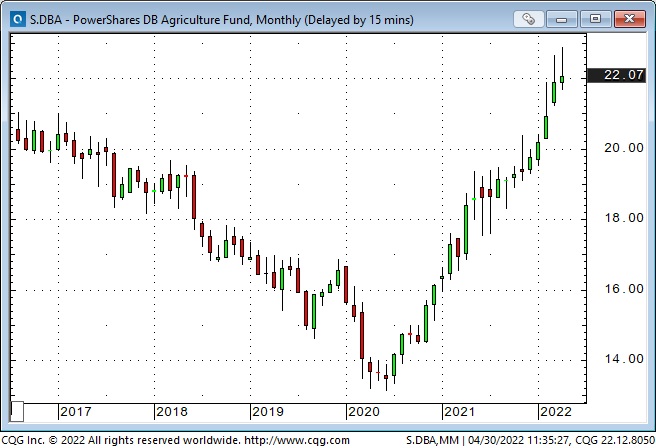

Grains, oilseeds and other agricultural products have rallied from major lows in March 2020.

My short term trading

The trading environment: Short-term market price action is very choppy and volatile. Liquidity is low. Open interest in several vital futures markets has dropped to multi-year lows. People are limiting participation as there is a lot to worry about: Ukraine, European energy, Russian aggression, the Fed, rising interest and mortgage rates, China lockdowns, global supply chains, global food shortages and the existential risk that something BIG is underway, for instance, stock market and real estate prices have gone parabolic over the past couple of years – maybe the top is in!

I called the mid-to-late March stock market rally a bear market rally. That call is looking more prescient, but I don’t base my trading on Big Picture Calls – I make money from managing risk, not from having a great crystal ball!

I bought the Yen and TNotes Sunday night and sold them for decent gains on Monday. I rebought the Yen on Monday and covered it for a slight loss.

I bought the S+P Monday and sold it early Tuesday for a small profit.

On Thursday, I bought the S+P and the CAD and closed both positions for a profit early Friday. I was flat at the end of the week; my P+L was up 1.8%.

On my radar

I can imagine that a significant top in the stock market has happened and that the market is now in a bear market phase. The stock market (and the real estate market) had a remarkable run since the GFC, with much support from accommodative monetary and fiscal policies. Now there seems to be a sea-change at the Fed, and even though they have been slow to act, they may follow through on their determination to “take away the punch bowl” like the Fed of old.

But the current sentiment is extremely bearish, so pressing the short side here is not without risks.

I’ve written before about passive investing – where people invest money every month in a broad stock market index, regardless of price, assuming that, despite temporary corrections, the stock market will continue to rise over the longer term. Don’t try to time the market, and don’t try to pick stocks or sectors.

Retail and institutional money flows into passive investment strategies have grown dramatically over the last decade, overshadowing active management strategies. I wonder if/when a continuing bear market will cause passive investors to have “second thoughts” and withdraw money from passive systems. I think it will require a “crash” without much of a recovery, and then there will be relentless selling from that sector.

Currencies: I’ve traded currencies since the mid-1970s, and one of my mantras is that trends in the currency markets go WAY further than seems to make any sense, and then they turn on a dime and go the other way. (See leads and lags.)

Thoughts on trading

One of the best things about writing this blog is that I can swap emails with people I would otherwise never have met. This week, a subscriber and I exchanged emails about “missing trades.” Here’s my latest email to the subscriber:

I have mixed thoughts on “missed trades.”

Usually, the missed trade is something that has made a big move over an extended period – at least weeks, if not months, and I wonder, “how could I have missed that?” (Like the Japanese Yen!)

But I usually don’t initiate trades with a long-term time horizon because I would have to risk “too much” from my entry point. I’d also have to “believe” the story that justified the trade – and I don’t believe in much, except mean reversion! (h/t to JMP!)

So (to avoid missing a big trade), the implication would be that I get into a trade using my standard time horizon, then realize the idea is way bigger than I thought at first; I change plans (add size and risk) and ride out the big winner.

That honestly doesn’t seem likely. (I have no illusions about being the Tiger Woods of trading, although I’m always trying to improve.)

So I make my peace about missing trades; you can’t catch them all, trading is not a game of perfect, and some guys can live with huge drawdowns – that’s not me.

I don’t envy any trader. Some guys swing big and hit homers; others, like Bill Hwang, swing big and suffer huge losses.

Quotes from the notebook

“Unsuccessful traders are obsessed with analysis because it gives them a sense of certainty with their trade. There is no certainty. Be rigid with your rules – be flexible with your expectations.” Mark Douglas, Trading in the Zone, 2001

My comment: Trading in the Zone is a great book, filled with gems like this one. Over the years, I’ve seen so many people search for “someone who knows,” and so many people cling to a narrative as though it was “the truth.” Mark Douglas is the King of “Anything Can Happen.”

“Every waking moment of every day, we are predicting the implications of whatever is in front of us. The interpretation is in the form of an expected feeling/emotion. If you embrace this, you will make better decisions.” Denise Shull, The ReThink Group, on Twitter, April 2022.

My comment: It seems that making predictions is part of our DNA. We can’t stop doing it, and we can’t stop reading other people’s predictions. So, live with that; just don’t let it run your life or your trading.

I have three separate computers on my trading desk, including my laptop. They are all loaded with the same software etc. If any of them fail, I will have redundancy, but typically one computer is strictly for charts, quote boards and a trading platform, while the other is for emails, internet browsing etc.

The trading computer is where I make or lose money; the other is where I read and write. I’ve noticed that I spend more time on the read/write computer (but constantly glancing at the other one!) I’ve purposefully decided to spend more time on the trading computer.

The Barney report

Barney will be eight months old next week. He’s 56 pounds now, but walking keeps him slim and trim. When I take him for walks on the forest trails, we always play the hide and seek game (I hide behind a tree and wait for him to find me.) It’s getting harder and harder to hide from him because he is constantly looking over his shoulder to see where I am – precisely what I want him to do. It’s a primitive but effective training technique.

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets.

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The April 30 podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.