Powell’s “Substantial Further Progress” – is not happening yet – and neither is the taper

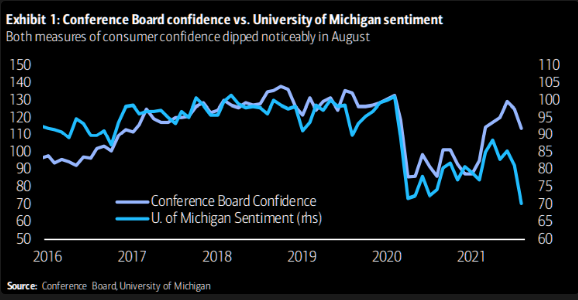

The combination of much weaker-than-expected employment and consumer confidence reports means that the Fed will delay the taper.

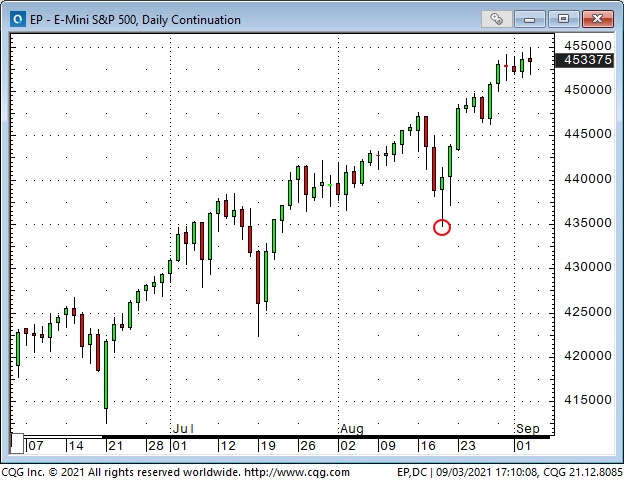

Price action was dull all week – nobody wanted to strap on a major position given the risk that markets could react violently to the employment report first thing Friday morning. But once that report was out – and it was WAY weaker than expectations – the market reaction was muted, although the S+P, the Nasdaq and the TSE all registered record-high weekly closes.

The S+P, the Nasdaq, and the TSE are up ~20% YTD. The Dow and the Russell small-cap index are up ~15%. The MSCI Emerging Market Index is up ~3% (China has been a drag, with the Chinese tech sector down ~12% YTD, down ~ 40% from the February highs.)

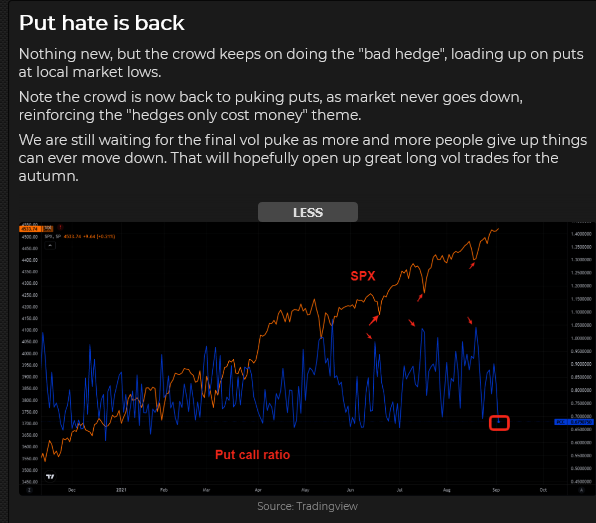

Implied option volatility is LOW

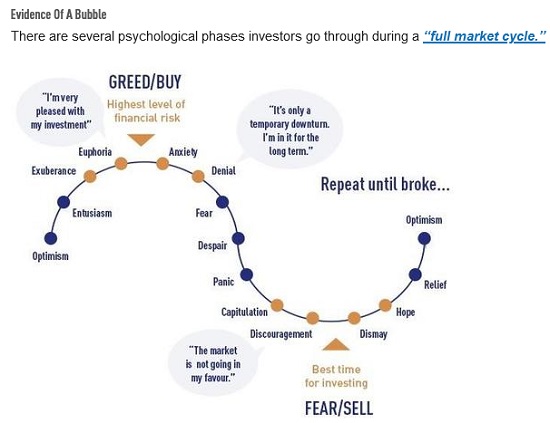

Option volatility across asset classes is historically LOW. One of the underlying reasons is that in recent years people have seen option writing as just another “reaching for yield” trade (that works well until it blows up in your face.) Let’s assume that writing options for yield established a lower benchmark vol level. But even given that lower benchmark, vol is LOW. I think this very low vol level signifies complacency – as in, what could possibly go wrong?

The bond market didn’t like the employment report

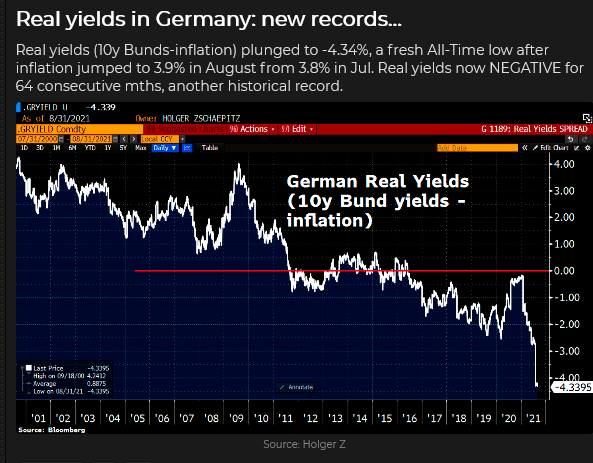

The headline miss on the employment report was bond friendly, but yields jumped on much larger-than-expected wage gains. I’ve thought that many of the current inflationary pressures could be “transitory,” but if wage gains persisted, that (and rising rents) would mean sustained higher inflation. It’s beginning to look as though stagflation could be a real possibility.

The US Dollar didn’t like the weak employment report

The US Dollar Index (USDX) hit a 9-month high on August 20, but it has closed lower 10 of the last 11 trading days. The USDX has been weaker as the equity and commodity markets have been stronger – a classic “pro-risk” market profile.

August 20 was a Key Turn Date

I’ve circled August 20 on a number of the charts in this report. That was the day many markets turned from “risk-off” to “risk-on.”

Gold traded to a 1-month high on the weak employment report

Last month’s strong employment report (August 6) sparked a sharp tumble in precious metals – this month’s report had the opposite effect. The prospect of higher interest rates last month caused gold to break below the July lows. The “margin cleck selling disaster” on the following Sunday afternoon drove gold (briefly) to 5-month lows. All in all, gold dropped and rebounded ~$150 in the last five weeks. Silver dropped nearly $4 but has only bounced back ~$2.50. No surprise – the weaker USD the past three weeks has made it easier for precious metals to rally.

The Canadian Dollar rallied as the USD fell

The USDX hit a 9-month high on August 20 and reversed lower – the CAD hit a 9-month low on August 20 and reversed nearly 3-cents higher. The CAD rally was concurrent with the rally in stocks and commodities. The correlation between price action in the CAD and stocks and commodities has been very strongly positive since the April 2020 Covid panic; the correlation with the USD over that same time period has been very strongly negative.

Traders need to be aware of strong correlations between markets to avoid concentration. For instance, for the past 18 months, being long the S+P, long the commodity index or long the CAD was essentially the same trade – you were concentrating your risk in a “pro-risk” profile, not diversifying risk in different assets.

Fossil fuels rallied on the recent pro-risk mood

WTI crude bounced back ~$8 (13%) from the August 20 lows (the day the USDX peaked), but gasoline and heating oil had stronger rallies as hurricane-related refinery outages caused supply shortages.

Nat Gas and Uranium may have been off your radar (and off mine), but they’ve had powerful rallies since, you guessed it, August 20!

What will be the knock-on effects of the major policy changes taking place in China?

In my July 31 Notes and again on August 21, I wondered if the weak stock markets in China could lead to weaker stock markets elsewhere. So far, that’s not happening; in fact, you have to wonder if money leaving Chinese markets isn’t flowing into other markets and boosting those prices.

I’m looking for possible contagion from China because the government of the world’s 2nd largest economy is making major policy changes that will be in place for years. Jack Ma got wacked last year for criticizing regulations that stifled fintech innovation. Imagine what “innovation” will look like in the China that Xi Jinping envisions. I think there is a bigger risk to markets, due to policy changes in China than is currently priced into markets.

For instance, exports to China are an important part of the German economy. If “Common prosperity for all” means BMW, Audi and Mercedes sell fewer cars in China, does the Euro weaken Vs. the USD? Will the CAD (next door to the USA) outperform the AUD (highly dependant on exports to China?)

My short term trading

It was the last week of summer, and markets felt dull. There was also the possibility that whatever position I took could get crushed by the looming employment report at the end of the week. So I didn’t do much. I shorted the Dow a couple of times early in the week – it seems to be the weakest of the different share indices – and I was stopped for tiny losses both times. Honestly, these weren’t well-thought-out trades; they were more a case of, “Don’t just sit there, do something.” ( I know I’m not supposed to do that, but…)

I let an hour go by after the release of Friday’s UE report (I waited for the thrashing around to die down), and then I shorted the Dow again. The Dow has been unable to take out the mid-August highs while the S+P and Nasdaq are well above those levels. (Old trading axiom: if you want to be short a market, sell the weakest sector of that market.) Short Dow futures is my only position going into the 3-day weekend. My net P+L on the week was down ~0.20%.

On my radar

From a trading perspective, the Christmas season and late summer are awkward times of the year. Trading is thin, and there are other things to do. There are trading opportunities, but I look forward to getting past Labor Day, just like I look forward to the New Year.

I think markets have been complacent throughout late summer; I think they may be stressful as we get into fall. If I’m right about that, I will want to be doing the opposite of the pro-risk trades. That doesn’t mean I automatically sell stocks and commodities and buy USD and bonds – but if the pro-risk mood fades, I will be looking for setups to make those trades.

Thoughts on trading

When I started this new website over a year ago, my one golden rule was that it would always be a work in progress – nothing was set in stone. As time passed, I wanted to do less “reporting” and write more about what I was doing and why. I also wanted to be clear that what I was doing was what suited me – I didn’t want to imply that what I was doing was the best thing to be doing! I absolutely believe that everybody who chooses to be a trader has to find their own way – find a way that suits them – and that will take a lot of trial and error!

I keep asking myself, “Why do you believe what you believe?” I might think that my beliefs have been formed by an impartial study of the “evidence,” but was there some subliminal bias in selecting the “evidence” I chose to study? Was there a “confirmation bias?” (How could there NOT have been?)

Am I trying to guess where a market might go, or am I trying to guess what the other participants in that market will do if such-and-such happens? How much of my “analysis” is already in the price?

My answer is that I can’t know where the market will go. I can’t know who the other people are trading this market or what they will do. I can’t trade without a bias. I absolutely have to be prepared that the market will do exactly the opposite of what I expect.

My friend Peter Brand keeps repeating that managing trade risks is more important to your success than your trade selection process. Let that sink in.

The romance novels of traders “seeing” something that nobody else saw and becoming rich because of that are truly romance novels. You may stumble into a trade that makes you a lot of money and good for you; that happens sometimes. It doesn’t mean you’re the next boy wonder. Just be sure you don’t see a “sure thing” coming and blow up your account waiting for it to kick in!

One last thing: in terms of where we are in the fear and greed cycle, I think we are at Euphoria. I don’t know how long it takes before we get to Anxiety or how much higher the stock market may go between now and then. Be careful out there!

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.