The dominant market theme YTD, “the Fed will stay higher for longer,” softened this week

Price action across equity, interest rate and currency markets this week was buffeted by US economic and inflation data, concerns about Treasury and Fed policy decisions, currency intervention by the Japanese finance ministry, and concerns about critical corporate reports.

The net takeaway from all the data seems to be that economic growth and employment are slowing but still strong, and inflation remains “sticky” well above the Fed’s 2% target. Fed policy seems to be biased towards easing even though Powell reported that there had been a “lack of progress” in getting inflation down.

Price action was bumpy, but at the end of the week, stocks were higher, bond yields and the USD were lower, and the market is pricing the Fed to cut slightly more/sooner than it did last week.

S&P futures had their highest weekly close in three weeks, up ~4% from April’s lows.

Bond prices hit 6-month lows last week before turning higher.

December SOFR futures (Secured Overnight Financing Rate) gained 34 bps from Wednesday’s lows to Friday’s highs as the market backed away from pricing “higher for longer.”

The US Dollar Index rallied to 6-month highs in April on the notion that other central banks would cut rates sooner and more than the Fed. That idea moderated this week, and the USD weakened.

Currency market speculative positioning long the USD was at 5-year highs at the beginning of this week, with traders aggressively short YEN and CHF (less aggressively short CAD and AUD, slightly short EUR). The unwinding of some of those short positions undoubtedly helped drive down the USD this week.

Japanese authorities repeatedly warned about intervention as the Yen plunged over the past two weeks. They intervened aggressively twice this week, causing the Yen to rally ~5% from Monday’s 34-year lows to Friday’s highs.

AAPL and AMZN were this week’s leading quarterly reports, and both stocks rose after the reports. AAPL earnings were “better than feared” (weaker iPhone sales in China), and the company promised $110B in buybacks and a dividend boost.

The leading North American, European and Japanese stock indices fell in April, the first down month since October. (Bonds and foreign currencies had weakened since late December on the “higher for longer” story, but stocks continued to rise in January, February and March, seemingly oblivious to the concerns affecting the credit and currency markets.)

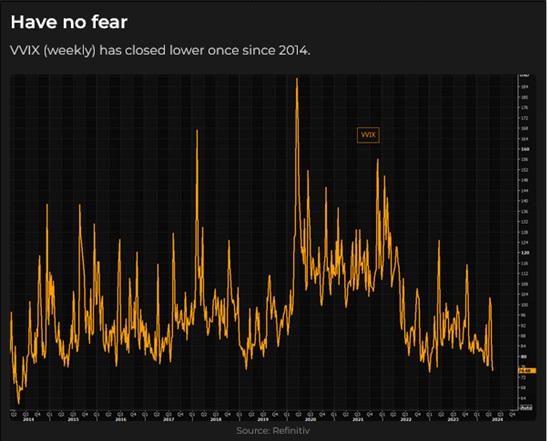

Stock market sentiment now appears to be neutral (recovering from fear during April’s sell-off), and volatility metrics are low.

Gold closed this week ~$150 below the April 12 All-Time highs, even as the USD and interest rates fell.

The breakdown in the historical correlation between gold and the USD/interest rates over the past several months has pointed to “something else” being the “dominant factor” affecting the gold price.

The “something else” was frequently identified as a substantial central bank buying, but recently, aggressive speculative buying by Chinese retail accounts on the Shanghai futures exchanges may have accounted for much of the last $250 surge to All-Time highs. The liquidation of some of that buying due to increased margin requirements by the Shanghai exchange may have contributed to falling prices over the past three weeks.

Click here for an excellent 28-minute summary of “What’s Important for the Gold Market Now” by London-based analyst Ross Norman.

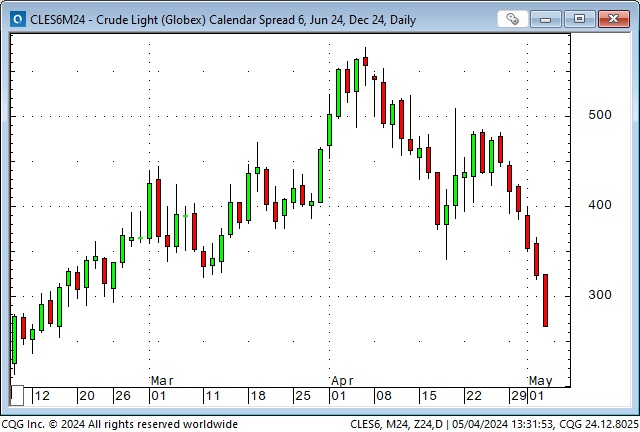

WTI crude oil futures closed this week down ~$9 (10%) from their six-month highs reached at the end of April, reflecting lower geopolitical risk premiums.

The backwardated forward WTI curve flattened as premiums for nearby contracts fell. This chart shows the premium for June 2024 over December 2024 fell from ~$5.50 in early April (when WTI was at 6-month highs) to ~$2.50 at Friday’s close.

The Trans Mountain pipeline began delivering Alberta crude to the Vancouver tidewater export terminal this week. (The pipeline volume is nearly 900,000 bpd.) This should shrink the discount of Canadian crude to WTI as Canada can now export oil to countries other than the USA.

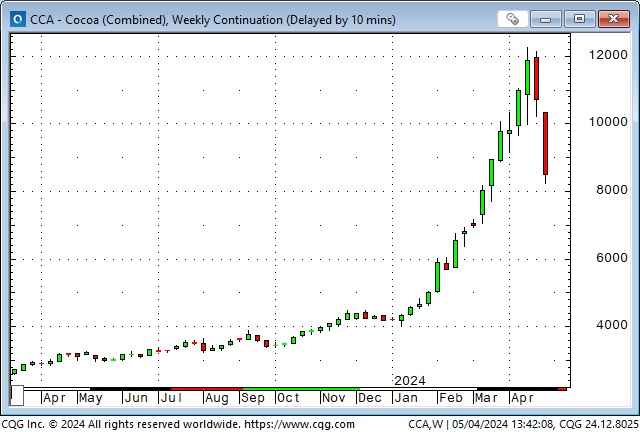

Cocoa prices skyrocketed to historic highs earlier this year on reports of supply shortages but have corrected dramatically over the past two weeks. (Bob Farrell’s 10 Rules for Investing include #4: Exponentially rising or falling markets usually go further than you think, but they do not correct by going sideways.)

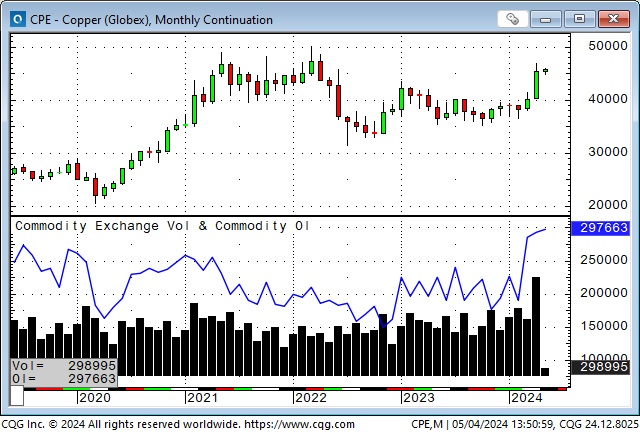

Comex copper prices hit 2-year highs early this week following a surge in open interest and All-Time high volumes in April. Prices corrected ~4% by Friday.

My short-term trading

I began this week flat, but I had made notes over the weekend to look for opportunities to buy Yen, Swiss Francs and the Canadian Dollar. The Commitments of Traders report showed that last week, speculators had increased their net short positions in Yen (to 9-year highs) and Swiss (to 5-year highs) and had only slightly reduced their net short CAD positions from 7-year highs.

I bought the Yen on Sunday evening and bought the CAD and Swiss on Monday.

The Yen spiked down to new 34-year lows on Sunday (a holiday in Japan) but then reversed and soared on apparent intervention. I raised my stop. Prices drifted lower on Tuesday and Wednesday and then spiked again after the FOMC meeting on another apparent intervention. (The 2nd intervention was well timed for effect – coming in thin conditions late in the North American trading session.)

I considered covering my long position on the spike higher for a gain of ~200 points but didn’t because I thought the rally could go much higher if speculators with short positions began to cover aggressively. I raised my stop again, and it was hit a few hours later (while I was sleeping) for a gain of ~80 points.

I was stopped on my long Swiss on Tuesday for a loss of ~35 points (it fell another 120 points by Wednesday’s low, so the stop did its job!)

I was stopped on my long CAD on Wednesday for a loss of ~30 points (it dropped another 40 points by Wednesday’s low, so the stop did its job!)

The Swiss, Yen and CAD all rallied from Wednesday to Friday without me.

I shorted the S&P on Tuesday and was ahead by ~70 points at the close. I lowered my stop and stayed with the trade. The market spiked higher on Wednesday following the FOMC statement/Powell presser, and I was stopped for a gain of ~15 points.

My net P+L on the week was a tiny loss and I went into the weekend flat.

Thoughts on trading

I wasn’t exactly banging my head on my desk, but it was a frustrating week in terms of “what could have been!”

I remembered a trader friend telling me many, many years ago that the market teaches you bad habits.

In this case, the market was teaching me that if I had good gains, I should grab them. (Cover my long Yen for 200 points, and cover my short S&P for 70 points.) If I had done that, I would have earned a handsome net P+L gain for the week instead of a tiny loss.

With no disrespect to my friend, the market doesn’t teach you bad habits; you teach yourself bad habits when you play “shoulda, woulda, coulda” when you review your trading results (and I think my friend would agree.)

I should have grabbed those early profits if that had been my plan, but I was looking for bigger moves, so I did the right thing by staying with my plan and tightening my stops.

Trading is not a game of perfect. Nobody bats 1000.

On my radar

The Swiss and the Yen both had Weekly Key Reversals on the charts. I’ll be looking for opportunities to buy them next week, thinking that the massive spec short positioning is now an asymmetrical risk for an extension of the 4-month downtrend.

Monday is a UK holiday, so FX markets will be thinner than usual (London is still the center of global FX trading.)

Tuesday has a 3-year Treasury auction, and the Aussy Central Bank is that evening.

Wednesday is a 10-year auction, with the 30-year on Thursday. The Bank of England meets early Thursday.

The Canadian employment report is on Friday morning.

The Barney report

Barney loves to get out of the house and go for off-leash runs in the forest. (I can’t let him off-leash near roads – he doesn’t know that cars are dangerous.) When we’re in the forest, he loves to climb up on things to get a better look around. This rotting old fir log is one of his favourite spots. He just runs and jumps about four feet high and lands with perfect balance every time!

Listen to Victor talk about markets

On this morning’s Moneytalks show, Mike Campbell and I discussed the market’s changing view about the Fed staying “higher for longer.” We also discussed the Japanese currency market intervention and the importance of the “just opened” Trans Mountain pipeline. You can listen to the entire Moneytalks show here. My spot with Mike starts around the 1 hour 6 minute mark.

I also did a 10-minute market summary to start the This Week In Money show. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.