Speculative excesses are starting to crack

My base case is that speculative excesses have driven many markets too high, too fast. Some markets that attracted massive speculative money flows have started to crack – perhaps an early warning sign for other markets that remain near their highs. I expect these initial “cracks” in speculative excess to “ripple out” to other markets.

Jim Rogers

Markets are interrelated. A move in soybeans, for example, will have some impact on the bond market. I remember interviewing Jim Rogers years ago, and he asked, “How can you trade wheat in Chicago if you don’t know what’s happening to iron ore in China?” Perhaps the Shanghai stock market, which “cracked” earlier this year, will impact North American markets.

Bob Hoye

The speculative excesses that have driven many markets higher over the last year may well have been underwritten by massive fiscal and monetary stimulus. There seems to be a strong correlation. (No kidding!) But there have also been stories, and predictions and expectations and momentum and FOMO. In that regard, my long-time friend Bob Hoye likes to remind me that “People will believe the most preposterous stories – so long as prices keep going up!“

Time to call bullshit

I like to call bullshit, and I’ve been looking for opportunities to short speculative excesses. I will not short a market simply because I think it is ridiculously over-priced. “Valuation” is not a timing took. I will not short a market simply because I think it “should” go down for a list of reasons. I watch for technical signs that it has stopped going up and may have started to go down.

Bill Fleckenstein

I interviewed Bill Fleckenstein many years ago and introduced him to our radio audience as a short-seller – a guy who made profits from selling WAY overpriced stocks. Bill quickly corrected me, “No, no Victor, I don’t short over-valued stocks. They can easily get WAY more overvalued. I short stocks that I have good reason to believe will fall – and one of the best reasons to believe they will fall is that they are already going down.”

Sell things that are going down

My P+L is down small YTD because I’ve shorted some markets that looked like they were turning lower but reversed, and I was stopped out with small losses. I’ve been trading small size and using tight stops (or option strategies) because I have huge respect for the power of the rallies from last year’s lows. I also think of my trades as “initial probes” to “test” the strength of the market. I’m willing to take a small loss because I will make much more than what I’m risking if I’m right on the trade. If the trade starts to work in my favour, I will try to add to it.

Speculative excesses may drive markets much higher. I may be hugely underestimating their strength. I don’t pretend to know the future. I believe that trading profits come from managing risk, not from having a great crystal ball and that a big part of managing risks is taking losses quickly and staying with and adding to winning trades.

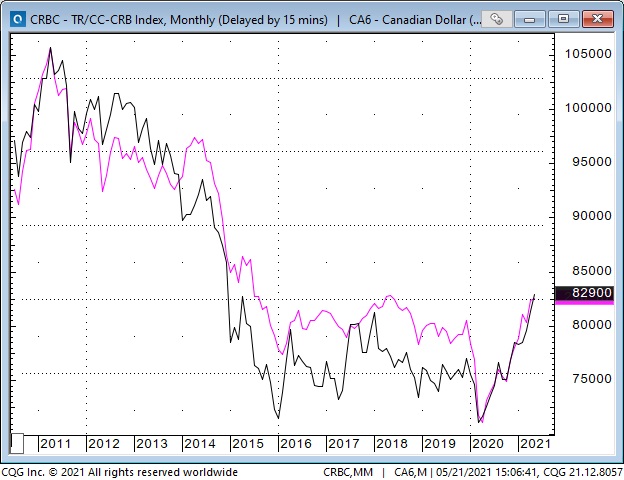

Why I’ve been shorting the Canadian Dollar

The Canadian Dollar has been the strongest currency in the world, YTD. It was knocked down to ~18-year lows in March 2020 during the Covid panic and has rallied ~22% from there to its current 6-year highs.

Over time the main influences on the CAD are commodities, the strength/weakness of the USD, the strength/weakness of pro-risk sentiment (the S+P is a good barometer) and interest rate differentials. From time to time, other things, like the April 21 surprisingly hawkish comments from the Bank of Canada, will influence the CAD. These “influences” have helped drive the CAD higher, especially since the end of March – the CAD has closed higher for eight consecutive weeks.

Another (underestimated?) influence on the CAD is capital flows. Since the beginning of 2021, speculators in the CAD futures market have built a larger and larger net long position. The net speculative long positioning is now the largest it has been since late 2019. I think speculators are buying the CAD as a play on the commodity markets; there is a robust correlation between the CAD and the CRB. They are also buying it because it has been trending higher. (People buy things that are going up, things go up because people are buying them.) This aggressive speculative CAD buying has helped drive the CAD higher. (In this chart, the black line is the CAD, the pink line is the CRB commodity index.)

The “flow of funds” that has driven the CAD higher will become a “liability” if (for some reason) the CAD starts to fall – speculators will create additional selling pressure if/when they exit their long positions.

A quick segue – I’ve traded currencies since the late 1970s, and back then, I thought the FX market was more “psychological” than other markets (remember leads and lags.) My thinking has changed – I now believe that other markets have become more like the FX markets; they have become more psychological – meaning that they are driven primarily by fund flows, not valuations. (Think of the size of the relentless Passive Investing bid in the stock market.)

I’ve been anticipating a reversal of speculative excesses that would see stocks and commodities fall and the USD rally. That would be a triple whammy against the CAD – likely exacerbated by speculators exiting their long positions.

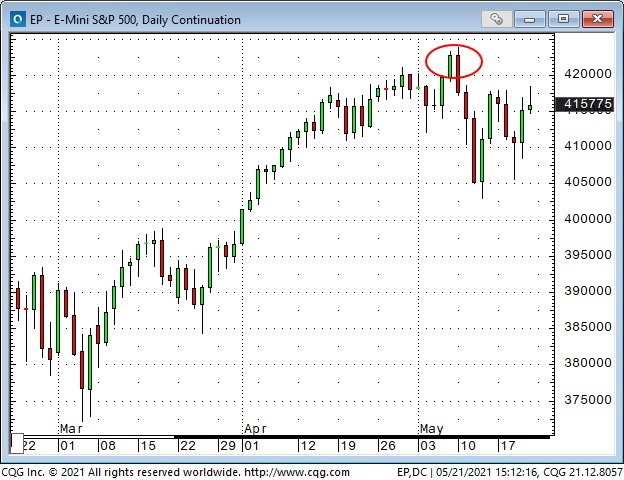

Shorting the stock indices

The S+P and DJIA may have topped out last week. I caught part of last week’s 1,500 point decline in the DJIA and then stepped aside. I got short the S+P early this week, stepped aside Wednesday (when the market had a wonderful opportunity to take out last week’s lows – but didn’t) and re-shorted the S+P Friday after it reversed from making new highs for the week.

Shorting the Australian Dollar

The Australian Dollar has been “On My Radar” for a few weeks. It may be making a 5-month Head and Shoulders top. (A break below 7550 would target 70 cents.) I bought July 76-strike puts Friday as a toe-in-the-water.

My short term trading

Over the past two weeks, I have shorted CAD, S+P and Russell futures. I’ve had some winners and some losers, net, net, I’ve made money. I’ve been trading small size given that I’ve been shorting markets that have been in strong up-trends. At the end of the week, I’m short S+P, long CAD and AUD puts. If the markets start to break down from their range of the past two weeks, I hope to add to my positions.

Be careful trading Intermarket correlations

I watch Intermarket relationships closely. No correlation lasts forever, but when a correlation lasts for a long time, people will invest as though it will last forever (think about the zillions of dollars invested on the assumption that the stock/bond correlation will last forever.)

If I identify a correlation, say WTI crude oil and the CAD, there is a temptation to make an “if/then” trade. For instance, if WTI is falling, then the CAD “should” fall, so short the CAD. I have made many “if/then” trades over the years, but I think it is better to use the correlation as an “alert” – in this case, if WTI is falling, then watch the CAD closely and if it looks weak on its own merits, get short with extra confidence – but don’t short it just because WTI is falling.

Be careful what you believe to be true – you never have all the information!

On My Radar

The EUR/YEN cross rate hit a 4-year low during the March 2020 Covid panic and has rallied ~15% since then – in virtual lockstep with the rally in stocks and commodities. In “flow of funds” terms, speculators are very long Euro and very short Yen. If (for some reason!) the bullish enthusiasm that has driven stocks and commodities higher were to reverse, then EUR/YEN might reverse – with the reversal exacerbated by position unwinding.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.