Gold and copper hit all-time highs this week; silver rallied to 12-year highs

June Comex gold futures closed at an all-time high on Friday at ~$2,420, up ~$80 from Monday’s low.

The Gold Miners ETF closed at a two-year high.

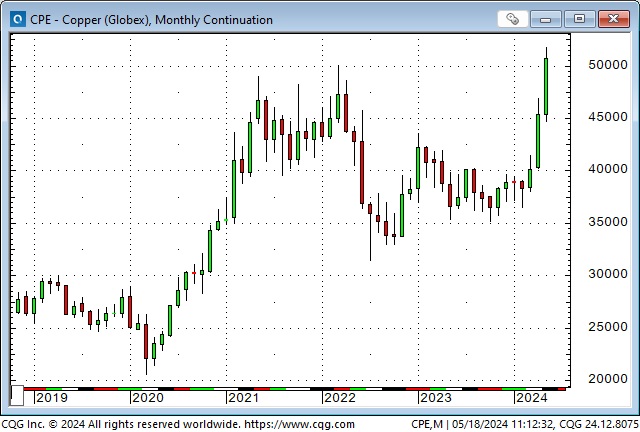

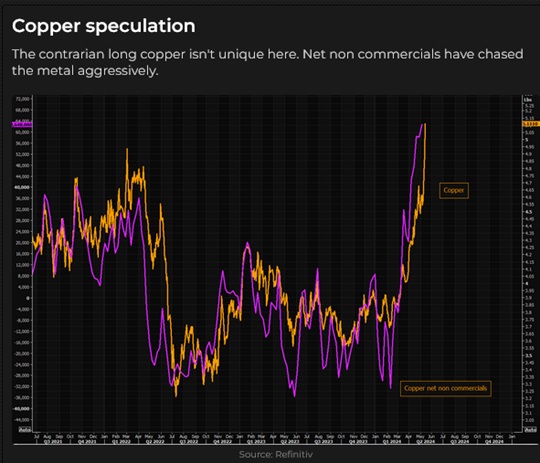

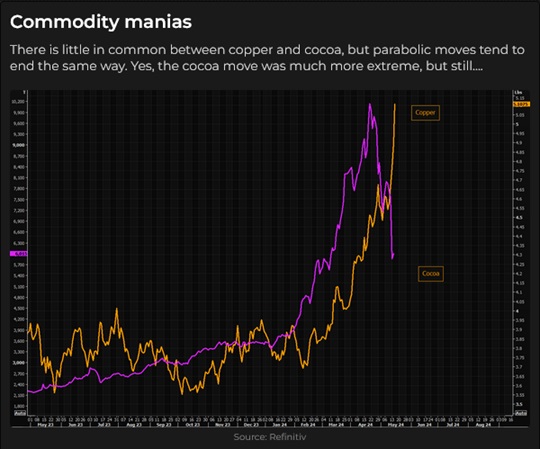

Comex copper rallied above $5 a pound to close higher than the previous record set in March 2022 following the invasion of Ukraine. Copper has risen ~14% since the end of April and 38% in the last three months.

The Copper Miners ETF closed this week at 13-year highs.

The all-time high for this ETF in April 2011 came at the end of the strong commodity market rally from 2009 to 2011.

Copper irony: The anticipated “electrification” of everything is the most significant boost for copper prices, but thieves are stealing the “copper-rich” cables at EV charging stations because the “scrap metal” prices for copper have soared!

Forward Comex copper prices remained in contango as prices rose until late last week when the premiums for nearby over deferred contracts soared into steep backwardation. Copper is a global market, and I suspect international arbs may be moving physical metal to different delivery points. This chart of the July 2024 / December 2024 copper futures shows the wild surge in the premium of July over December. When physical markets surge like this, it is often a sign of a supply shortage for immediate delivery.

Silver rallied nearly $4 from Monday’s low to Friday’s 12-year high. Silver is up ~20% in May and ~38% since the beginning of March.

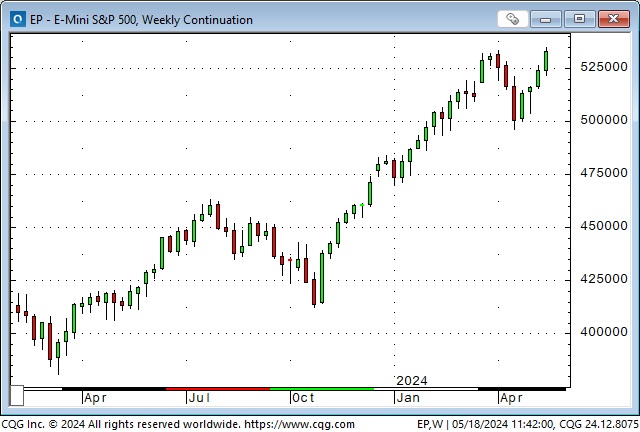

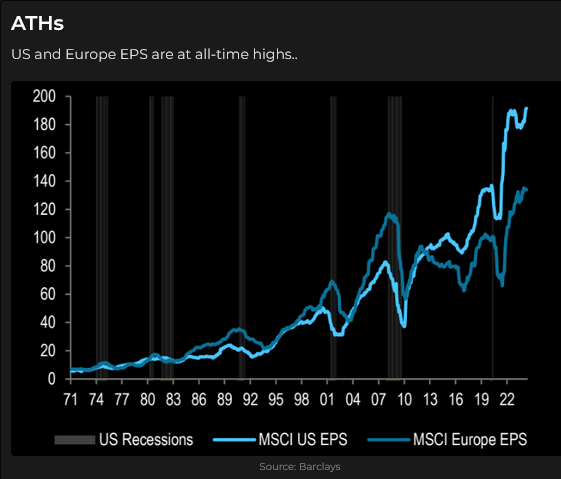

Leading North American and European stock indices reached new all-time highs this week

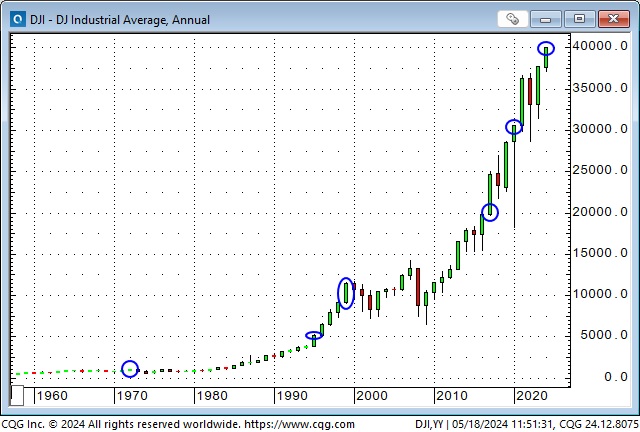

Capital flowed into stock markets as “higher for longer” is yesterday’s news. The DJIA closed above 40,000 this week for the first time. It broke above 1,000 in 1972, 5,000 in 1995, 10,000 in 1999, 20,000 in 2017, and 30,000 in 2020.

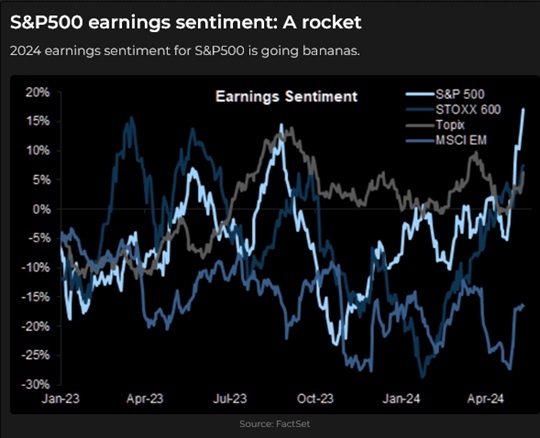

Quarterly corporate reporting in the USA is mostly over except for NVDA next Wednesday. US markets benefit from ~$5 billion a day of corporate buybacks.

P/E ratios are high relative to historical levels. Corporations plan to cut costs to continue to boost earnings.

FOMO is intense. Retail seems to think, “We’ve got to get into the stock market.”

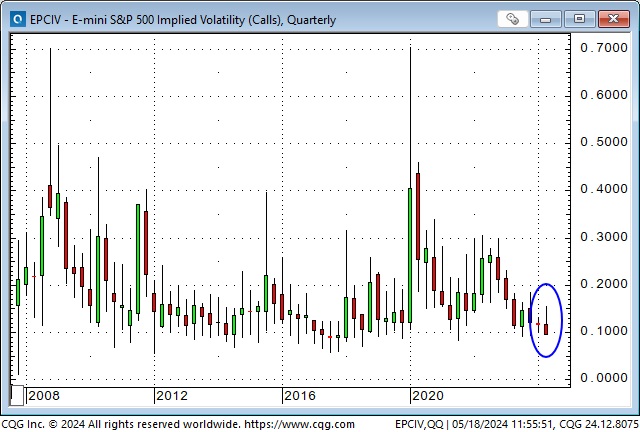

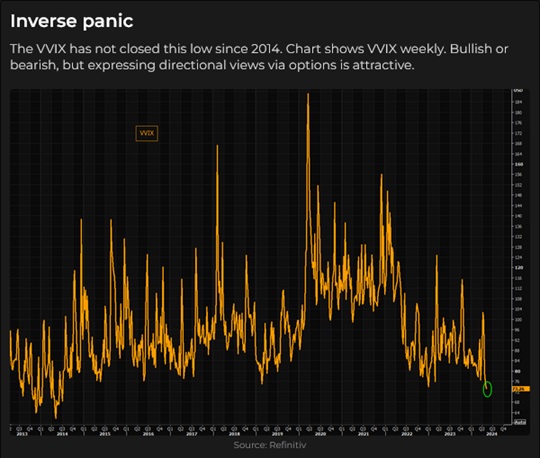

Stock VOL levels are ultra-low, a sign of complacency and ACTIVE option selling to generate extra income. (Oh boy!)

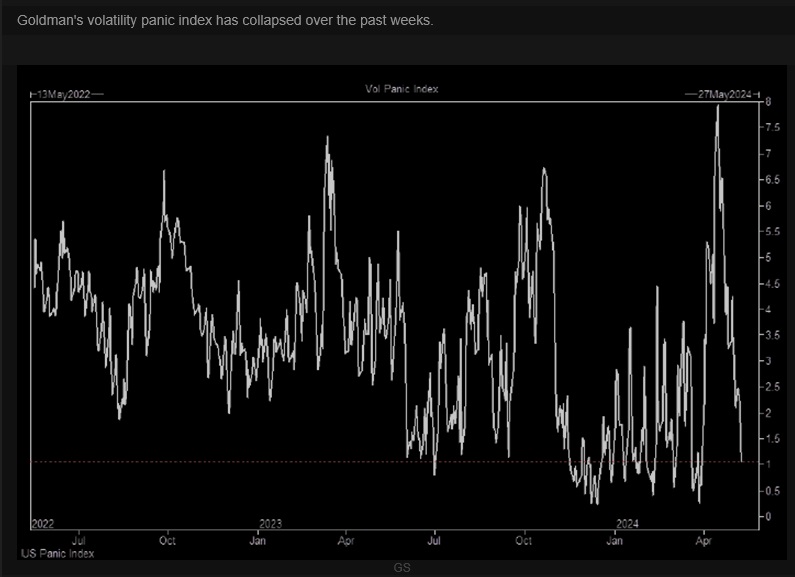

Goldman’s volatility panic index has collapsed over the past few weeks.

VVIX is at its lowest level since 2014.

Interest rates

The 3-month December 2024 SOFR futures (Secured Overnight Financing Rate) fell 150 bps from mid-January (when markets were pricing 6+ 25bps Fed cuts in 2024) to May 1 (when no cuts seemed like a distinct possibility.) Prices have bounced back over the past three weeks on some softer economic, employment and consumer sentiment data, and markets are pricing ~60% chance of two cuts by year-end. (“Higher for longer” is yesterday’s news.)

Japanese 10-year bond yields traded to a 12-year high this week at ~0.96%.

Currencies

The US Dollar Index rallied ~6% from December lows to its recent highs as traders embraced the notion that other central banks (X the BoJ) would be cutting rates more and faster than the Fed. As “higher for longer” faded in popularity over the past three weeks, the USDX weakened.

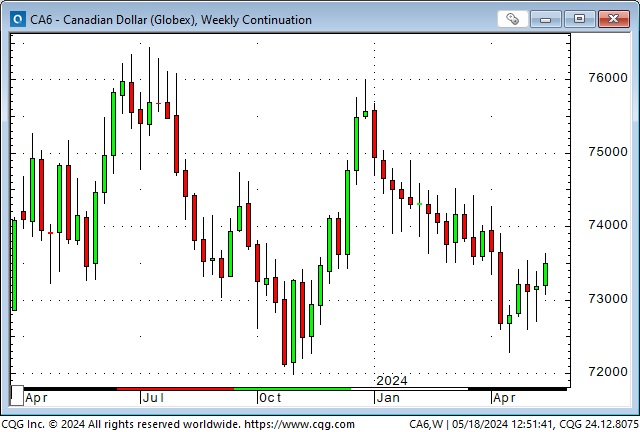

The Euro (the anti-dollar) initially spiked down on Tuesday’s stronger-than-expected PPI news but then reversed and continued the rally that began in mid-April. The failure of the USD to rally on “bullish” news strengthens the “USD has topped out” story. If the USD has topped out, speculators who are heavily long the USD (especially against the JPY, CHF and CAD) may start covering their positions.

Energy

The speculative long positioning in WTI declined from early April to mid-May as geopolitical tensions eased and prices fell ~$10 to a “floor” around $77. OPEC+ meets June 1 and is expected to maintain production cutbacks to support prices.

Natural gas prices have jumped ~40% from recent ultra-low levels.

Biden banned the importation of Russian uranium this week to encourage domestic production. Uranium prices soared.

Thoughts on trading – Carry – why interest rates matter

Regular readers may remember that I’ve been looking for opportunities to get long the Swiss Franc now that it is down ~10% from last December’s near-record highs. Net short speculative positioning is at 5-year highs, so if the CHF were to rally, some/all speculators might buy to cover their short positions, accelerating the rally.

But those speculators have good reasons to be short the Swiss. I believe the SNB signalled last December that it wanted the ultra-strong currency to weaken against the Euro and the USD and backed that up by (unexpectedly) cutting interest rates in March.

Another reason to be short Swiss/long USD is the American interest rate premium. Short-term Swiss interest rates are ~1.5% compared to ~5.25% in the US. That difference is reflected in the forward FX market. If spot CHF is ~110, then the 6-month forward price is ~112.50. If a speculator shorts six months forward at 112.50 and maintains the position for six months (and the spot market remains constant), he could cover the position for a gain of 2.50 points. (On one Swiss Franc futures contract of 125,000 CHF, 2.50 points = $3,125. Minimum margin requirements to be short one contract are ~US$4,000.)

It is unlikely that the spot market will remain unchanged for six consecutive months, but the clock ticks in favour of the short position every day.

Interest rates are an even bigger issue in the gold market since gold does not pay interest, and there are carrying charges (storage, insurance, etc.). For instance, with Comex June gold at ~$2,417, December is ~$2,486, a premium of $69. If a speculator shorts December and holds it for six months (and the spot remains unchanged), he would gain $69.

If the spot price of gold rises, the forward premium rises; if interest rates rise, the forward premium rises. If the spot price and interest rates rise together, the forward premium increases sharply.

This chart tracks the premium of December 2024 gold over June 2024. Since early February, the premium has increased from ~$50 per ounce to ~$70 per ounce as (forward) interest rates and the spot price of gold have risen.

My short-term trading

I started this week with long CAD and CHF positions established last Thursday. On Monday, I covered the Swiss for a breakeven when it failed to sustain a weak rally. On Wednesday, I covered the CAD for a modest profit when it struggled to rally along with other currencies following the US CPI report. I repurchased it later in the day when it rebounded, and I’ve kept it into the weekend.

I bought 2-month Swiss call options on Tuesday before the Wednesday CPI report. The market had good gains on Wednesday and Thursday but then reversed. I held the trade into the weekend with a modest unrealized loss.

I took a small short position in copper on Thursday. The Wednesday/Thursday price action looked like a reversal, but I was stopped overnight for a slight loss.

I shorted the S&P on Friday, following a reversal candle on Thursday. I held the position into the weekend with a slight unrealized loss. I have a buy stop below Thursday’s high.

My net realized and unrealized P+L for the week was a slight loss.

On my radar

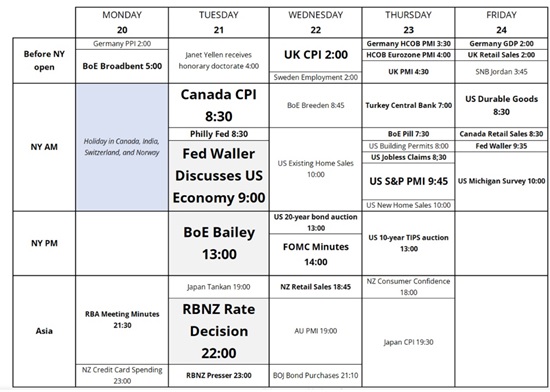

Just for fun, here’s a lift from Brent Donnelly’s weekly letter detailing some of the scheduled events for next week.

The Barney report

An abandoned railroad (built ~140 years ago) runs through the forest near our home, making it a perfect place for Barney to have an off-leash walk or run. There is no traffic, and there are lots of things to explore.

Listen to Victor talk about markets

On the Moneytalks show this morning, Mike Campbell and I discussed the surge to new all-time highs in the leading stock indices in North America and Europe. We also discussed the metals markets, with gold and copper at all-time highs and silver up sharply this week. You can listen to the entire show here. My spot with Mike starts around the 48-minute mark.

I also did my 30-minute monthly chat with Jim Goddard on the This Week In Money show this morning. We discussed why the markets are so concerned with “What will the Fed do?” I gave Jim a quick “metals report” about the wild price action in gold, silver and copper. We also talked about the currency and energy markets, and I explained to Jim why I keep saying that I make money because I’m a good risk manager – not because I have a great crystal ball. You can listen to the entire show here. My spot with Jim starts around the 12-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.