Interest rates are surging higher

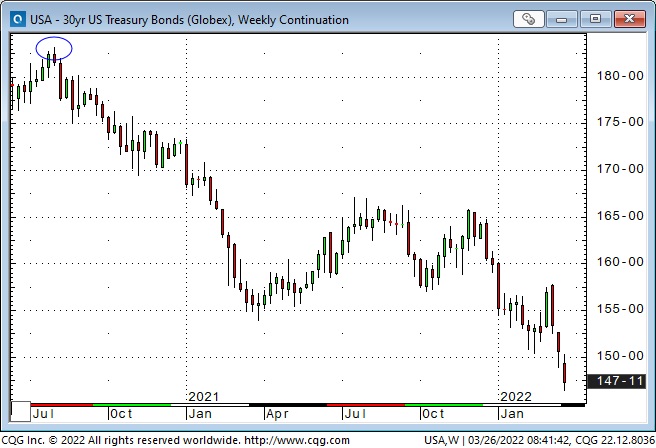

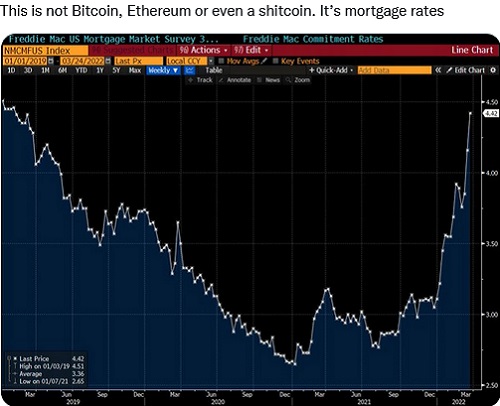

American interest rates hit All-Time Lows in August 2020. Short rates stayed close to zero for the next fifteen months while mid-term and especially long-term bond yields rose (prices fell.)

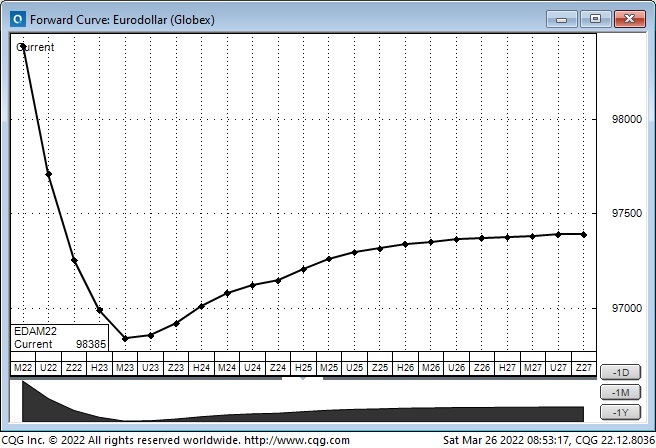

In October 2021, forward markets for short-term rates began to rise. The rate of change accelerated in January and February, stalled when Russia invaded Ukraine in late February but dramatically accelerated the last three weeks.

Short rates have been rising faster than long rates, causing some inversions (when short-term interest rates are higher than longer rates.) Historically, an inversion in the 2-year/10-year spread is a harbinger of recession. The 10-year is currently ~20bps premium the 2-year.

Why are interest rates rising so quickly?

The keyword for the Fed last year was “Transitory.” The Fed expected the sharp rise in inflation to be a “flash in the pan,” and therefore, it would be wrong to raise interest rates (or to stop their QE program) to “kill inflation.”

Some folks agreed with the Fed’s assessment, other folks didn’t, but as inflation continued to rise and became more pervasive, the forward markets began to price in higher interest rates.

This year, communications from the Fed have become increasingly hawkish, and market analysts have “hop-scotched” one another as they continued to raise their interest rate forecasts. This week, Citibank announced that they expect the Fed to raise rates by 50 bps at each May, June, July, and September FOMC meeting and raise rates by 275 bps in 2022.

There is also “talk” that some major players are wrongly positioned with their interest rate exposure and are aggressively selling Eurodollar futures. (Think of Jeremy Irons and Kevin Spacey in Margin Call.) If there is a “motivated seller” hitting all bids, other players will try to front-run that seller – adding to pressure on prices.

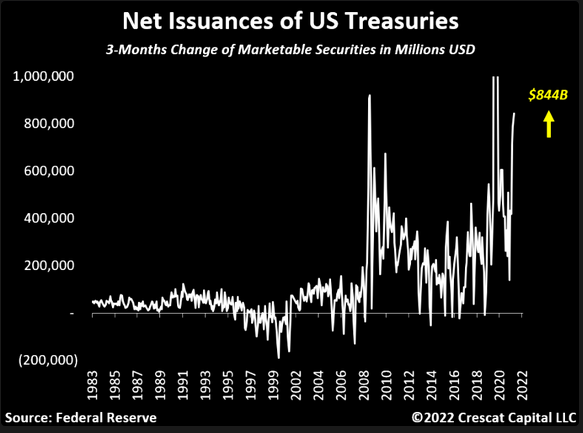

Then there is the thought that governments (everywhere?) will be spending more “stimmy” to help voters deal with rising food and energy costs. Why not? Governments “crossed the Rubicon” with direct fiscal stimulus (helicopter money) during the Covid lockdowns, and there’s no going back to fiscal “prudence” now (especially with mid-term elections looming!) Who wants to buy Treasuries when governments are issuing a flood of paper to fund fiscal stimulus, and the Fed has shut down QE?

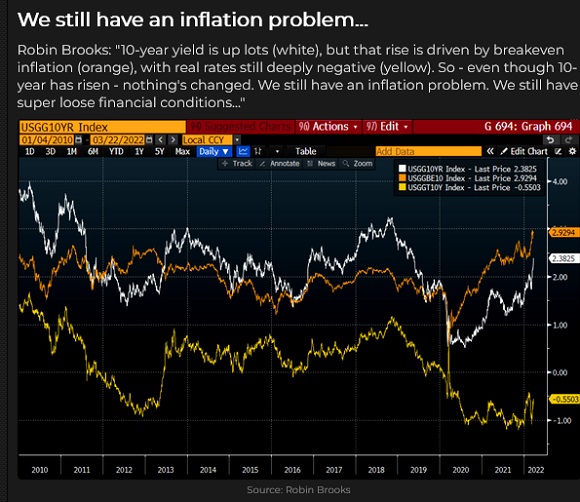

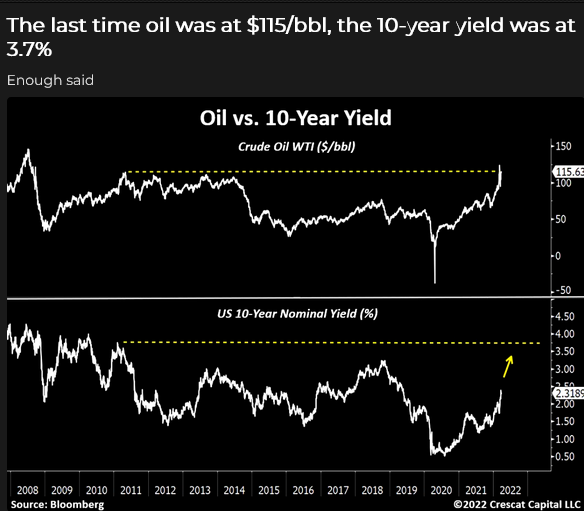

This chart was created mid-week (when 10-year yields were only 2.38%), but its point is even more valid, with rates at 2.5%.

Remember when high prices were the best cure for high prices? That quaint thought assumed that high prices stimulated both new supply and demand destruction. But as the Heisenberg Report argues, “demand destruction” in Western Democracies may no longer be politically viable. Governments will fight inflation with inflationary policies! Voters will love it, but bond investors won’t.

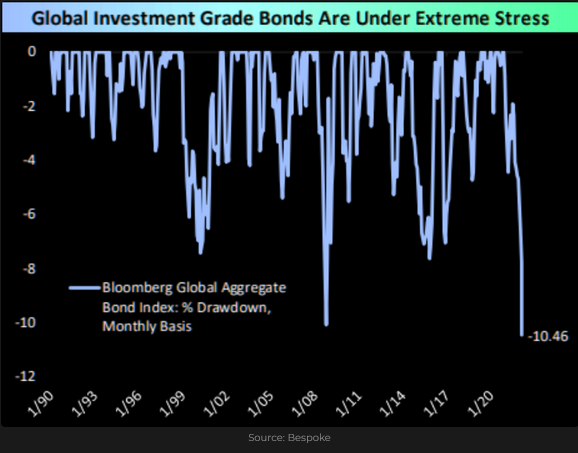

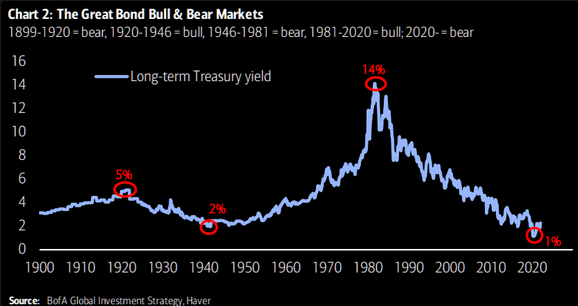

Is the forty-year bond bull market over?

The All-Time High in the bond bull market was August 2020, when the ten-year Treasury yield was ~0.50%. The current yield is ~2.50%, and the forty-year uptrend line is at risk of being decisively broken.

But the Eurodollar forward curve shows rates rising into June 2023 but then drifting lower after that. This pricing may be on the expectation that the Fed will be “tightening into a recession” and will have to reverse course or risk an economic collapse.

If that is the case, the bond market will “see” the slowdown coming, and bond prices will rise. Maybe.

Canada/Commodities

Canadian interest rates have also been soaring. This week the yield on the ten-year closed at 2.55% – an eight-year high. Futures market pricing for December 2022 Banker Acceptances has 3-month yields >3%, an increase of ~ 1.2% in the last three weeks.

The Loonie closed above 80 cents this week for the first time since early November as commodity currencies are bid.

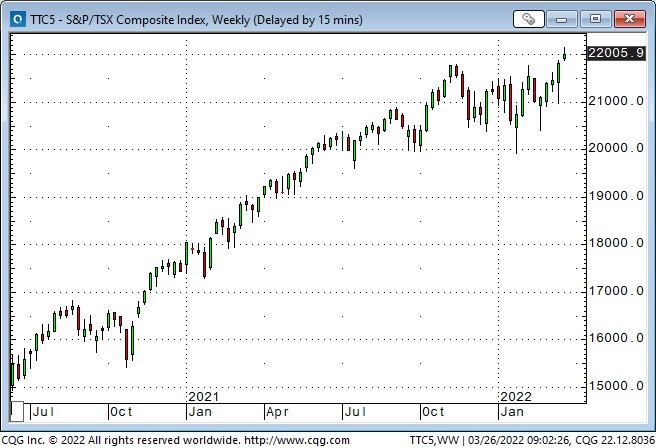

The Toronto Stock Index hit new All-Time Highs this week. Australian and Brazilian stock markets have also been surging higher.

Japan

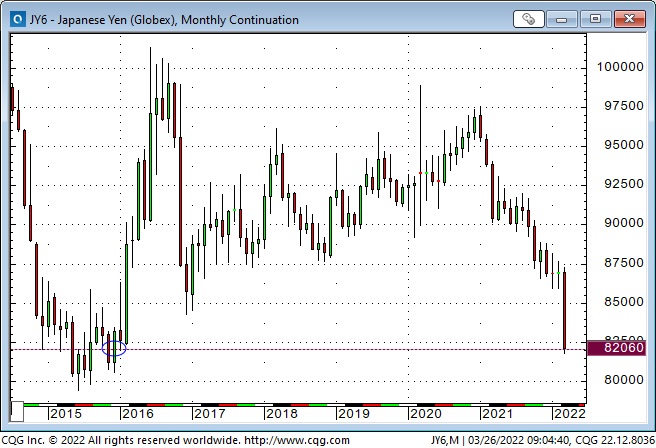

The Yen plunged the past three weeks, hitting a six-year low, as American interest rates have surged while the BoJ is committed to capping their ten-year bond at 0.25%. Red hot commodity markets also hurt the Yen, but a weak Yen helps the Japanese stock market.

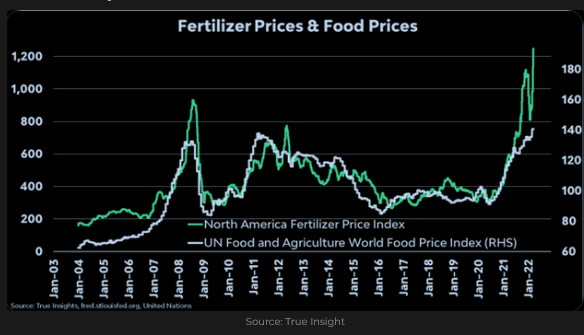

The intersection of food, energy policies and geopolitics

The Russian invasion of Ukraine set off multiple chains of consequences in food and energy that may quickly escalate into a generational food crisis due to diminishing supply availability. I recommend the latest piece from Doomberg (a ten-minute read) that examines how shortages of fertilizer, herbicides, diesel, propane, computer chips, and labour may impact the cost and availability of food. (Late note: a subscriber just emailed me that Doomberg should have added that a severe drought is developing in Canadian and American grain-growing regions. Pray for rain!)

The low on this chart was March 24th – the day Russia invaded Ukraine. We are going to need more tractors.

How delusional green policies set up the Russian invasion of Ukraine

Here’s a quote from Michael Shellenberger’s latest piece: “But it was the West’s focus on healing the planet with “soft energy” renewables, and moving away from natural gas and nuclear, that allowed Putin to gain a stranglehold over Europe’s energy supply. As the West fell into a hypnotic trance about healing its relationship with nature, averting climate apocalypse and worshiping a teenager named Greta, Vladimir Putin made his moves.”

My short term trading

I “got busy” with other things this week and didn’t trade much. I thought that the stock market might correct after last week’s steep rally (in last week’s Notes, I wrote that it may have been a bear market rally), and I looked for setups to get short. That didn’t work, and my P+L was down ~0.20% on the week. (I was trading small size with tight stops.)

I thought soaring interest rates might cause stocks (especially long-duration tech stocks) to weaken, that the winding down of corporate buybacks going into the blackout period ahead of quarterly reports would weaken stocks, that option dealers not being net short gamma after last week’s rally would weaken stocks – but they just kept rising. Maybe the market is looking at the seasonality chart! Yikes!

One of my favourite trading mantras is that there’s nothing wrong with being wrong except staying wrong, so when I’m wrong, I’m gone.

Thoughts on trading

I’m falling behind in my attempt to “keep up.” I’ve got podcasts and videos and research reports stacking up, and I know I’ll have to hit the “delete” button on many of them. Other traders I talk to/swap emails with tell me they have the same problem.

There is so much “going on” and so many violent moves in so many different markets that it’s impossible to stay current with everything.

Quotes from the notebook

“There are no solutions, there are only trade-offs; and you try to get the best trade-off you can get, that’s all you can hope for.” Thomas Sowell

My comment: I’ve been a Thomas Sowell fan for years. He is a true American icon. This quote seems particularly appropriate for today. It applies to Russia/Ukraine, the Maltusiasn forecasts of soaring commodity prices, the prospect of ever-growing and ever-intrusive government, and to virtually any problem I see today. Do yourself a favour and spend a few minutes reading about this man, his life and his pithy quotes. He is a beacon of clear-eyed observation and an inspiration to truth-seekers everywhere.

The Barney report

One of the great things about writing this blog is that I have developed relationships with people worldwide that I would otherwise never have known.

Recently, a man in Connecticut asked his wife to paint a portrait of Barney based on a photo I posted on this blog. He sent me the picture (painted on a rock) as a thank you for the value he received from reading my blog.

How amazing is that!

The portrait stands on the windowsill behind my screens – right where I can see it every day.

You can see more of his wife’s pet portraits on her Art Instagram page: @querocks.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 26th podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.