Stock indices closed on their lows this week

The Nasdaq 100 closed higher for 8 consecutive weeks but closed on its lows this week after making new All-Time Highs. The index has rallied ~15% since the May 10-12 Key Turn Date.

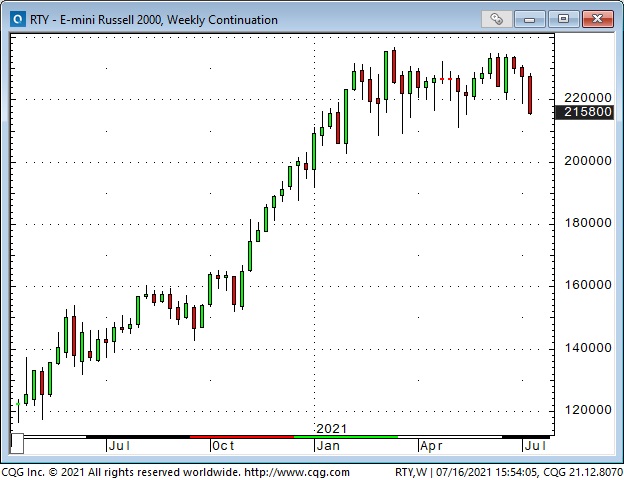

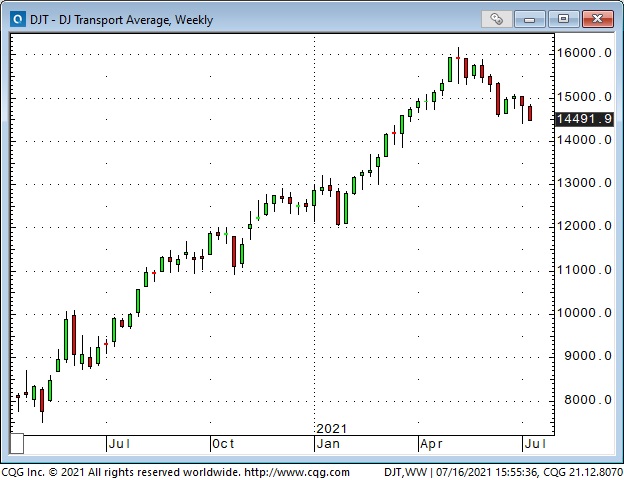

The small-cap Russell 2000 Index and the Dow Jones Transportation Index have been the weakest of the major indices in the past two months. The Russell had its lowest weekly close since January.

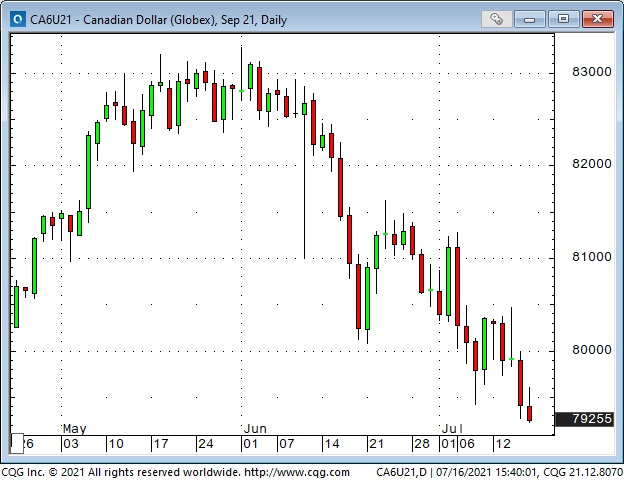

The US Dollar had its best weekly close since late March

The Canadian Dollar has closed lower six of the last seven weeks, falling from the 6-year high it touched in May. The CAD had a very brief bounce on the Bank of Canada decision this week but closed the week right on its lows – down 4 cents from its June highs.

Gold: a strong negative correlation with the USD

Gold tumbled ~$175 from the beginning of June to its month-end lows as the USD surged higher. Gold recovered ~50% of its June decline the past two weeks but turned lower Friday as stocks fell and the USD rallied.

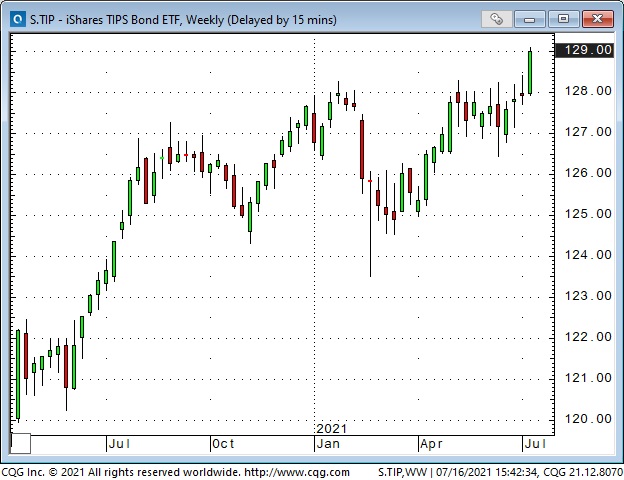

Gold’s strong correlation with falling real interest rates the past three years has not been maintained recently as the TIPS have rallied to new All-Time Highs – without gold tagging along.

Silver tumbled with gold in June but did not bounce back the past two weeks and closed this week at a 3-month low. Silver’s poor performance may be a drag on gold.

Bond prices continue to rally

The 30-year T-Bond futures contract closed higher for eight of the last nine weeks, and the yield curve flattened. (Longer-term yields have fallen sharply relative to shorter-term yields.) The bond market rally has been highly correlated with the Nasdaq rally for the past two months.

Crude oil: sideways to down after hitting 7-year highs

Front-month WTI crude nearly touched $77 last week when OPEC+ disagreed on production increases; price action since then has been sideways to down.

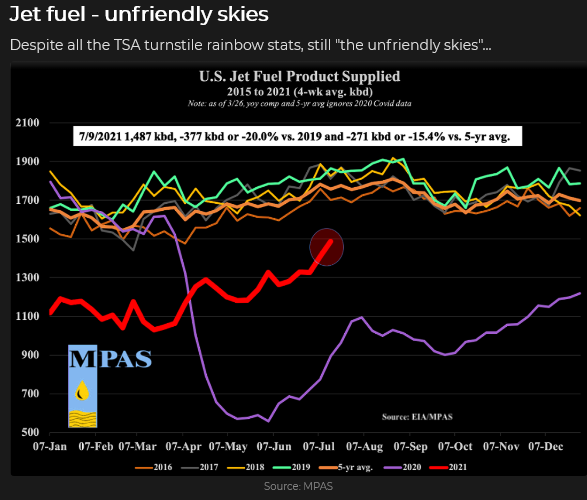

American demand for gasoline in July 2021 is higher than it was in July 2019. Not so for jet fuel.

Weaker spot prices for crude oil have caused a sharp break in WTI time spreads. This chart shows that the premium of September over December fell from ~$3.50 to ~$2.25 within the last two weeks.

My short term trading

I started this week with only one position: long CAD calls that I bought last Friday when the CAD bounced from 3-month lows. I have traded the CAD from the short side the past two months but thought it was due for a bounce. I was wrong. I covered the position for a small loss this week (but not as quickly as I should have!)

I’ve been looking for a break in the stock market and shorted the small-cap Russell 2000 on Monday. I closed that trade for a small gain Wednesday morning. (I was going to be travelling for two days and wanted to be flat.) I shorted the Dow Friday morning and covered it for a small gain later in the day. My P+L had a net gain on the week; I’m flat going into the weekend.

I knew I would be travelling (and disconnected from the markets) this week, so I didn’t make (or stay with) trades I might otherwise have made. I was a little grumpy about that – feeling like I had left money on the table – so I tried to focus on the fact that markets will provide new trading opportunities again next week. (What’s done is done, move on, Grumpy!)

On my radar

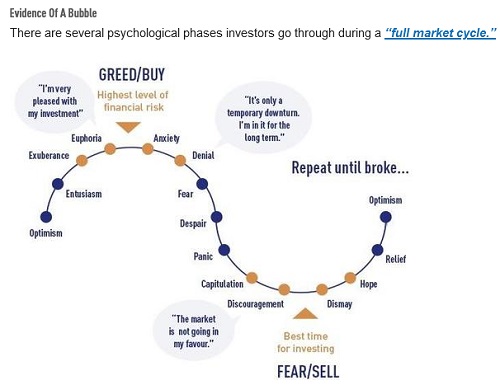

My recent bias has been that pro-risk positioning across markets is WAY overdue for a substantial correction – this week’s price action looks ominous. I would have stayed with the short Dow position I established Friday, except that I felt “out-of-sync” with markets due to travelling this week.

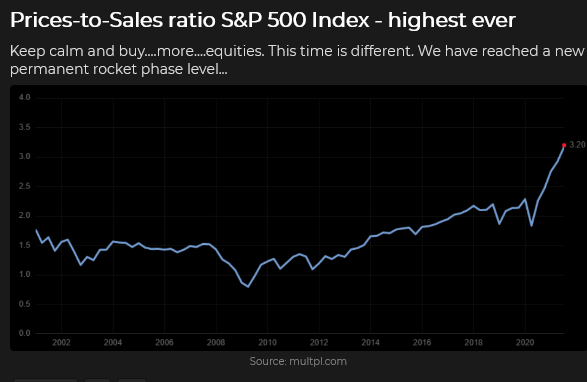

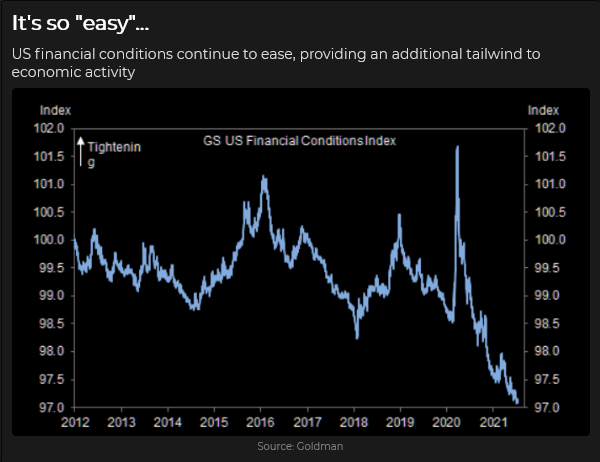

Are we in a bubble?

My friend Lance Roberts wrote a great piece this week answering that question. Here’s the link (a good 5-minute read.)

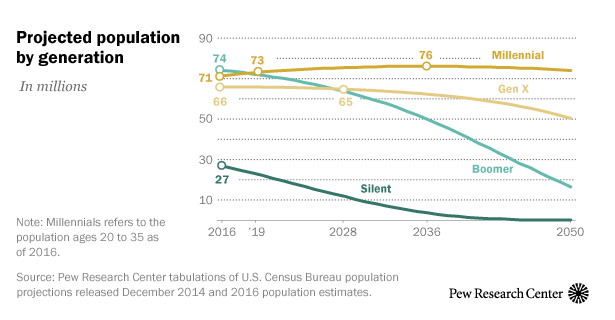

Changing demographics will change everything

The boomer generation is in the process (whether they like it or not) of passing the baton to the Millennial and Gen X generations. This is going to change everything – including markets!

Thoughts on trading

My starting point is that everybody has to find their own way to trade. You can learn from other people, but you can’t copy them. You have to find out what works for you and what doesn’t, and the only way to do that is to trade.

I don’t like losing money, and I certainly don’t like missing a trade, but it happens. What’s done is done; let it go.

Taking a loss on a trade means that the trade wasn’t working. I’m better off getting out of the trade, saving my capital and looking to get into a trade that is working..

I know that I don’t know what will happen – so if a market moves against me, I don’t take it “personally.”

The ultimate goal of ALL my risk management habits is to make sure that I never take a BIG loss. Small losses are a “cost of doing business,” but a BIG loss will put me “out of business.“

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.