“In the short run the market is a voting machine, but in the long run it is a weighing machine.” Benjamin Graham

Across the spectrum of traders and investors there would be a wide dispersion of definitions for “short run” and “long run” but for the purposes of my personal trading “short run” means a few days to a few weeks. For me, “a voting machine” implies a popularity contest wherein the current winners have been created by self-reinforcing waves of bullish mass psychology.

Inter-market relationships

Regular readers know that I pay a lot of attention to inter-market relationships, believing that different markets influence one another to varying degrees. Sometimes the correlations between markets are very strong, at other times the correlations are virtually non-existent.

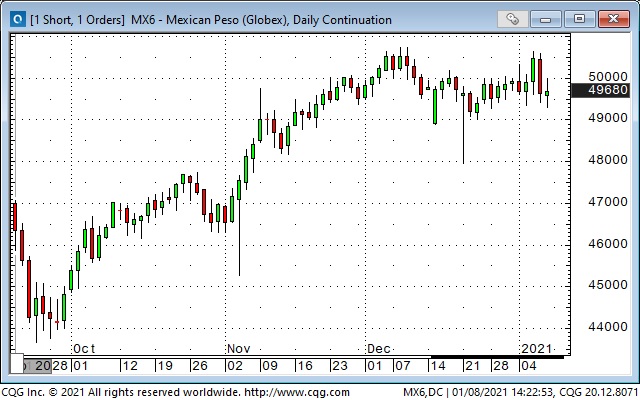

For the past several months, and increasingly since the Key Turn Date (KTD) around November 1, 2020 THE highly correlated pro-risk trade has been long stocks, long commodities and short the US Dollar. Late this week I started to fade this pro-risk trade by buying the USD. If it continues to rally I will add to my positions.

The debasement of the US Dollar

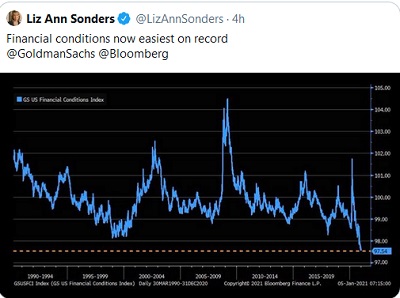

In many respects the pro-risk trade is the result of the “debasement” of the USD by aggressive American monetary and fiscal policy. As the supply of dollars has increased dramatically (and the market anticipates that the supply will continue to increase dramatically) the supply of shares and commodities has not increased, therefore the dollar price of shares and commodities should rise. Low nominal and negative real interest rates have further pressured the USD Vs. foreign currencies.

USD bears see America plagued with multiple problems, but in the world of currency trading the value of the USD is measured relative to other currencies. Is there a country in the world that does not have multiple problems? Are the problems in America that much worse than the problems in the Eurozone to warrant a rally of ~12% in the Euro over the past 10 months?

Forecasts are interesting but I trade price action

I read a lot of research reports and market forecasts. There are many highly qualified and experienced analysts who take totally opposite views from each other on what “should” be happening in different markets. For instance, Jeremy Grantham recently authored a widely circulated report saying that the stock market is in a bubble and could soon fall dramatically. While I am sympathetic to that idea, I think Jeremy would agree that he is writing from a “weighing” perspective and that over-valuation is not a timing tool.

Many other analysts disagree with Jeremy. A widely held view is that the stock market will keep rising because of on-going easy monetary policy, aggressive fiscal stimulus from the “Blue Wave” and a strong rebound in economic activity once the virus is vanquished. Last summer a popular view was that the stock market would tumble if the Democrats controlled the Federal government, but currently the market seems to like the prospect of aggressive fiscal stimulus (while over-looking the prospect of higher taxes.)

I do not trade based on forecasts, as much as I may find them interesting and thought provoking. I trade by trying to gauge market psychology as it is expressed through price action.

Markets:

The US Dollar Index had its best close Friday in 8 trading sessions after hitting a 32-month low Wednesday when the Capitol building was stormed. I’ve traded currencies since the 1970’s and I’ve seen trends go way further than I could believe many times, but then they turn on a dime and go the other way. Was Wednesday a cathartic inflection point for the USD?

I am effectively long the USD by being short the EUR, the MEX and the NZD. Their charts look toppy and they could quickly develop downside momentum. I have kept my position size small and my stops tight because I am using daily chart patterns to short into a multi-month uptrend.

Over the past 44 years I have seen the EUR change direction against the USD many times in the January/February period. If the EUR does turn lower against the USD it will likely have a “follow me” influence on other currencies. Futures market speculators are now massively net long the Euro currency. If the EUR starts to fall expect these speculators to become sellers.

I missed shorting gold when it tumbled on Friday. My good friend Ross Clark (chartsandmarkets.com) wrote a gold report early this week saying that gold “had to” stay above 1900 to sustain the Monday breakout. Great advice! I should have had a sell stop in the market around 1900 but I did not. However, the dramatic weekly reversal in gold increases my willingness to be long the USD.

WTI crude has had a spectacular $18 (53%) rally from the November KTD low and is now at its best levels since last February. A surprise production cut by the Saudis at this week’s OPEC+ meeting and rising mid-east tensions helped fuel the rise.

If the USD has indeed hit an inflection point and begins to rally from here, I expect that will have a negative impact on stocks and commodities, given the strong negative correlation the USD has had with those markets for the past several months.

Victor Adair retired from the brokerage business after 44 years this past summer and is no longer licensed to provide investment advice. This blog and everything else on this website is not be be construed as investment advice for anybody about anything.