FOMO Alert!

The Nasdaq had its highest weekly close yesterday since September, up ~13% from the 27-month lows made last October. This week’s close was 28% below the All-Time High made in November 2021.

Inflation is falling and is expected to keep falling, so the Fed is expected to increase short rates (only) 25 bps this coming week, and maybe another 25bps next month and then (the market hopes) pause – which I’ve previously described as the “Green Light Special” to Buy Baby Buy!

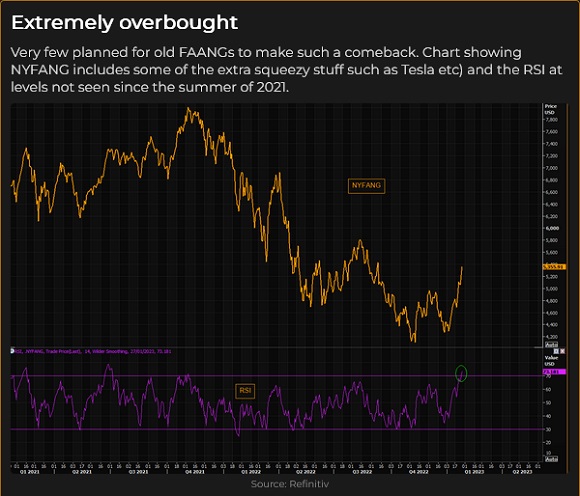

Some of last year’s Dogs have rallied hard, undoubtedly driven by short-covering, bargain hunting and FOMO.

Tesla is up ~75% in three weeks on huge volume. This week, the stock is so “hot” that Tesla options volume represented 13% of all single stock options trading. (Despite this sizzling rally, TSLA is still down nearly 60% from Nov 2021 ATH.)

Bitcoin futures have jumped >45% YTD. (But still down ~68% from November 2021 ATH.)

ARKK has jumped ~37% after falling >80% over the last two years.

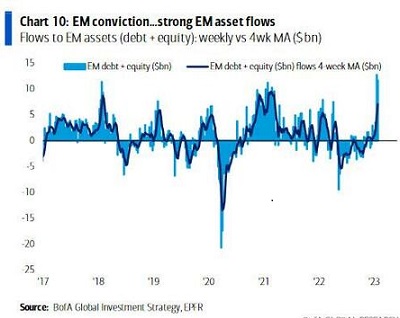

For the past decade, the US stock market has outperformed the rest of the world, but lately, capital has been flowing into EM stocks at a record rate. (When FOMO kicks in, people forget Donald Coxe’s caution that “Emerging markets are markets you can’t emerge from in an emergency!”

In late December, investors seemed worried about a possible recession and weak earnings. Still, for the past three weeks, upside market momentum has been so robust that options volatility, which rises when the stress level goes up, has fallen to 1-year lows; there is nothing to be worried about!

China reopening

The reversal of Chinese covid policies has stoked bullish enthusiasm in various ways. (Rumors of a reversal began circulating in the markets in early November.) The RMB has rallied ~10% against the USD in the last three months, while the KWEB Chinese Internet ETF is up ~100% (but is still down ~65% from 2021 ATH.)

Falling prices on this chart mean it takes fewer RMB to buy one USD.

The Australian Dollar has surged ~14% (by comparison, the Canadian Dollar is up only 4%.)

Copper has rallied ~25% since early November, 15% YTD.

Chinese consumers are expected to go on a “revenge buying” spree after being locked down for three years, and that buying will be good news for European exporters – an idea that helped boost the Euro currency.

Energy

Exxon and Chevron shares hit All-Time Highs this week despite WTI trading mostly between $72 and $82 the past two months, while Nat Gas prices are down ~70% from last summer’s highs. I guess “returning money to shareholders” is more popular on Wall Street than investing in future production.

Currencies

The US Dollar Index soared to a 20-year high in September 2022 and was overdue for a correction. The initial leg of the correction was linked to the reversal in the British Pound, which hit a 37-year low on September 26 and bounced back ~10% within a few days.

The Euro reached a 20-year low on September 28 (as The Existential Winter loomed) but bounced back ~ 5% within a few days and then kept rising.

The Japanese Yen made a 32-year low on October 21 and bounced back ~5% within a few days following massive intervention by the Japanese authorities. Two weeks later, the BoJ ignited another round of Yen buying when they changed their yield curve control policies.

The absolute High for the USDX was September 28, the same day the Euro bounced back from its 20-year low (the Euro is ~57% of the USDX), but I think the “nail in the coffin” for the USDX was November 4, when markets priced in THE high for US short term interest rates. That was also a big day for the RMB (and all major Asian FX), gold, copper and CAD.

The period of the Fed being the most aggressive Central Bank ended on November 4, and that removed significant support for the USD.

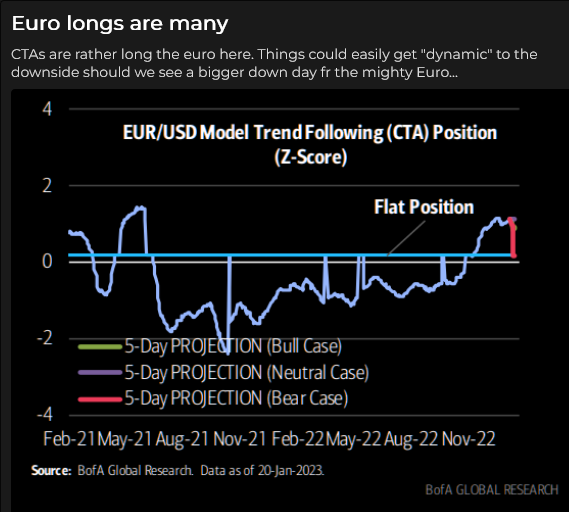

The USDX has trended lower since November 4 (last week, I wrote about several Anti-dollar trades), but the pace of the decline has moderated over the past few weeks, and I’m anticipating a bounce (at least) in the USD.

The Euro has risen in anticipation of the ECB being more aggressive than the Fed over the next couple of months – raising rates by ~125 bps while the Fed raises only ~50 bps. If those were “terminal” rates, that would see the ECB to ~3.25% and the Fed to ~5%, which leaves the US with a significant interest rate differential advantage – which might be attractive if European energy costs/security or geopolitical issues re-emerge.

Speculators are heavily net long Euro futures.

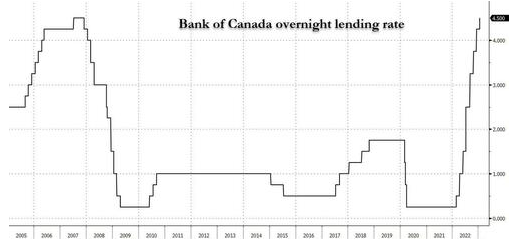

The Bank of Canada raised rates by 25bps this week and declared that they will now pause to judge the cumulative effects of the increases made over the past 12 months.

Gold and interest rates

The correlation between gold and interest rates (real and nominal) has been tight at times and less so at other times. For instance, the 10-year US Treasury bond yield hit an All-Time Low on August 5, 2020, as gold made an All-Time High (save a 2-day spike on the Russian invasion.)

Gold and bond prices spiked together in early March 2022 on the Russian invasion but fell in virtual lockstep until early November.

Since November 4 and THE low in short-term interest rates, gold and bonds have rallied, although the bond rally has been modest compared to the $325 (20%) rally in gold.

The gold rally since November 4 strongly correlates to the decline in the USD. I’m looking for the USD to bounce (at least), and if it does, I’d expect gold to have a correction.

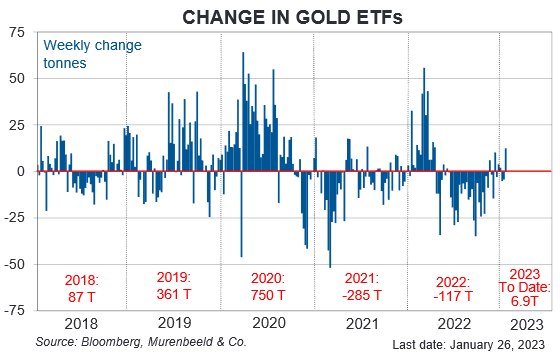

The gold ETF market finally saw some buying – after a $300 rally!

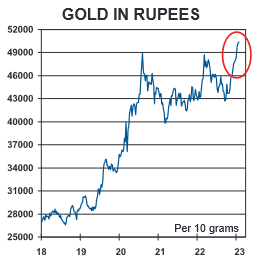

India is usually a BIG market for gold sales, but that may not be the case with gold at record highs in Rupees. (Chart courtesy of Murenbeeld and Co.)

Inflation

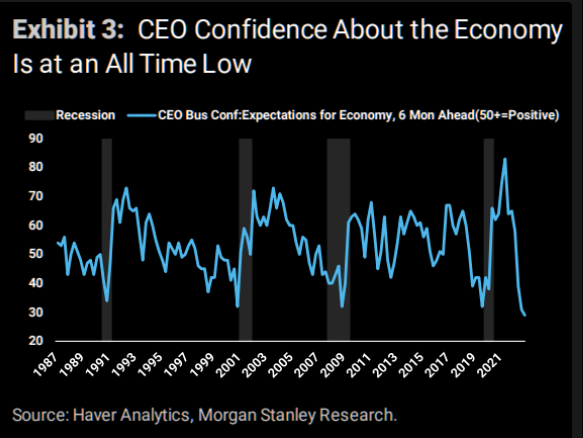

I recently watched a fascinating interview with David Rosenberg on RTV. I’ve had tremendous respect for David for years. He reported that inflation was coming down fast and speculated it might turn negative later this year. He thinks the recession has already started and will be deep. He expects people to pull money away from the stock market (he believes it hasn’t bottomed yet), that the 2-year bear market in bonds ended in October 2022, and that bonds may return as much as 20% in 2023. He was also bullish on gold over a 1-2 year time horizon.

If I remember correctly, he expects the “strong employment” factor, which supports the “sticky services inflation” idea, to fade away as the recession bites.

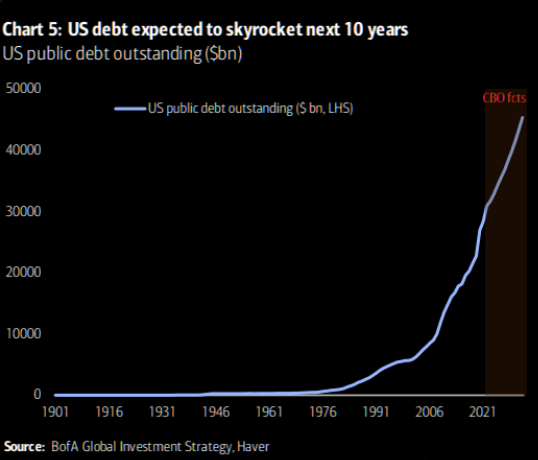

I think inflation is a policy choice, and the authorities have already decided on a course of action which will result in more enormous fiscal deficits sustained by issuing more and more debt. The expanding quantity of “money” will continue to diminish purchasing power, and people will try to earn more to “catch up” with rising prices. I think demographics will add inflationary pressures as retiring boomers shrink the labour supply and millennials become the driving force of consumer spending.

My short-term trading

I’ve had a bias that stocks would fall, but fortunately, I didn’t see any good opportunities to get short this week!

I never cease to be surprised at how having a bias will get in the way of making money.

My other recent bias has been that the USD is due for (at least) a bounce. Due to that bias, I took some minor losses in EUR and CAD this week.

I’m short a small position in gold at the end of the week.

On my radar

The FOMC is expected to raise rates by (a well-telegraphed) 25bps on Wednesday, Feb 1. Financial conditions have been easing with the USD, bond yields, mortgage rates, and inflation falling while stock prices have been rising. The market expects (hopes that) the Fed will soon pause and is currently pricing short rates to fall in H2 2023. Chairman Powell could surprise markets if he maintains his hawkish determination to “make sure” inflation and inflation expectations are subdued.

(Note: this paragraph was added Sunday morning, January 29.)

No Trading Desk Notes next week

I’ll be attending the World Outlook Conference in Vancouver next week and won’t have time to post TD Notes.

The Barney Report

Barney can wait patiently in my office for me to FINALLY leave my computers alone and take him out for a good run in the forest, which is where he REALLY loves to be.

The 33rd Annual World Outlook Financial Conference at the Bayshore Hotel, Vancouver, February 3 & 4, 2023

Mike Campbell’s hugely popular annual conference will be back LIVE AND IN PERSON at the Bayshore Hotel after two years of Covid restrictions. Mike and his team have again created a fantastic roster of speakers and exhibitors. I’ve attended every one of these conferences, and with all the turmoil and confusion in today’s markets, I highly recommend my readers make plans to attend. Videos will be available after the conference if you can’t attend in person. You can get all the information you need here.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s Moneytalks show for >22 years. The January 28 show is available at: https://mikesmoneytalks.ca/category/mikes-content/complete-show/

I recorded my monthly 30-minute interview with Jim Goddard for “This Week In Money” on January 7. You can listen here. I talked about how I thought markets would shift from being laser-focused on the Fed – that maybe geopolitical issues would be the big driver of markets this year. We also talked about stocks and interest rates and currencies and especially gold.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I’ve had friends who took their own lives. Headsupguys is a project at the University of British Columbia that helps men deal with depression. If you or someone you know is struggling, reach out to Headsupguys. They are there to help.

Here’s a link to a recent 7-minute interview on the Canadian national CTV network with John Ogrodniczuk, the UBC prof who founded Headsupguys, discussing how Headsupguys saves lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.