US stock indices are higher again this week, with the DJIA up ~6,000 points (18%) from its October lows

The S&P, Nasdaq 100, DJIA, and the VTI ETF have all closed higher for 12 of the last 13 weeks. The rally continues to be led by big-cap tech, with MSFT and AAPL both reaching a $3+ Trillion market cap this week.

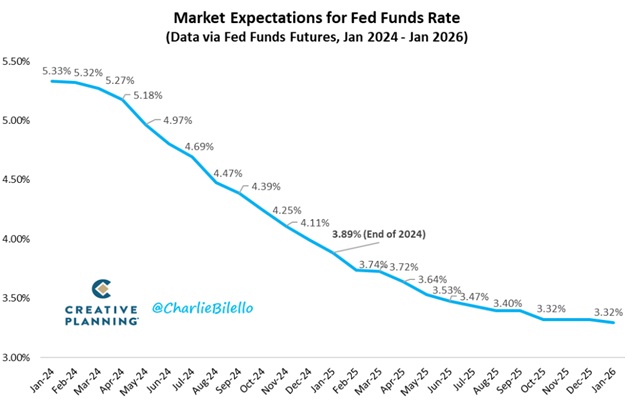

A major Fed policy shift at the end of October (the Fed signalled a halt to interest rate increases and likely cuts in 2024) inspired across-the-board buying in stocks, bonds, foreign currencies and gold as traders front-ran anticipated Fed cuts.

But since the turn of the year, bonds, foreign currencies, and gold have gone sideways to down while stock indices have continued to rally. This divergence between asset classes may be due to upgraded expectations for US economic growth in 2024 (boosting corporate profits – good for stocks) while reducing the “need” for interest rate cuts.

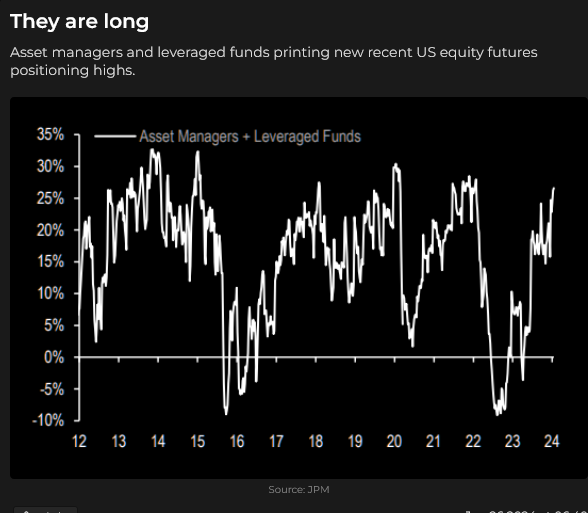

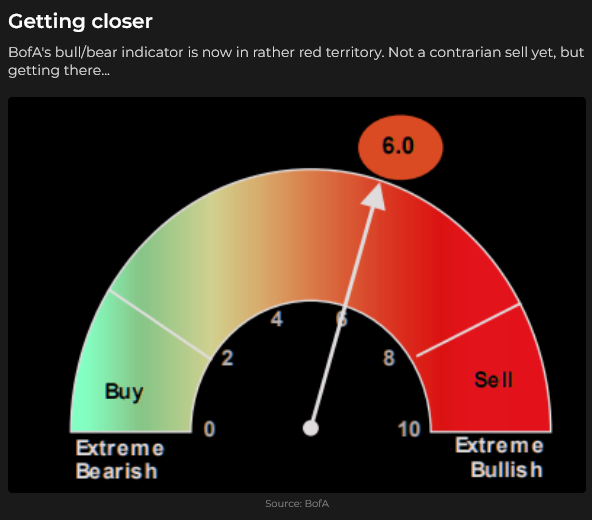

The rapid run to new all-time highs in many big-cap stocks and the leading indices, amid bullish sentiment and positioning, has some analysts anticipating a correction. Investors who have benefited from the strong rally over the past three months may be inclined to book some profits given (among other things!) the increasingly divisive political environment. Money market yields above 5% may be a safe harbour.

The cost of buying “downside protection” is relatively cheap.

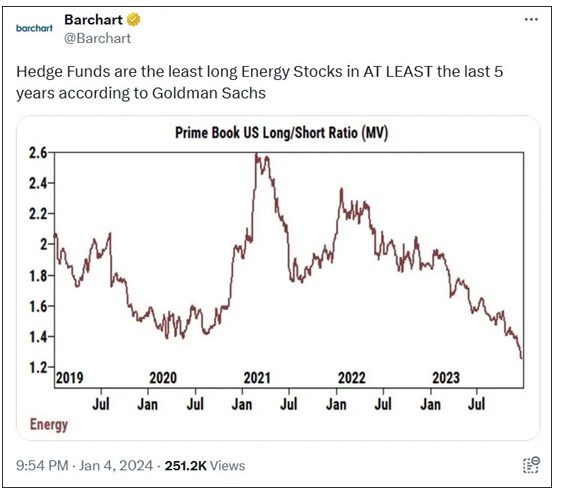

When I posted this chart in the October 28, 2023, Trading Desk Notes, the indicator was at 1.5 – a STRONG buy signal in an extremely bearish environment.

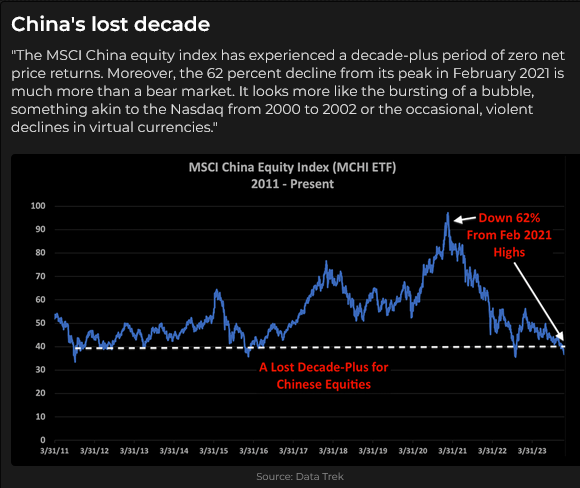

China

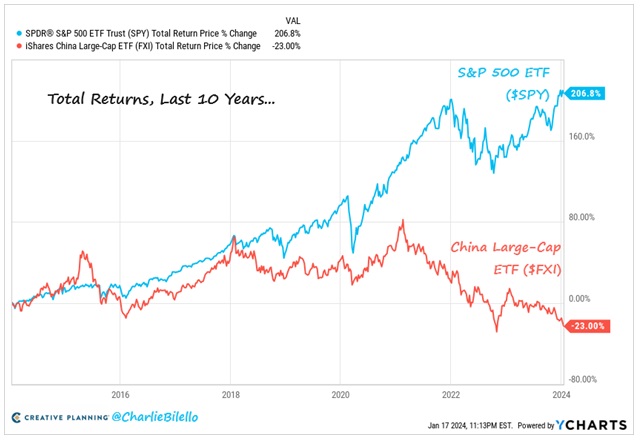

The leading Chinese stock indices fell to 5-year lows this week (down ~30% from 2021 highs), bounced slightly on government stimulus plans, but then turned lower again.

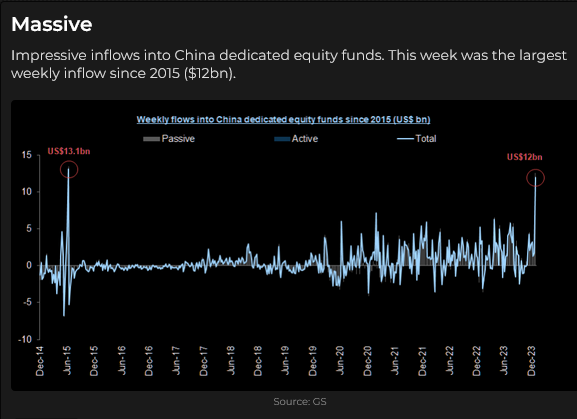

This chart shows a historically massive flow of capital into Chinese dedicated equity funds this week. Perhaps “somebody knows something” about Chinese stimulus measures to come, or maybe “somebody’s feeling lucky” about the alligator jaws closing in the CharlieBilello chart above.

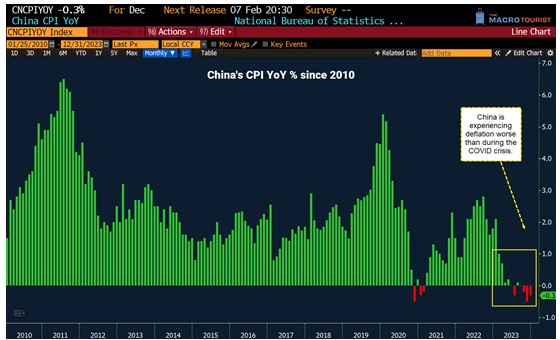

My friend Kevin Muir’s chart shows that China is struggling with deflation.

Tesla

TSLA’s quarterly report disappointed the market this week, with shares down ~30% from December highs on signs that EV sales are (and will likely continue to be)) weaker than expected. (Note: my suspiciously prescient comments last week that TSLA risked being booted from the Mag7 for share price performance unbecoming a member were only intended to entertain my readers; I swear I was not privy to any inside information.)

Central banks are playing it safe. The BoJ, the ECB and the BoC met this week with no change in policy. The FOMC and the BoE meet next week with no policy change expected. The leading Central Banks (ex-Japan) have signalled that they will not raise rates but are reluctant to cut rates too soon. (Odds of a Fed cut in 1) March: ~50% in 2) May: ~90%, in 3) June: ~99%.)

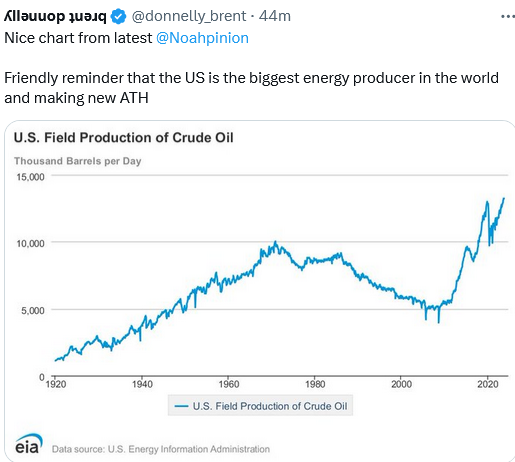

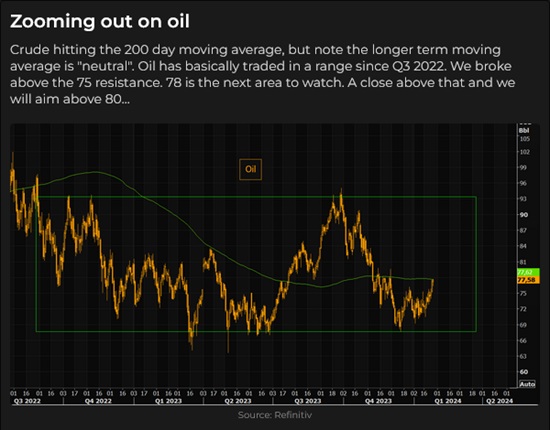

WTI futures traded above $78 this week – a two-month high – after trending lower from $95 in September to $67 in December. An OPEC+ meeting is scheduled for February 1, but no significant policy change is anticipated. An oil tanker off the coast of Yemen caught fire lat this week after being hit by a missile.

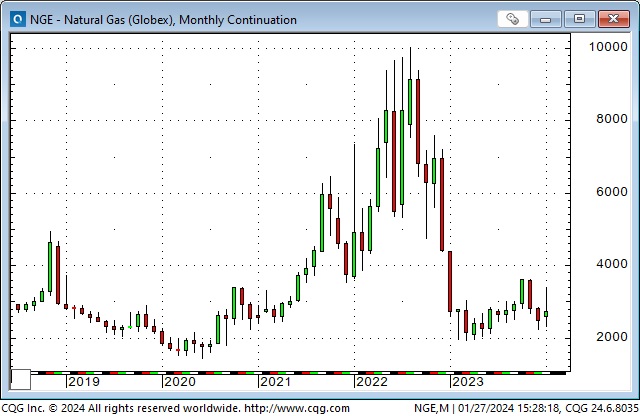

NYMEX Natural Gas futures tumbled ~40% from early November highs to mid-December lows as supply from shale drilling threatened to overrun demand. Prices bounced back ~50% into early January in anticipation of extraordinarily cold weather but subsequently tumbled back to around December lows in only six days as the cold weather came and went.

While the recent price action in Nat Gas appears to have been volatile, it pales compared to the volatility in 2022 following the Russian invasion of Ukraine.

Uranium company shares hit multi-year highs two weeks ago as the spot market for physical uranium traded above $100. On January 24, my long-time friend and excellent technical analyst, Ross Clark, noted, “the Sprott Physical Uranium Trust has established an upside Trifecta Sell signal with the daily, weekly and monthly charts each into Exhaustion mode.”

Scheduled events next week could rock the markets

The FOMC meets on Tuesday/Wednesday, and the BoE meets on Thursday. The Treasury Quarterly Refunding Announcement is early Wednesday, and traders will be keen to see the total issue size and particularly the ratio of bills to bonds. (The November 1 QRA, which showed a smaller-than-expected Notes issuance, was credited with igniting the two-month bond rally.) There will be several US employment reports next week, including the NFP report on Friday. From Tuesday to Thursday, quarterly reports for MSFT, GOOGL, AAPL, AMZN, and META are expected.

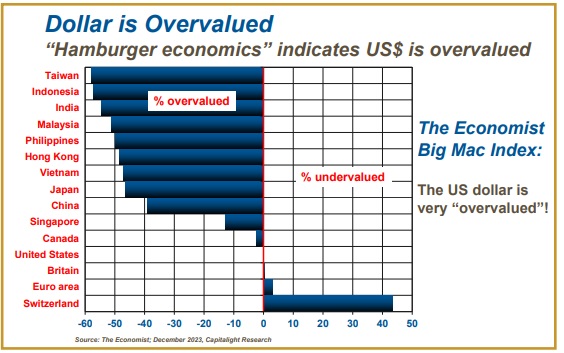

The Annual Economist Magazine Big Mac currency index

My friend of 30 years, Dr. Martin Murenbeeld, the globally renown gold analyst, likes the MacDonald Big Mac Index, calling it a “down and dirty purchasing power parity tool. If a Big Mac costs less in China than in the US, the presumption is that the Chinese RMB is undervalued. (Purchasing Power Parity Theory (PPP) holds that the Big Mac should cost the same across countries, converted to a common currency – in this case, the dollar!)”

Well, once again, the Big Mac Index shows that the USD is extraordinarily overvalued against most Asian currencies and is substantially undervalued against the Swiss Franc. The Canadian dollar and the principal Eurozone currencies are “fairly valued.” (Thanks to Martin for this chart.)

My short-term trading

I started this week with no positions held over from last week. I shorted the CAD on Monday, seeing that it had bottomed on Wednesday of last week, January 17, when the S&P bottomed but was rolling over (again) even as the S&P broke out to new highs. (I pay a lot of attention to correlations and correlation failures.) As noted in the first section of today’s Notes, bonds, currencies, and gold have weakened even as stocks continued to rally since late December so I was willing to press the short side on CAD. (I’ve had two successful short CAD trades earlier this month.)

I had my stop too tight and was stopped for a tiny loss when the CAD spiked ahead of the BoC meeting on Wednesday morning.

I shorted the S&P on Thursday after it had twice challenged Wednesday’s all-time highs and fell back. I was stopped early on Friday’s day session when the market (very briefly) made new all-time highs. When it didn’t sustain those highs, I shorted it again and held the position into the weekend.

As noted above, next week has a number of scheduled events that could produce very volatile price action, so I’m trading small size with tight stops as I try to “catch a turn” in the S&P.

No Trading Desk Notes for the next two weeks

I will go to Vancouver next week to speak at the World Outlook Conference and then go to Cabo San Lucus for a week in the sun with an old friend. I plan to post the next Trading Desk Notes on February 17.

Quotes of the week

The Barney report

The dreaded “Pineapple Express” rolled in this week with a combination of higher-than-normal temperatures and higher-than-normal precipitation, so the ski mountains are struggling, and the snow we had around here is all gone. Barney loved the snow, but he also loved swimming in the warm ocean last summer. To everything, there is a season.

Listen to Victor talk markets

On this morning’s show Mike Campbell and I discussed how the continuing strong US economic data is causing markets to price in fewer interest rate cuts this year and why people might start taking some profits after the sizzling stock market rally – with 5% returns in money markets looking good. My 6-minute interview with Mike starts around the 52 minute mark. You can listen to the entire show here.

I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show last week. We discussed my macro view of markets and drilled down on big-cap tech, gold, bonds, currencies and the energy market. We also examined why I prefer sentiment and positioning data over market predictions. You can listen to the show here. My spot with Jim starts around the 40-minute mark. My long-time friend Ross Clark, an excellent technical analyst, talks with Jim during the first 12 minutes of the show.

The 36th Annual World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.