THIS IS NOT A DRILL

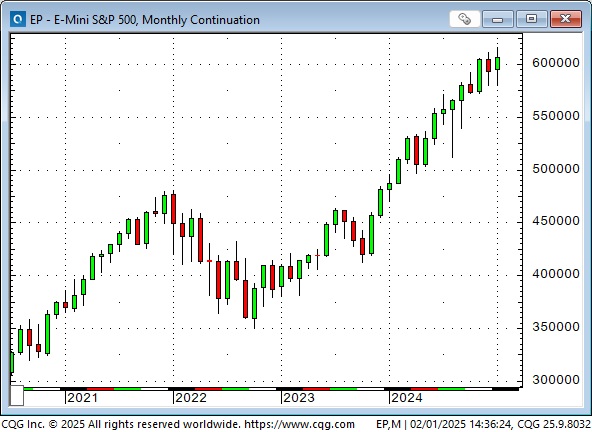

It was a hectic week in the markets, but two events were especially significant: 1) The spot S&P traded to all-time highs last Friday, January 25, but the S&P futures gapped lower Sunday afternoon and fell hard early Monday on the DeepSeek story (blue ellipse) and 2) The S&P rallied all week from Monday’s lows, filled the Sunday gap, and then dropped like a stone to close at the day’s lows when the White House confirmed that 25% tariffs on imports from Canada and Mexico would begin today (pink ellipse.)

NVDA was hit especially hard on Monday and closed at 4-month lows. Retail bought aggressively on Tuesday, with the market closing at its highs, but there was no follow-through, and NVDA closed near its lows on Friday.

The S&P is up ~70% from the October 2022 lows (when the market began to price in “peak tightening” from the Fed), and the NAZ is up over 100%.

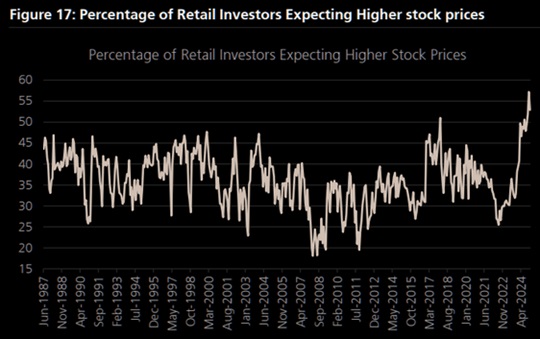

Flows into US equities in January are estimated at ~$76 billion, and retail clearly expects the rally from the October 2022 lows to continue. (Their bullish enthusiasm was at 5-year lows in October 2022.)

Bullish commentators said Monday’s break on the DeepSeek story was a “healthy correction. ” They may be correct, but I thought Friday’s reversal packed a punch, and I’m short in my short-term trading account. A break of Tuesday’s lows of ~6020 would open the door for a drop to Monday’s lows of ~5950.

Currencies

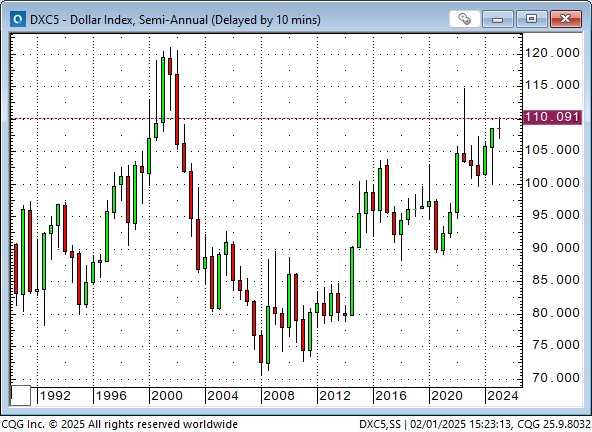

The US Dollar Index rallied ~10% from late September 2024 to the beginning of January as the market priced in fewer Fed cuts than previously expected. Trump’s election victory on November 5 (pink ellipse) accelerated the rally. The January highs around 110 were the highest since late 2022, following the most aggressive Fed tightening cycle in ~20 years. COT data shows that speculators’ net long USD positioning in the currency futures market is near a 6-year high.

This chart demonstrates the real strength of the US Dollar index. The 110 level is the highest in 23 years, outside of seven weeks in late 2022.

The long-term chart back to 1971, when the major currencies began to float freely, shows that the US Dollar Index is historically very strong, outside of five years during Reagan’s Presidency when 10-year yields were between 14 and 16% (and we know Trump doesn’t want to see bond yields at those levels!)

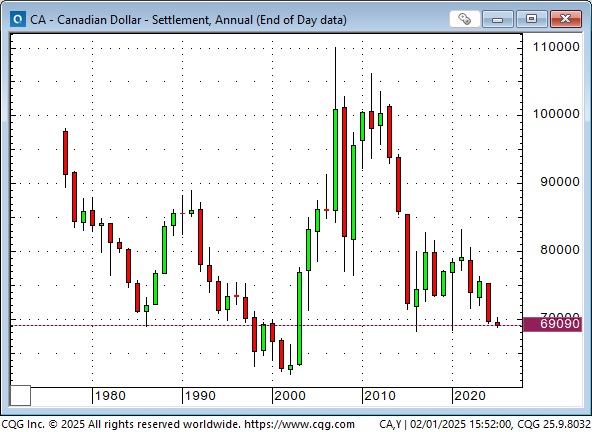

The Canadian dollar, like most currencies, has been under pressure since Trump’s election victory (blue ellipse.) From mid-December to early this week, it traded mainly in a half-cent range between 6950 and 7000 but broke to 5-year lows late in the week when the tariffs were “officially” announced.

The CAD is approaching the lowest level in 23 years on a longer-term chart.

Since September, speculators in the currency futures market have held a historically massive net short position in the CAD and will have substantial unrealized gains on those positions. The early rationale for that positioning may have been that the CAD was particularly vulnerable to a rising USD (Canadian 2-year yields are now ~150 bps below US rates), but the threat of 25% tariffs would have increased their confidence in maintaining short CAD positions. Now that the “worst” tariff news has been “realized” (some commentators thought that tariffs would be phased in or that some exports, such as oil, would not be subject to 25% tariffs), the CAD should fall further.

If the CAD does not fall further next week, it could be a “news event failure,” and some speculators could start covering their positions to realize their gains. (If the CAD can’t fall on 25% tariffs, what will it take to make it fall?)

Like most “Western” stock indices, the TSE may benefit from bullish American stock market sentiment, but the weak Canadian dollar may also be helping to attract capital.

Mainstream media may portray Germany as an economic wasteland, but the DAX is at all-time highs. Maybe the weak Euro is helping attract capital.

Gold

Gold rallied to new all-time highs this week. It closed higher for five consecutive weeks and is up more than $1,000 (55%) from the October 2023 lows made before the Hamas attack on Israel.

A recent massive transfer of gold bullion from London to New York may have helped buoy Comex prices.

Rising gold prices have boosted the share prices of gold mining companies, but in earlier days, such a strong bullion rally would have sent mining company shares soaring because of the inherent leverage of gold prices rising faster than production costs. There may be many reasons for this recent underperformance by gold mining companies (for instance, the major bullion buyers are central banks, particularly the PBoC, and they want physical gold, not shares). Still, the miner’s profitability is rising, and value investors may see bargains. Canadian gold miners with operations in Canada may be especially attractive due to the weak Canadian dollar.

Energy

Other interesting charts

My short-term trading

I returned to my trading desk Monday night after a fantastic 10-day road trip to Palm Springs with my son. We played a lot of golf with each other and some good old friends and I thoroughly enjoyed being back in the USA.

I was a little slow getting back to work, but on Friday, I took small short positions in the S&P and gold and held those into the weekend. I still have my OTM CAD calls, which expire at the end of next week. They are nearly worthless now, but I may buy the CAD next week if it doesn’t drop on the tariff news.

Quote of the week

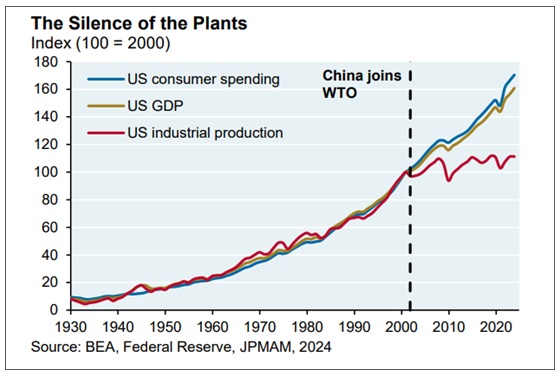

“The US consumer and stock market were the biggest beneficiaries of globalization – and Trump wants to reverse it.” Kevin Muir

The Barney report

Barney was pleased to see his Papa again after I’d been away for 10 days. The next day, we went on an extra-long forest walk, and he ran around to his heart’s content. He’s stayed extra close to me this week, and I’ve enjoyed that.

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks podcast, Mike and I discussed the Canadian dollar and its reaction to Trump’s tariffs, gold hitting new all-time highs, and my suggestion that Trump’s approval rating may have already hit its highs. You can listen to the entire show here (be sure to listen to Kevin Muir’s interview). My 8-minute spot starts around the 58-minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money Show. We discussed my US road trip, how much I enjoy being in the USA, and how I wish Canada and the US worked together more rather than squabbling. We also discussed currencies, stocks, gold, and interest rates. You can listen here.

Sunday edit

I forgot to include a link to this dispassionate article by TD Bank: “Setting the Record Straight on Canada-US Trade.”

If you want to know the facts about trade between Canada and the USA, it will take less than 10 minutes to read this essay.

If you want to know how I feel about the Canada/US relationship, listen to my interview on This Week in Money. I’ve lived in the US several times, totalling about two years. I’ve been in 27 states and felt “at home” in all of them. I worked for large American commodity brokerage firms for over two decades. There is nobody on this earth who is more like Canadians than Americans. After the 9/11 attacks, I wrote about “Fortress North America,” about how Canada, Mexico, and the USA working together didn’t need the rest of the world for anything. Canada isn’t poisoning Americans with dangerous drugs; China is. Let’s work together to stop that. Yes, Canada has lived virtually “rent-free” under the American security umbrella, and it’s time we stepped up and paid our fair share.

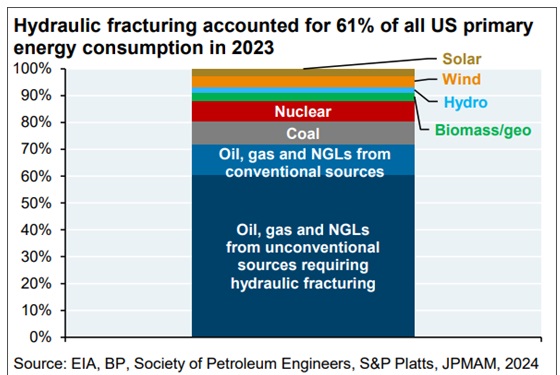

The “good news” about getting hit with 25% tariffs is that it will be a “wake-up” call for Canadians. We’ve become demoralized by crappy economic policies and outrageously high taxes. Don’t just scrap the carbon tax; realize that we are blessed with incredible energy supplies (hydro, oil and gas, uranium). Deliver cheap energy to Canadians and watch our economy soar.

I will attend the World Outlook Financial Conference at the Bayshore Hotel in Vancouver on February 7 & 8, so there will be no Trading Desk Notes next week.

Click here to connect to the WOFC main page for all the info you will need about this conference, which will be live and on streaming video. I’m honoured to speak at the conference again this year, along with several world-class speakers, including Tony Greer from Long Island, Peter Grandich from New Jersey, Lance Roberts from Houston, Paul Beattie from Montreal, Jim Thorne from Toronto, and Martin Armstrong will make two presentations live from his home in Tampa Bay.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!