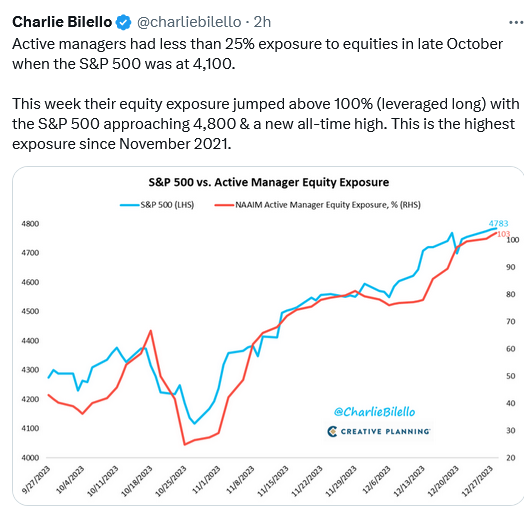

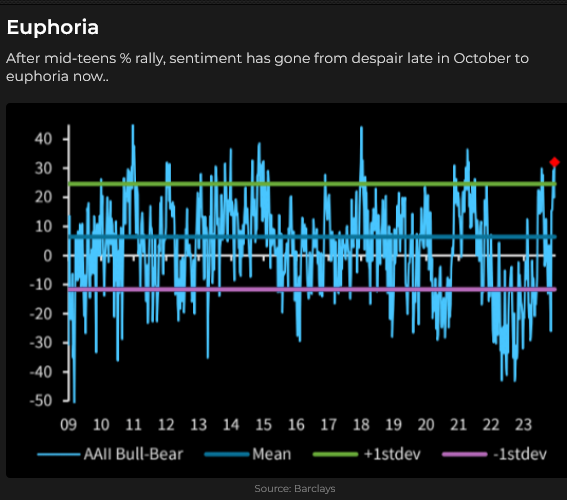

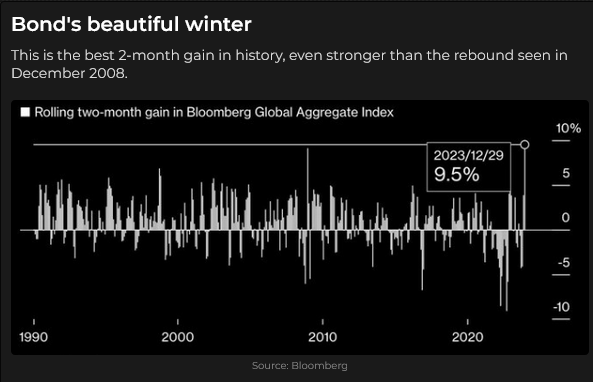

We’ve had a historic 2-month rally in stocks and bonds in anticipation of several interest rate cuts in 2024 due to falling inflation – what’s next?

The leading stock indices (and many individual names) traded higher for nine consecutive weeks, with the DJIA and the NAZ 100 ending 2023 at All-Time Highs.

The DJIA rallied ~5,450 points (~17%) from the October lows.

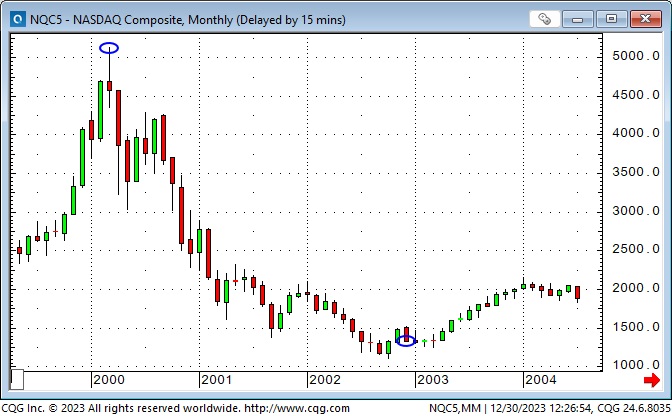

NAZ 100 futures rallied ~20% from the October lows to gain ~54% on the year – the best annual gain since 1999. (Following the 1999 gain, NAZ fell for the next three years and closed 2002 ~74% below ATH.)

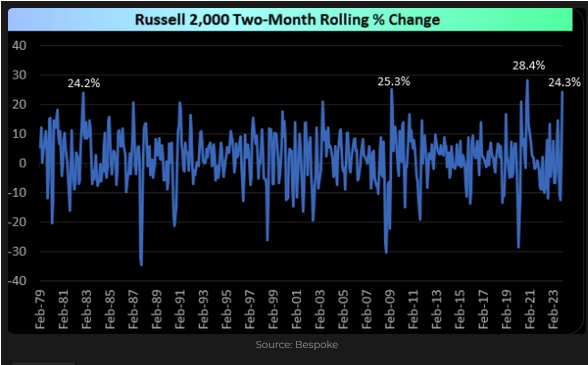

The Russell 2000 index gained ~24% from the October lows, its 3rd biggest 2-month gain in history.

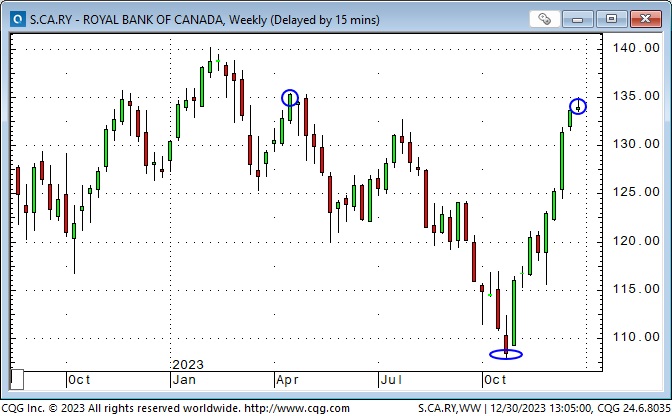

RBC, historically a premier Canadian blue chip stock, fell ~23% from April highs to 30-month lows in October, then rallied ~23% over nine weeks to end the year up ~5.5%.

XHB, the home builders ETF, rallied ~37% from the October lows to end the year at All-Time Highs, up ~60% in 2023.

S&P Seasonality had a good year in 2023. (2023 is the red line. h/t to Brent Donnelly.)

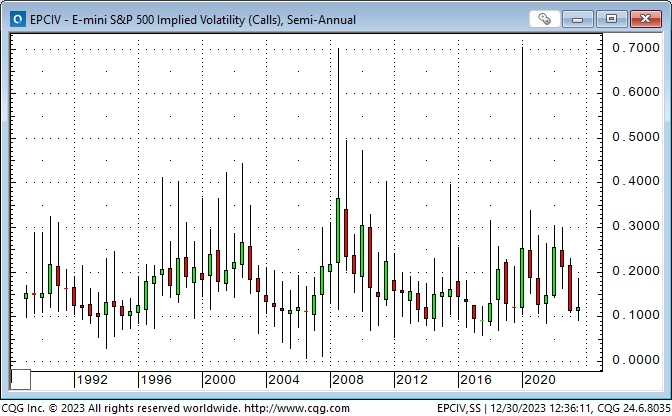

Implied volatility for S&P futures averaged ~13% in 2023. Will we get a spike higher in 2024?

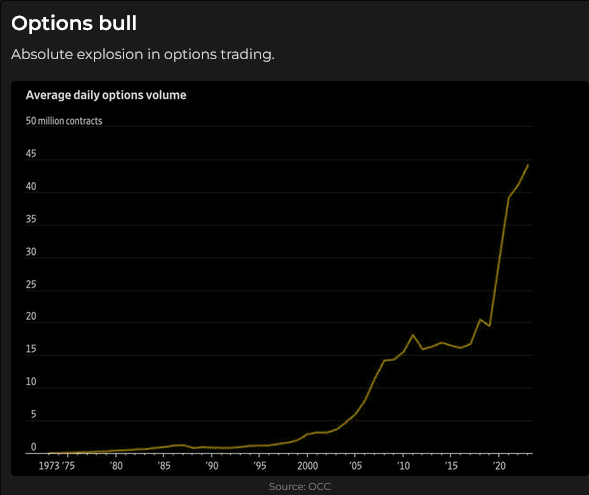

Options volume has picked up since covid.

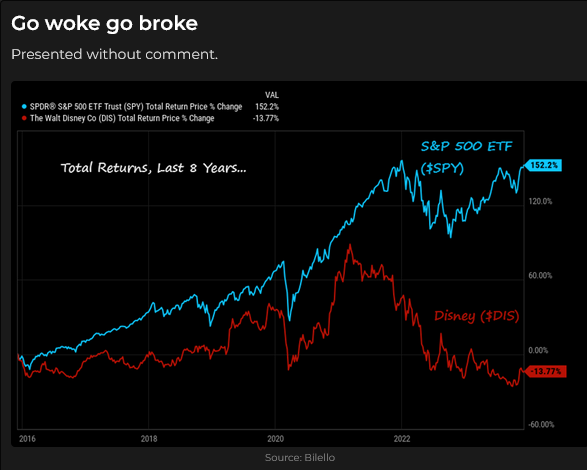

The rising tide of bullish sentiment has not benefited all stocks.

Credit markets

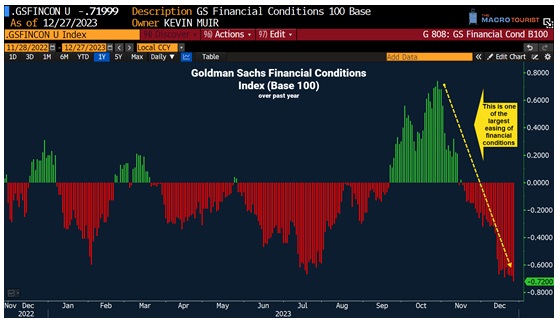

Going into October, the prevailing market sentiment was driven by the “higher for longer” mantra, and the Goldman Sachs Financial Conditions Index soared. Following the October pivot, market sentiment has been driven by the notion that the Fed’s monetary policy is “too tight” in light of falling inflation, and the FOMC will slash interest rates in 2024. (Chart courtesy of Kevin Muir.)

The Secured Overnight Funding Rate (SOFR) futures are pricing 3-month interest rates at ~3.75% for December 2024, which is ~160 bps below current levels. (This implies >6 X 25 bps cuts over the next 12 months.)

The long bond futures contract had a terrific rally off the October lows to close the year almost exactly where it closed in 2022.

Corporate and High-yield bond ETFs soared from the October lows.

Currencies

The US Dollar index had its lowest monthly close in December since March 2022, down ~6% from the October pivot.

The Euro (the Anti-dollar) had its highest monthly close in December since March 2022. Large speculators have sharply reduced the net long positioning they held from mid-September to mid-December over the past two weeks, which may mean that the rally off the October lows has run out of steam.

The Japanese Yen traded to a 33-year low against the USD in November but has since rallied ~9%. Large Specs held their largest net short position in years at the November lows (~130,000 contracts) but have reduced that to ~56,000 as of December 26. Their short-covering likely accelerated the recent rally and may indicate that it is losing momentum.

The Canadian Dollar fell to a 12-month low in October but rallied back ~4 cents (5.5%) as the USD fell against virtually all currencies. Large commercial accounts held their largest net long position (~77,000 contracts) in seven years at the October lows (Speculators were net short) but reduced that position to ~35,000 as of December 26 as the CAD rallied. This “rebalancing” of positioning between commercials and speculators may indicate that the CAD rally has run out of steam.

Gold

Comex gold futures nearly made a new low for the year in early October but rallied sharply following the Hamas attack in Israel. The ~$300 rally from the October lows to the ATHs made on Sunday afternoon, December 3, was thus supported by geopolitical stress, record central bank buying (Russia and China), a weaker USD and falling interest rates.

Net positioning by large commercial accounts and speculative accounts was near a 12-month low before the Hamas attacks, but, not surprisingly, both sides have ramped up their positions since then, with specs now holding their largest net long position since April 2022 (two months after the Russian invasion of Ukraine.) If gold weakens from here, we may see some selling from the “larger than usual” spec positioning.

Energy

WTI futures have trended lower for three months, and speculators have reduced their net long positioning from ~350,000 contracts to ~195,000. The 6-month forward curve has fallen from ~$10 backwardation to flat, which may signify reduced supply anxiety.

For an excellent (free) weekly summary of oil and gas markets, I highly recommend the Eye on Energy report written by my good friend Josef Schachter. His paid subscription service provides in-depth coverage of publicly traded energy shares. Josef and I will speak at the World Outlook Financial Conference at the Bayshore Hotel in Vancouver on February 2 & 3, 2024

The uranium market had a strong rally this year but seemed to run into resistance over the last month.

I subscribe to and highly recommend Doomberg and Robert Bryce for a global macro perspective on energy markets.

My short-term trading

I’ve done substantially less trading in December than in previous months due to two cataract surgeries early in the month and the Christmas slowdown. I expect the pace of my trading will pick up in the New Year.

My bias is that markets have run too far too fast (in terms of sentiment and positioning) on expectations of several interest rate cuts next year. As usual, I will wait to see market action that may indicate a correction is starting before I take positions in line with my bias.

I took small initial positions short CAD and gold this Thursday, with stops above recent highs. I held those positions into the weekend.

On my radar

Corporate buybacks were massive in December. There will be a buyback blackout period (ahead of corporate reports) for ~70% of S&P stocks for the first three weeks of January.

40% of the world’s population goes to the polls in 2024, with Taiwan just two weeks away. Market “nerves” could become a problem before the November American election (and maybe even more so after the election?)

I believe that, generally, the best cure for high prices is high prices, and that may apply to equity markets. (Although I also think that large fiscal deficits will continue to diminish the purchasing power of currencies, which is the essence of inflation, and equities may be a good hedge against inflation.)

I’m willing to believe that the market is pricing too many cuts from the Fed in 2024. For instance, the dramatic decline in financial conditions and especially mortgage rates may (together with other supports) result in rising home prices in 2024. I also believe we will see continuing wage growth. If I’m right, there will be less “need” for the Fed to cut rates.

As a trader, I’m also willing to be dead wrong on my ideas, and if so, I’ll limit my losses.

The market seems to believe that the Fed will cut before the ECB. I don’t see it this way, and I think the recent weakness in the USD (due to expectations that the Fed will cut aggressively in 2024) is overdone, so I’ll be looking for opportunities to buy the USD.

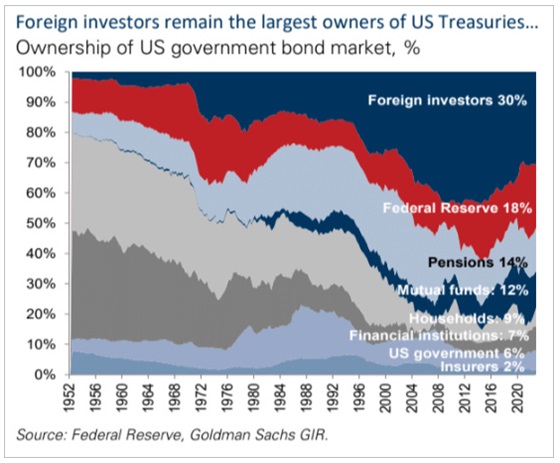

I’ve been waiting for market action to show me it’s time to be short bonds after the big rally off the October lows. People have been buying bonds like they are the “buy of the century,” but I think the looming avalanche of supply is a BIG negative factor.

I read research to get trading ideas I might not otherwise get. I’m not looking for recommendations to “buy this now.”

I respect good analysts but loathe the grifters who dress up their marketing as “research.” There is always a rising star analyst somewhere (and many wannabes), just as there is always a fading group of former “star” analysts. Making market predictions on the public record is a tricky business.

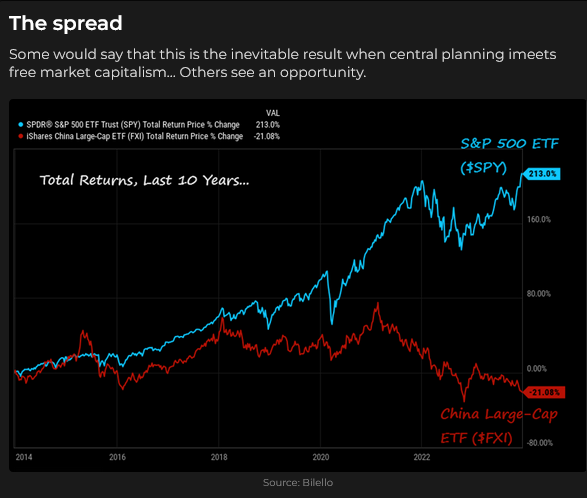

China

For the yearend Moneytalks show, Mike Campbell asked me what I thought was the most significant financial story of 2023. I went with, “What happened to China?” Here are the notes I sent to Mike before we recorded the podcast:

China has been on a roll for over twenty years. Still, I wonder if the boom times are over, given deleveraging, deflation, declining FDI, dictatorship, and wrong-way demographic trends (not enough babies.) The authorities are trying to stimulate domestic consumption, but the people seem wary and have decided to save their money after the lockdowns and the “disappearing” of prominent people. One-man autocratic rule stifles innovation.

- Chinese stock indices hit a low in October 2022 and then rallied into the spring of 2023, a pattern similar to many other stock indices worldwide.

- But Chinese stock indices had an extra incentive to rise – an economic “boom” was expected once the covid era lockdowns ended.

- But since the early 2023 highs, the leading Chinese stock indices are down (on average) ~20%, with the Shanghai Composite ending 2023 at a 40-month low, down ~30% from 2021 highs, while other indices around the world are ending the year on their highs. The Chinese tech stock index is down over 60% from its 2021 highs, while the NAZ is at new all-time highs. (The Financial Times: “Foreign investors have pulled ~$28 Billion from Chinese equities since Country Garden missed bond payments, and their net buying in 2023 was the lowest in 8 years.“)

- (To be fair, the Chinese stock indices have been much more volatile than American indices over the past thirty years since the CPP allowed citizens to trade stocks.)

- The Chinese economy did not “boom” once the covid lockdowns ended. Post-pandemic growth has been slow, unemployment (especially youth unemployment) has increased, and a pervasive debt crisis has hit the over-leveraged property sector and local governments.

- Foreign Direct Investment in China turned negative in 2023 for the first time in 25 years.

- Lower worldwide demand for Chinese exports, previously a significant driver of economic growth in China, has contributed to slower growth. Tariffs have restricted some Chinese exports, and more tariffs may be coming; for instance, the Eurozone is looking at blocking Chinese exports of cheap electric cars.

- Chinese authorities have tried to encourage greater domestic consumption, but citizens seem wary about spending their money after the lockdowns and the debt crisis.

- Caprious edicts from the increasingly authoritarian government may also be causing citizens to be wary about spending. Innovators and people with an entrepreneurial spirit must see the “disappearing” of prominent citizens as a warning to get their capital and themselves out of the country before they become trapped.

- Elections in Taiwan between the pro-independent DPP party and the KMT (closer links to China) are two weeks away.

- Since being one of the poorest countries in the world 40 years ago, China (The Sleeping Giant) has awoken, and the economy has boomed, contributing significantly to world economic growth. If Chinese economic growth continues to weaken, the global economy will weaken.

12: Financial Times: “House sellers in Beijing have been cutting prices aggressively. Selling prices are down 10 – 30% from 2021 peak.”

You can listen to Mike Campbell’s full Year End Special Moneytalks show here. My segment with Mike, where we talk about “What happened to China,” starts around the 57-minute mark.

Thoughts on trading

Since I retired from the brokerage business three years ago, I’ve been trading small (relative to the equity in my account) while experimenting with different approaches and time horizons. My objective has been more like “trading for income” rather than trying to generate 100%+ annual returns. I treat every trade as “just another trade” and don’t pretend to have “high conviction” trades.

I’ve made a little money, and my win/loss ratio has been roughly 40/60, but I’m more interested in improving my results. For instance, I’ve noticed that my trading time horizon is often shorter than my analysis time horizon. For example, I’ll enter a trade that might have a two-week time horizon, but I’ll get stopped out quickly because I’ve been placing my stops too tight (I have an extreme focus on keeping losses small) or because the trade doesn’t start to work right away.

In 2024, I will be more patient in picking trades. I will trade bigger size and use wider stops, but losses will be limited to less than 1% per trade.

The Barney report

My wife took Barney for a long walk/run beside the Englishman River today while I wrote these notes. The river is high with all the rain we’ve had recently, and she took this photo of Barney. If he contemplated going for a swim, he made the right decision to stay out of that fast-flowing river!

Victor talks with Jim Goddard on This Week In Money

Jim and I had our monthly 25-minute chat about stocks, bonds, currencies, gold, the trades I’ve been making and what’s “On My Radar” for 2024. You can listen to the show here.

The 36th Annual World Outlook Financial Conference

Tickets are now on sale for the 2024 WOFC, which will be held at the Westin Bayshore Hotel in Vancouver on February 2 & 3, 2024. Click here for more information and to purchase tickets.

The Archive

Readers can access weekly Trading Desk Notes going back seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

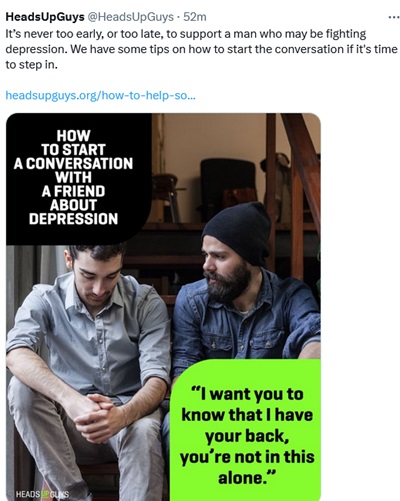

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.