Are you de-risking into yearend?

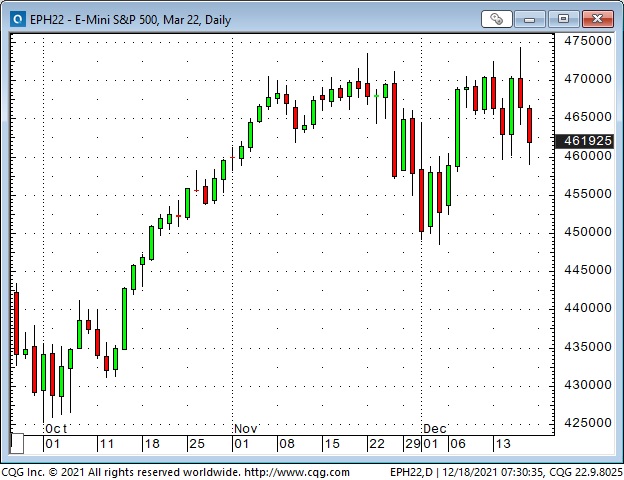

Day-to-day and intra-day price action since Thanksgiving Friday has been very choppy. Big Cap Tech has been fading. Are Portfolio Managers de-risking before yearend to preserve stellar track records?

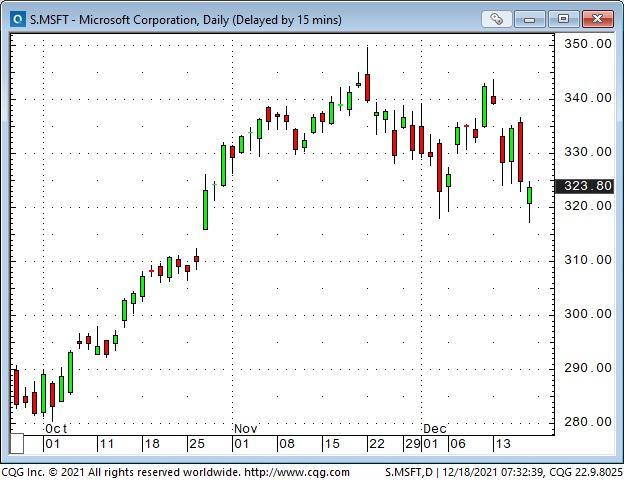

Big Cap Tech fading?

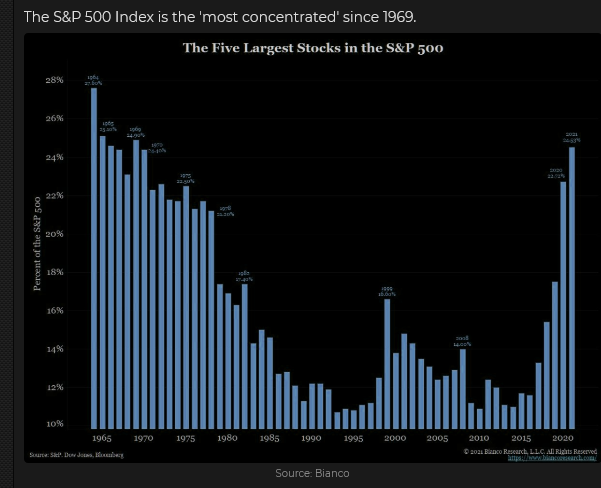

Big Cap Tech has been THE most significant part of YTD gains in the S+P and NAZ (NAZ is up ~21% YTD; without AAPL, GOOGL, MSFT, TSLA and NVDA, it is up only ~5.5%.) If the “Generals” are starting to fade while the “troops” are already weak, the indices may risk a bigger correction.

APPL hits $3 Trillion market cap

APPL hit an All-Time High Monday but ended the week on its lows.

MSFT touched a 7-week low this week – a classic lower high/ lower low double top on the daily chart.

TSLA is down ~25% from November All-Time Highs. Elon Musk has sold >$13 Billion worth of shares.

Volatility has been volatile

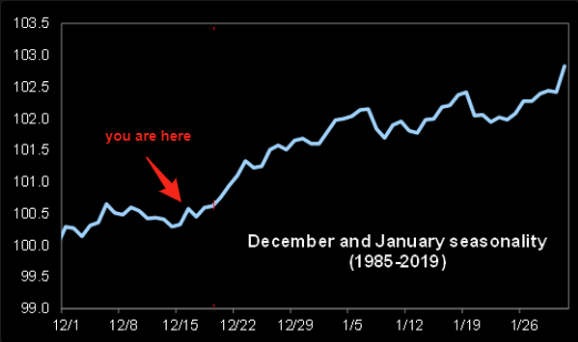

Liquidity will be THIN between now and Jan 3, 2022

Positioning

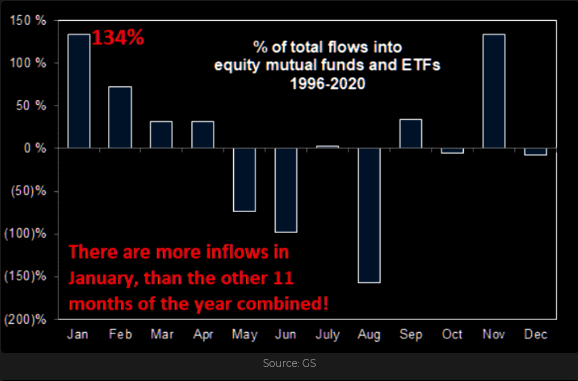

Suppose you were a Portfolio Manager and you’ve had an excellent YTD performance (primarily due to gains in Big Cap Tech). Would you be de-risking during December to lock in a strong 2021 track record – for the benefit of your clients, of course – and to attract a CHUNK of all that new cash that will be looking for a PM come January?

The Fed was hawkish – but stocks rallied – for a day

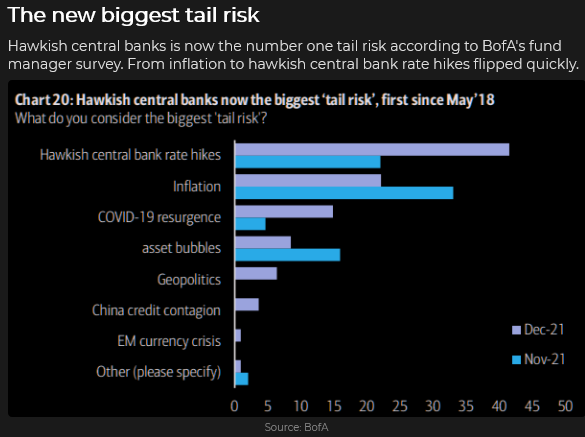

The Fed – prompted by non-transitory high and rising inflation – voted to accelerate the “tapering” of their bond and mortgage purchases – and, if the economy stays strong and inflation remains high, they may raise short-term interest rates by 0.25% three times in 2022.

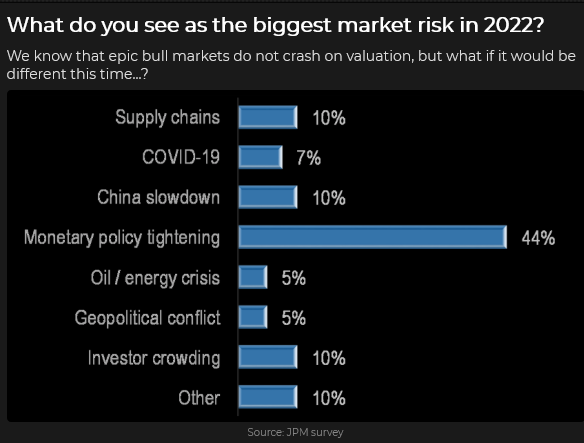

A Fed policy error is the market’s biggest worry

The Biggest worry for 2022 (according to money manager surveys) is that the Fed will begin tightening monetary policy while the economy slips into recession, and bitter political divisions in Washington mean that there will be no more fiscal stimulus. (Note: 43 million Americans will be required to resume payments on student loan debt beginning February. The average monthly loan payment is $393, and the total student loan debt is $1.7 Trillion. This will effectively be a tax increase and a drag on consumer spending. Given that consumer spending is ~70% of GDP, then…)

Omicron

The market does not view the latest Covid variant as a significant threat. Any change in that assessment could tip the scales to a broader bearish sentiment.

The mountain of cash on the sidelines

Some people see “all that cash” as “dry powder” that will be FOMOed into the market and drive it much higher. Maybe, but I think that mountain of cash may be a sign that (primarily wealthy) people see a lot of risk in the stock market at these levels and are willing to sit patiently with a significant cash position. (Berkshire Hathaway, which is super-long cash, was bid to an ATH this week – while Big Cap Tech was sold.) The massive flow of funds into low-yielding Treasury bonds may be another sign of patient money de-risking – or preparing for a possible economic slowdown.

Emerging markets are markets you can’t emerge from in an emergency

The MSCI Emerging Markets ETF had its lowest weekly close since November 2020. For the DJIA to get back to November 2020 levels, it would need to drop >7,000 points (20%.) The NAZ would need to drop ~25%.

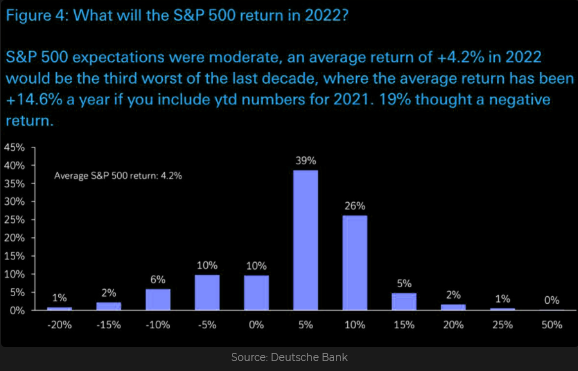

What do very highly paid portfolio managers expect the stock market to do in 2022?

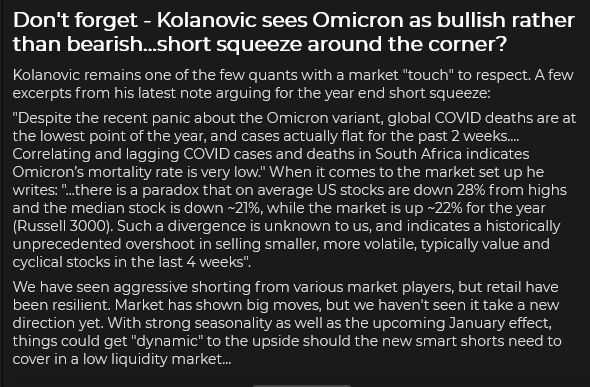

For balance – here’s a very perceptive bullish “take” on the stock markets from JP Morgan’s top quant

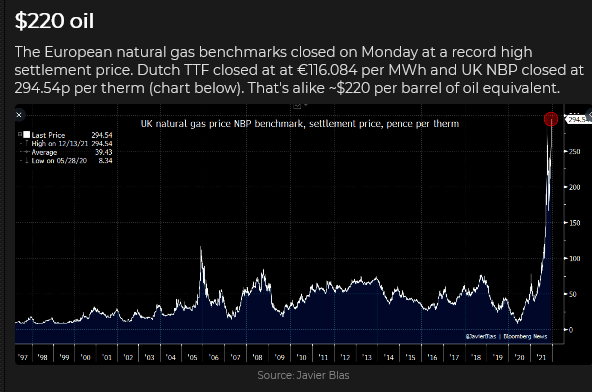

European and Asian NatGas prices hit ATH this week

NatGas in Europe and Asia is `10X the price of North American NatGas. What are the knock-on effects of these extraordinarily high energy prices?

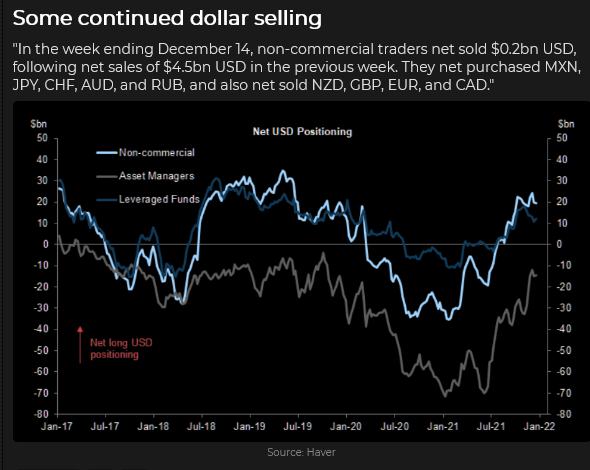

The US Dollar Index had its highest weekly close in 18 months

The USD is trading higher YTD against virtually every widely traded currency – except the Israeli Shekel and the Chinese RMB.

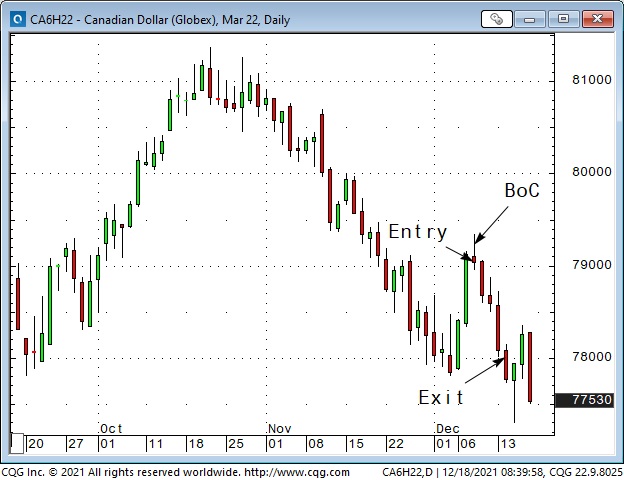

The Canadian Dollar: lowest weekly close against the USD in 13 months

The CAD bounce more than a full cent Wednesday/Thursday following the Fed meeting, but as stocks and crude oil weakened on Friday and the USD gained against most other currencies, the CAD weakened to ~7850.

Gold rebounded as much as $60 from a 2-month low following the Fed announcement. It gained ~$15 Friday to Friday

Immediately before any major scheduled market risk event – like this week’s Fed announcement – dealers/traders in all markets pull their bids and offers – the depth of market (DOM) thins out to practically nothing, and there is (relatively) NO liquidity. The risk event happens, the machines have their fun, prices spike or dive for a few seconds and then liquidity returns. Sometimes (!) stops get hit.

Comex Gold dropped ~$10, to more than a 2-month low within a few seconds following the Fed announcement and then rallied back ~$12 within 2 minutes. Comex traded about 800,000 ounces in those 2 minutes.

My short term trading

The only position I carried over from last week was short CAD. I had sold it when it fell back from the highs made following the BoC meeting Wednesday of last week. I covered the position for more than a one-cent gain on Tuesday when the CAD had an excellent opportunity to take out the early December lows – but didn’t.

I scalped the S+P from the short-side Tuesday when it broke below the previous three day’s lows. I covered the trade for a 20 point profit later that day. I wanted to be flat going into the Wednesday Fed announcement.

I took Barney for a two-hour walk Wednesday morning. I wanted to be away from my screens when the Fed announcement/press conference happened. I did NOT want to have a position on and be subject to the wild price swings that often follow such events. I wanted to let the market “settle down” before I made any new trades.

Following the Fed announcement/press conference, the S+P ran up ~140 points to new All-Time Highs in the Wednesday overnight session. I did not participate in that terrific move. The Thursday day session opened below the overnight highs, and I got short about an hour after the opening. I covered that trade for a ~90 point gain just after the Friday day session began. (Friday was a HUGE option expiry day – I expected a LOT of volatility and saw the early Friday dive to new lows for the week as a gift and closed my position.)

I re-shorted the CAD Thursday morning about the same time I shorted the S+P. It had bounced more than a full cent off its pre-Fed lows (tracking the S+P and WTI) and rolled over like the S+P. I covered that trade for ~30 point gain at the same time as I covered the short S+P early Friday.

I stayed out of the markets for the balance of Friday, and I’m flat going into the weekend. I had a good week (my P+L was up more than 2% on the week), and I didn’t want to give back any of those gains in what I expected to be a very choppy Friday due to the quad-witching OPEX. I was remembering that Peter Brandt likes to say, “It’s easy to make money trading, the hard part is hanging onto it.”

Thoughts on trading

I stay in touch with a few old trading friends. One of them knew I had shorted the S+P and the CAD Thursday and when he saw they were down hard Friday morning he sent me a note saying that he hoped I had shorted a bunch. I replied:

The old saying is that you never have enough on when you’re right! I want my size to be small enough so that each trade is just a trade – no big deal if it wins or loses. I’ve caught a couple of good moves – luckily missed getting clobbered on some other moves. I’m up about 2% on the week. I might stay flat now – this is a HUGE option expiry today – price action could continue to be choppy.

Using stops: Before initiating a position, I pick out a level where I want to be out if the market goes against me. After I take my position I place a GTC stop at that level. I see the stop as a “fail-safe” – if the market goes there, I’m out even if I’m away from my screens. (We know it’s not really a “fail-safe“- crazy things that I can’t control can happen – but I can control placing the stop – acknowledging that the trade could go against me and I’ve taken what steps I can to limit losses.)

If the market goes in my favour I will usually trail my stop behind the market (not with an eye to simply reducing the dollar amounts of risk, but to new levels that make sense – and that also reduce risk.) If the market moves quickly and a LOT in my favour (like the S+P did early Friday morning), I often take my profits and CXL the stop.

I have a long history of taking losses quickly, and profits quickly. (That may come from sitting in front of screens for 40 years and getting too caught up in short-term movements.) Some friends tell me that I need to learn how to stay with winning trades longer (I’d like to do that!) For instance, I could trail stops behind the market and only exit a profitable trade when my stop gets hit.

Maybe someday I’ll change, but if my goal is to make money (as opposed to “being right“) I’ll probably keep booking profits when I have the chance.

Quotes from the Notebook

“Inflation is not a coincidence – it is a policy.” Daniel Lacalle December 2021

My comment: I agree 100%. Daniel’s quote is a subset of “Don’t fight the Fed.” If the Fed wants inflation bad enough they will do “whatever it takes” to get it. The BoJ might also want to create inflation, and they have tried, without much success, to get it, but just because they have not succeeded doesn’t mean they have not made a policy decision. You want to be on the right side of any major policy decision.

“For most investments, sizing is more important than entry-level.” Harley Bassman, repeatedly over the years

My comment: I’ve watched several video interviews with Harley, listened to many of his podcasts and read commentary on his website for years. He is an innovative, successful veteran trader who has forgotten more about the bond market than most people will ever learn. He is not a day trader – he is an old-school value investor, and that’s his way of saying risk management is more critical to long-term success than where/when you decide to pull the trigger.

A Small Request

If you like reading the Trading Desk Notes, please do me a favour and forward a copy or a link to a friend. Also, I genuinely welcome your comments. Please let me know if there is something you would like to see included in the TD Notes.

There will be no Trading Desk Notes next week. It’s Christmas. I’ll be back the following week.

Barney: “Hey Papa, is it time for our morning walk?”

Barney was 13 pounds when he came to live with us six weeks ago. He is now 25 pounds, and just over three months old!

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.