Global stock markets continue the rally from the June lows, S+P up ~18%, NAZ up 23%, AAPL up 33%

The S+P, DJI and VTI (Vanguard total stock market ETF) have recovered >50% of their decline from the January All-Time Highs to the 20-month lows made around the mid-June FOMC meeting – when the Fed raised short rates 75bps and promised much more to come.

The DJI lost ~3,550 points in 8 trading days leading into the mid-June lows and has recovered ~4,100 points in the 38 trading days since that low.

At the June lows, the S+P was down ~24% from the January All-Time Highs. The DJI was down ~20%, the VTI was down ~26%, and the NAZ was down ~35% from its November All-Time Highs.

The total market cap of US publicly traded shares has increased >$5 Trillion from the June lows to ~$46 Trillion. The DJI has closed higher in 7 of the last 8 weeks.

The S+P, DJI and VTI are at their highest levels in >3 months, and the NAZ and the Russell 2000 are near 4-month highs. As stock markets have rallied, implied volatility has declined, falling in 8 of the last 9 weeks.

AAPL hit an All-Time High of $183 in early January, fell ~29% to the mid-June lows of $129, and has rallied back to $172 – a gain of ~33%, recovering 81% of its decline from early January to mid-June.

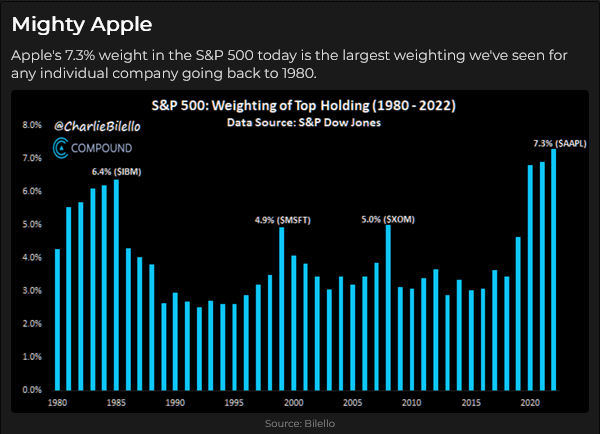

AAPL is ~7.5% of the S+P market cap; the largest % of market cap of any stock in the last 40+ years.

AAPL total share buy-backs over the last 10 years = ~$522 Billion. Total outstanding shares have declined from ~26 Billion to ~16 Billion due to the buy-backs.

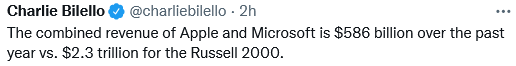

Here are two stats from Charlie Bilello, which imply that the market is paying a substantial premium for a dollar of revenue from Big Cap Tech over the income created by companies in the Russell 2000.

So, what now?

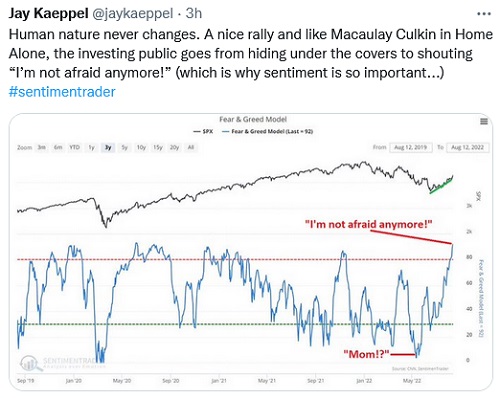

I thought the market was WAY over-sold at the mid-June lows and was due for a bounce – a bear market rally. I thought the S+P rally was capped at ~3,900, but when resistance at ~3,900 became support on July 26, the rally caught fire, and prices ripped higher with extra buying power from short-covering and FOMO.

Last week I was impressed with the fact that the market had two great opportunities to break (Pelosi going to Taiwan in the face of grim threats from China and a sizzling employment report that dashed hopes that the Fed would pivot) – but the market didn’t break so I bought the S+P (despite my analytical mind believing it was a bear market rally!) I sold that position early this week when the rally seemed to falter and held no stock market position at the end of the week.

Despite the extreme bearish sentiment at the June lows, retail has NOT (net, net) started selling passive equity market investments. In addition to that, the stock market rally of the past two months looks to be pricing Peak Inflation and thus Peak Fed.

Bonds see things differently

The bond market, which has trended in harmony with the stock market YTD, has been falling for the last two weeks, while the DJI has rallied ~1,350 points. (Last week’s sizzling employment report and this week’s CPI and PPI reports were not good news for bond bulls.)

The ~1,000-point rally in the DJI from Tuesday’s close to Friday’s close (~155 S+P points) looks like a short-covering freakout, especially given the sharp rise across the interest rate curve. The last time the forward Eurodollar market was falling like this was early June – and the stock market was in free fall.

Currencies

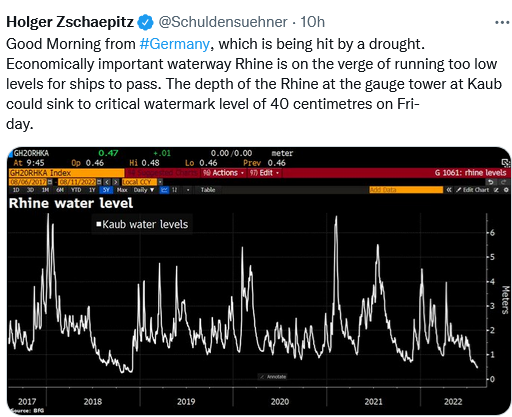

The Wednesday CPI report (which some traders chose to see as “evidence” of Peak Inflation) caused the Euro to rally out of the narrow sideways range it has been in for the past month. Strength in the Euro sparked a rally in virtually all other currencies, and the US Dollar Index fell to a 6-week low, down ~4% from the 20-year highs made in mid-July.

When the Euro did not make a higher high on Thursday, I took the opportunity to short Euro, Yen and CAD. I held those positions into the weekend.

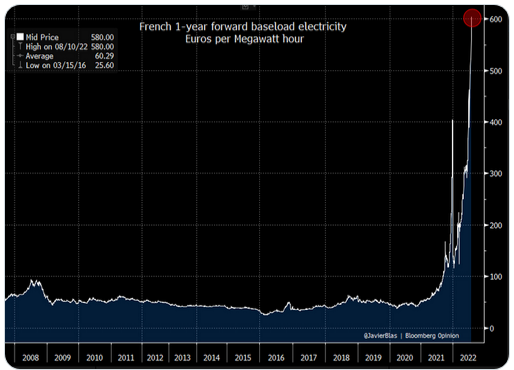

The existential crisis continues in the Eurozone. The Euro/Swiss spread fell to new All-Time Lows this week.

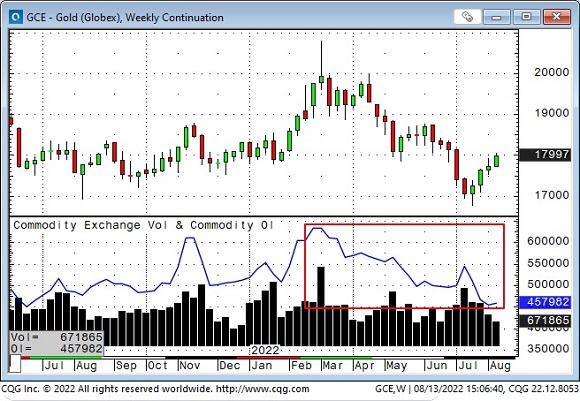

Gold

Gold fell ~$400 from March All-Time Highs to the 16-month lows it touched in July. It has bounced ~$125 since, but low COMEX open interest and low ETF participation show that traders have little interest in the gold market. I shorted a small position on Wednesday, when the CPI rally faded, but closed the position for a slight loss at the end of the week.

Thoughts on trading

I have long believed a trader cannot honestly know what causes a market to move. He may think he knows, especially if the market moves the way he thought it would, but it may have moved for a reason he never considered.

Because of this belief, I have frequently thought I should go to the “dark side” and make my trading decisions based solely on technical analysis.

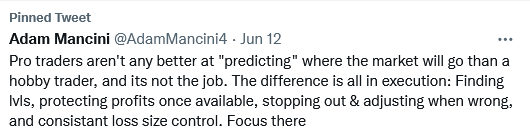

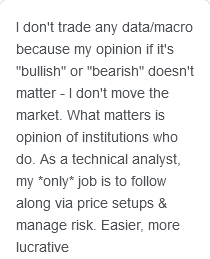

Here are two quotes from Adam Mancini, who has been terrific at calling moves in the S+P futures this year:

I haven’t gone “totally technical,” perhaps because I have a long history of reading and writing “fundamental” analysis. Still, I never make a trade without using short-term price action to determine entry points and risk levels.

I have also long believed that every successful trader has found a way to participate in markets that “suits” him and that what works for one person may not work for another.

Two good questions

I often ask myself, “Why do you believe what you believe?” and “what are you going to do when you’re wrong?” I highly recommend these questions to anyone who wants to make a living from trading.

My short-term trading

I started this week long a small Dow futures position that I bought last Friday. I covered the trade for a modest gain on Monday when the market reversed from new highs – this looked like a good move when the market traded lower on Tuesday, but I missed the sharp 3-day rally following the CPI report Wednesday morning.

I missed getting short bonds but took small losses shorting gold, CAD and the S++P.

I shorted Euro and Yen Thursday when they had no follow-through from their (CPI-inspired) Wednesday gains and added to that bullish USD positioning by re-shorting CAD on Friday. I’m short Euro, Yen and CAD into the weekend with stops lowered to near b/e levels. My net P+L was down a hair on the week.

On my radar

I will be looking for an opportunity to get short equities. I think the 3-day rally late this week may have been a blow-off in illiquid mid-August trade (but it could have been an acceleration point, and the market will be trading at new All-Time Highs this fall – I don’t pretend to know “for sure” what will happen!)

Quote of the week

The Barney report

The heat wave was back again this week, and Barney and I went swimming in the ocean. We also did a few long off-leash walks in the forest. During those walks, we play hide-and-seek to get him used to constantly looking over his shoulder for me. He’s still not good at coming when I call him, but he will come running to find me if he can’t see me. I give him a food treat and lots of verbal congratulations whenever he finds me. No stick is “too big” for Barney!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The August 13 podcast is available at: https://mikesmoneytalks.ca.

I did my regular 30-minute monthly interview with Howe Street Radio on August 5th. I talked about my Pelosi/Taiwan trade, the employment report, currencies, energy, gold, the Canadian dollar, my Macro views and what I think is “the most important thing” impacting all those markets. You can listen here or here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.