Why do you believe what you believe?

If you choose the trading life, you will have to deal with these existential questions, “Who do you chose to believe, why do you believe what you believe, how much of that is already priced in and what are you going to do when you’re wrong?”

In terms of, “who do you chose to believe,” it seems that the opposing views we hear these days from “thoughtful” people are more strident than ever – whether the differences of opinion are over markets, the economy, social or political issues. For the purposes of a Trading Desk discussion, I will focus on what people chose to believe about markets while acknowledging that those other issues also have an impact on markets.

I was at a gold conference years ago when a popular speaker yelled from the podium that gold was going to the moon. A thousand people in the room erupted with yells of agreement. I wondered if there was any difference between being bullish gold because you thought it was going up and being bullish gold because you owned gold.

People believe what they want to believe

I have noticed that in markets, and elsewhere, that people choose to believe people who reinforce beliefs they already hold. Some folks describe this as tribal behavior. My thought is that this tribal behavior may create biases that impair cognitive ability, that people will align their investment behavior with what they “like” while purposefully discounting or ignoring things they don’t “like.”

For instance, the major stock indices were at or near All Time Highs at the end of 2020. The DJIA and the S+P 500 indices were up ~65% from their March lows. Many popular market analysts believe that the indices will continue to trend higher in 2021, for a variety of reasons including the idea that vaccines will bring about the end of lockdowns and “pent up” demand will ignite an economic boom which will in turn inspire stock prices to soar.

How much of your belief is already in the market?

Fair enough. But given that markets are constantly discounting the future, how much of that bullishness is already priced in? I have no way of knowing but over the years I have seen “buy the rumor, sell the news” play out many times.

Many people want a “prediction” of the future that “makes sense” to them and they will use this forecast to construct their trading/investment strategy. Keep in mind that “predictions” are often marketing ploys, not research.

Believing in predictions might not be a good strategy

I remember in the 1970’s there were a lot of predictions about the Dark Future that was going to engulf the world because of runaway inflation and/or the Cold War turning Hot. People were buying dehydrated food, silver coins, guns and ammo and building bomb shelters.

Maybe believing predictions about a market, especially if you tune out anybody who does not agree with your belief, is not the best way to participate in a market. When a market is going your way you might feel vindicated for “having the courage of your convictions,” but what will you do if/when the market turns against you?

What do you do when you’re wrong?

What will you do when you’re wrong? How will you know when you’re wrong? Will you take it “personally” or will you just get out and move on to whatever is next?

A few weeks ago I used this quote (wrongly) attributed to Mark Twain to describe a HUGE market risk: “It ain’t what you don’t know that gets you into trouble, its what you know for sure that just ain’t so.” Please keep that in mind when you are making trading decisions.

Market action and consensus expectations

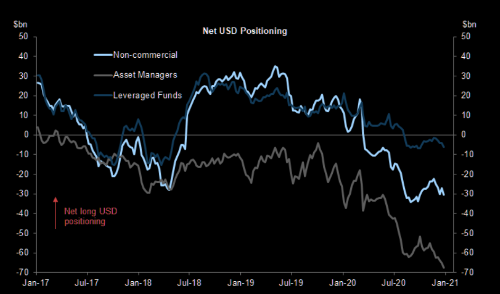

The US Dollar Index ended 2020 at 32-month lows. Since March the downtrend in the USDX has had a strong negative correlation to the rally in equities and commodities. THE pro-risk trade the past several months was short the USD, long stocks and long commodities. That is certainly a very crowded trade as we go into the new year.

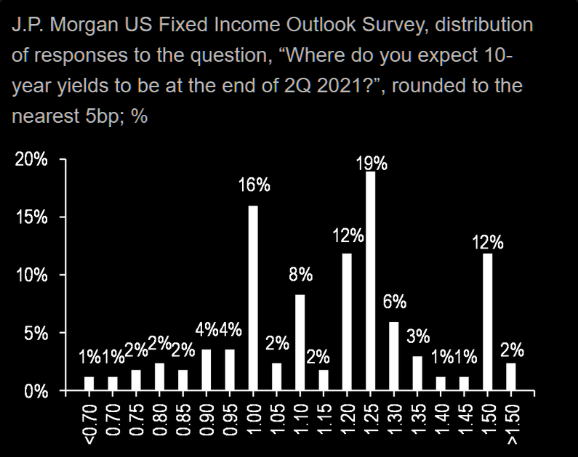

Inflation and interest rates are widely expected to rise in 2021.

The small cap Russell 2000 index rallied as much as 30% from the beginning of November through year-end. It was up ~110% from the March lows while the Nasdaq 100 was only up ~95%.

Soybeans and lumber had spectacular rallies this year. The CRB commodity index rallied to 6-year highs.

The Canadian Dollar rallied from around 68 cents in March to nearly 79 cents in December. Credit the weak USD and rising commodity prices.

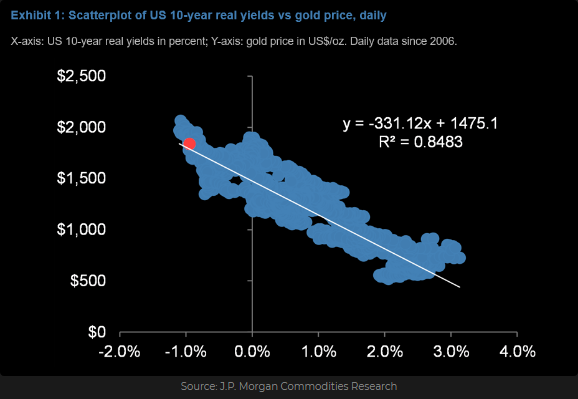

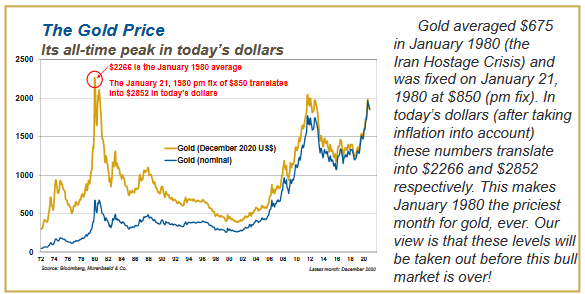

Gold has been highly correlated with falling real interest rates since the 2018 lows and made a new All Time nominal high in August ~$2050.

This gold chart, courtesy of my good friend Dr. Martin Murenbeeld, shows that in today’s dollars the 1981 high was ~$2850.

Best wishes to all my readers for good health and good trading in 2021.

Victor Adair retired from the brokerage business in 2020 after a great 42 year run and is no longer licensed to provide investment advice. This report and everything on this website is therefore not to be considered to be investment advice in any way for anybody.