Rising bond yields are weighing on the stock market but have boosted the US dollar

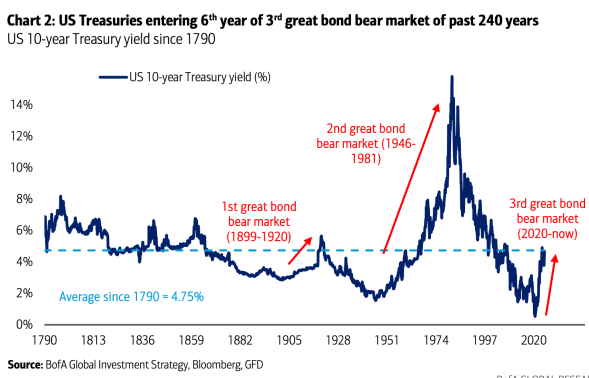

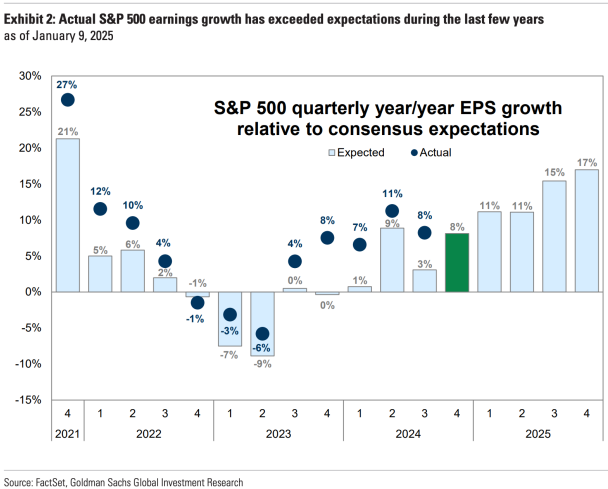

30-year Treasury yields hit a 15-month high of 5% following Friday’s stronger-than-expected employment report. Since September 2024, the Fed has cut short rates by 100 bps, but bond yields have risen ~100 bps on concerns that continuing government deficit spending will sustain above-target inflation and require a flood of new issuance. Outside of a brief period in October 2023, US bond yields are at 16-year highs.

Bond prices have dropped like a stone (yields have risen) since the Fed started cutting rates in September (blue ellipse.) In September, the market priced 150+ bps cuts from the Fed in 2025. Current pricing is ~30 bps in cuts and none before June 2025. BoA suggests that the Fed is done cutting and may raise short rates in 2025.

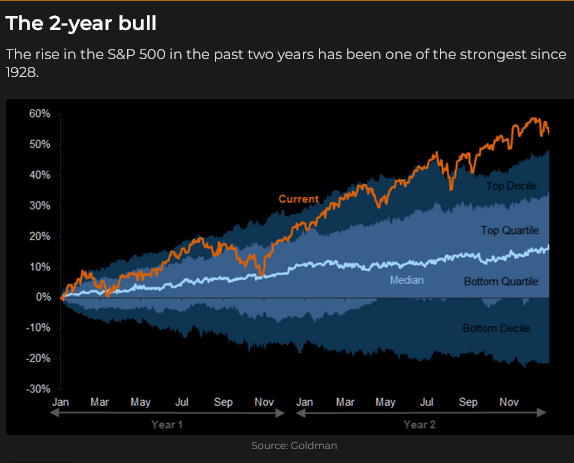

The S&P rallied to record highs after the Fed’s September cut (blue ellipse) and then rallied some more after Trump’s victory (red ellipse), especially after Trump nominated Scott Bressent for Treasury Secretary.

However, by early December, with bond yields trending higher, the S&P rally ran out of steam and drifted sideways until December 18, when the Fed’s “hawkish cut” (blue ellipse) caused both bond and stock prices to fall. Sharply rising bond yields are weighing on the equity markets.

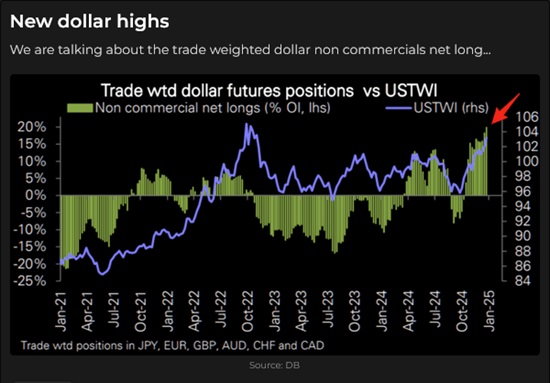

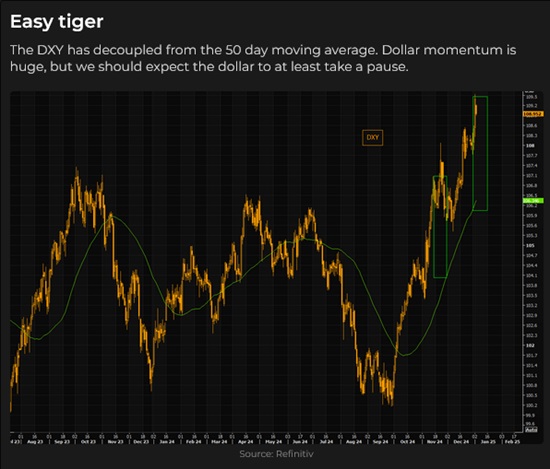

The US dollar trended lower from July to September 2024, fueled by expectations that the Fed would cut interest rates more aggressively than other central banks. (The 30-year bond hit a 1-year low yield of ~3.9% in September.) However, following the Fed’s first rate cut in September (blue ellipse), currency market sentiment began to expect the Fed to cut less than other central banks, and the USDX rallied. The rally gained momentum following Trump’s election victory (red ellipse) and has accelerated over the last six weeks as US bond yields have soared to a 15-month high of 5%.

The USDX closed this week at a 15-month high, and outside of six weeks in late 2022 (following aggressive short-term rate increases from the Fed), this week’s close was the highest since June 2002. From a historical perspective, the US dollar is very strong against all other actively traded currencies, up ~58% from its 2008 record lows.

Net speculative positioning is very bullish on the US Dollar.

How do we measure the strength of the US dollar? Since late September, the Chinese RMB is down ~6%; the Euro has fallen ~9%, the Swiss ~8%, the Pound ~9%, the Yen ~11%, the Brazilian Real ~11%, the AUD ~12%, and the NZD ~13%. The CAD is down ~7%.

Currencies

The Yen has fallen ~11% since the Fed’s September rate cut (circled) and is nearing the 35-year lows reached in early July before the Japanese authorities intervened to boost the Yen. I wonder if/when Trump will signal that Asian countries have kept their currencies too low to facilitate exports to the USA and demand a revaluation. (Will he push for another Plaza Accord, but this time in the Trump Hotel instead of the Plaza?)

Japanese bond yields hit a 15-year high this week.

The Chinese currency has tumbled to near-record lows since the Fed’s September cut (and would likely have fallen further without support from the PBoC.) In this chart, higher prices mean that it takes more RMB to buy one USD.

The Canadian Dollar initially rallied following the Fed’s September cut (blue ellipse on the chart below) but has fallen 7% from late September to this week’s close. (Trump’s threat of 25% tariffs against all imports from Canada was made on November 26 (red ellipse.) The CAD has traded in a narrow half-cent range since the sharp leg down on the Fed’s “hawkish cut” on December 18 (black ellipse.) Trudeau’s “I will resign” speech prompted a brief half-cent rally on January 6 (pink ellipse) that quickly faded.

The decline in the CAD since September is not Canada-specific – it is “collateral damage” as the US dollar has been a “wrecking ball” against all other currencies. (Better governance in Canada would have seen the Loonie stronger than it has been. Better European governance would have helped the Pound and the Euro.)

Here’s a link to a good 30-minute UnHerd interview with Louis Vincent Gave (who now lives in Whistler, BC). In it, he discusses Canada’s situation vis-a-vis the US with Trump as President.

Metals

Gold rallied ~$800 (~40%) from the February 2024 lows to October’s all-time highs, and it has been unscathed by rising interest rates and a stronger US dollar (typically kryptonite for gold.) Analysts, including my good friend, Dr. Martin Murenbeeld, believe that record central bank buying has been the driving force behind gold’s rise. (I was surprised to learn, in this week’s Gold Monitor, that Poland – yes, Poland’s central bank bought 448 tonnes of gold between January and November 2024.

This chart is from this week’s Gold Monitor. Click here for a free trial.

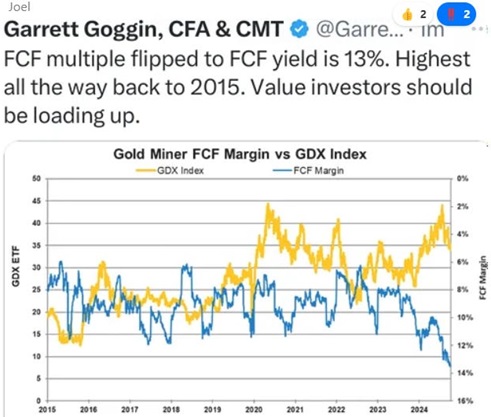

I noted last week that the share prices of gold mining companies have hugely underperformed gold bullion prices. The best answer to why that has been the case may be that the biggest buyers of gold have been central banks, and they want gold, not gold mining shares (which would widen the spread between gold and gold shares.)

Another thought is that there is only one gold mining company (Newmont) in the S&P 500 index, and with passive investments representing the lion’s share of capital flows into equity markets, gold shares only get a pittance of those flows.

However, gold mining companies seem to be handsomely benefiting from the rising gold price, which may spark the interest of value investors.

Copper hit record highs near $5.20 in May as investor enthusiasm drove open interest to near-record highs, but the gains couldn’t be sustained, and investors lost interest. (A softening Chinese economy didn’t help.) Prices jumped this week – maybe the market is sold out.

Energy

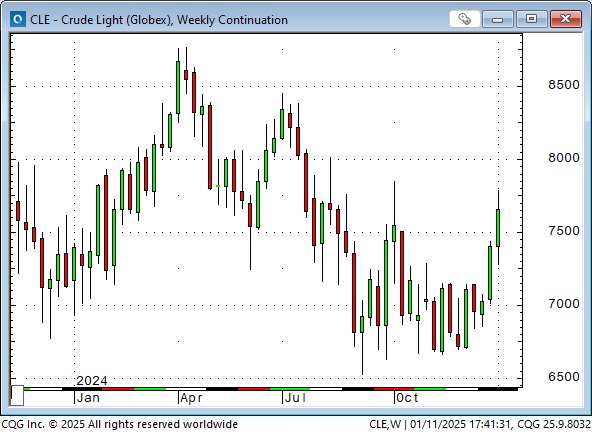

Nymex WTI trended lower from April to December on a bearish supply/demand picture but has popped nearly $11 (~15%) from December lows to this week’s highs.

The price of February WTI relative to the deferred months has risen sharply over the last six weeks (from nearly flat to a current steep backwardation), which may have driven the market higher.

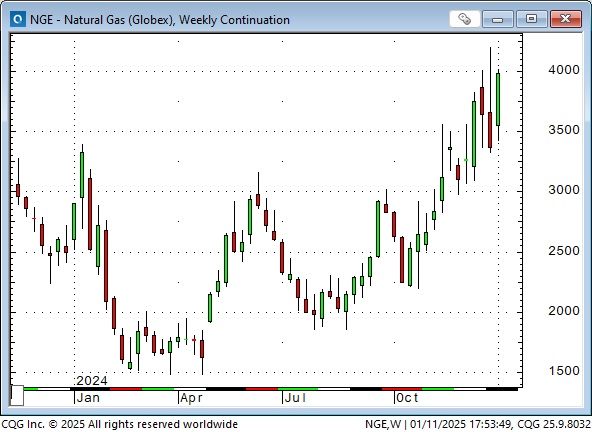

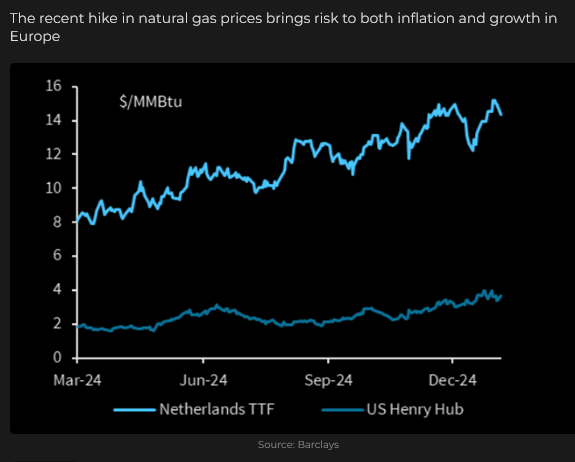

Natgas was at multi-decade lows in early 2024 (in inflation-adjusted terms, it was near all-time lows) but has recently more than doubled from early 2024 lows.

My short-term trading

I traded the S&P from the short side on Monday and Tuesday and from the long side following Friday’s sharp break. My net P&L was a modest gain during the week, and I’m long going into the weekend.

I bought the Yen Friday after it rallied back from early lows and held that into the weekend.

I’m still long February OTM CAD calls; bottom fishing.

On my radar

Trump becomes President in nine days. He has promised to get a lot done quickly. I don’t doubt his intentions, but I’d bet the under on that.

This is not a good time to be short VOL.

Trump’s threats against Canada are a good “wake-up call” for better governance in this country. Our next ambassador to Washington should be a good golfer. Maybe Wayne Gretzky or Mike Weir.

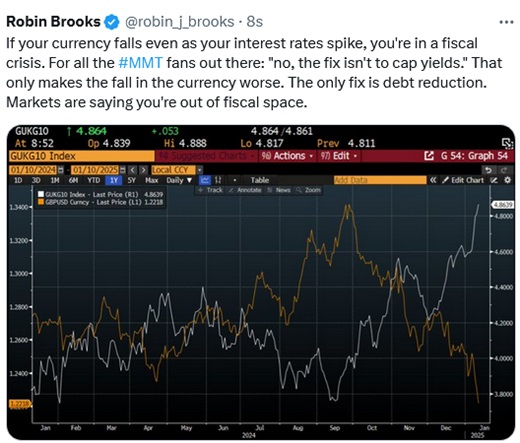

Here’s Robin Brooks on the financial woes in the UK. His warning may also apply to other countries.

I will be on a long-overdue road trip with my son over the next two weeks. We will drive to Palm Springs, play golf where we can and then play more golf in the desert. Our last road trip was three weeks in Australia and New Zealand in 2006. The next Trading Desk Notes will be on January 31.

The Barney report

Our golf course has been hit with a lot of rain over the past two months, and the front nine has been closed due to too much standing water. Barney and I have used the opportunity to go ball hunting in the forest alongside the fairways. Barney can find balls with his nose that I can’t see. He loves finding balls because he gets treats when he gives them to me. (I wash them and give them away from a bucket on my back fence.) Here’s a photo of Barney, the “working dog.”

Listen to Mike Campbell and me discuss markets on the Moneytalks podcast

Mike and I talked about the Canadian dollar and how the US dollar has been soaring against all currencies. We spoke about surging bond yields and the shakey stock market. You can listen to the whole show here. My 10-minute spot with Mike starts around the 52-minute mark.

The World Outlook Financial Conference – Bayshore Hotel Vancouver February 7&8

“We’re experiencing a global anti-establishment trend, and it’s essential to understand that it is driving capital – it’s moving money. Weak currencies to strong ones, cash into tangible assets, government bonds into stocks, international investors into “safe” havens – and it affects your finances. We’re living in an era of historic change, including to the monetary system.” – Michael Campbell

Click here to connect to the WOFC main page for all the info you will need about this conference, which will be live and on streaming video. I’m honoured to speak at the conference again this year, along with several world-class speakers, including Tony Greer from Long Island, Peter Grandich from New Jersey, Lance Roberts from Houston, Paul Beattie from Montreal, Jim Thorne from Toronto, and Martin Armstrong will make two presentations live from his home in Tampa Bay.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!